Middle East and Africa Steel Rebar Market Size (2024 - 2030)

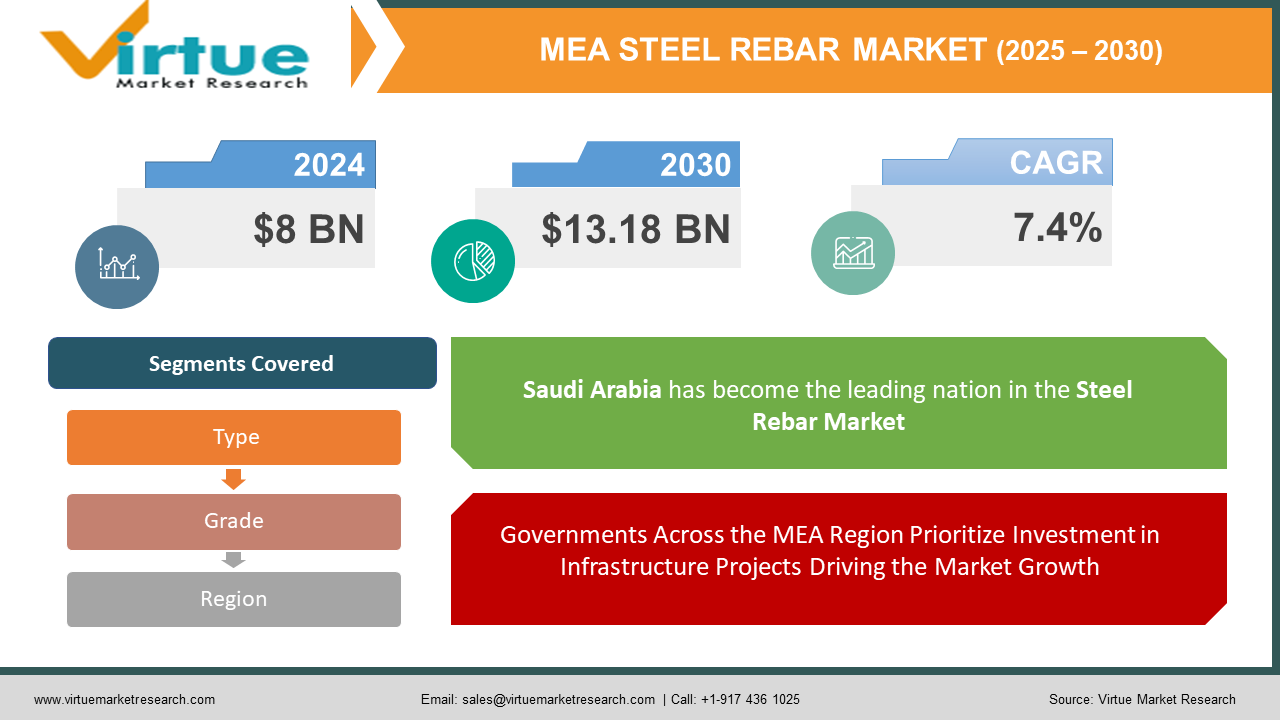

The Middle East and Africa Steel Rebar Market was valued at USD 8 Billion in 2023 and is projected to reach a market size of USD 13.18 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.4%.

Steel rebar, the unsung hero of construction, forms the skeletal framework of buildings, bridges, and other concrete structures. The Middle East and Africa (MEA) region, undergoing rapid urbanization and infrastructural development, presents a dynamic market for steel rebar. Governments across the MEA region are heavily investing in infrastructure projects, including roads, railways, power plants, and renewable energy facilities. This surge in construction activity translates to a heightened demand for steel rebar, the essential reinforcement material for concrete structures. Many MEA countries are actively pursuing economic diversification by focusing on sectors like manufacturing and tourism. This diversification fuels the construction of industrial facilities, hotels, and other commercial establishments, increasing steel rebar consumption. Several governments in the MEA region are implementing policies to stimulate the construction sector. This can include tax breaks for developers, investment in public housing projects, and promoting the use of locally produced steel rebar, all of which contribute to market growth.

Key Market Insights:

- Stainless steel rebar held a market share of 12%, and with its corrosion resistance and increasing application in coastal and marine construction, its growth rate is projected to be 7.2%.

- Epoxy-coated rebar, which had a 3% market share in the same year, is anticipated to experience a rate of 6.8% during the forecast period due to its improved durability and ability to withstand severe conditions.

- With a 32% market share, the infrastructure development category is expected to rise at a rate of 7.1%, due to the region's emphasis on infrastructure projects like roads, bridges, and railroads.

- The commercial construction category accounted for 18% of the market. Over the forecast period, the segment is predicted to rise at a rate of 6.2%, driven by the expansion of office complexes, retail malls, and commercial buildings.

- At a compound annual growth rate (CAGR) of 7.8%, the market value of steel rebar for seismic-resistant buildings is expected to reach $264 million by 2028 from its current $192 million value.

- Steel rebar's market value in nuclear power plant construction was $102 million, and throughout the projection period, it is expected to expand at a compound annual growth rate (CAGR) of 7.2% to reach $140 million by 2028.

Middle East and Africa Steel Rebar Market Drivers:

Governments Across the MEA Region Prioritize Investment in Infrastructure Projects Driving the Market Growth

New roads, bridges, railways, and airport expansions are crucial for connecting cities, facilitating trade, and promoting economic growth. Steel rebar forms the core reinforcement material for bridges, elevated roadways, and retaining walls, ensuring their structural integrity and longevity. Investments in power plants, both conventional and renewable, require significant quantities of steel rebar. Power plants utilize reinforced concrete structures for containment buildings, cooling towers, and transmission line pylons. Similarly, the growing focus on renewable energy like solar and wind farms necessitates reinforced concrete foundations for turbines and support structures. This infrastructure boom isn't just about physical structures; it fosters long-term economic and social development. Improved transportation networks connect markets, reduce transportation costs, and facilitate trade. Reliable access to clean water and sanitation improves public health and creates a more sustainable future. Additionally, investments in power infrastructure provide a stable energy supply, attracting businesses and industries, and further stimulating economic growth. This growth, in turn, fuels the demand for steel rebar as construction activity expands to accommodate a growing population and economic diversification.

The MEA region is experiencing rapid urbanization, with a growing number of people migrating to cities in search of better opportunities. This influx necessitates the construction of new residential and commercial buildings to accommodate this growing urban population.

Governments and private developers are actively constructing new housing units to meet the demand of a growing urban population. This includes affordable housing projects, high-rise apartment buildings, and gated communities. Steel rebar plays a vital role in reinforcing these structures, ensuring their earthquake resistance, durability, and ability to withstand the demands of high-density living. Urbanization also fuels the construction of commercial buildings, shopping malls, office spaces, and hotels. These structures require significant quantities of steel rebar to ensure their structural integrity and accommodate their often intricate designs. The rise of megacities in the MEA region necessitates the development of supporting infrastructure within urban areas. This includes creating efficient public transportation systems, constructing waste management facilities, and building recreational spaces and parks. All these urban development projects rely heavily on steel rebar for structural reinforcement.

Middle East and Africa Steel Rebar Market Restraints and Challenges:

Steel rebar production hinges on two key raw materials: iron ore and scrap steel. The prices of these materials are notoriously volatile and susceptible to fluctuations in global market dynamics. This volatility creates a ripple effect throughout the steel rebar market, impacting manufacturers and ultimately, construction projects. Geopolitical tensions, trade disputes, and disruptions in the global supply chain can all lead to sharp increases in iron ore and scrap steel prices. This can squeeze profit margins for steel rebar manufacturers, forcing them to raise prices or face reduced profitability. Currency fluctuations within the MEA region can further complicate matters. If the local currency weakens against major currencies like the US Dollar, the cost of importing iron ore and scrap steel increases for regional manufacturers. This can lead to price hikes for steel rebar within the domestic market. When a region relies heavily on imports for a crucial material like steel rebar, it becomes vulnerable to fluctuations in global steel prices and potential supply chain disruptions. Unexpected import delays or trade restrictions can lead to shortages of steel rebar, jeopardizing ongoing construction projects.

Middle East and Africa Steel Rebar Market Opportunities:

The development of high-strength steel rebar allows for the use of less material to achieve the same level of structural strength. This translates to cost savings for construction projects and potentially lighter building designs. Additionally, high-strength rebar can enable the construction of taller and more slender structures, optimizing space utilization in urban areas. Traditional steel rebar is susceptible to corrosion, particularly in harsh environments like coastal regions or areas where de-icing salts are used. The development and adoption of corrosion-resistant rebar formulations can significantly extend the lifespan of structures, reducing maintenance costs and promoting long-term sustainability. Building Information Modeling (BIM) allows for the creation of a virtual model of a construction project, facilitating collaboration between architects, engineers, and steel rebar suppliers. This can optimize steel rebar usage by ensuring precise calculations and reducing material waste. Digital fabrication techniques like computer-controlled cutting and bending machines can streamline the production of steel rebar. This leads to increased accuracy, reduced production time, and potentially lower overall costs. Several MEA countries are actively investing in expanding their domestic steel production capacities. This can reduce reliance on imports, create jobs within the manufacturing sector, and foster economic development within the region.

MIDDLE EAST AND AFRICA STEEL REBAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

7.4% |

||

|

Segments Covered |

By Type, Grade, and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Emirates Steel , Emaar Steel (UAE), Saudi Steel Pipe Company , Jeddah Steel , ArcelorMittal , SAIL , Evraz , CMC |

Middle East and Africa Steel Rebar Market Segmentation:

Middle East and Africa Steel Rebar Market Segmentation: By Type:

- Deformed Steel Rebar

- Mild Steel Rebar

Deformed steel rebar reigns supreme in the MEA market, accounting for roughly 75-80% of the total steel rebar consumption. Its characteristic ribbed surface creates a superior mechanical bond with concrete, enhancing its grip and load-bearing capacity. This makes deformed rebar the go-to choice for a vast array of construction applications. The ribbed surface of deformed rebar ensures a strong connection with concrete, providing crucial stability for building foundations. Deformed rebar strengthens concrete beams, enabling them to bear the weight of floors, ceilings, and other building components.

The fastest-growing segment in the MEA steel rebar market is high-strength steel rebar. This category is estimated to capture around 15-20% of the market share and is projected to witness significant growth in the coming years. Due to its superior strength, high-strength rebar allows for the use of less material compared to traditional deformed rebar to achieve the same level of structural load-bearing capacity. This translates to cost savings for construction projects. By using less rebar, high-strength steel can contribute to lighter building designs. This can be beneficial for high-rise structures or projects where minimizing weight is crucial. The ability to use less material with high-strength rebar opens doors for more innovative and slender building designs, potentially enhancing aesthetics and architectural possibilities.

Middle East and Africa Steel Rebar Market Segmentation: By Grade:

- Fe 400

- Fe 500

- Fe 600

With almost 65% of the market share, grade 60 (420 MPa) steel rebar is the most prevalent grade in the MEA market. This grade is extensively utilized in a wide range of construction projects, including bridges, infrastructure projects, and residential and commercial buildings. There are various reasons why Grade 60 steel rebar is so popular. First of all, it provides a cost-effective, ductile, and balanced combination that makes it appropriate for a variety of applications. Furthermore, by regional building rules and standards, Grade 60 steel rebar satisfies the minimum strength requirements for the majority of construction projects in the area.

Grade 75 (520 MPa) steel rebar, also known as high-strength rebar, is considered the fastest-growing grade in the MEA market, with an estimated market share of around 25%. This grade offers superior strength and ductility compared to Grade 60, making it suitable for applications that require higher load-bearing capacities and seismic resistance. The growing adoption of Grade 75 steel rebar in the MEA region can be attributed to several factors. Firstly, as construction projects become more complex and demanding, there is an increasing need for higher-strength materials that can withstand greater loads and ensure structural integrity. Grade 75 steel rebar meets these requirements, making it an attractive choice for high-rise buildings, bridges, and infrastructure projects that require enhanced durability and safety.

Middle East and Africa Steel Rebar Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

Saudi Arabia has become the leading nation in the Steel Rebar Market, securing a substantial 22% share of the market. The country has embarked on numerous large-scale construction endeavors, including housing complexes, infrastructure projects, and the creation of new cities. Due to these large-scale initiatives, there is a notable demand for steel rebar, which supports the nation's dominant position in the market. Saudi Arabia's oil and gas sector has been a key force behind the building of refineries, pipelines, and other associated infrastructure. This has increased the nation's need for steel rebar even more. Saudi Arabia has a well-established steel industry, including several steel mills and production facilities. This domestic production capability has ensured a steady supply of steel rebar to meet the country's construction needs, further strengthening its market position.

Kenya emerged as the fastest-growing country in the Middle East and Africa Steel Rebar Market, with a projected compound annual growth rate (CAGR) of 9.5% during the forecast period. The Kenyan government has launched various initiatives to promote infrastructure development, including the construction of affordable housing units and the expansion of transportation networks. These initiatives have provided a significant boost to the demand for steel rebar. Kenya's manufacturing sector has been expanding, leading to the construction of new industrial facilities and production units. This has further contributed to the increasing demand for steel rebar in the country.

COVID-19 Impact Analysis on the Middle East and Africa Steel Rebar Market:

Lockdowns and social distancing measures caused project postponements and even cancellations. Businesses faced financial uncertainties, and infrastructure projects became less of a priority. This led to a decrease in demand for steel rebar, the essential ingredient for reinforced concrete structures. Government spending shifted towards healthcare and social safety nets during the peak of the pandemic. This diverted resources away from infrastructure projects, further dampening demand for rebar. Lockdowns and restrictions on movement hampered steel production in major manufacturing hubs. This limited the availability of rebar, creating supply chain bottlenecks. With a limited supply and a sudden drop in demand, the market experienced price volatility. Initially, there was a surge in prices due to supply constraints. However, as demand plummeted, prices started to correct. Steel rebar manufacturers and distributors faced a squeeze on their profit margins. The rise in production costs due to pandemic-related disruptions coincided with a drop in demand, putting pressure on their bottom line.

Latest Trends/ Developments:

Traditionally, Fe 500 grade rebar has been the dominant player in the MEA market. However, a growing emphasis on high-rise buildings and earthquake-prone zones is driving demand for higher-strength grades like Fe 550 and Fe 600. These grades offer superior strength-to-weight ratios and improved seismic resistance, making them ideal for complex and demanding construction projects. The construction industry in the MEA region is witnessing a surge in online procurement platforms dedicated to steel rebar. These platforms offer benefits like increased transparency in pricing, streamlined ordering processes, and easier access to a wider range of rebar options from various suppliers. BIM is revolutionizing the construction industry, and steel rebar is no exception. Integrating rebar data into BIM models allows for more accurate project planning, material quantification, and clash detection, leading to reduced waste and improved efficiency.

Key Players:

- Emirates Steel

- Emaar Steel (UAE)

- Saudi Steel Pipe Company

- Jeddah Steel

- ArcelorMittal

- SAIL

- Evraz

- CMC

Chapter 1. Middle East and Africa Steel Rebar Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Steel Rebar Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Steel Rebar Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Steel Rebar Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Steel Rebar Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Steel Rebar Market– By Type

6.1. Introduction/Key Findings

6.2. Deformed Steel Rebar

6.3. Mild Steel Rebar

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Steel Rebar Market– By Grade

7.1. Introduction/Key Findings

7.2. Fe 400

7.3. Fe 500

7.4. Fe 600

7.5. Y-O-Y Growth trend Analysis By Grade

7.6. Absolute $ Opportunity Analysis By Grade, 2024-2030

Chapter 8. Middle East and Africa Steel Rebar Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Grade

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Industrial Lubricants Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Emirates Steel

9.2. Emaar Steel (UAE)

9.3. Saudi Steel Pipe Company

9.4. Jeddah Steel

9.5. ArcelorMittal

9.6. SAIL

9.7. Evraz

9.8. CMC

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Governments across the MEA region are heavily investing in infrastructure projects like roads, bridges, power plants, and transportation networks. These projects require vast quantities of steel rebar to reinforce concrete structures, leading to a surge in demand

The global steel market is susceptible to price fluctuations due to factors like geopolitical tensions, supply chain disruptions, and raw material costs. These fluctuations can impact the price of steel rebar in the MEA region, creating uncertainty for construction projects and potentially hindering investment.

Emirates Steel, Emaar Steel (UAE), Saudi Steel Pipe Company, Jeddah

Steel, ArcelorMittal, SAIL, Evraz, CMC

Saudi Arabia has become the leading nation in the Steel Rebar Market, securing a substantial 22% share of the market.

Kenya emerged as the fastest-growing country in the Middle East and Africa Steel Rebar Market, with a projected compound annual growth rate (CAGR) of 9.5% during the forecast period