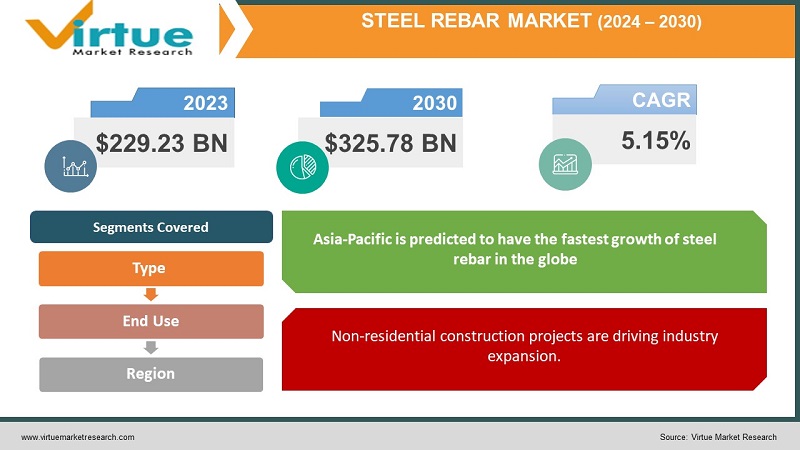

Steel Rebar Market Size (2024 – 2030)

Global Steel Rebar Market was valued at USD 229.23 billion and is projected to reach a market size of USD 325.78 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.15%.. The increasing usage of higher rebar goods, the growth of value-added products, the expansion of existing steel factories around the world, population growth, and urbanisation are all major market drivers.

Market Overview

A rebar is a steel bar or grid of steel wires used as a tension machine in reinforced concrete and reinforced masonry structures to enhance and aid the concrete under tension. Concrete has a high compression strength but low tensile strength. Rebar significantly improves the structure's strength. To build a better bond with the concrete and reduce the possibility of slippage, the surface of the rebar is typically "deformed" with ribs, lugs, or indentations.

Steel rebars are increasingly used in non-residential applications, such as the oil and gas sector, infrastructure, commercial construction, corporate buildings, and so on, as urbanisation grows.

According to the United States Census Bureau, total construction products in the United States are expected to reach USD 1,639.86 billion in December 2021, with the non-residential sector accounting for USD 820.73 billion, a 3.9 per cent increase over the same month last year.

According to a White House briefing, 1 in 5 miles of highways and major roads in the United States, as well as 45,000 bridges, are in bad condition. Surface transportation programmes will be reauthorized for five years, with USD 110 billion in additional financing to maintain roads and bridges and support significant transformational projects.

Covid-19 Impact on steel rebar market

The steel rebar market has been significantly impacted by the COVID-19 epidemic, which has resulted in worldwide lockdowns, disruptions in manufacturing activities and supply chains, production halts, and labour shortages. The worldwide steel rebar market is being held back by the COVID-19 epidemic, which has disrupted the global supply chain. The increased cost of materials is limiting the growth of the steel rebar industry. Second, there has been a deficit of trained professionals in the industry, which is mostly due to a lack of understanding, and which may pose a problem to the market in the coming years. However, beginning in 2021, conditions began to improve, resuming the market's growth trajectory for the projection period.

MARKET DRIVERS

Non-residential construction projects are driving industry expansion.

According to the steel rebar market data, non-residential construction activities are on the rise in global regions such as North America. One of the primary drivers projected to fuel the growth of the steel rebar industry by the end of the forecast period in 2028 is the expansion of product portfolios, which is followed by a shift in market trends towards the increased use of higher grades and degrees of steel rebar.

The market is growing due to the availability of a diverse portfolio.

The availability of broad product portfolios, followed by multiple uses, are the primary market drivers expected to be responsible for increasing the market positions of these prominent firms in the steel rebar market size. Market participants have been pursuing various organic and inorganic growth methods, such as new product development and launches, acquisitions, and merger agreements. By the conclusion of the period in 2030, these will have helped to improve the market's position.

MARKET RESTRAINTS

Market expansion is being stifled by a lack of skill and awareness.

The steel rebar market analysis reveals that industry trends are witnessing the emergence of several key factors that may limit market growth during the forecast period, which ends in 2028. The market is experiencing a shortage of experienced individuals, as well as a lack of awareness, which could offer issues in the future. Market and target audience knowledge and awareness of product portfolios will encourage them to spend their disposable income on purchasing these market shares and products. However, the lack of accurate information and a reluctance to spend may prevent the market from rising as predicted.

The global steel rebar market is being held back by the COVID-19 epidemic.

The increased cost of materials as a result of the pandemic is limiting the growth of the steel rebar industry. Second, there has been a deficit of trained professionals in the industry, which is mostly due to a lack of understanding, and which may pose a problem to the market in the coming years. The intended market audience's increased awareness and understanding of product offerings encourage them to spend more money to obtain this market share and commodities. Furthermore, a lack of understanding and the difficulties of investing may prevent the market from growing as projected.

STEEL REBAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.15% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Commercial Metals Company, Ansteel Group, Essar Steel, Gerdau S.A, Nucor Corporation, Nippon Steel & Sumitomo Metal Corporation, Tata Steel Ltd., Mechel PAO, JFE Steel Corporation, Sohar Steel LLC, Steel Authority of India Limited, ArcelorMittal, Kobe Steel, and Celsa Steel UK |

This research report is based on the steel rebar market and is segmented and sub-segmented by type, end-user and region.

Steel rebar market by type

- Deformed

- Mild

The market is divided into two types: deformed and mild. Mild vary in size from 6mm to 50mm in length. The deformed division has the biggest market share, accounting for 54 per cent of total market value, while the moderate dividend accounts for 30 per cent. Due to its high yield strength, better ductility and malleability than mild steel rebar, and its deformed surface, which facilitates the bond formation of materials and prevents slippage in concrete throughout the world during the anticipated period, Deformed Steel Rebar is the highest global steel rebar.

Steel rebar market by end-user

- Housing

- Industrial

- Infrastructure

The market is divided into three categories based on the end-user: housing, industrial, and infrastructure. Steel rebar is extensively utilised in infrastructural construction such as bridges, major roadways, dams, athletic arenas, and other similar structures. Furthermore, it minimises the likelihood of fracture formation, is exceptionally robust, and reduces the propagation of cracks at joint edges.

The residential construction business has a 45 per cent market share, followed by the industrial construction industry with a 35 per cent market share.

Steel rebar market by region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

The Global Steel Rebar Market is divided into four regions: North America, Europe, Asia Pacific, and the Rest of the World.

Due to rising economies and an increase in construction projects, Asia-Pacific is predicted to have the fastest growth of steel rebar in the globe. The growth of the Asia-Pacific steel rebar market can be linked to the building industry's increased use of infrastructure and housing developments. Steel rebar is in increased demand in this region for government and private sector infrastructure projects.

By the end of 2022, the Asia-Pacific region is expected to dominate construction investment, accounting for about 46% of worldwide spending, with countries like China, India, and Indonesia leading the way.

The construction industry in China is exploding. China's construction production is expected to reach CNY 29.31 trillion in 2022, according to the National Bureau of Statistics of China.

Capital investment in infrastructure has been boosted by 35.4 per cent in the Indian Union Budget 2022-23, from INR 5.54 lakh crore to INR 7.50 lakh crore, which includes a total of 2,000 kilometres of the rail network and 60,000 dwellings under the PM Aawas Yojna, among other things.

The North American area holds the second-largest market share in the global market, owing to the existence of nations such as the United States, Canada, and Mexico, which have a big vehicle sector and hence boost market demand in this region. Increased investment in various power production projects, the oil and gas industry, and construction sites also increase market demand. The presence of several significant key companies in this region also boosts market demand.

The European area holds the third-largest market share in the global market, owing to the presence of a well-established technologically advanced infrastructure that necessitates more steel rebar, resulting in greater growth potential in this region. Furthermore, rising investment in private construction is being accompanied by greater expenditure.

Because of the lack of infrastructure in both Latin America and the Middle East and Africa, these regions have the lowest market share. Low per capita income is another factor limiting market expansion in these areas

Steel Rebar market by company

The key players use a variety of strategies to maintain their market position in the global steel rebar market, including mergers and acquisitions, collaboration, setting up a new joint venture, forming a partnership, developing of a new product line, innovating existing products, developing a unique production process, and many others to expand their customer base in the steel rebar market's untapped market.

- Commercial Metals Company

- Ansteel Group

- Essar Steel

- Gerdau S.A

- Nucor Corporation

- Nippon Steel & Sumitomo Metal Corporation

- Tata Steel Ltd.

- Mechel PAO

- JFE Steel Corporation

- Sohar Steel LLC

- Steel Authority of India Limited

- ArcelorMittal

- Kobe Steel

- Celsa Steel UK

NOTABLE HAPPENINGS IN THE Steel rebar market IN THE RECENT PAST.

- PRODUCT LAUNCH

In December 2021, Nucor Corporation stated that it had approved the development of a rebar micro mill with spooling capability in the South Atlantic region. The new micro mill's capital expenditure budget is USD 350 million. It will have a capacity of 430,000 tonnes per year.

- MERGERS AND ACQUISITIONS

In February 2022, Nucor Corporation stated that it had completed its acquisition of a majority ownership position in California Steel Industries, Inc. (CSI), resulting in CSI becoming a joint venture firm with Nucor owning 51 per cent and JFE Steel owning 49 per cent. CSI is a flat-rolled steel converter capable of producing over two million tonnes of finished steel and steel products per year.

- EXPANSION

In November 2021, Mechel PAO reported supplying roughly 22,000 tonnes of rails and other steel rolls for the Bolshaya Koltsevaya Line of the Moscow Metro.

Chapter 1.Steel Rebar Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Steel Rebar Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Steel Rebar Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Steel Rebar Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Steel Rebar Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Steel Rebar Market – By Type

6.1. Deformed

6.2. Mild

Chapter 7.Steel Rebar Market – By End-User

7.1. Housing

7.2. Industrial

7.3. Infrastructure

Chapter 8.Steel Rebar Market – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.Steel Rebar Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Commercial Metals Company

9.2. Ansteel Group

9.3. Essar Steel

9.4. Gerdau S.A

9.5. Nucor Corporation

9.6. Nippon Steel & Sumitomo Metal Corporation

9.7. Tata Steel Ltd

9.8. Mechel PAO

9.9. JFE Steel Corporation

9.10. Sohar Steel LLC

9.11. Steel Authority of India Limited

9.12. ArcelorMittal

9.13. Kobe Steel

9.14. Celsa Steel UK

Download Sample

Choose License Type

2500

4250

5250

6900