Global Tomato Ketchup Market Size (2024 – 2030)

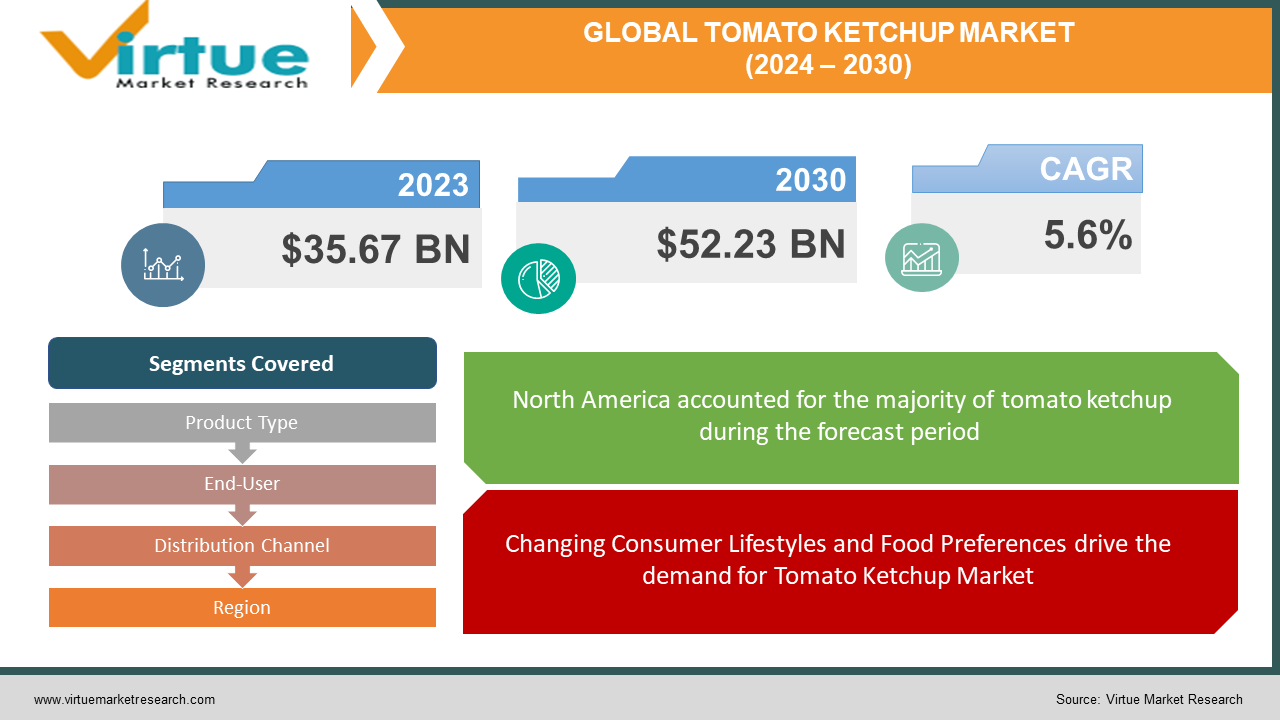

The Global Tomato Ketchup Market was valued at USD 35.67 billion and is projected to reach a market size of USD 52.23 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6 %.

Tomato ketchup is a popular condiment that is widely used as a topping or dipping sauce for a wide range of foods. It is a thick, sweet, and tangy sauce made primarily from tomatoes, vinegar, sweeteners, and various seasonings. The Tomato Ketchup Market is expected to grow significantly in the coming years due to its widespread use as a condiment. The major well-established key players in the Tomato Ketchup Market are Heinz (Kraft Heinz Company), Del Monte Foods, Inc., Hunt's (Conagra Brands), French's (McCormick & Company, Inc.), Hellmann's (Unilever), and many other private-label or store brands.

Key Market Insights:

Tomato Ketchup is commonly paired with hamburgers, french fries, sandwiches, and other fast food items. It is also used as an ingredient in recipes for sauces, marinades, and dressings. Organic and natural ketchup, made without artificial additives are gaining popularity. There are variations of tomato ketchup, including reduced-sugar or no-sugar-added versions for health-conscious consumers. Changing consumer preferences, increasing demand for convenience foods, and the growth of the fast-food industry are propelling the Tomato Ketchup Market. The restraints on the Tomato Ketchup Market include health concerns, fluctuating raw material prices, and intense competition. North America occupies the highest share of the Tomato Ketchup Market. Asia-Pacific is the fastest-growing segment during the forecast period. Finland has earned the distinction of being the global leader in ketchup consumption, boasting an average of 3.3 kilograms per person annually. Canada ranks second in ketchup consumption, with an average of 2.8 kg per person per year.

Tomato Ketchup Market Drivers:

Changing Consumer Lifestyles and Food Preferences drive the demand for Tomato Ketchup Market

Changes in urbanization and busier lifestyles have led to an increased demand for convenience foods and ready-to-eat meals. Consumers are seeking quick and easy meal solutions. Tomato ketchup serves as a versatile and convenient condiment that enhances the flavor of various dishes. It is used as a dipping sauce or topping for fast-food items like burgers and fries. This aligns with the demand for on-the-go and quick-preparation options. Companies develop low-sugar or no-sugar-added versions of tomato ketchup to align with health-conscious consumer preferences. This addresses concerns related to sugar intake and healthier eating habits. Companies also introduce convenient packaging, such as squeeze bottles, single-serve packets, or upside-down bottles for easy dispensing. Additionally, they innovate with flavor profiles and variations to cater to diverse consumer tastes.

Globalization and Increased Food Consumption are propelling the Tomato Ketchup Market

People are becoming more exposed to diverse cuisines and flavors from around the world. There is a growing demand for condiments that can complement a wide range of global dishes.

Tomato ketchup, with its adaptable and neutral flavor profile, can be easily incorporated into various international cuisines. It has become a common condiment not only in Western countries but also in Asia, the Middle East, and other regions. This reflects its global appeal. Thus globalization of food culture and increased international trade contribute to the growth of the tomato ketchup market. Companies introduce regional or globally-inspired tomato ketchup flavors, such as spicy variations for markets that prefer a higher level of heat in their foods or mild versions for regions where a less intense flavor is preferred.

Tomato Ketchup Market Restraints and Challenges

The major challenge faced by the Tomato Ketchup Market is the increasing consumer awareness of health issues, including concerns about sugar and sodium intake. This led to a shift in preferences towards healthier alternatives, impacting traditional tomato ketchup consumption. The other restraints to the Tomato Ketchup Market include fluctuating raw material prices, intense competition, environmental sustainability, supply chain disruptions, regulatory changes, shifts in eating habits, alternative condiments, global economic factors, and cultural/regional differences.

Tomato Ketchup Market Opportunities:

The Tomato Ketchup Market has various opportunities in the market. Opportunities lie in developing and marketing healthier versions of tomato ketchup. This includes low-sugar or organic options, as well as specialty varieties with unique flavors and ingredients. There are opportunities for expansion by entering new geographical regions and customizing products to suit local tastes and preferences. This aligns with the trend of globalization in food consumption. Opportunities lie in catering to the food service industry by providing bulk or customized tomato ketchup products to restaurants, cafes, and other food establishments. Other Opportunities in Tomato Ketchup include product diversification, e-commerce growth, sustainable packaging, health collaborations, premium offerings, and partnerships with fast-food chains.

GLOBAL TOMATO KETCHUP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Product Type, End-User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Heinz (Kraft Heinz Company), Del Monte Foods, Inc.:, Hunt's (Conagra Brands):, French's (McCormick & Company, Inc.):, Hellmann's (Unilever):, Organicville:, Annie's Homegrown (General Mills):, Sir Kensington's (The Hain Celestial Group):, Primal Kitchen (Kraft Heinz Company):, Private Label Brands (Supermarket Chains): |

Tomato Ketchup Market Segmentation

Tomato Ketchup Market Segmentation: By Product Type:

-

Traditional Tomato Ketchup

-

Organic Ketchup

-

Low-Sugar or No-Sugar-Added Variants

-

Flavored Ketchup

-

Specialty Blends

In 2023, based on market segmentation by Product Type, Traditional Tomato Ketchup occupies the highest share of the Tomato Ketchup Market. This is mainly due to its widespread use as a classic condiment across various cuisines and consumer preferences. Established brands dominate this segment, catering to consumers who prefer the familiar taste and texture of traditional ketchup.

However, organic ketchup is the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 15%. This is due to the increasing demand for organic and natural food products. Health-conscious consumers are seeking cleaner and more environmentally friendly options.

Tomato Ketchup Market Segmentation: By End-User:

-

Household Consumers

-

Foodservice Industry (Restaurants, Cafes, Fast-Food Chains)

In 2023, based on market segmentation by End-User, the household consumers segment occupies the highest share of the Tomato Ketchup Market. This is mainly due to the ubiquitous use of tomato ketchup as a condiment in households worldwide. Consumers use ketchup in various homemade dishes, snacks, and meals, making it a staple in many kitchens

However, the service industry (Restaurants, Cafes, fast food chains) is the fastest-growing segment during the forecast period. This is mainly due to the increasing popularity of fast-food items and the use of ketchup as a common condiment in dining establishments. The fast-food industry's expansion, coupled with the increasing trend of dining out or ordering food, contributes to the growth. Restaurants and food service establishments often use ketchup in large quantities, creating opportunities for suppliers to cater to this demand.

Tomato Ketchup Market Segmentation: By Distribution Channel:

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online Retail

-

Foodservice Outlets

In 2023, based on market segmentation by the Distribution Channel, the Supermarkets and hypermarkets segment occupies the highest share of the Tomato Ketchup Market. It has a market share of around 60%. This is mainly due to the convenience of one-stop shopping and the high foot traffic in these stores. These outlets offer a wide variety of ketchup brands, including both established and private-label products.

However, Online retail is the fastest-growing segment during the forecast period. This growth is driven by the rise of e-commerce, the increasing trend of online grocery shopping, the convenience of doorstep delivery, and the ability to explore a wide variety of options. Online retail often provides a platform for a diverse range of ketchup brands, including specialty or niche products.

Tomato Ketchup Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Tomato Ketchup Market. The Tomato Ketchup is a staple in American cuisine, commonly used in households, restaurants, and fast-food establishments.

North America is an advanced region with established brands like Heinz and Hunt contributing to the region's large market size. The United States is a major consumer of tomato ketchup. This growth is driven by continuous demand for innovative products, including organic and low-sugar ketchup, as health-conscious consumer trends influence purchasing decisions.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the increasing popularity of Western-style fast food, a rising middle class, and changing consumer preferences. Countries like China, India, and Japan have significant market shares. The adoption of tomato ketchup in traditional Asian cuisines and the demand for diverse flavors and specialty blends contribute to the growth in this region.

COVID-19 Impact Analysis on the Global Tomato Ketchup Market:

The COVID-19 pandemic had a significant impact on the Tomato Ketchup Market. There were restrictions on movement, lockdowns, and changes in transportation capacities. The pandemic led to disruptions in global supply chains. This affected the sourcing of raw materials, production processes, and distribution networks for tomato ketchup manufacturers. The closure of restaurants and the increase in home cooking altered the demand for certain condiments, including tomato ketchup. The pandemic accelerated the adoption of online shopping, including groceries. This shift in consumer behavior may led to increased online sales of food products, including tomato ketchup, as people sought convenient ways to purchase essential items. Thus, the pandemic accelerated certain trends in the Tomato Ketchup Market.

Latest Trends/ Developments:

The globalization of food culture influenced the demand for diverse and ethnic flavors. Tomato ketchup manufacturers are introducing products that cater to regional tastes and incorporate global culinary trends. Companies are introducing flavored ketchup, such as spicy, smoky, or herb-infused varieties. Growing consumer awareness of health and wellness led to increased demand for healthier condiment options. Manufacturers are introducing low-sugar, no-sugar-added, and organic variants of tomato ketchup. One of the developments, in the Tomato Ketchup is the heightened focus on sustainability, with consumers seeking eco-friendly packaging options. Companies are exploring innovative and sustainable packaging solutions.

There is a general trend toward plant-based and clean-label products. Ketchup options with minimal additives, natural ingredients, and plant-based formulations are high in demand. Manufacturers are also increasingly focusing on online retail channels and direct-to-consumer sales to reach a wider audience.

Key Players:

-

Heinz (Kraft Heinz Company):

-

Del Monte Foods, Inc.:

-

Hunt's (Conagra Brands):

-

French's (McCormick & Company, Inc.):

-

Hellmann's (Unilever):

-

Organicville:

-

Annie's Homegrown (General Mills):

-

Sir Kensington's (The Hain Celestial Group):

-

Primal Kitchen (Kraft Heinz Company):

-

Private Label Brands (Supermarket Chains):

Market News:

In July 2023, Heinz Tomato Ketchup launched a fully recyclable squeeze bottle with an innovative monomaterial cap. Aligned with Kraft Heinz's 2025 sustainability goal, the cap enables the entire bottle to be recycled at once, potentially diverting 300 million plastic caps annually from landfills. This eco-friendly packaging, designed for improved functionality, will be available in UK supermarkets from August.

Chapter 1. Global Tomato Ketchup Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Tomato Ketchup Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Global Tomato Ketchup Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Global Tomato Ketchup Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Global Tomato Ketchup Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Global Tomato Ketchup Market – By Product Type

6.1 Introduction/Key Findings

6.2 Traditional Tomato Ketchup

6.3 Organic Ketchup

6.4 Low-Sugar or No-Sugar-Added Variants

6.5 Flavored Ketchup

6.6 Specialty Blends

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Global Tomato Ketchup Market – By End-Users

7.1 Introduction/Key Findings

7.2 Household Consumers

7.3 Foodservice Industry (Restaurants, Cafes, Fast-Food Chains)

7.4 Y-O-Y Growth trend Analysis By End-Users

7.5 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 8. Global Tomato Ketchup Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3 Convenience Stores

8.4 Online Retail

8.5 Foodservice Outlets

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Global Tomato Ketchup Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End-Users

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End-Users

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End-Users

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End-Users

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End-Users

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Tomato Ketchup Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 Heinz (Kraft Heinz Company):

10.2 Del Monte Foods, Inc.:

10.3 Hunt's (Conagra Brands):

10.4 French's (McCormick & Company, Inc.):

10.5 Hellmann's (Unilever):

10.6 Organicville:

10.7 Annie's Homegrown (General Mills):

10.8 Sir Kensington's (The Hain Celestial Group):

10.9 Primal Kitchen (Kraft Heinz Company):

10.10 Private Label Brands (Supermarket Chains):

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Tomato Ketchup Market was valued at USD 35.67 billion and is projected to reach a market size of USD 52.23 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%.

Changing consumer lifestyles and preferences for convenience foods and the globalization of food culture are the market drivers of the Global Tomato Ketchup Market.

Traditional Tomato Ketchup, Organic Ketchup, Low-Sugar or No-Sugar-Added Variants, Flavored Ketchups, and Specialty Blends are the segments under the Global Tomato Ketchup Market by Product Type.

. North America is the most dominant region for the Global Tomato Ketchup Market.

Heinz (Kraft Heinz Company), Del Monte Foods, Inc., Hunt's (Conagra Brands), French's (McCormick & Company, Inc.), and Hellmann's (Unilever) are the key players in the Global Tomato Ketchup Market.