Wind Turbine Brakes Market Size (2024 – 2030)

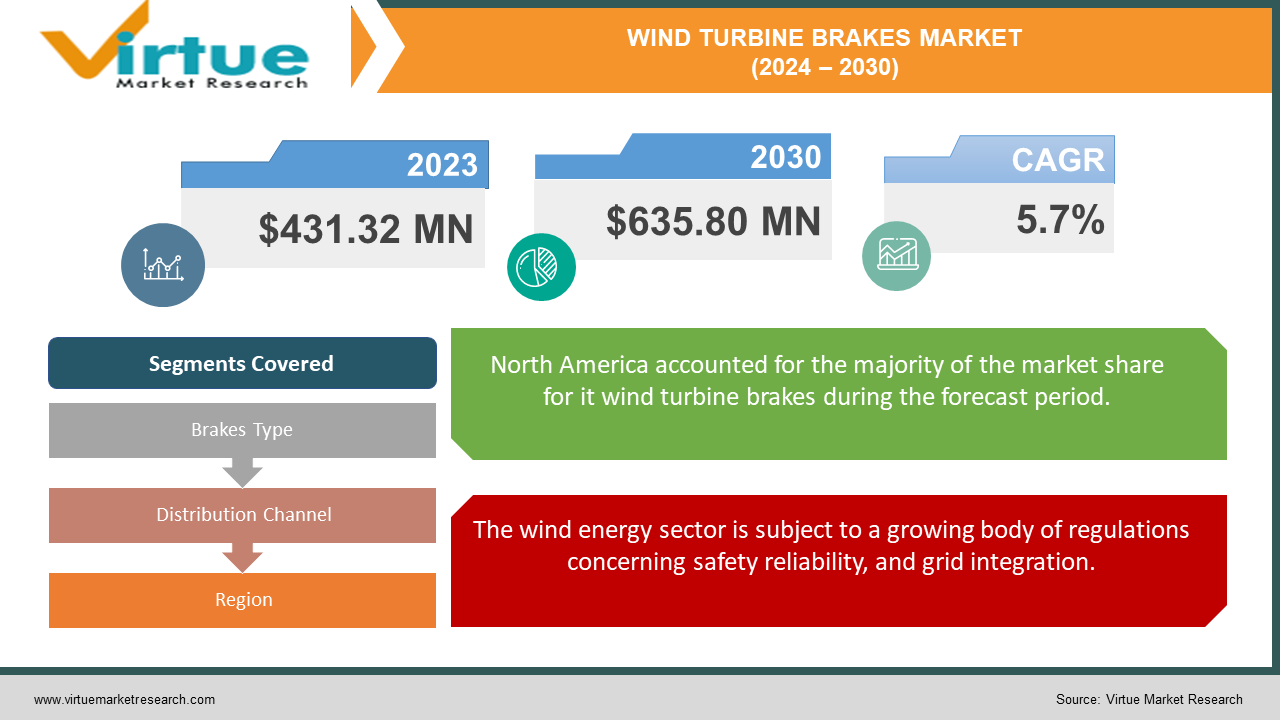

The Global Wind Turbine Brakes Market was valued at USD 431.32 Million in 2023 and is projected to reach a market size of USD 635.80 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.7%.

The use of wind energy, a clean, renewable energy source, is expanding rapidly. The wind turbine brake system is an essential but frequently disregarded part that protects the massive wind turbines that pierce the skylines. This complex process is essential to maintaining the safety and efficient operation of these wind industry giants. The number of wind turbine installations is rising as a result of the global push towards renewable energy sources. Since every wind turbine needs a reliable braking system, this directly leads to an increase in the need for wind turbine brakes. Regulatory bodies are implementing stricter safety standards for wind turbines. This focus on safety necessitates the use of reliable and high-performance braking systems, further driving market growth.

Key Market Insights:

Disc brakes hold the dominant market share, accounting for roughly 65% of the market, due to their efficiency and ability to handle high torque loads.

Caliper brakes are expected to witness a significant growth rate in the coming years due to their compact size and suitability for smaller wind turbines.

Onshore wind farms currently dominate the market, accounting for over 80% of the demand for wind turbine brakes.

However, the offshore wind sector is projected to experience faster growth due to government incentives and technological advancements enabling installation in deeper waters.

Depending on the wind turbine's size and complexity, the average cost of a brake system might vary from $50,000 to $200,000.

Annual maintenance and repair contracts, which range in value from $10,000 to $30,000 per turbine, constitute a substantial source of income for wind turbine brake manufacturers and service providers.

Fluctuations in raw material prices, particularly for metals used in brake components, can pose challenges for manufacturers in terms of cost control.

Stringent regulations on safety and environmental impact may require additional research and development efforts for brake manufacturers.

Wind Turbine Brakes Market Drivers:

The wind energy sector is witnessing a relentless pursuit of efficiency. One key strategy is the installation of larger wind turbines, capable of harnessing stronger winds and generating more electricity.

Larger rotors capture more wind energy, translating to higher power generation. However, this also translates to a significant increase in rotational inertia, the energy is stored by the rotating turbine blades. Stopping or slowing down such a massive system requires powerful and reliable brakes. Large-scale wind energy integration into the power grid requires precise control over turbine output. Wind turbine brakes play a critical role in enabling rapid power regulation, ensuring grid stability, and preventing overloads during fluctuating wind conditions. Large wind turbines operate in diverse environments, and robust braking systems are essential for safe emergency shutdowns. These systems need to function effectively in high winds, extreme temperatures, and even icing conditions to ensure personnel and equipment safety.

The wind energy sector is subject to a growing body of regulations concerning safety reliability, and grid integration. These regulations directly influence the design and functionality of wind turbine brakes.

International and national safety regulations, IEC 61400 series, set stringent requirements for wind turbine brakes. These mandate specific performance criteria for emergency braking, including stopping distances and response times. Grid operators have established codes that wind turbines need to adhere to for safe and reliable power integration. Wind turbine brakes play a crucial role in enabling compliance with these codes by ensuring rapid power regulation and preventing grid instability during wind fluctuations or electrical faults. The focus on safety and grid code compliance requires advanced braking technology. Manufacturers are exploring disc brakes and caliper brakes, known for their faster response times and better control over high-inertia systems, alongside traditional disc brakes. Additionally, advancements in control systems and brake pad materials are leading to improved efficiency, reduced wear and tear, and ultimately, lower operating costs for wind farm operators.

Wind Turbine Brakes Market Restraints and Challenges:

Wind turbines operate in diverse environments often at high altitudes and exposed to harsh weather conditions. Braking systems play a critical role in ensuring safety during various scenarios, including emergency shutdowns, blade adjustments, and routine maintenance. These brakes need to be powerful and reliable enough to bring the massive turbine to a complete stop quickly and safely in case of emergencies. Frequent braking, particularly during high winds or grid instability can lead to accelerated wear and tear of the braking components. This necessitates regular maintenance and replacement of brake parts, increasing operational costs for wind farm operators. Finding the optimal balance between safety and minimizing wear is a constant challenge for the wind turbine brakes market. The wind energy industry is witnessing a trend towards larger and more powerful turbines. Gigawatt-class turbines with longer blades and increased capacity are being developed to harness more wind energy and reduce the number of turbines needed in wind farms.

Wind Turbine Brakes Market Opportunities:

Offshore wind turbines are constantly exposed to salt spray, high winds, and extreme temperatures. Traditional brake systems can be susceptible to corrosion, leading to malfunctions and costly repairs. The wind turbine brakes market presents an opportunity for the development and adoption of corrosion-resistant brake materials and coatings specifically designed for offshore applications. The remoteness of offshore wind farms requires reliable and efficient braking systems that require minimal maintenance. Opportunities exist for the development of self-diagnostic and condition-monitoring systems integrated with wind turbine brakes. This allows for preventive maintenance, reducing the need for costly offshore service calls. Offshore wind turbines operate in a critical environment, and ensuring safety is paramount. The wind turbine brakes market offers an opportunity for the development of redundant braking systems. This ensures that even in the event of a single brake failure, the turbine can be brought to a standstill safely.

WIND TURBINE BRAKES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Brakes Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Altra Industrial Motion Corp, ANTEC Group, Dellner Brakes AB, The Hilliard Corp, Hindon LLC, Hydratech Industries, Miki Pulley Co. Ltd, Siegerland Bremsen GmbH, Thomson Industries Inc., W.C. Branham Inc |

Wind Turbine Brakes Market Segmentation: By Brakes Type

-

Rotor Brakes

-

Yaw Brakes

-

Parking Brakes

Rotor Brakes account for roughly 70% of the market share, Rotor brakes are the workhorses of wind turbine braking systems. They are typically large disc brakes positioned on the main shaft behind the gearbox. During normal operation, rotor brakes can be used to adjust the rotational speed of the turbine blades, optimizing energy capture or slowing down the rotor in high winds for safety reasons. Rotor brakes are essential for bringing the wind turbine to a complete standstill for maintenance activities or emergencies. This ensures the safety of technicians and allows for essential repairs or replacements. The dominance of rotor brakes stems from their crucial role in ensuring the safe and efficient operation of wind turbines. Their ability to regulate speed, bring the turbine to a complete stop, and provide a parking function makes them an indispensable component.

While rotor brakes reign supreme, yaw brakes are experiencing the most significant growth, capturing around 20% of the market share, and are projected to grow at a rate exceeding 5% annually. Yaw brakes, typically hydraulic brakes, are responsible for controlling the yaw mechanism of the wind turbine. This mechanism allows the nacelle, which houses the gearbox and generator to rotate and face the prevailing wind direction. Offshore wind farms are increasingly being deployed in deeper waters with stronger and more variable winds. Precise yaw control is crucial in these conditions to maximize energy capture and minimize stress on the turbine structure. Yaw brakes play a vital role in achieving this precise control. As wind turbine technology evolves, yaw drive systems are becoming more complex. Modern yaw drives require sophisticated braking systems to ensure smooth and precise control, further fueling the demand for advanced yaw brakes.

Wind Turbine Brakes Market Segmentation: By Distribution Channel

-

Direct Sales (Manufacturer to Wind Turbine OEM)

-

Distributors and Aftermarket Sales

-

Retailers

-

Online Platforms

Direct Sales (Manufacturer to Wind Turbine OEM) (40-50%) channel represents the most dominant distribution method. Here, wind turbine brake manufacturers establish direct relationships with Original Equipment Manufacturers (OEMs) who build wind turbines. Manufacturers collaborate closely with OEMs during the design phase, ensuring the brakes seamlessly integrate with the specific turbine model and control systems. This approach offers greater control over product quality and technical specifications.

E-commerce Platforms (Emerging Channel - 5-10%) The rise of e-commerce is gradually making inroads into the wind turbine brakes market. This channel offers a convenient platform for sourcing specific brake parts and components, particularly for smaller wind farm operators or those seeking readily available spare parts. However, the complexity and high value of wind turbine brakes limit the dominance of this channel for now.

Wind Turbine Brakes Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

With a market share of roughly 30–35%, Europe leads the global market for wind turbine brakes. The region's long-standing dedication to renewable energy sources, its aggressive measures to mitigate climate change, and the existence of reputable wind turbine manufacturers are all responsible for this dominance. The strict quality requirements and environmental restrictions of the European Union have also been a major factor in boosting demand for sophisticated and dependable wind turbine braking systems.

On the other hand, the Asia-Pacific region is considered the fastest-growing market for wind turbine brakes. With a market share of approximately 25-30%, the region's rapid economic growth, increasing demand for renewable energy sources, and the adoption of ambitious climate change policies have created a favorable environment for the growth of the Wind Turbine Brakes market. China, in particular, has been a major driving force behind the market's growth, driven by its massive investment in wind energy projects and its ambitious renewable energy targets.

COVID-19 Impact Analysis on the Wind Turbine Brakes Market:

Restrictions on mining and manufacturing operations led to shortages of essential materials like steel, cast iron, and hydraulic components used in brakes. This limited production capacity and caused delays in fulfilling existing orders. Disruptions in air and sea freight transportation resulted in delays and increased shipping costs. The movement of completed wind turbine brakes to project sites became a logistical challenge, impacting installation timelines. The pandemic instilled caution in investors, leading some to postpone or pull back from renewable energy projects. This wait-and-see approach reduced the immediate need for wind turbine brakes. Social distancing measures and travel restrictions hampered the availability of skilled labor for wind farm construction and maintenance. This caused delays in brake installation and maintenance activities, further impacting market growth. The need for social distancing spurred the adoption of remote monitoring and maintenance technologies for wind turbines. This allowed for more efficient brake performance monitoring and troubleshooting, minimizing the need for on-site personnel.

Latest Trends/ Developments:

Modern wind turbine brakes are increasingly equipped with sensors that monitor factors like rotor speed, wind direction, and blade pitch angle. This real-time data can be used to optimize braking performance and ensure smooth operation under varying wind conditions. Advanced braking systems can be integrated with machine learning algorithms for predictive maintenance. By analyzing sensor data, these systems can identify potential brake issues before they occur, allowing for proactive maintenance and preventing costly downtime. The integration of internet-of-things (IoT) technologies enables remote monitoring and control of wind turbine brakes. This allows for centralized oversight of brake performance across wind farms, facilitating faster response times to potential problems and improving overall operational efficiency. Traditional brake pads and linings are being replaced with materials that offer superior wear resistance, higher temperature tolerance, and improved braking efficiency. These advancements can extend the lifespan of brake components and reduce maintenance requirements. Advancements in materials like composites and high-strength steels allow for the development of lighter and more compact brake systems. This can be particularly beneficial for offshore wind turbines, where weight reduction is crucial for stability and cost-effectiveness.

Key Players:

-

Altra Industrial Motion Corp

-

ANTEC Group

-

Dellner Brakes AB

-

The Hilliard Corp

-

Hindon LLC

-

Hydratech Industries

-

Miki Pulley Co. Ltd

-

Siegerland Bremsen GmbH

-

Thomson Industries Inc.

-

W.C. Branham Inc

Chapter 1. Wind Turbine Brakes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wind Turbine Brakes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wind Turbine Brakes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wind Turbine Brakes Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wind Turbine Brakes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wind Turbine Brakes Market – By Brakes Type

6.1 Introduction/Key Findings

6.2 Rotor Brakes

6.3 Yaw Brakes

6.4 Parking Brakes

6.5 Y-O-Y Growth trend Analysis By Brakes Type

6.6 Absolute $ Opportunity Analysis By Brakes Type, 2024-2030

Chapter 7. Wind Turbine Brakes Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales (Manufacturer to Wind Turbine OEM)

7.3 Distributors and Aftermarket Sales

7.4 Retailers

7.5 Online Platforms

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Wind Turbine Brakes Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Brakes Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Brakes Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Brakes Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Brakes Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Brakes Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Wind Turbine Brakes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Altra Industrial Motion Corp

9.2 ANTEC Group

9.3 Dellner Brakes AB

9.4 The Hilliard Corp

9.5 Hindon LLC

9.6 Hydratech Industries

9.7 Miki Pulley Co. Ltd

9.8 Siegerland Bremsen GmbH

9.9 Thomson Industries Inc.

9.10 W.C. Branham Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The increasing global focus on renewable energy sources is driving the installation of wind farms. This surge in wind turbine installations necessitates a proportional growth in the wind turbine brakes market, as these brakes are crucial for safe and efficient operation.

Wind turbine brakes, particularly those designed for larger, more powerful turbines, can be expensive to purchase and install. This can be a hurdle for some wind energy developers, especially in cost-competitive renewable energy markets.

Altra Industrial Motion Corp, ANTEC Group, Dellner Brakes AB, The Hilliard Corp, Hindon LLC, Hydratech Industries, Miki Pulley Co. Ltd, Siegerland Bremsen GmbH, Thomson Industries Inc., W.C. Branham Inc.

Europe emerged as the most dominant player in the MEA smart irrigation market, commanding an impressive 35% share.

Asia-Pacific emerges as the fastest-growing region in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.