Vertical Farming Market Size (2024-2030)

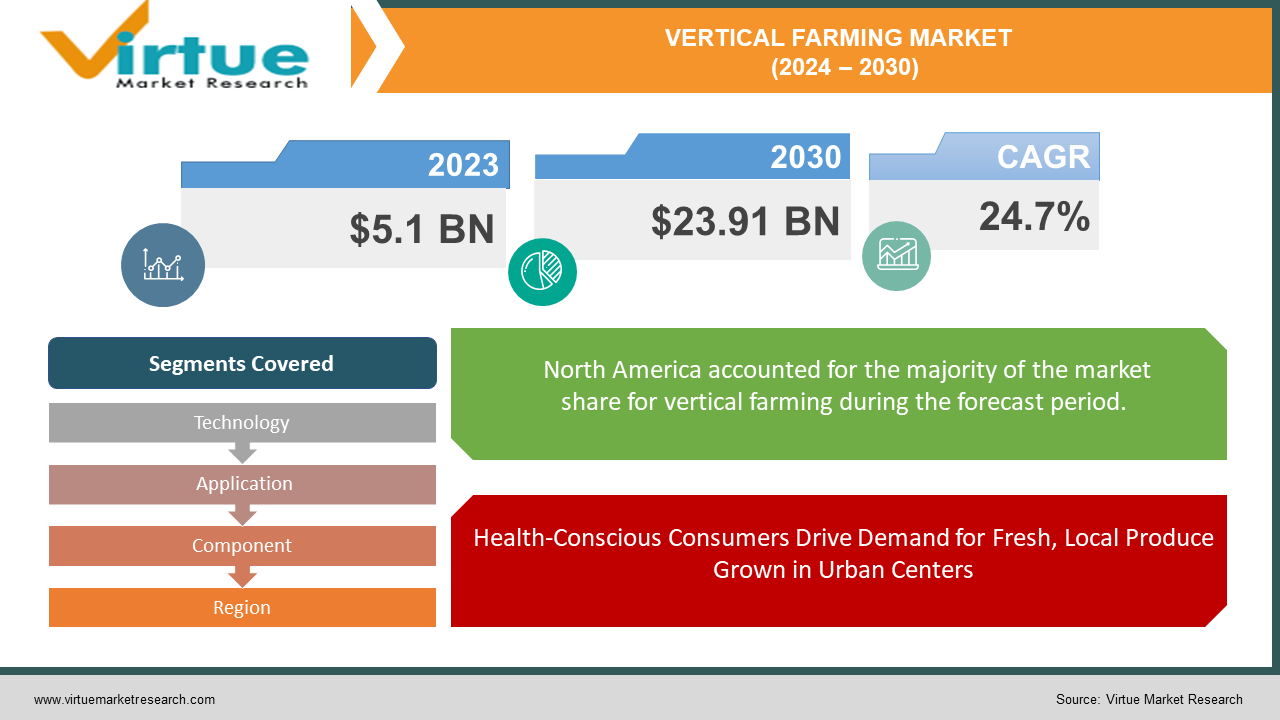

The Vertical Farming Market was valued at USD 5.1 billion in 2023 and is projected to reach a market size of USD 23.91 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 24.7%.

The vertical farming industry is experiencing a boom, driven by several key trends. Consumers are increasingly seeking fresh, local produce, and vertical farms deliver growing crops close to cities.

Key Market Insights:

The vertical farming market is thriving, driven by a confluence of factors. Consumers are increasingly health-conscious, demanding fresh, local produce. Vertical farms address this perfectly by cultivating crops near urban centers. Sustainability is another major trend, and vertical farming excels in this area. It utilizes up to 95% less water compared to traditional methods and requires minimal land. This is particularly significant as urbanization and other factors are constantly shrinking suitable land for traditional farming.

Technological advancements are continuously propelling the vertical farming market forward. New technologies are making vertical farming more efficient and cost-effective, fostering wider adoption. Additionally, governments are recognizing the potential of vertical farming to address food security and sustainability challenges. Many are starting to invest in research and development for vertical farming, further propelling market growth.

Vertical Farming Market Drivers:

Health-Conscious Consumers Drive Demand for Fresh, Local Produce Grown in Urban Centers

Health-conscious consumers are driving a surge in demand for fresh, high-quality food. Vertical farms cater to this demand perfectly by cultivating crops near urban centers. This significantly reduces transportation times, ensuring that produce reaches consumers at peak freshness. Vertical farms can also cater to specific local preferences for vegetables, herbs, and fruits, offering a wider variety of fresh options to nearby communities.

Limited Arable Land Finds a Solution in Vertical Farming's Efficient Use of Space

Shrinking arable land due to urbanization, desertification, and other factors is a pressing global challenge. Vertical farming offers an innovative solution by maximizing yield in a condensed space. Unlike traditional farms that require vast tracts of land, vertical farms can be established in urban areas or on rooftops, utilizing previously unsuitable spaces for food production. This allows for increased food production without sacrificing valuable land resources.

Technological Advancements in Lighting, Automation, and Climate Control Drive Efficiency and Growth

Constant advancements in technology are propelling the vertical farming market forward. Developments in LED lighting systems allow for precise control over the light spectrum, optimizing plant growth and maximizing yield. Automation is also playing a key role, streamlining processes like planting, harvesting, and nutrient delivery, leading to increased efficiency and reduced labor costs. Advancements in climate control systems enable precise regulation of temperature, humidity, and air circulation within vertical farms, creating optimal growing conditions for a wider variety of crops. These technological advancements are making vertical farming more efficient and cost-effective, fostering wider adoption and accelerating market growth.

Vertical Farming Market Restraints and Challenges:

Despite the promising outlook for vertical farming, some challenges need to be addressed for wider adoption. A major hurdle is the high upfront cost associated with setting up a vertical farm. The infrastructure, specialized technology for lighting and automation, and climate control systems require significant investment, potentially discouraging new entrants and smaller businesses.

Another challenge is the ongoing operational cost, particularly related to energy consumption. Artificial lighting is essential for plant growth within vertical farms, and traditional lighting systems can be energy-intensive. Optimizing energy usage and exploring alternative energy sources are crucial for long-term economic and environmental sustainability.

While vertical farming offers numerous advantages, the current technology is more suited for specific crops. Leafy greens and herbs thrive in these controlled environments. However, cultivating fruits and vegetables with specific pollination requirements or those with larger root structures can be challenging in a vertical setting. Research into adapting vertical farming for a wider variety of crops is ongoing but necessary for broader market appeal.

Vertical Farming Market Opportunities:

The vertical farming market offers exciting opportunities that extend beyond just the technology itself. As the market matures, there's a chance to diversify the crops grown. While leafy greens and herbs are a good starting point, research into optimizing conditions for fruits, vegetables with specific pollination needs, and even grains could open doors to entirely new market segments and wider consumer options. This could lead to a more secure and reliable food supply chain.

Furthermore, vertical farms needn't be isolated operations. The potential exists to integrate them with existing infrastructure, such as repurposing warehouses or even incorporating them into the design of skyscrapers. This would optimize space utilization in urban areas and create unique opportunities for urban agriculture. By strategically partnering with traditional farmers, distributors, and retailers, vertical farming companies can create a more robust and efficient food supply chain. This collaboration could involve knowledge sharing, joint ventures, or exploring entirely new models for the distribution and marketing of vertically farmed produce.

VERTICAL FARMING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24.7% |

|

Segments Covered |

By Technology, Application, Component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AeroFarms, Plenty, Signify, Freight Farms, Sky Greens, Valoya, Osram, Everlight Electronics, Heliospectra. |

Vertical Farming Market Segmentation: By Technology:

-

Hydroponics

-

Aeroponics

-

Aquaponics

The most dominant technology segment in vertical farming is Hydroponics, which utilizes a nutrient-rich water solution to grow plants without soil. It's popular due to its ease of use and lower initial investment. However, Aeroponics (or) Aquaponics is emerging as a fast-growing segment due to its potential benefits like maximized oxygen availability (Aeroponics) or combining plant and fish production (Aquaponics).

Vertical Farming Market Segmentation: By Application:

-

Urban Agriculture

-

Controlled-Environment Agriculture (CEA)

-

Remote Locations

The most dominant segment by application in the vertical farming market is currently Urban Agriculture. This segment leverages vertical farms' ability to thrive in cities, bringing fresh produce closer to consumers and reducing transportation costs. However, the fastest-growing segment is expected to be Controlled-Environment Agriculture (CEA). CEA capitalizes on vertical farming's ability to provide a year-round, precisely controlled environment for optimal crop production regardless of external conditions. This makes CEA attractive for areas with harsh climates or limited arable land.

Vertical Farming Market Segmentation: By Component:

-

Hardware

-

Software

-

Services

The dominant segment in the vertical farming market by component is Hardware. Hardware forms the backbone of vertical farming systems, encompassing crucial components like lighting, hydroponic components, climate control systems, and sensors. The fastest-growing segment is Software. Software plays an increasingly crucial role in optimizing and managing farms through farm management software and data analytics software that analyzes sensor data to improve resource use and maximize yield.

Vertical Farming Market Segmentation: Regional Analysis:

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America currently holds the dominant position in the vertical farming market. Government support for research and development, coupled with a strong focus on innovation and technological advancements, has fueled growth. Early adoption by major players in the food industry and a growing demand for fresh, local produce are driving the market forward.

The Asia-Pacific region is expected to witness the fastest growth in the vertical farming market. This is driven by several factors, including a rapidly growing population, increasing urbanization, and a rising demand for safe and high-quality food. Additionally, government support and initiatives in countries like China and Japan are accelerating market expansion.

COVID-19 Impact Analysis on the Vertical Farming Market:

The COVID-19 pandemic's impact on vertical farming was a double-edged sword. On the one hand, global disruptions in supply chains for hardware and labor shortages in some regions presented obstacles. Additionally, a shift in consumer spending toward essential goods during the pandemic might have dampened demand for vertically farmed-produce in the short term.

On the other hand, the pandemic also presented significant opportunities. The focus on food security during this time highlighted the potential of vertical farming to produce fresh produce locally and year-round, offering a solution for potential disruptions in traditional supply chains. Furthermore, heightened awareness of sustainability issues during lockdowns potentially increased interest in methods like vertical farming that align with environmentally friendly practices. The surge in e-commerce also benefitted vertical farms with robust online sales channels, allowing them to reach consumers directly. While the pandemic presented initial challenges, the long-term outlook for vertical farming appears positive. The focus on food security, sustainability, and shorter supply chains creates fertile ground for the wider adoption of vertical farming technologies in the years to come.

Latest Trends/ Developments:

The future of vertical farming is brimming with exciting developments. Artificial intelligence is playing a growing role, with AI systems analyzing sensor data to optimize plant health, predict issues, and automatically adjust environmental factors. This level of automation can significantly improve efficiency and maximize crop yields.

Integration with existing infrastructure is another key trend. We're seeing a move towards repurposing warehouses or incorporating vertical farms into the design of skyscrapers. This optimizes space utilization in urban areas and creates opportunities for local food production, bringing fresh produce closer to consumers.

Finally, sustainability remains a top priority. Vertical farming companies are focusing on using renewable energy sources, developing closed-loop water systems, and utilizing biodegradable packaging materials. By demonstrating a commitment to environmental responsibility, vertical farming companies can solidify their market position and appeal to environmentally conscious consumers. These advancements position vertical farming as a strong contender for revolutionizing agriculture and creating a more sustainable food system.

Key Players:

-

AeroFarms

-

Plenty

-

Signify

-

Freight Farms

-

Sky Greens

-

Valoya

-

Osram

-

Everlight Electronics

-

Heliospectra

Chapter 1. Vertical Farming Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Vertical Farming Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Vertical Farming Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Vertical Farming Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Vertical Farming Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Vertical Farming Market – By Technology

6.1 Introduction/Key Findings

6.2 Hydroponics

6.3 Aeroponics

6.4 Aquaponics

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Vertical Farming Market – By Application

7.1 Introduction/Key Findings

7.2 Urban Agriculture

7.3 Controlled-Environment Agriculture (CEA)

7.4 Remote Locations

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Vertical Farming Market – By Component

8.1 Introduction/Key Findings

8.2 Hardware

8.3 Software

8.4 Services

8.5 Y-O-Y Growth trend Analysis By Component

8.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 9. Vertical Farming Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.3 By Application

9.1.4 By Component

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology

9.2.3 By Application

9.2.4 By Component

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology

9.3.3 By Application

9.3.4 By Component

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology

9.4.3 By Application

9.4.4 By Component

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology

9.5.3 By Application

9.5.4 By Component

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Vertical Farming Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 AeroFarms

10.2 Plenty

10.3 Signify

10.4 Freight Farms

10.5 Sky Greens

10.6 Valoya

10.7 Osram

10.8 Everlight Electronics

10.9 Heliospectra

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Vertical Farming Market was valued at USD 5.1 billion in 2023 and is projected to reach a market size of USD 23.91 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 24.7%.

Surging Demand for Fresh, Local Produce, Sustainability Focus as a Core Value, Limited Arable Land: A Pressing Challenge, Technological Advancements Fueling Efficiency and Growth.

Urban Agriculture, Controlled-Environment Agriculture (CEA), Remote Locations.

North America holds the dominant position in the Vertical Farming Market due to government support, technological advancements, and a strong focus on innovation.

AeroFarms, Plenty, Signify, Freight Farms, Sky Greens, Valoya, Osram, Everlight Electronics, Heliospectra.