Carbon Fiber in Wind Turbine Rotor Blade Market Size (2024 – 2030)

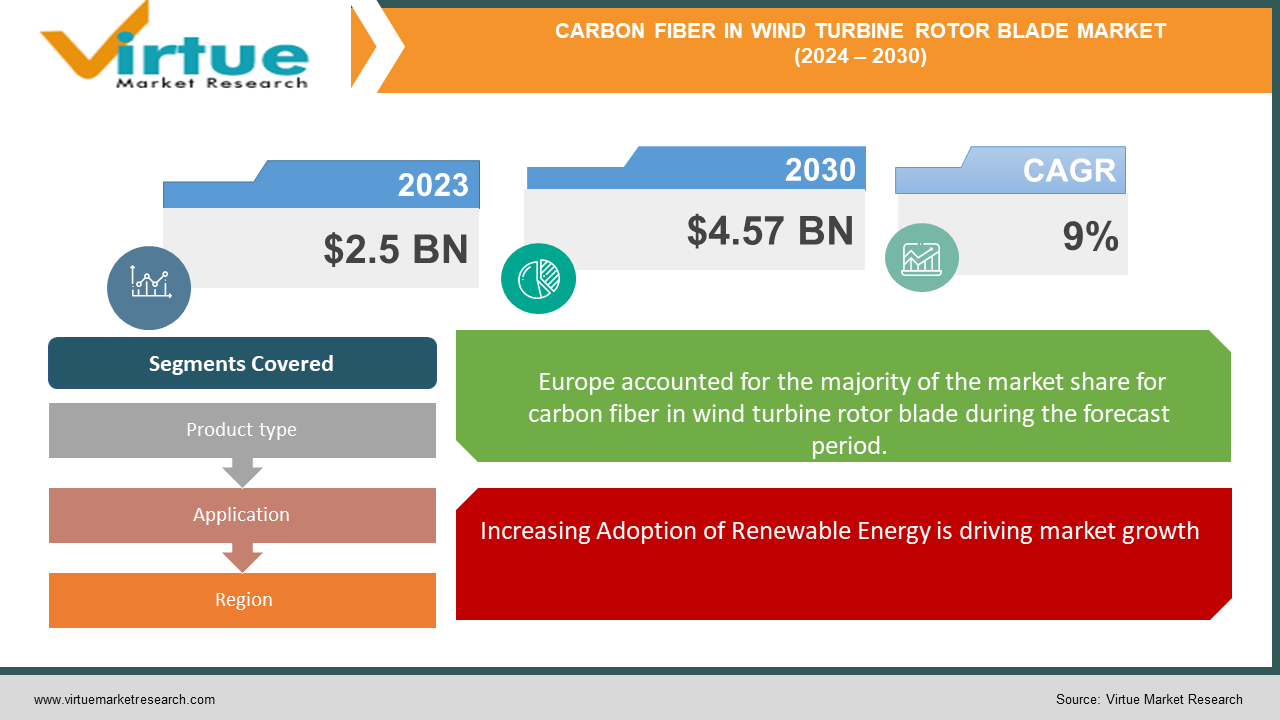

The Carbon Fiber in Wind Turbine Rotor Blade Market was valued at USD 2.5 billion in 2023 and is poised to grow at a CAGR of 9% from 2024 to 2030. By 2030, the market is expected to surpass USD 4.57 billion.

The rising global focus on renewable energy drives the carbon fiber in the wind turbine rotor blade market due to its lightweight and high-strength properties. Manufacturing advancements are enabling the production of longer, lighter carbon fiber blades, enhancing turbine efficiency.

Government policies and subsidies for renewable energy boost the adoption of carbon fiber in wind turbine blades. Decreasing carbon fiber costs due to improved production techniques makes it more accessible for wind turbine manufacturers.

Offshore wind farms create significant opportunities, as robust and lightweight carbon fiber blades are ideal for marine environments. Collaborations between carbon fiber manufacturers and wind turbine producers drive innovation and market growth.

Key Market Insights

-

Carbon fiber reinforced plastics (CFRP) account for nearly 25% of the total wind turbine rotor blade material composition, owing to their high strength-to-weight ratio and fatigue resistance.

-

The demand for carbon fiber in wind turbine rotor blades is growing at a rate of approximately 12% annually, driven by the increasing adoption of larger and more efficient wind turbines.

-

The offshore wind sector is expected to contribute around 40% of the demand for carbon fiber in wind turbine rotor blades, as offshore installations typically require longer and more durable blades.

-

In terms of region, North America holds the largest market share of around 62% for carbon fiber in wind turbine rotor blades, attributed to the region's leadership in wind energy installations and the presence of major blade manufacturers.

Global Carbon Fiber in Wind Turbine Rotor Blade Market Drivers

Increasing Adoption of Renewable Energy is driving market growth:

The global shift towards renewable energy sources is a primary driver of the carbon fiber in the wind turbine rotor blade market. Governments and organizations worldwide are prioritizing renewable energy to reduce carbon emissions and combat climate change. Wind energy, being one of the most viable and scalable renewable sources, is witnessing significant investments and installations. Carbon fiber, with its lightweight and high-strength properties, is crucial for manufacturing efficient wind turbine blades. The superior performance of carbon fiber blades in terms of energy capture, durability, and maintenance makes them a preferred choice for modern wind turbines, supporting the market's growth.

Technological Innovations in Wind Turbine Design are driving market growth: Technological advancements in wind turbine design are propelling the adoption of carbon fiber rotor blades. Innovations in materials science and engineering are enabling the production of longer and lighter blades that can capture more wind energy. Carbon fiber's exceptional strength-to-weight ratio allows for the creation of blades that are not only longer but also more efficient in converting wind energy into electrical power. Additionally, advancements in manufacturing processes, such as automated fiber placement and resin transfer molding, are enhancing the scalability and cost-effectiveness of carbon fiber blade production. These technological innovations are driving the market by improving the overall efficiency and performance of wind turbines.

Supportive Government Policies and Incentives are driving market growth:

Government policies and incentives aimed at promoting renewable energy are significant drivers of carbon fiber in the wind turbine rotor blade market. Many countries have implemented policies to support the development and deployment of wind energy projects, including subsidies, tax incentives, and feed-in tariffs. These measures reduce the financial burden on wind energy developers and encourage investments in advanced turbine technologies, such as carbon fiber rotor blades. Additionally, international agreements and national commitments to reduce greenhouse gas emissions are driving the adoption of wind energy as a clean and sustainable power source. The supportive regulatory environment and financial incentives provided by governments are instrumental in driving the market's growth.

Global Carbon Fiber in Wind Turbine Rotor Blade Market Challenges and Restraints

High Initial Cost and Investment are restricting market growth:

One of the major challenges in the carbon fiber in the wind turbine rotor blade market is the high initial cost and investment required for carbon fiber materials and manufacturing processes. Although the cost of carbon fiber has been decreasing over time, it remains higher than traditional materials such as fiberglass. The production of carbon fiber rotor blades involves advanced fabrication techniques and specialized equipment, which add to the overall cost. This high upfront investment can be a barrier for some wind energy developers and manufacturers, particularly in regions with limited financial resources. Overcoming this challenge requires continued efforts to reduce the cost of carbon fiber through technological advancements and economies of scale.

Technical and Logistical Challenges Restricting Market Growth:

The use of carbon fiber in wind turbine rotor blades presents several technical and logistical challenges. Carbon fiber blades, being longer and lighter, require precise engineering and manufacturing processes to ensure structural integrity and performance. The fabrication and assembly of large carbon fiber blades demand specialized skills and facilities. Additionally, the transportation and installation of these long blades pose logistical challenges, particularly for offshore wind farms. Transporting oversized blades to remote or offshore locations requires careful planning and coordination, often involving customized transportation solutions. Addressing these technical and logistical challenges is crucial to ensuring the successful deployment and operation of carbon fiber wind turbine blades.

Market Opportunities

The carbon fiber in wind turbine rotor blade market offers numerous opportunities for growth and innovation. One significant opportunity lies in the expanding offshore wind energy sector. Offshore wind farms have the potential to generate substantial amounts of renewable energy, but they require robust and lightweight blades to withstand harsh marine conditions. Carbon fiber's superior strength and resistance to corrosion make it an ideal material for offshore wind turbine blades. By capitalizing on the growth of offshore wind projects, manufacturers can increase their market share and drive demand for carbon fiber blades. Another opportunity exists in the development of hybrid blades that combine carbon fiber with other advanced materials. Hybrid blades can offer a balance of performance and cost-effectiveness by leveraging the benefits of different materials. For example, combining carbon fiber with fiberglass or other composites can enhance blade strength, reduce weight, and optimize overall performance. Manufacturers can explore innovative hybrid designs to cater to various wind turbine specifications and market requirements. Furthermore, the integration of smart technologies and sensors in carbon fiber blades presents an opportunity for enhanced performance monitoring and maintenance.

CARBON FIBER IN WIND TURBINE ROTOR BLADE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Hexcel Corporation, Toray Industries, Inc., Teijin Limited, Mitsubishi Chemical Holdings Corporation, SGL Carbon SE, Owens Corning, TPI Composites, Inc., Vestas Wind Systems A/S, Gamesa Corporación Tecnológica, General Electric Company |

Carbon Fiber in Wind Turbine Rotor BladeMarket Segmentation - By Product Type

-

Prepreg Carbon Fiber

-

Infusion Carbon Fiber

-

Pultruded Carbon Fiber

Prepreg carbon fiber is the most dominant segment in the carbon fiber wind turbine rotor blade market. This dominance is due to its superior performance characteristics, such as a high strength-to-weight ratio, excellent fatigue resistance, and consistent quality. These attributes make prepreg carbon fiber the preferred choice for manufacturing rotor blades that need to endure extreme stress and environmental conditions. Additionally, the controlled resin content in prepreg materials ensures better load transfer and enhanced structural integrity, which is crucial for the long-term durability and efficiency of wind turbine blades. The ongoing advancements in prepreg manufacturing technologies and increased adoption in high-performance applications further cement its leading position in the market.

Carbon Fiber in Wind Turbine Rotor BladeMarket Segmentation - By Application

-

Onshore Wind Turbines

-

Offshore Wind Turbines

The offshore wind turbines segment is the most dominant in the carbon fiber wind turbine rotor blade market. This dominance is due to the growing emphasis on offshore wind energy projects, which require robust and lightweight blades to withstand harsh marine environments. Carbon fiber's superior strength and resistance to corrosion make it an ideal material for offshore applications, driving its preference in this segment.

Carbon Fiber in Wind Turbine Rotor BladeMarket Segmentation - Regional Segmentation

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe is the dominant region in the carbon fiber in the wind turbine rotor blade market. The region's leadership is driven by strong government support, favorable policies, and significant investments in renewable energy projects. Europe has a well-established offshore wind energy sector and continues to invest in advanced turbine technologies, including the use of carbon fiber composites.

COVID-19 Impact Analysis on the Carbon Fiber in Wind Turbine Rotor Blade Market

The COVID-19 pandemic had a mixed impact on the carbon fiber in the wind turbine rotor blade market. Initially, the market experienced disruptions due to lockdowns, supply chain interruptions, and reduced workforce availability. The global manufacturing sector faced significant challenges, with many production facilities temporarily shutting down or operating at reduced capacity. These disruptions affected the production and delivery of carbon fiber materials and wind turbine components, leading to project delays and increased costs. However, as the pandemic progressed, the renewable energy sector, including wind energy, demonstrated resilience. Governments around the world recognize the importance of maintaining momentum in renewable energy projects to achieve long-term sustainability goals. In many regions, wind energy projects continued to receive support and investment, which helped mitigate the adverse effects of the pandemic on the market. Overall, while the COVID-19 pandemic posed challenges to the carbon fiber in the wind turbine rotor blade market, the long-term outlook remains positive. The continued emphasis on renewable energy, coupled with technological advancements and supportive government policies, is expected to drive market growth and recovery in the post-pandemic period.

Latest Trends/Developments

The carbon fiber in the wind turbine rotor blade market is witnessing several noteworthy trends and developments. One major trend is the increasing length of wind turbine blades. Manufacturers are continuously pushing the boundaries of blade length to capture more wind energy and improve turbine efficiency. Carbon fiber's exceptional strength-to-weight ratio allows for the production of longer blades without compromising structural integrity. This trend is particularly prominent in offshore wind projects, where longer blades can significantly enhance energy capture and reduce the number of turbines needed. Another significant development is the adoption of advanced manufacturing techniques such as automated fiber placement (AFP) and resin transfer molding (RTM). These techniques improve the precision and efficiency of carbon fiber blade production, reducing costs and enhancing scalability. Automated processes enable consistent quality and reduce manual labor, making the manufacturing of large and complex blades more feasible. Additionally, there is a growing focus on sustainability in the production of carbon fiber wind turbine blades. Overall, the carbon fiber in wind turbine rotor blade market is dynamic and evolving, driven by technological advancements, sustainability initiatives, and collaborative efforts. These trends and developments are expected to shape the market's future, providing new opportunities for growth and innovation.

Key Players

-

Hexcel Corporation

-

Toray Industries, Inc.

-

Teijin Limited

-

Mitsubishi Chemical Holdings Corporation

-

SGL Carbon SE

-

Owens Corning

-

TPI Composites, Inc.

-

Vestas Wind Systems A/S

-

Gamesa Corporación Tecnológica

-

General Electric Company

Chapter 1. Carbon Fiber in Wind Turbine Rotor Blade Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Carbon Fiber in Wind Turbine Rotor Blade Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Carbon Fiber in Wind Turbine Rotor Blade Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Carbon Fiber in Wind Turbine Rotor Blade Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Carbon Fiber in Wind Turbine Rotor Blade Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Carbon Fiber in Wind Turbine Rotor Blade Market – By Product Type

6.1 Introduction/Key Findings

6.2 Prepreg Carbon Fiber

6.3 Infusion Carbon Fiber

6.4 Pultruded Carbon Fiber

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Carbon Fiber in Wind Turbine Rotor Blade Market – By Application

7.1 Introduction/Key Findings

7.2 Onshore Wind Turbines

7.3 Offshore Wind Turbines

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Carbon Fiber in Wind Turbine Rotor Blade Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Carbon Fiber in Wind Turbine Rotor Blade Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Hexcel Corporation

9.2 Toray Industries, Inc.

9.3 Teijin Limited

9.4 Mitsubishi Chemical Holdings Corporation

9.5 SGL Carbon SE

9.6 Owens Corning

9.7 TPI Composites, Inc.

9.8 Vestas Wind Systems A/S

9.9 Gamesa Corporación Tecnológica

9.10 General Electric Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market size for the Global Carbon Fiber in Wind Turbine Rotor Blade Market is substantial and expanding, driven by the increasing adoption of wind energy and the superior performance characteristics of carbon fiber blades.

Key drivers include the rising demand for renewable energy sources, technological advancements in blade manufacturing, and supportive government policies and incentives promoting wind energy projects.

The market is segmented by product type (Prepreg Carbon Fiber, Infusion Carbon Fiber, Pultruded Carbon Fiber) and by application type (onshore wind turbines, offshore wind turbines).

Europe is the dominant region due to strong government support for renewable energy, advanced wind energy infrastructure, and significant investments in offshore wind projects.

Leading players include Hexcel Corporation, Toray Industries, Inc., Teijin Limited, Mitsubishi Chemical Holdings Corporation, SGL Carbon SE, Owens Corning, TPI Composites, Inc., Vestas Wind Systems A/S, Gamesa Corporación Tecnológica, and General Electric Company.