Tomato Products Market Size (2024 – 2030)

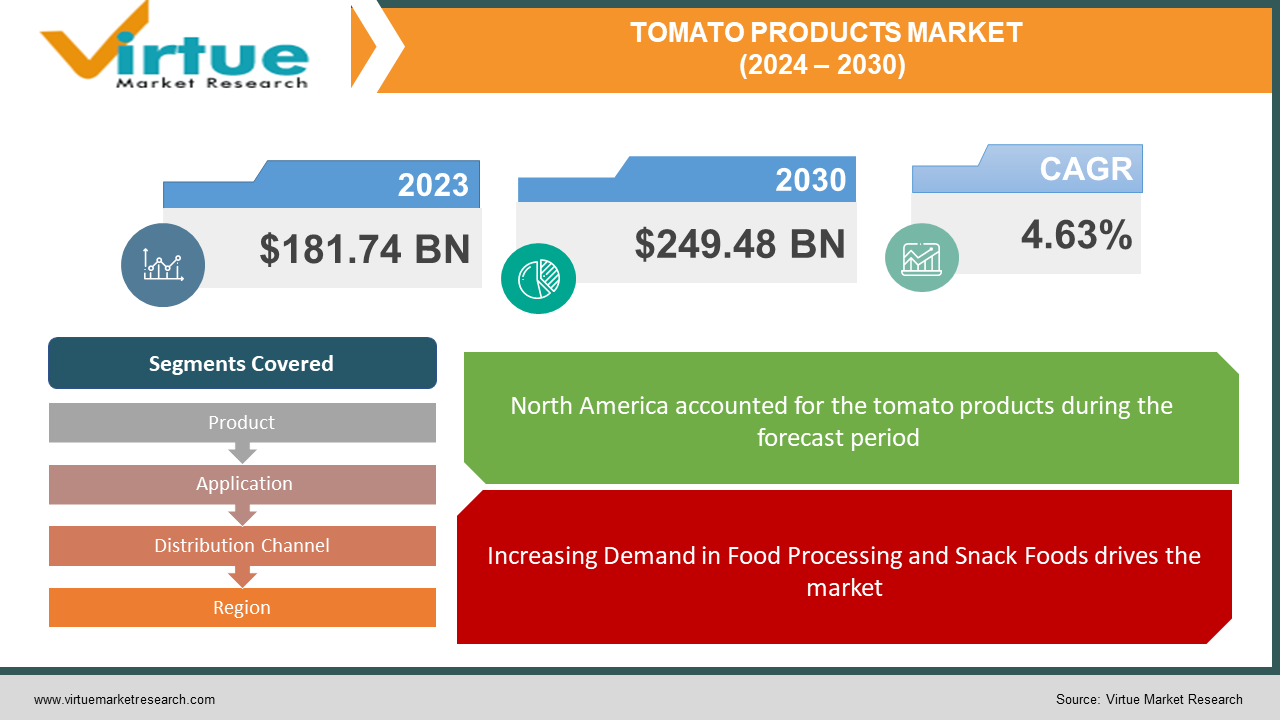

The Tomato Products Market was valued at USD 181.74 Billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 249.48 Billion by 2030, growing at a CAGR of 4.63%.

Key Market Insights:

Tomatoes, classified as fruits within the nightshade family (Solanaceae), originally hail from Central and Western South America. They boast a rich nutritional profile, containing significant amounts of vitamin C, K, lycopene, potassium, folate, and antioxidants. These nutrients confer various health benefits, including promoting optimal digestion, reducing the risk of cancer, providing protection against sunburn, and maintaining cardiovascular health, blood pressure, and blood glucose levels among individuals with diabetes. Presently, global tomato production predominantly serves fresh consumption, accounting for 80% of the yield, while the remaining 20% caters to the processing industry for the production of purees, soups, tomato ketchup, pickles, juices, and sauces.

Tomato Products Market Drivers:

Increasing Demand in Food Processing and Snack Foods drives the market.

The tomato product market is primarily propelled by sectors such as household consumption, food processing, and snack foods, along with extensive usage in the hospitality, dining, and fast-food segments of the food service industry. Global expansion in the fast-food sector acts as a key driver for market growth, while the burgeoning organized retail landscape further fosters market expansion. There is a notable demand for further-processed tomatoes owing to their amplified health benefits and prolonged shelf life. Tomato puree holds particular significance among processed tomato products due to its versatile applications in various food items such as tomato juice, ketchup, paste, strained tomato pulp, pickles, pasta, pizza sauces, gravies, ready-to-eat curries, salsa, and tomato-based powder goods.

In Europe, there's a noticeable trend towards improved dietary habits, driven by increasing disposable incomes. This inclination towards healthier eating habits emphasizes the consumption of more fruits and vegetables. Additionally, there's a noticeable shift in dietary preferences towards organic foods, attributed partly to the growing expatriate community in Europe. The European region is anticipated to witness a rise in the production of organic tomatoes, as they offer significantly higher quantities of essential nutrients such as vitamin C, sugar, and lycopene compared to conventionally grown tomatoes.

Tomato Products Market Restraints and Challenges:

Climatic variability and the impacts of climate change pose significant threats to tomato production and revenue streams. These challenges can lead to adverse quality effects, placing pressure on domestic markets and necessitating increased capacity for the absorption of both fresh and second- and third-grade tomatoes for processing. Key climatic hazards include shortages of cold winter units, particularly in arid regions, heat stress, and unusually warm weather during crucial developmental phases, conditions conducive to pest and disease outbreaks, water scarcity for irrigation, hailstorms, and flooding.

While the direct effects such as early flowering in spring and inadequate winter chilling are apparent, climate change presents additional complexities for tomato growers. For instance, warmer evenings foster the proliferation of pests and diseases, while hot winter days can inflict damage on tomato plant tissues. Elevated temperatures also detrimentally affect pre-formed fruit, rendering them unsuitable for sale, as tomatoes intended to ripen red may instead turn brown or pink if nocturnal temperatures fail to sufficiently cool. Moreover, tomatoes cultivated in open fields are more vulnerable to adverse weather conditions compared to those grown in controlled greenhouse environments. Consequently, open-field tomato farming faces heightened susceptibility to the impacts of global warming.

Tomato Products Market Opportunities:

Rising awareness of the nutritional value of vegetables, including tomatoes, to meet diverse dietary needs has led to increased consumption among the populace. This heightened demand for tomatoes is driven by factors such as preferences for fresh produce and the adoption of advanced farming methodologies like indoor cultivation, bolstering domestic tomato production. Additionally, challenges stemming from climate change, evolving insect resistance, inadequate infrastructure, and post-harvest losses have underscored the necessity for developing new high-yielding hybrid seeds to enhance farmers' productivity.

To address the expanding demand, efforts are underway to boost tomato production. Moreover, the growing demand for processed tomato products such as sauces, pastes, ketchup, and diced tomatoes in international markets further fuels growth in the sector, thereby strengthening tomato production. Growers are also investing in enhancing production techniques, including sheltered cultivation and the adoption of practices such as plastic mulching and drip irrigation, to augment tomato yields and meet market demands effectively.

TOMATO PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.63% |

|

Segments Covered |

By Product, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Mills Inc., Neil Jones Food Company, Galla Foods, The Kraft Heinz Company, Dabur, The Morning Star Company, Riviana Foods Pty Ltd, Chitale Agro, Mutti S.p.A, Pacific Coast Producers |

Tomato Products Market Segmentation - By Product

-

Sauces

-

Paste

-

Canned Tomatoes

-

Ketchup

-

Juice

-

Others

The canned tomatoes segment emerges as the primary contributor to the market, with an estimated Compound Annual Growth Rate (CAGR) of 5.73% projected during the forecast period. Both fresh and canned tomatoes are equally rich in nutrients and contribute to the daily intake of vegetables, a goal achieved by only a minority, as per the C.D.C. While low-acid foods like meat and vegetables maintain their optimal quality for 2 to 5 years, high-acid foods such as tomatoes and fruits retain quality for up to 18 months. Canned tomatoes remain safe for consumption indefinitely if stored properly (free from dents, swelling, or rust) in a cool, dry environment.

Tomato sauce, made from tomato puree (or strained tomatoes), savory vegetables, and additional ingredients, serves as a versatile condiment, commonly used over pasta dishes. Variants like spaghetti sauce or pasta sauce offer numerous options for enhancing pasta meals. Though tomato sauces complement meat and vegetable dishes, they are particularly renowned as foundational elements in Italian pasta dishes and Mexican salsas. The importance of sauces lies in their ability to elevate the flavor, texture, moisture, viscosity, and visual appeal of a dish, facilitating the harmonious integration of its various components.

Tomato Products Market Segmentation - By Application

-

Household/Retail

-

Food Service Sector

The dominating segment in the market is the food service sector. The increasing consumption of tomatoes correlates with a heightened demand for tomato products in households and retail settings.

Tomato Products Market Segmentation - By Distribution Channel

-

Direct Selling

-

Retail

-

Online Mode

The Offline segment held the largest market share in the Global Tomato Products Market last year and is anticipated to maintain its dominance throughout the forecast period, particularly in the distribution channel category. Consumers prefer offline channels when purchasing groceries, consumer goods, and processed foods like ketchup due to the ability to physically inspect products. The market is expected to be driven by consumers' convenience and the opportunity to explore a diverse range of processed tomato products in stores. The expected expansion of global distribution channel networks in the forecast period is likely to sustain the dominance of offline channels.

In the coming years, the online channel is expected to experience the fastest growth. Many producers of these products are leveraging e-commerce platforms and their websites for selling goods. Additionally, the increasing rate of internet penetration has significantly contributed to the notable expansion of the global e-commerce industry.

Tomato Products Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region stands as the dominant force in the global market, with significant revenue contribution and an anticipated Compound Annual Growth Rate (CAGR) of 5.36% during the forecast period. The region's market expansion is primarily propelled by the proliferation of high-intensity tomato cultivation practices. In India, tomatoes hold the third position among essential horticulture crops, following potatoes and onions, supported by the government's initiative called "Operation Greens" aimed at improving farmers' livelihoods. China boasts extensive tomato plantations, including greenhouse facilities in the north and open-field cultivation in the south, with the Xinjiang Uygur region alone contributing over 70% of the nation's total tomato output.

North America is poised to grow at a CAGR of 4.89% over the forecast period. Tomatoes are a staple in American cuisine, both fresh and processed into items like ketchup, tomato sauce, and paste. The anticipated population growth, increasing preference for healthy eating, and the utilization of fresh tomatoes and tomato-based products in sandwiches, pizzas, and other fast meal options drive significant customer demand in the tomato industry. According to the USDA, tomatoes rank as the second-most popular vegetable in the nation, with per capita consumption of fresh tomatoes on the rise. Concurrently, consumption of processed tomato products, including ketchup, tomato sauce, and paste, is witnessing growth alongside the surge in fresh tomato consumption, with a growing interest in organic tomatoes among consumers seeking healthier food options.

Europe is also expected to witness substantial growth during the forecast period. The Extremadura region in Spain is targeted to become the primary production hub, with over 70% of the nation's tomato crops concentrated in this area. Additionally, the Guadiana region, the Guadalquivir region, and the Ebro River valley have been identified as priority regions for tomato production in Spain. Major tomato-producing areas include Andalusia, the Grand Canary and Canary Islands, the Valencian Community, Murcia, Extremadura, and Navarre.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has indeed impacted the market to a certain extent. Lockdown measures implemented worldwide significantly disrupted the trade of tomato pastes and purees due to quarantine restrictions, thereby exerting influence on the market dynamics. However, amidst these challenges, manufacturers have the opportunity to adapt to the evolving regulatory landscape by designing and introducing new products to the market. This adaptability is anticipated to contribute positively to market growth despite the pandemic's adverse effects.

Latest Trends/ Developments:

-

In May 2022, Ingomar Packing Company, a leading tomato processor in the United States, joined forces with Botanical Water Technologies (B.W.T.) to address the water crisis.

-

Following this, in June 2022, The Morning Star Company engaged in the complete tomato processing cycle, from harvesting to packaging, ensuring the retention of the health benefits of tomato paste and diced tomatoes.

-

By August 2022, as reported by ABC Fruits, approximately 80% of tomatoes were consumed fresh, with the remaining 20% processed into tomato paste and puree. Tomato paste serves as a fundamental ingredient in the production of various tomato-based products, with the sauce and ketchup industry being the primary consumers.

Key Players:

These are the top 10 players in the Tomato Products Market: -

-

General Mills Inc.

-

Neil Jones Food Company

-

Galla Foods

-

The Kraft Heinz Company

-

Dabur

-

The Morning Star Company

-

Riviana Foods Pty Ltd

-

Chitale Agro

-

Mutti S.p.A

-

Pacific Coast Producers

Chapter 1. Tomato Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tomato Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tomato Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tomato Products Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tomato Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tomato Products Market – By Product Type

6.1 Introduction/Key Findings

6.2 Sauces

6.3 Paste

6.4 Canned Tomatoes

6.5 Ketchup

6.6 Juice

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Tomato Products Market – By Application

7.1 Introduction/Key Findings

7.2 Household/Retail

7.3 Food Service Sector

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Tomato Products Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Selling

8.3 Retail

8.4 Online Mode

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Tomato Products Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Tomato Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 General Mills Inc.

10.2 Neil Jones Food Company

10.3 Galla Foods

10.4 The Kraft Heinz Company

10.5 Dabur

10.6 The Morning Star Company

10.7 Riviana Foods Pty Ltd

10.8 Chitale Agro

10.9 Mutti S.p.A

10.10 Pacific Coast Producers

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The tomato product market is primarily propelled by sectors such as household consumption, food processing, and snack foods, along with extensive usage in the hospitality, dining, and fast-food segments of the food service industry.

The top players operating in the Tomato Products Market are - General Mills Inc., Neil Jones Food Company, Galla Foods, The Kraft Heinz Company, Dabur, The Morning Star Company, Riviana Foods Pty Ltd, Chitale Agro, Mutti S.p.A, Pacific Coast Producers.

The COVID-19 pandemic has indeed impacted the market to a certain extent. Lockdown measures implemented worldwide significantly disrupted the trade of tomato pastes and purees due to quarantine restrictions, thereby exerting influence on the market dynamics.

In May 2022, Ingomar Packing Company, a leading tomato processor in the United States, joined forces with Botanical Water Technologies (B.W.T.) to address the water crisis.

Europe is also expected to witness substantial growth during the forecast period. The Extremadura region in Spain is targeted to become the primary production hub, with over 70% of the nation's tomato crops concentrated in this area.