GLOBAL WIND TURBINE BLADE MARKET (2024 - 2030)

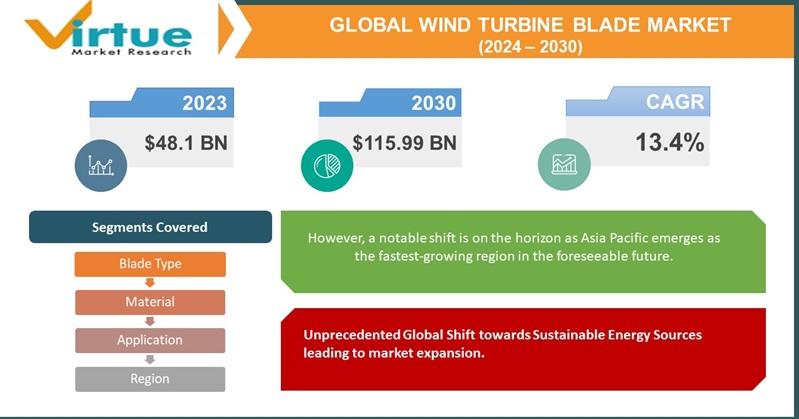

The Global Wind Turbine Blade Market was valued at USD 48.1 Billion in 2023 and is projected to reach a market size of USD 115.99 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is anticipated to grow at a CAGR of 13.4%.

The wind turbine blade market is a rapidly growing and dynamic industry that is playing a critical role in the global transition to renewable energy. Wind turbine blades are the large, aerodynamic components of wind turbines that capture the kinetic energy of the wind and convert it into mechanical energy, which is then used to generate electricity. As the world transitions to a more sustainable energy mix, wind energy is becoming increasingly important. Wind turbine technology is constantly improving, with new designs becoming more efficient and capable of generating more electricity from less wind. This is making wind energy an even more attractive option for power generation.

Key Market Insights:

The global wind turbine blade market exhibits a diverse regional landscape, with Europe leading the pack, commanding around 40% of the market share. This dominance is attributed to the region's early embrace of wind energy and supportive regulatory frameworks. Meanwhile, the Asia Pacific region emerges as a key growth engine, poised to experience a remarkable compound annual growth rate (CAGR) exceeding 8% from 2024 to 2030. This surge is fuelled by rapid urbanization, industrialization, and a heightened focus on renewable energy sources in the region. In North America, a mature market with a 20% share, moderate growth is anticipated as the region continues to expand its wind energy capacity. Latin America, while holding a smaller market share at approximately 5%, is positioned for substantial growth as it endeavours to diversify its energy mix and leverage its abundant wind resources.

The wind turbine blade market is undergoing significant transformations driven by key trends. Longer and lighter blades, designed to capture more wind energy and enhance overall efficiency, are at the forefront. Additionally, the adoption of advanced materials, such as carbon fiber and composites, is becoming increasingly prevalent, offering improved strength, durability, and weight reduction compared to traditional materials. Innovations in manufacturing techniques, such as additive manufacturing and automated layup processes, are revolutionizing production, promising greater efficiency, cost-effectiveness, and design flexibility.

The market is also witnessing the emergence of ground-breaking technologies. Smart blades, equipped with sensors and embedded systems, are revolutionizing blade monitoring, optimizing performance, and predicting maintenance needs. The exploration of bio-based materials, like flax fiber and lignin, showcases a commitment to sustainability, while the incorporation of recycled materials into manufacturing further reduces the industry's environmental footprint. Advanced computational modelling techniques are driving blade design optimization, resulting in more aerodynamically efficient and structurally robust blades. These trends and innovations collectively shape the trajectory of the wind turbine blade market, propelling the industry toward a more sustainable and efficient future.

Wind Turbine Blade Market Drivers:

Unprecedented Global Shift towards Sustainable Energy Sources leading to market expansion.

The increasing global emphasis on sustainable energy solutions is steering a significant transition in the energy landscape. As nations strive to reduce carbon emissions and combat climate change, there is a mounting demand for renewable energy sources. Wind energy stands out as a key player in this shift, and wind turbine blades are integral components for harnessing this clean and abundant resource. The escalating global demand for wind energy is, therefore, a direct driver for the heightened need for wind turbine blades.

Continuous Technological Advancements Aimed at Enhancing Efficiency.

Ongoing advancements in wind turbine technology are contributing to the increased efficiency and power output of these renewable energy systems. Innovations in design, materials, and manufacturing processes are making wind turbines more effective in converting wind into electricity. This growing efficiency not only enhances the overall appeal of wind energy but also intensifies the demand for advanced wind turbine blades. The continuous pursuit of more powerful and cost-effective solutions is a key factor propelling the market for these essential components.

Surging Prominence of Offshore Wind Farms on the Global Landscape.

The expansion of offshore wind farms represents a notable trend in the renewable energy sector. Offshore locations offer access to stronger and more consistent winds, making them ideal for energy generation. However, the unique demands of offshore environments necessitate longer and more resilient wind turbine blades. The proliferation of offshore wind projects, therefore, contributes significantly to the increasing demand for advanced blade technologies. This shift towards offshore installations is not only expanding the market but also pushing manufacturers to develop cutting-edge solutions to meet the challenges posed by marine environments.

Robust Government Backing and Incentives Propelling Market Momentum.

Governments across the globe are playing a pivotal role in driving the adoption of renewable energy. Supportive policies, such as subsidies, tax incentives, and renewable portfolio standards, are encouraging businesses and investors to participate in wind energy projects. This governmental backing indirectly fuels the demand for wind turbine blades, as it creates a conducive environment for the growth of the wind energy sector. The alignment of economic incentives with environmental goals is a key catalyst in propelling the wind turbine blade market forward, ensuring a sustained and robust trajectory for the industry.

Wind Turbine Blade Market Restraints and Challenges:

Material Availability and Pricing Challenges in Wind Turbine Blade Manufacturing.

The wind turbine blade manufacturing industry faces inherent uncertainties in the availability and pricing of critical materials, such as carbon fibre and composites. These materials are essential for constructing durable and efficient blades. However, their prices can be volatile, and supply chain disruptions can occur, impacting the overall production costs. Manufacturers must navigate these challenges to maintain competitiveness and safeguard profit margins in an ever-changing market. As the demand for wind energy continues to rise, ensuring a stable and cost-effective supply of these materials becomes crucial. Industry players often find themselves at the mercy of global market dynamics, geopolitical factors, and fluctuations in raw material prices, necessitating strategic planning and risk management.

Overcoming the Challenges of Size, Weight, and Fragility in Blade Transportation.

The transportation and logistics involved in moving wind turbine blades from manufacturing facilities to installation sites present distinctive challenges. The sheer size, weight, and fragility of these blades require specialized equipment and transport methods. This includes oversized trucks, custom carriers, and careful route planning to navigate challenging terrains. The unique logistics of blade transportation contribute to increased project complexity and costs. Coordination with transportation providers, adherence to regulatory requirements, and mitigating potential delays become crucial elements in successfully delivering blades to their intended locations. As the wind energy sector expands, optimizing transportation strategies remains a focal point for enhancing efficiency and minimizing logistical challenges.

Addressing Environmental Concerns and Innovating Sustainable Solutions in Blade End-of-Life Processes.

The environmental impact of wind turbine blade disposal at the end of their operational life presents a growing challenge for the industry. The composite materials used in blade construction are durable but pose difficulties in terms of recyclability. Traditional disposal methods contribute to environmental concerns, prompting a push for sustainable solutions. Ongoing research and development efforts seek to address these challenges by exploring innovative approaches to blade recycling. Finding alternative materials or methods that are environmentally friendly and economically viable is a key focus. The industry is actively engaged in shaping a more sustainable lifecycle for wind turbine blades, aligning with broader environmental goals and regulations. As the sector evolves, the development of effective recycling practices remains integral to maintaining the green profile of wind energy as a whole.

Wind Turbine Blade Market Opportunities:

Harnessing Strength and Efficiency through Cutting-edge Material Science.

The incorporation of cutting-edge materials, notably carbon fiber and advanced composites, stands as a pivotal strategy for enhancing wind turbine blade performance. These materials not only offer superior strength and durability but also contribute to substantial weight reduction when compared to traditional counterparts like fiberglass. Companies at the forefront of integrating these advanced materials into their blade manufacturing processes position themselves to gain a competitive advantage. The quest for innovative solutions in material science becomes a key driver in achieving heightened efficiency and elevating overall turbine performance.

Revolutionizing Production Processes for Enhanced Efficiency and Precision.

The adoption of state-of-the-art manufacturing techniques, including additive manufacturing and automated layup processes, holds the potential to revolutionize the landscape of blade production. These technologies not only enhance efficiency and reduce production costs but also enable the creation of more intricate, durable, and precisely designed blades. Companies that wholeheartedly embrace and implement these innovative manufacturing methods position themselves as industry leaders, capable of meeting the growing demand for advanced and high-performance wind turbine blades.

Strategically Positioning for Growth in Stronger Winds and Deeper Waters.

The escalating popularity of offshore wind farms, attributed to their access to stronger and more consistent winds, presents a golden opportunity for companies to diversify and specialize. Tailoring blade production to meet the unique challenges and requirements of offshore environments becomes paramount. Companies that strategically pivot towards manufacturing blades specifically designed for offshore applications position themselves at the forefront of this burgeoning sector. This strategic move not only aligns with the global shift towards offshore wind energy but also underscores a commitment to addressing the evolving needs of the renewable energy market.

GLOBAL WIND TURBINE BLADE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.4 % |

|

Segments Covered |

By Blade Type, Material, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

LM Wind Power (GE Renewable Energy), Siemens Gamesa Renewable Energy Vestas Wind Systems, Suzlon Energy Limited, Nordex SE, Enercon GmbH, TPI Composites, China National Offshore Oil Corporation (Bladena), Molded Fiber Glass Companies (MFG), SiFAB (Sinoma Science & Technology Co., Ltd.) |

Wind Turbine Blade Market Segmentation:

Market Segmentation: By Blade Type

- Fixed-pitch blades

- Variable-pitch blades

In the realm of wind turbine blades, the landscape is notably characterized by distinct types, each playing a pivotal role in shaping the market dynamics. Among these, fixed-pitch blades emerge as the predominant force, commanding a substantial 75% share of the global market in 2023. This dominance is a testament to their widespread adoption and proven efficacy in converting wind energy into electricity. Fixed-pitch blades maintain a consistent angle of attack, simplifying their design and operation.

However, amidst the established reign of fixed-pitch blades, a notable contender is rapidly gaining ground. Variable-pitch blades, despite currently constituting a smaller share, are positioned as the fastest-growing segment in the wind turbine blade market. The anticipated Compound Annual Growth Rate (CAGR) of over 12% underscores the rising prominence of this dynamic technology. Variable-pitch blades offer the advantage of adjusting their angle to optimize energy capture under varying wind conditions, enhancing overall efficiency and performance.

Market Segmentation: By Material

- Glass fiber reinforced polymer (GFRP)

- Carbon fiber reinforced polymer (CFRP)

- Other materials (wood, resin, composites)

Within the intricate realm of wind turbine blade materials, a clear distinction arises, with glass fiber reinforced polymer (GFRP) reigning as the largest and most pervasive segment, claiming a substantial 75% share of the global market in 2023. The dominance of GFRP can be attributed to its trifecta of advantages – affordability, an impressive strength-to-weight ratio, and a well-suited composition for the large-scale manufacturing of blades. The inherent cost-effectiveness and structural prowess of GFRP make it the material of choice for a majority of wind turbine blade applications.

Yet, amid the established dominance of GFRP, a dynamic shift is evident. Carbon fiber reinforced polymer (CFRP) emerges as the fastest-growing segment, poised for remarkable expansion with an anticipated Compound Annual Growth Rate (CAGR) exceeding 15%. The heightened interest in CFRP is underpinned by its exceptional strength and lightness, offering a compelling alternative for manufacturers seeking to optimize blade performance and energy efficiency. The unique properties of CFRP, coupled with ongoing advancements in material science, position it as a frontrunner in meeting the evolving demands of the wind energy sector.

Market Segmentation: By Application

- Onshore wind farms

- Offshore wind farms

In the expansive domain of wind energy, onshore wind farms stand as the cornerstone, dominating the wind turbine blade market with a commanding share of approximately 90% on a global scale. This pre-eminence is a testament to the maturity and well-established presence of onshore wind farms, reflecting years of technological refinement and widespread adoption. The appeal of onshore wind farms lies not only in their maturity but also in the comparatively lower installation costs and ease of accessibility for maintenance, making them a reliable and cost-effective choice for harnessing wind energy.

However, amid the established dominance of onshore wind farms, offshore wind farms emerge as a dynamic force propelling the industry towards new frontiers. Positioned as the fastest-growing segment, offshore wind farms are anticipated to exhibit a remarkable Compound Annual Growth Rate (CAGR) exceeding 12%. This surge in growth is attributed to the unique advantages offered by offshore locations, including access to stronger and more consistent winds. The vast potential of offshore wind farms to contribute significantly to the global renewable energy mix is underscored by ongoing technological advancements, mitigating challenges, and a growing global emphasis on sustainable energy sources.

Market Segmentation: Regional Analysis

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

In the dynamic landscape of the wind turbine blade market, geographical considerations play a pivotal role in shaping industry trends. Presently, Europe stands as the leader, poised to maintain its prominent position in the near term. The continent's robust wind energy infrastructure, coupled with supportive regulatory frameworks and early adoption of renewable energy, cements its role as a key player in the global market.

However, a notable shift is on the horizon as Asia Pacific emerges as the fastest-growing region in the foreseeable future. This projection reflects the region's rapidly expanding energy demands, fuelled by rapid industrialization, urbanization, and a growing emphasis on sustainable power sources. Countries within Asia Pacific are increasingly investing in wind energy projects, capitalizing on abundant wind resources and government initiatives aimed at diversifying the energy mix.

COVID-19 Impact Analysis on the Global Wind Turbine Blade Market:

The COVID-19 pandemic exerted a substantial influence on the global wind turbine blade market in 2020, introducing challenges such as supply chain disruptions, project installation delays, and a temporary downturn in demand. The pandemic disrupted global supply chains, impeding the availability of critical raw materials, components, and transportation services essential for wind turbine blade manufacturing. Consequently, production faced delays and increased costs. Project installations were also hampered by travel restrictions and social distancing measures, leading to a decline in demand as the industry grappled with pandemic-induced uncertainties.

Despite the setbacks caused by the pandemic, the wind turbine blade market is poised for recovery and sustained growth in the coming years. Several factors contribute to this optimistic outlook. The global transition towards cleaner and more sustainable energy sources remains a driving force, propelling an increased demand for renewable energy. Wind energy, as a pivotal component of this transition, fuels the need for wind turbine blades. Moreover, ongoing technological advancements in wind turbine design, leading to enhanced efficiency and power generation, contribute to the attractiveness of wind energy, further stimulating demand for turbine blades.

Latest Trends/Developments:

Additive manufacturing, colloquially known as 3D printing, stands at the forefront of transformative technologies with the potential to revolutionize the landscape of wind turbine blade manufacturing. This cutting-edge technology opens doors to the creation of intricate and complex blade designs that were once deemed unattainable through traditional manufacturing methods. The flexibility afforded by additive manufacturing not only enhances design possibilities but also contributes to a reduction in material waste, signalling a paradigm shift towards more sustainable and efficient production processes.

Incorporating smart technologies into wind turbine blades marks another significant advancement in the industry. Smart blades, equipped with sensors and embedded systems, provide invaluable real-time data on various aspects of blade performance, structural integrity, and potential maintenance requirements. This data-driven approach allows for the optimization of turbine performance, reduction of downtime, and extension of the overall lifespan of the blades. The integration of smart blade technologies exemplifies a forward-looking approach to enhancing the efficiency and operational reliability of wind energy systems.

As the wind energy sector continues to expand, the quest for sustainable solutions in blade recycling and disposal becomes increasingly crucial. Companies within the industry are actively engaged in developing innovative approaches to address the environmental impact associated with the end-of-life phase of wind turbine blades. Seeking alternatives and methodologies that align with eco-friendly practices, the focus on sustainable blade recycling and disposal underscores the commitment of the industry to mitigate its ecological footprint. In navigating the intricate balance between technological innovation and environmental responsibility, the wind turbine sector is poised to set new benchmarks for sustainable practices on a global scale.

Key Players:

- LM Wind Power (GE Renewable Energy)

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems

- Suzlon Energy Limited

- Nordex SE

- Enercon GmbH

- TPI Composites

- China National Offshore Oil Corporation (Bladena)

- Molded Fiber Glass Companies (MFG)

- SiFAB (Sinoma Science & Technology Co., Ltd.)

LM Wind Power is a global leader in wind turbine blade manufacturing, with a market share of approximately 20%. The company has a strong track record of innovation and is known for its high-quality blades. LM Wind Power has production facilities in Europe, North America, and Asia. Siemens Gamesa Renewable Energy is a leading provider of wind energy solutions, with a market share of approximately 15%.

Vestas Wind Systems is a Danish company that is one of the world's largest wind turbine manufacturers, with a market share of approximately 12%. The company has a strong focus on innovation and is known for its advanced blade designs. Vestas Wind Systems has a global presence, with production facilities in Europe, North America, Asia, and South America.

These companies are at the forefront of the wind turbine blade industry, driving innovation and shaping the future of wind energy. Their efforts are helping to make wind energy a more competitive and sustainable source of electricity.

Chapter 1. GLOBAL WIND TURBINE BLADE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL WIND TURBINE BLADE MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL WIND TURBINE BLADE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL WIND TURBINE BLADE MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL WIND TURBINE BLADE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL WIND TURBINE BLADE MARKET – By Blade Type

6.1. Fixed Pitch Blades

6.2. Variable Pitch Blades

Chapter 7. GLOBAL WIND TURBINE BLADE MARKET – By Material

7.1. Glass fiber reinforced polymer (GFRP)

7.2. Carbon fiber reinforced polymer (CFRP)

7.3. Other materials (wood, resin, composites)

Chapter 8. GLOBAL WIND TURBINE BLADE MARKET – By Application

8.1. Onshore Wind Farms

8.2. Offshore Wind Farms

Chapter 9. GLOBAL WIND TURBINE BLADE MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Blade Type

9.1.3. By Material

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Blade Type

9.2.3. By Material

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Blade Type

9.3.3. By Material

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Blade Type

9.4.3. By Material

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Blade Type

9.5.3. By Material

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL WIND TURBINE BLADE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. LM Wind Power (GE Renewable Energy)

10.2. Siemens Gamesa Renewable Energy

10.3. Vestas Wind Systems

10.4. Suzlon Energy Limited

10.5. Nordex SE

10.6. Enercon GmbH

10.7. TPI Composites

10.8. China National Offshore Oil Corporation (Bladena)

10.9. Molded Fiber Glass Companies (MFG)

10.10. SiFAB (Sinoma Science & Technology Co., Ltd.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wind Turbine Blade Market was valued at USD 48.1 Billion in 2023 and is projected to reach a market size of USD 115.99 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is anticipated to grow at a CAGR of 13.4%.

The primary drivers of the Global Wind Turbine Blade Market include the global transition towards renewable energy, advancements in wind turbine efficiency and design, expansion of offshore wind farms, and supportive government policies promoting renewable energy adoption.

Wind turbine blades are pivotal in converting wind energy into electricity. Their aerodynamic design captures kinetic energy from the wind. As wind flows over the curved surfaces, it creates a pressure difference, generating lift. This lift force propels the rotation of the blades, turning the turbine's rotor and facilitating energy generation.

Europe dominates the Wind Turbine Blade Market primarily due to its early adoption of wind energy and well-established wind power infrastructure.

LM Wind Power (GE Renewable Energy), Siemens Gamesa Renewable Energy, Vestas Wind Systems, Suzlon Energy Limited, Nordex SE, Enercon GmbH, TPI Composites, China National Offshore Oil Corporation (Bladena), Molded Fiber Glass Companies (MFG), SiFAB (Sinoma Science & Technology Co., Ltd.).