Anti-Money Laundering (AML) Market Size (2025 – 2030)

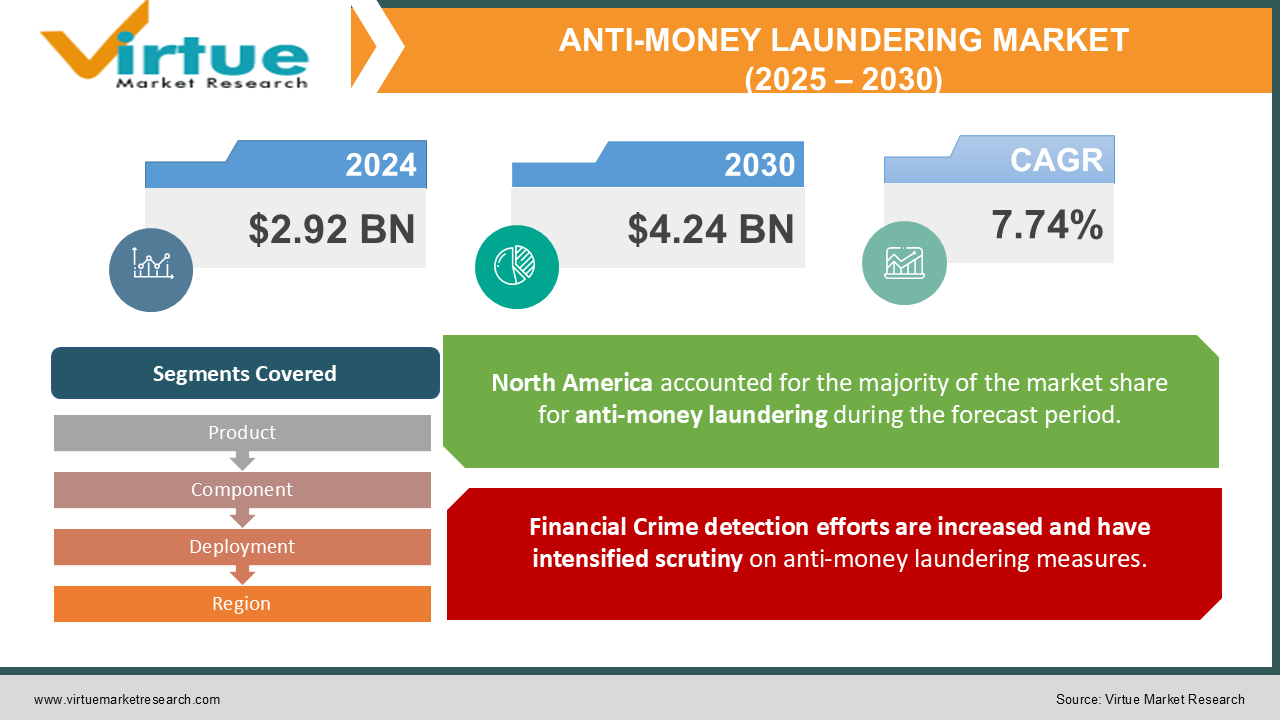

The Global Anti-Money Laundering (AML) Market was valued at USD 2.92 billion in 2024 and is projected to reach a market size of USD 4.24 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.74%.

Anti-money laundering is a procedure undertaken by financial institutions like banks, insurance companies, and gaming and gambling clubs to monitor and stop illegal activity leading to money laundering and terrorism financing. In order to counter illegal and fraudulent activity in relation to the financial systems, financial institutions and banks implement a sequence of rules and regulations for KYC (Know Your Customer)/CDD (Customer Due Diligence), transaction screening, monitoring, and compliance. Anti-money laundering is used to stop the practice of earning income from illegal activity.

Key Market Insights:

-

In October 2022, ThetaRay, an Israel-based fintech software and big data analytics company, launched an advance software version of its flagship SONAR advanced SaaS anti-money laundering (AML) platform.

-

Anti-money laundering systems are utilized for preventing online offence and reducing potential money-laundering danger related to digital payment.

-

In February 2023, according to the Ministry of Electronics and Information Technology, an Indian government ministry, 8,840 crore transactions were done for digital payment for the financial year 2021–22, while 5,554 crore transactions were performed for the previous financial year. Thus, growing importance of internet banking and digital payment is developing the anti-money laundering market size.

-

In February 2023, according to the Australian Cyber Security Centre, an Australia-based cyber security agency, in 2022, cybercrime reports received were 76,000, up from 13% from the previous year. Therefore, the increase in the number of cyber threats is driving the growth of the anti-money laundering market.

Global Anti-Money Laundering Market Drivers:

Financial Crime detection efforts are increased and have intensified scrutiny on anti-money laundering measures.

Increased detection efforts for financial crime have put greater focus on anti-money laundering (AML) measures to further improve compliance and monitoring systems. Financial institutions are putting more robust procedures in place to detect suspicious transactions and patterns that can be suggestive of money laundering. These steps involve fortifying internal controls, refining transaction reporting practice, and increased coordination with the regulatory authorities. The drive for greater transparency and accountability is to dismantle financial crime syndicates and close illicit financial flows. By instituting full-scale AML programs, organizations hope to reduce the risk and preserve the integrity of the financial system. In August 2024, the blog Informa PLC published that Israel-based AI-driven transaction monitoring specialist ThetaRay has bought Belgium-based fintech company Screena. Screena provides an AI-based anti-money laundering (AML) screening solution for FIs. The strategic buy is aimed at improving ThetaRay's ability to provide a comprehensive picture of transactional and customer screening threats. Further, it allows for greater efforts in the detection of financial crimes, including criminal activities related to gambling, and improves ThetaRay's end-to-end financial crime detection, cloud-based platform.

Stringent Regulations and compliance related to AML are increasing.

An anti-money laundering compliance program refers to a rule or regulation a bank has to adhere to in order to thwart and identify money laundering and terrorism funding operations. Financial crime targeting financial institutions like banks and credit unions has increased over the last few years. There was a 50- 60% rise in the number of cases involving financial fraud during 2019 compared to 2018, and it is anticipated that it will rise further in subsequent years. The banks in Europe have suffered considerable losses. In July 2024, as reported in the article by The Good Returns, governments have expanded Anti-Money Laundering (AML) rules beyond conventional financial institutions to non-financial sectors like real estate and virtual assets. This move was to cover loopholes in these sectors because of their high-value transactions and lack of transparency. More stringent sanctions for non-compliance were also implemented, strengthening the compliance culture and lowering the risk of financial abuse. For gambling operators, these enhanced regulations create a stronger AML environment, supporting integrity and lowering legal risks.

Global Anti-Money Laundering (AML) Market Restraints and Challenges:

Privacy concerns in coustomer data monitoring is increasing and deploying AML software is expensive.

The growth in internet gambling websites has increased privacy issues over the monitoring of customer data. As operators use sophisticated anti-money laundering (AML) controls, they gather and examine vast amounts of personal data to monitor suspicious activity. Such probing raises serious privacy issues, as individuals' sensitive information is coming under growing scrutiny and examination. Balancing strong fraud prevention with strong data protection is important, since over-monitoring can result in privacy violations and undermine customer confidence. Based on the Government Accountability Office (GAO) survey. U.K. banks invested between 0.4% and 2.4% of their overall 2018 operating costs in anti-money laundering software. Banks in the survey spent USD 15 on average per new account on due diligence requirements, although the actual expenditure varied from USD 5 to USD 44 based on the bank type. It was noted that banks invest most in CDD, 29%, and reporting expenses of 28% on average. For comparison, 18% were linked to third-party expenses, software, training, testing, and internal controls, representing on average 17% of AML solutions. In Europe, according to a survey by LexisNexis risk solution in 2019, the actual cost of anti-money laundering (AML) software is quite high in European nations since demand for the product is high.

Global Anti-Money Laundering (AML) Market Opportunities:

Advanced analytics is the semi-autonomous or autonomous system that processes data or content based on advanced techniques and tools, which is very much distinct from conventional business intelligence. These analytics provide a more in-depth analysis based on which the system predicts and gives suggestions. Advanced analytics in AML solutions can be instrumental in identifying money laundering, financial crime, identity theft, and cross-border transactions. Further, Advanced Analytics can be instrumental in advanced transaction monitoring. Money Laundering is now a highly significant financial problem that money laundering authorities are attempting to prevent. The survey estimates money laundering to be 2 to 5% of the GDP of Europe, or a net worth of USD 2 trillion being laundered. There are some other problems, including identity theft and cross-border transactions. In 2020, as per a survey, 1.4 million identity theft cases were reported. In 2020, cross-border transactions in Europe were approximately USD 23.21 trillion. All financial crimes are occurring due to poor AML solutions and reluctance to adhere to the guidelines laid down by the regulators.

ANTI-MONEY LAUNDERING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.74% |

|

Segments Covered |

By Product, Component, Deployment, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

LexisNexis, Oracle, FIS, Fiserv, Jumio, NICE Actimize, SAS Institute, GB Group, Experian, Nelito Systems |

Global Anti-Money Laundering (AML) Market Segmentation: By Product

-

Compliance Management

-

Customer Identity Management

-

Currency Transaction reporting

-

Transaction Monitoring

The Anti-Money Laundering (AML) market globally is segmented into four main product categories: Compliance Management, Customer Identity Management, Currency Transaction Reporting, and Transaction Monitoring. Transaction Monitoring in 2024 continues to hold the largest market share as the regulatory environment increasingly pressures financial institutions to monitor and analyze suspicious activity in real time. Compliance Management products are also growing rapidly as companies focus on keeping up with changing financial regulations. Customer Identity Management is picking up momentum with the increase in digital banking and remote onboarding, which requires strong Know Your Customer (KYC) processes. Currency Transaction Reporting remains a core requirement, fueled by the necessity of transparency in large-value transactions.

Global Anti-Money Laundering (AML) Market Segmentation: By Component

-

Software

-

Services

The AML market is comprised of Software and Services as its major constituents. The Software segment has a large market share, fueled by the use of AI-based AML solutions that increase automation, risk scoring, and fraud detection. Banks are increasingly incorporating AI and machine learning into their AML software to enhance efficiency and minimize false positives. In contrast, the Services segment, comprising consulting, implementation, and support, is experiencing steady growth. Organizations are looking for professional services to remain current with compliance obligations and maximize their AML infrastructures. The need for managed AML services is also increasing as companies seek economical compliance solutions.

Global Anti-Money Laundering (AML) Market Segmentation: By Deployment

-

Cloud based

-

On-premises

AML solutions are implemented using Cloud and On-premises deployments. In 2024, the Cloud deployment segment is poised to lead the market due to the demand for scalability, real-time monitoring, and cost savings. Fintech firms and financial institutions are increasingly embracing cloud-based AML solutions to provide quicker updates, improved data integration, and increased analytics. On-premises deployment, though in decreasing favor, is still utilized by big banks and financial institutions which need total control of their AML infrastructure because of data security and regulatory requirements. Nevertheless, the move to hybrid deployments is becoming more prevalent wherein institutions utilize on-premises security and cloud-based analytics.

Global Anti-Money Laundering (AML) Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Geographically, North America continues to lead the AML market in 2024 due to stringent regulatory frameworks, high adoption rates of advanced AML solutions, and increased financial crime activities. The European market is also expanding rapidly, fueled by the European Union’s continuous updates to AML directives. The Asia-Pacific region is experiencing the highest growth rate, driven by the digital transformation of banking systems, rising financial fraud incidents, and government initiatives to strengthen financial security. South America and the Middle East & Africa are also witnessing gradual adoption, with governments implementing stricter AML laws to combat money laundering and terrorism financing. The AML market in 2024 is shaped by technological advancements, regulatory changes, and increasing financial crime threats, making it a critical area of investment for businesses worldwide.

COVID-19 Impact Analysis on the Global Anti-Money Laundering (AML) Market:

The pandemic caused by the COVID-19 virus significantly impacted the international Anti-Money Laundering (AML) industry, driving the process of digital transformation forward but revealing new loopholes in the financial system. With an outburst of electronic transactions, remote banking, and the use of cryptocurrencies, banking institutions were faced with heightened exposure to cyber deceit, identity crimes, and financial crime. Regulatory authorities around the globe bolstered AML compliance standards to counter new challenges like pandemic-inspired fraud schemes, including fake medical supply deals and government relief fund scams. The crisis also compelled the widespread embrace of AI-powered AML technology, which supports real-time tracking and risk-based monitoring to more effectively identify suspicious transactions. Yet, the pandemic also brought problems like resource shortage, late regulation implementations, and rising compliance expense for firms, especially small and medium-sized firms. In summary, COVID-19 was a driving force towards innovation in the AML domain, focusing on the requirement of automation, cloud-based compliance programs, and cooperation between global regulations.

Latest Trends/ Developments:

In September 2023, IBM posted that its Payment Center became a member of the Swift Partner Programme, opening new opportunities for cooperation with more than 11,000 members of Swift partners around the globe. This collaboration enabled IBM to provide improved payment solutions and end-to-end cloud Swift connectivity, minimizing the need for clients to deal with Swift hardware and software. In April 2024, Oracle launched the Financial Services Compliance Agent, a cloud-based AI service that enables banks to reduce anti-money laundering (AML) risks. The service enables banks to perform cost-efficient scenario testing to modify controls, detect suspicious transactions, and improve compliance. It assists banks in evaluating and optimizing transaction monitoring systems, analyzing new product risks, and actively managing high-risk typologies. In January, Oracle showcased its end-to-end cloud offerings for banks via Oracle Financial Services. Oracle stressed that banks are embracing cloud services powered by AI and ML innovations at an accelerated rate. Oracle offers the complete range of fintech solutions that are cloud-enabled, scalable, and secure, and includes everything in a one-vendor package without the necessity of various fintech alliances. In September, Quantifind and Oracle announced a strategic partnership to bolster anti-money laundering (AML) processes. Quantifind's SaaS investigation, customer due diligence, and alerts management solutions were integrated with Oracle's Financial Crime and Compliance Management solution. The two firms aimed at making AML more efficient by up to 30% and streamlining the process using state-of-the-art AI and machine learning. Through the integration, Oracle customers had access to enhanced data and expanded AML compliance features using an integrated platform.

Key Players:

-

LexisNexis

-

Oracle

-

FIS

-

Fiserv

-

Jumio

-

NICE Actimize

-

SAS Institute

-

GB Group

-

Experian

-

Nelito Systems

Chapter 1. Anti-Money Laundering (AML) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Anti-Money Laundering (AML) Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Anti-Money Laundering (AML) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Anti-Money Laundering (AML) Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Anti-Money Laundering (AML) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Anti-Money Laundering (AML) Market – By Product

6.1 Introduction/Key Findings

6.2 Compliance Management

6.3 Customer Identity Management

6.4 Currency Transaction reporting

6.5 Transaction Monitoring

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. Anti-Money Laundering (AML) Market – By Component

7.1 Introduction/Key Findings

7.2 Software

7.3 Services

7.4 Y-O-Y Growth trend Analysis By Component

7.5 Absolute $ Opportunity Analysis By Component, 2025-2030

Chapter 8. Anti-Money Laundering (AML) Market – By Deployment

8.1 Introduction/Key Findings

8.2 Cloud based

8.3 On-premises

8.4 Y-O-Y Growth trend Analysis By Deployment

8.5 Absolute $ Opportunity Analysis By Deployment, 2025-2030

Chapter 9. Anti-Money Laundering (AML) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Component

9.1.4 By Deployment

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Component

9.2.4 By Deployment

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Component

9.3.4 By Deployment

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Component

9.4.4 By Deployment

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Component

9.5.4 By Deployment

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Anti-Money Laundering (AML) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 LexisNexis

10.2 Oracle

10.3 FIS

10.4 Fiserv

10.5 Jumio

10.6 NICE Actimize

10.7 SAS Institute

10.8 GB Group

10.9 Experian

10.10 Nelito Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Anti-Money Laundering (AML) Market was valued at USD 2.92 billion in 2024 and is projected to reach a market size of USD 4.24 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.74%.

Financial Crime detection efforts are increased and have intensified scrutiny on anti-money laundering measures.

Based on Service Provider, the Global Anti-Money Laundering (AML) Market is segmented in-to Banks and Financial Institutions, Consulting and Advisory Services, Software and Technology Providers and Regulatory Authorities.

North America is the most dominant region for the Global Anti-Money Laundering (AML) Market.

LexisNexis, Oracle, FIS, Fiserv, Jumio, Experian, Nelito Systems, Wolter Kluwer are the key players operating in the Global Anti-Money Laundering (AML) Market.