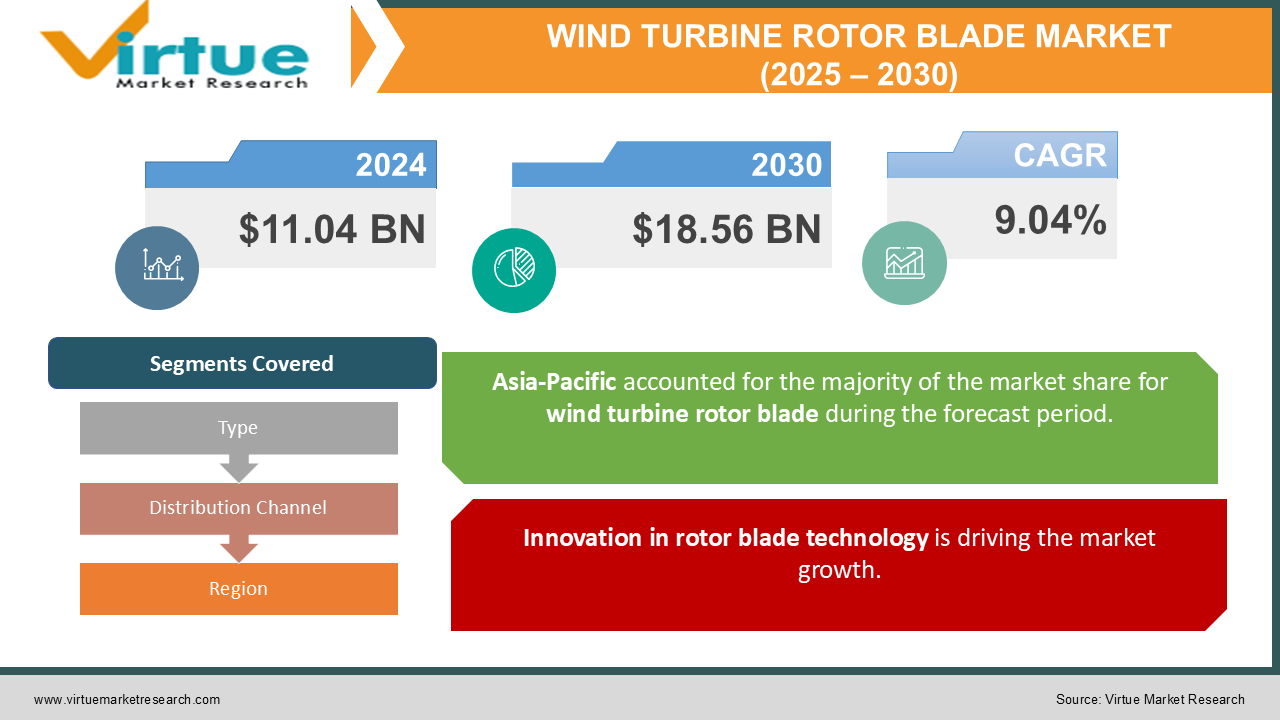

Wind Turbine Rotor Blade Market Size (2025 – 2030)

The Wind Turbine Rotor Blade Market was valued at USD 11.04 Billion in 2024 and is projected to reach a market size of USD 18.56 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.04%.

The wind turbine rotor blade market is at the forefront of the global shift towards renewable energy, driven by increasing demand for clean energy solutions to combat climate change. Wind energy, a cornerstone of the renewable energy sector, relies heavily on the efficiency and performance of wind turbine rotor blades. These blades are integral components of wind turbines, capturing kinetic energy from the wind and converting it into mechanical energy for electricity generation. With the global push for carbon neutrality, governments, energy companies, and private investors are committing significant resources to expand wind energy installations, both onshore and offshore, thereby propelling the demand for rotor blades. As wind turbines grow larger and more sophisticated, rotor blade designs are becoming increasingly complex, incorporating advanced materials and aerodynamic structures to enhance efficiency, durability, and performance under varying wind conditions.

Key Market Insights:

-

Over 65% of newly installed wind turbines in 2023 featured blades exceeding 60 meters in length.

-

Offshore wind turbines accounted for nearly 40% of global rotor blade demand in 2023.

-

More than 80% of rotor blades manufactured in 2023 utilized glass-reinforced plastic (GRP) as the primary material.

-

Carbon fiber composites contributed to 20% of rotor blades in 2023, primarily for offshore applications.

-

The market saw over 50,000 new rotor blades manufactured globally in 2023.

-

The wind turbine rotor blade market supported the employment of over 120,000 workers globally in 2023. Demand for custom-designed rotor blades grew by 18% in 2023.

-

Floating offshore turbines required approximately 5% of rotor blades manufactured in 2023. The average lifespan of rotor blades installed in 2023 was estimated at 25 years.

-

Over 30% of global wind energy capacity in 2023 was attributed to wind turbines with rotor diameters exceeding 150 meters.

-

Over 2 million metric tons of composite materials were used in rotor blade manufacturing in 2023. The average downtime for turbine blade repairs decreased by 10% in 2023 due to advanced repair techniques.

Market Drivers:

Global Efforts to Reduce Carbon Emissions and Combat Climate Change is Driving the Market Growth

Governments worldwide have implemented stringent policies and financial incentives to encourage the adoption of renewable energy systems, making wind energy a critical part of these efforts. Wind turbines, driven by advanced rotor blades, have become a primary choice due to their scalability and ability to generate substantial energy in both onshore and offshore settings. Wind energy's rapid integration into national energy grids has necessitated advancements in rotor blade design and technology to meet the growing demand. The continuous evolution of rotor blade materials and manufacturing techniques allows turbines to harness wind more effectively, improving energy output while lowering operational costs. Additionally, subsidies and tax benefits for renewable energy projects have further fueled investments in wind farms, directly driving the demand for rotor blades.

Innovation in rotor blade technology is driving the market growth.

Modern rotor blades are designed to be longer, lighter, and more efficient, thanks to advancements in materials such as hybrid composites and carbon fiber-reinforced plastics. These innovations enhance turbine efficiency by maximizing energy capture while minimizing structural stress. Technological breakthroughs in aerodynamic design and computational modeling have optimized blade performance, enabling turbines to operate efficiently even in low-wind-speed areas. Additionally, modular and segmented blade designs are revolutionizing logistics, reducing transportation challenges and enabling easier installation, particularly for offshore wind farms. These advancements, coupled with a focus on durability and recyclability, are attracting more investments in the wind turbine rotor blade market.

Market Restraints and Challenges:

Despite the positive outlook, the wind turbine rotor blade market faces significant challenges. One major restraint is the high cost of manufacturing rotor blades. Advanced materials like carbon fiber composites and hybrid materials, while offering superior performance, significantly increase production costs. Additionally, the complexity of blade design and the precision required during manufacturing add to expenses. These factors can deter small and mid-sized players from entering the market, limiting competition and innovation. Another challenge is the recyclability of rotor blades. Traditional materials used in blades, such as glass-reinforced plastics, are difficult to recycle, leading to a growing waste management problem as turbines reach the end of their operational lives. While efforts are underway to develop recyclable materials and repurposing solutions, these initiatives are still in the early stages and lack widespread adoption. Logistics and transportation pose additional challenges, particularly for offshore wind farms. The size and length of rotor blades make them difficult to transport, especially to remote or deep-water locations. Even with modular designs, the costs and risks associated with blade transportation remain significant. Moreover, the need for specialized equipment and skilled labor for installation and maintenance adds to operational complexities.

Market Opportunities:

The growing adoption of offshore wind farms represents a significant opportunity for the rotor blade market. Offshore locations offer higher and more consistent wind speeds, which can significantly increase energy generation. The trend toward floating wind turbines is particularly promising, as it allows the installation of turbines in deeper waters where wind conditions are optimal. These developments are expected to drive demand for larger, more robust rotor blades capable of withstanding harsh marine environments. Another opportunity lies in the development of recyclable and sustainable rotor blades. With increasing environmental awareness and regulatory pressure, manufacturers investing in green materials and end-of-life management solutions stand to gain a competitive edge. Innovations in biodegradable composites and repurposing strategies not only address waste management concerns but also enhance brand reputation among environmentally conscious consumers and governments. The adoption of digital technologies, such as sensors and predictive maintenance systems, offers another growth avenue. These technologies can monitor rotor blade performance in real-time, identify potential issues before they escalate, and optimize maintenance schedules, thereby reducing downtime and improving operational efficiency.

WIND TURBINE ROTOR BLADE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.04% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, General Electric (GE), Nordex SE, LM Wind Power, TPI Composites Inc., Enercon GmbH,Suzlon Energy Ltd., Mingyang Smart Energy Group Co., Ltd., Senvion S.A. |

Wind Turbine Rotor Blade Market Segmentation: By Type

-

Glass-Reinforced Plastics (GRP)

-

Carbon Fiber-Reinforced Plastics (CFRP)

-

Hybrid Composites

Glass-Reinforced Plastics (GRP) dominate the market because of their cost-effectiveness, durability, and relatively simpler manufacturing process. GRP is widely used in both onshore and offshore turbines due to its balance between affordability and structural strength.

Carbon Fiber-Reinforced Plastics (CFRP) are experiencing the fastest growth in the market. CFRP blades are lighter and stronger than GRP, allowing for longer blade designs and higher efficiency in capturing wind energy, especially for offshore applications. Despite the higher cost, the increased energy yield and lower maintenance requirements make CFRP blades highly attractive for large-scale wind farms.

Wind Turbine Rotor Blade Market Segmentation: by Distribution Channel

-

Direct Sales

-

Distributors

-

Online Sales

Direct Sales dominate the market, as most rotor blade manufacturers prefer working directly with wind farm developers and operators. This approach ensures better customization of products, seamless after-sales support, and stronger relationships with clients.

Online Sales are the fastest-growing channel in the rotor blade market. As digitalization transforms procurement processes, wind energy companies increasingly use online platforms to streamline sourcing, compare options, and access technical specifications. Online sales channels are particularly gaining traction among small and mid-sized operators in the market.

Wind Turbine Rotor Blade Market Segmentation: Regional Analysis

-

Asia-Pacific

-

Europe

-

North America

-

Rest of the World

Asia-Pacific dominates the market due to large-scale installations in countries like China and India, supported by strong government policies. Europe follows, driven by advanced offshore wind projects in countries like the UK and Germany. North America is the fastest-growing region, fueled by increasing investments in renewable energy and favorable policies under programs like the U.S. Inflation Reduction Act.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the wind turbine rotor blade market. While supply chain disruptions and labor shortages initially hampered production and project timelines, the crisis underscored the importance of sustainable energy solutions. As governments implemented recovery plans, many prioritized renewable energy investments, boosting demand for wind turbines. Additionally, the pandemic accelerated digitalization across the industry, leading to improved manufacturing processes and remote monitoring systems for rotor blades.

Latest Trends and Developments:

The wind turbine rotor blade market is experiencing a surge in technological innovations and sustainability initiatives. Recent trends include the development of modular and segmental blades for improved logistics, the adoption of hybrid composite materials for enhanced durability, and the integration of IoT-enabled sensors for real-time performance monitoring. Manufacturers are also exploring bio-based and recyclable materials to address end-of-life challenges. Meanwhile, floating offshore turbines are gaining traction, supported by advancements in lightweight blade designs that can operate efficiently in deep-water environments.

Key Players in the Market:

-

Vestas Wind Systems A/S

-

Siemens Gamesa Renewable Energy

-

General Electric (GE)

-

Nordex SE

-

LM Wind Power

-

TPI Composites Inc.

-

Enercon GmbH

-

Suzlon Energy Ltd.

-

Mingyang Smart Energy Group Co., Ltd.

-

Senvion S.A.

Chapter 1. Wind Turbine Rotor Blade Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wind Turbine Rotor Blade Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wind Turbine Rotor Blade Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wind Turbine Rotor Blade Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wind Turbine Rotor Blade Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wind Turbine Rotor Blade Market – By Type

6.1 Introduction/Key Findings

6.2 Glass-Reinforced Plastics (GRP)

6.3 Carbon Fiber-Reinforced Plastics (CFRP)

6.4 Hybrid Composites

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Wind Turbine Rotor Blade Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Online Sales

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Wind Turbine Rotor Blade Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Wind Turbine Rotor Blade Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Vestas Wind Systems A/S

9.2 Siemens Gamesa Renewable Energy

9.3 General Electric (GE)

9.4 Nordex SE

9.5 LM Wind Power

9.6 TPI Composites Inc.

9.7 Enercon GmbH

9.8 Suzlon Energy Ltd.

9.9 Mingyang Smart Energy Group Co., Ltd.

9.10 Senvion S.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Wind Turbine Rotor Blade Market is driven by the global shift towards renewable energy, advancements in blade materials like carbon fiber, increasing installations of large-scale wind farms, and supportive government policies. Rising energy demand, offshore wind projects, and innovations in aerodynamic blade design further enhance efficiency and output, accelerating the market’s growth trajectory.

The main concerns about the wind turbine rotor blade market include high production costs due to advanced materials like carbon fiber, challenges in recycling and environmental disposal, logistical difficulties in transporting large blades, and susceptibility to wear and tear from extreme weather conditions. Additionally, fluctuating raw material prices and evolving regulatory standards further complicate market dynamics.

Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, General Electric (GE), Nordex SE, LM Wind Power, TPI Composites Inc., Enercon GmbH.

Asia Pacific currently holds the largest market share, estimated around 35%.

North America has shown significant room for growth in specific segments.