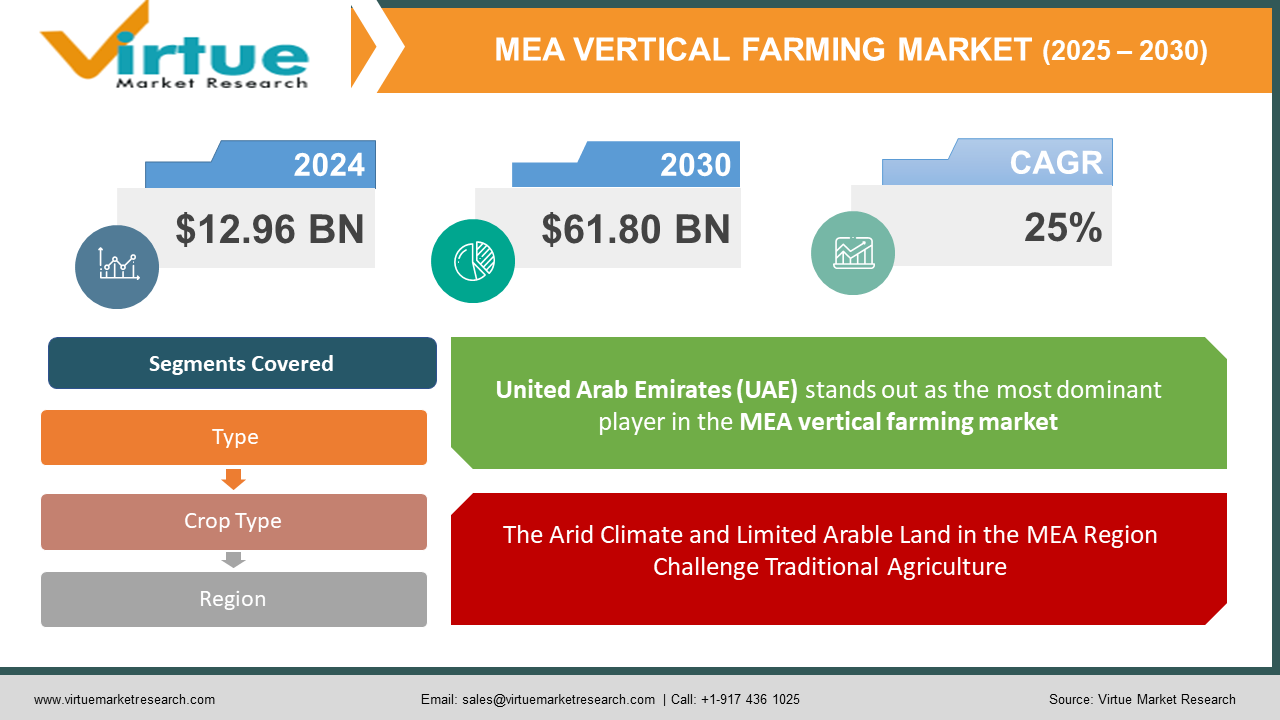

Middle East and Africa Vertical Farming Market Size (2024-2030)

The Middle East and Africa Vertical Farming Market was valued at USD 12.96 Billion in 2023 and is projected to reach a market size of USD 61.80 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 25%.

An agricultural revolution is about to occur in the Middle East and Africa (MEA) region. In this location of limited resources, vertical farming—a method that grows crops in layers that are stacked vertically within regulated environments—is gaining popularity quickly. Traditional agriculture is severely hampered by the MEA's arid environment and sparsely populated arable area. Due to many nations' declining groundwater supplies, water scarcity is a persistent problem. Furthermore, the current food production methods are severely strained by the rapid population growth. The idea of vertical farming seems like a good one. In comparison to open-field agriculture, vertical farms significantly reduce water consumption by using hydroponic or aeroponic technologies. Water efficiency is maximized by the recirculation of nutrient-rich solutions and the reduction of water evaporation in precisely controlled conditions.

Key Market Insights:

- In 2023, venture capitalists and private equity firms made global investments in vertical farming startups exceeding $1.2 billion.

- With multiple businesses securing fundraising rounds over $20 million in the last year, the MEA area is drawing an increasing proportion of these investments. This suggests that investors have a great deal of faith in the possibilities of vertical farming in the area.

- Leafy greens currently account for roughly 75% of the produce cultivated in vertical farms across the globe.

- The global market for LED lighting specifically designed for vertical farming is projected to reach $2.3 billion by 2027.

- Depending on the size and technology, the substantial upfront expenditures of establishing a vertical farm might vary from $2 million to $10 million.

- A survey conducted in Saudi Arabia revealed that over 60% of consumers expressed interest in purchasing vertically farmed-produce if quality and safety standards are met.

Middle East and Africa Vertical Farming Market Drivers:

The Arid Climate and Limited Arable Land in the MEA Region Challenge Traditional Agriculture

Water scarcity is a pressing concern, with many countries grappling with overexploitation of groundwater resources. Additionally, population growth puts immense strain on existing food production systems. Vertical farming emerges as a compelling solution, offering several advantages that address these resource limitations and bolster food security. Vertical farming utilizes hydroponic or aeroponic systems, dramatically reducing water consumption compared to traditional open-field agriculture. Precisely controlled environments minimize water evaporation, and nutrient-rich solutions are recirculated, maximizing water efficiency. Estimates suggest vertical farms can use up to 95% less water than conventional farming methods. Vertical farms operate in vertically stacked layers, maximizing production within a limited footprint. This is particularly advantageous in urban areas with limited land availability or in regions with poor soil quality. Warehouses, rooftops, or even repurposed shipping containers can be transformed into productive vertical farms.

Consumers in the MEA region, particularly in urban areas, are increasingly seeking fresh, healthy, and sustainably produced food. Vertical farming aligns perfectly with this growing demand.

Vertical farms' regulated environments reduce the possibility of disease outbreaks or pest infestations. This makes it possible to reduce or perhaps completely do away with chemical pesticides and herbicides, giving consumers cleaner, healthier fruit. Data collection and automation are commonplace in vertical farming businesses. Better monitoring of the entire production process—from seed selection to harvest—is made possible by this. Customers may be able to obtain information regarding the source and cultivation circumstances of their food, which promotes openness and confidence.

Middle East and Africa Vertical Farming Market Restraints and Challenges:

It takes a large initial investment in technology, infrastructure, and controlled environment systems to start a vertical farm. This covers the price of constructing or renovating facilities, buying hydroponic equipment, specialty lighting systems, and temperature control technology. For the most part, vertical farming is a relatively new idea in the MEA region. Customers may not be familiar with this technology and may have doubts about the product grown vertically tasting, being of higher quality, or being safer than produce grown conventionally. The initial costs associated with vertical farming can translate to higher-priced produce for consumers. In regions with high price sensitivity, convincing consumers to pay a premium for vertically farmed products can be challenging. The talent pool for vertical farming specialists, particularly those with expertise in areas like LED lighting optimization, hydroponic nutrient management, and automated climate control systems, might be limited in some parts of the MEA region.

Middle East and Africa Vertical Farming Market Opportunities:

Advancements in LED technology are leading to the development of more energy-efficient lighting systems specifically designed for optimal plant growth in vertical farms. This translates to lower operational costs and a faster return on investment for vertical farming companies. Integrating automation and robotics into vertical farming operations can significantly improve efficiency, reduce labor costs, and minimize human error. This includes tasks like planting, harvesting, and environmental monitoring. Leveraging sensor technology and big data analytics allows for real-time monitoring of various parameters like temperature, humidity, and nutrient levels within the vertical farm. This data can be used to optimize growing conditions, predict yields, and minimize resource waste. Collaboration between governments and private companies can accelerate the development and adoption of vertical farming technologies. This can involve joint research initiatives, technology transfer programs, or infrastructure development projects.

MIDDLE EAST AND AFRICA VERTICAL FARMING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

25% |

|

Segments Covered |

By Type, Farming, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Iran, UAE, Qatar, Oman, Iraq, Bahrain, Kuwait, Rest of Middle East |

|

Key Companies Profiled |

Aero Farms , Freight Farms, Plenty , Madar Farms , The Green Quarter, Grow Green , Badia Farms , Vertical Farm Systems , Naïve |

Middle East and Africa Vertical Farming Market Segmentation:

Middle East and Africa Vertical Farming Market Segmentation: By Type:

- Hydroponics

- Aeroponics

- Aquaponics

Hydroponics reigns supreme in the MEA vertical farming market, accounting for an estimated 70-75% of the total market share. This water-based system eliminates the need for soil, instead utilizing a nutrient-rich solution delivered directly to the plant roots. This method offers several advantages that have cemented its position as the dominant growth mechanism. Hydroponics is a champion of water conservation. Estimates suggest it can use up to 90% less water compared to traditional open-field agriculture. This is a critical advantage in the arid regions that characterize much of the MEA. By eliminating the need for soil tilling and minimizing the use of pesticides, hydroponics offers a more environmentally friendly approach to food production. This aligns well with growing concerns about sustainability in the region.

While hydroponics is the current leader, aeroponics is emerging as the fastest-growing segment in the MEA vertical farming market, capturing an estimated 10-15% share and projected to experience significant growth in the coming years. This method involves misting plant roots with a nutrient solution in an enclosed environment. By directly misting the roots, aeroponics provides plants with superior oxygen access compared to hydroponics. This can lead to faster growth rates and potentially higher yields. The constant air circulation in aeroponic systems minimizes the risk of root rot and other diseases that can plague hydroponic setups. This translates to less reliance on fungicides and promotes a more sustainable approach.

Middle East and Africa Vertical Farming Market Segmentation: By Crop Type:

- Leafy Green

- Fruits

- Microgreens

Leafy greens reign supreme in the MEA vertical farming market, accounting for roughly 75% of the total crop production. Leafy greens like lettuce, spinach, kale, and herbs boast rapid growth times, allowing for multiple harvests per year within a controlled environment. This translates to quicker returns on investment for vertical farming companies. Consumers in the MEA region have a growing appetite for fresh, high-quality leafy greens. Vertical farms can cultivate these crops year-round, regardless of harsh weather conditions or seasonal limitations, ensuring consistent supply to meet this demand.

While leafy greens currently dominate, the segment with the fastest growth potential fruits. This segment, estimated at around 15% of the current market share, is poised for significant expansion. As the vertical farming market matures, consumers are likely to seek a wider variety of produce beyond just leafy greens. Fruits offer an exciting opportunity to diversify product offerings and potentially command premium prices. Continuous research and development in areas like LED lighting and climate control are creating more suitable environments for cultivating fruits within vertical farms. This opens doors for previously challenging crops.

Middle East and Africa Vertical Farming Market Segmentation: Regional Analysis:

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The United Arab Emirates (UAE) stands out as the most dominant player in the MEA vertical farming market, commanding an impressive 22.7% share. With limited arable land and harsh climatic conditions, the UAE has prioritized food security as a national imperative. Vertical farming offers a sustainable solution to address these challenges, enabling year-round crop production while minimizing water usage and land requirements. The UAE government has been proactive in promoting vertical farming through various initiatives and investments. For instance, the Dubai Industrial Strategy 2030 and the UAE Food Security Strategy have prioritized the development of vertical farming technologies and facilities.

Kenya is becoming the fastest-growing nation in the MEA while having a very small 3.6% market share at the moment. Kenya has struggled to meet its food needs as a result of issues like land degradation, climate change, and population increase. A compelling way to address these problems is through vertical farming, which maximizes food production while reducing environmental effects. Recognizing the potential of vertical farming, the Kenyan government has put laws and programs in place to encourage its use. These initiatives consist of offering rewards, making funding more accessible, and encouraging public-private collaborations.

COVID-19 Impact Analysis on the Middle East and Africa Vertical Farming Market:

The movement of essential components like specialized lighting systems, hydroponic nutrients, and seeds became hampered due to border closures and logistical bottlenecks. This led to delays in setting up new farms and potential maintenance issues for existing operations. Social distancing measures and localized outbreaks impacted the availability of skilled labor for both farm operations and logistics. This could have resulted in slower production cycles and potential quality control concerns. The initial phase of panic buying may have seen a surge in demand for shelf-stable staples, potentially impacting the sales of fresh produce, including those grown vertically. Economic anxieties and altered spending habits in the later stages of the pandemic could have further dampened consumer enthusiasm for this relatively new technology. Lockdowns and restrictions on movement fueled a surge in online shopping. This benefitted vertical farming companies with a robust online presence, allowing them to reach consumers directly and minimize reliance on traditional brick-and-mortar retail channels.

Latest Trends/ Developments:

One of the most compelling drivers of vertical farming in the MEA region is the ever-present challenge of water scarcity. Many countries grapple with arid climates and limited arable land, making traditional open-field agriculture a precarious endeavor. Vertical farming offers a beacon of hope by utilizing hydroponic or aeroponic systems that require significantly less water compared to conventional methods. Estimates suggest that vertical farms can use up to 95% less water than traditional agriculture, making them a game-changer in water-stressed regions. This water efficiency, coupled with the ability to cultivate crops in controlled indoor environments, directly addresses food security concerns in the MEA region. Although leafy greens like lettuce and herbs were the primary emphasis of vertical farming in the MEA region initially, there has been a significant increase in the industry's diversification recently. Businesses are actively investigating the production of a greater range of crops, such as fruits, vegetables, and even some types of flowers. To increase consumer attractiveness and guarantee the market's long-term viability, diversification is essential. Another important factor in this expansion is innovation. Research and development are being done to find the best growth environments for different crops in vertical farms. Microgreens and strawberries, two crops that are sensitive to light, can now be grown thanks to developments in LED lighting technologies.

Key Players:

- Aero Farms

- Freight Farms

- Plenty

- Madar Farms

- The Green Quarter

- Grow Green

- Badia Farms

- Vertical Farm Systems

- Naïve

Chapter 1. Middle East and Africa Vertical Farming Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Vertical Farming Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Vertical Farming Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Vertical Farming Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Vertical Farming Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Vertical Farming Market– By Type

6.1. Introduction/Key Findings

6.2. Hydroponics

6.3. Aeroponics

6.4. Aquaponics

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Vertical Farming Market– By Crop Type

7.1. Introduction/Key Findings

7.2. Leafy Green

7.3. Fruits

7.4. Microgreens

7.5. Y-O-Y Growth trend Analysis By Crop Type

7.6. Absolute $ Opportunity Analysis By Crop Type , 2024-2030

Chapter 8. Middle East and Africa Vertical Farming Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Crop Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Vertical Farming Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Aero Farms

9.2. Freight Farms

9.3. Plenty

9.4. Madar Farms

9.5. The Green Quarter

9.6. Grow Green

9.7. Badia Farms

9.8. Vertical Farm Systems

9.9. Naïve

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

A significant portion of the MEA region experiences harsh climates with limited arable land suitable for traditional agriculture. Vertical farming offers a solution by utilizing controlled indoor environments and minimal land space.

Establishing vertical farms requires significant upfront investment in technology, infrastructure, and controlled environment systems. This can be a barrier to entry, particularly for smaller players

Aero Farms, Freight Farms, Plenty, Madar Farms, The Green Quarter, Grow Green, Badia Farms, Vertical Farm Systems, Naïve

United Arab Emirates (UAE) has firmly established itself as the most dominant player in the market, commanding an impressive 22.7% market share

Kenya emerges as the fastest-growing country in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.