North America Steel Rebar Market Size (2024-2030)

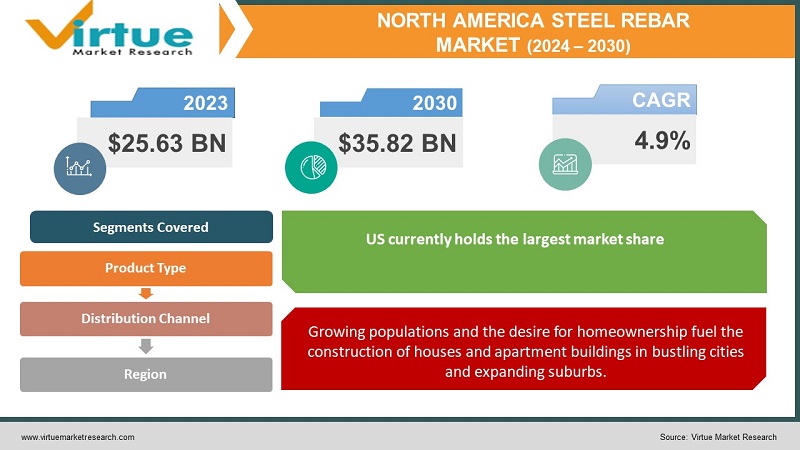

The North America Steel Rebar Market was valued at USD 25.63 Billion in 2023 and is projected to reach a market size of USD 35.82 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.9%.

The North American steel rebar market is substantial and has experienced steady growth in recent years. This growth aligns with increasing investment in both residential and non-residential construction projects across the continent. Government initiatives in countries like the United States and Canada aimed at revitalizing aging infrastructure provide a significant impetus to the demand for steel rebar. Steel rebar plays a vital role in a vast array of construction projects. This encompasses bridges, roadways, dams, tunnels, airports, and water or sewage treatment facilities. Government-funded infrastructure projects are a major driver of rebar demand. From foundations and slabs to columns and beams, rebar is found throughout multi-story apartment buildings, condominiums, and even some single-family homes. Rebar reinforces office buildings, shopping centers, warehouses, and various other types of commercial structures. Large-scale infrastructure programs in countries like the U.S. and Canada fuel market growth and boost demand for steel rebar. The construction industry's increasing emphasis on sustainability impacts the rebar market. Recycled steel content, innovative products designed for durability, and a reduced carbon footprint are becoming key considerations.

Key Market Insights:

Steel rebar, short for reinforcing bar, is an essential component in construction. Its ridged design bonds exceptionally well to concrete, providing tensile strength than concrete lacks. This combination creates structures capable of withstanding immense forces, making rebar integral to bridges, buildings, and various infrastructure projects. North America is seeing an increasing number of both new infrastructure projects and the renovation of existing structures. Governments are investing heavily in modernizing roads, bridges, and public buildings. This, in turn, fuels the demand for steel rebar, an indispensable construction material. As populations grow, the need for both residential and commercial spaces rises in tandem. The construction of apartment complexes, office buildings, and shopping centers requires substantial quantities of rebar for structural integrity. In areas prone to earthquakes and hurricanes, building codes often mandate the use of steel rebar in construction. This is due to its ability to enhance structural resistance to strong forces, making buildings safer and minimizing damage during natural disasters.

North America Steel Rebar Market Drivers:

Growing populations and the desire for homeownership fuel the construction of houses and apartment buildings in bustling cities and expanding suburbs.

As populations swell within urban centers, the demand for housing escalates. This translates into the construction of high-rise apartment buildings designed to maximize living space in a constrained footprint. From their foundations to rooftop terraces, steel rebar is integral in building these multi-level concrete structures strong enough to withstand both daily loads and the stresses of urban environments. Simultaneously, the desire for single-family homes and more space drives suburban development. While individual houses might seem to require less rebar than multi-story buildings, the sheer number of homes being built in these sprawling communities adds up to a significant volume of rebar use. The way we work is constantly changing. This means outdated office buildings frequently need renovations to accommodate modern layouts or completely new structures to house evolving industries. Steel rebar is heavily used in both adaptation and new construction scenarios to provide strength and longevity. The construction of shopping malls, restaurants, warehouses, and factories expands alongside our growing needs as consumers. Each of these commercial structures utilizes rebar from the ground up to support large floor spaces, machinery, and the substantial weight of goods and merchandise.

Governments at multiple levels within North America are recognizing the importance of infrastructure modernization. This recognition has materialized into ambitious spending programs that directly benefit the steel rebar market.

Infrastructure investment reaches far beyond the initial construction jobs. Money spent on rebar, concrete, and labor circulates through the economy. Workers buy goods, and businesses supplying the project spend on their own needs, creating a ripple effect that stimulates broader economic growth. Modern infrastructure creates favorable conditions for businesses. Reliable roads make transport faster, and good utility networks power factories and communication infrastructure facilitate business development. This attracts private investment, leading to further construction and additional rebar demand. While economic, and infrastructure improvement also impacts communities. Safe bridges, clean water systems, and reliable power grids aren't just a convenience, they raise living standards for everyone. This can boost overall morale, translating into a more productive workforce. Roads, highways, bridges, airports, and rail lines are a focus point. New construction to accommodate growth and repair of aging infrastructure are equally important. Rebar plays a central role in nearly all concrete elements, from pillars and beams to road surfaces and tunnel sections.

North America Steel Rebar Market Restraints and Challenges:

The main raw material used in the production of rebar in North America is recycled steel scrap. The price of completed rebar is directly impacted by changes in scrap market costs.

North American rebar production heavily relies on recycled steel scrap as a primary raw material. Any cost fluctuations in the scrap market directly impact the pricing of finished rebar. Scrap metal prices are notoriously volatile due to factors like global demand, export restrictions, and trade policies. This introduces significant uncertainty for rebar manufacturers and can lead to unexpected price hikes for buyers during periods of scrap price surges. While rebar can also be produced from iron ore, this method often costs more. Manufacturers may switch based on raw material availability, but this can further impact pricing and consistency. The construction market, the biggest consumer of rebar, experiences booms and busts. Periods of economic weakness, rising interest rates, or simply decreased demand for new housing slow down construction significantly. This downturn flows straight back up, impacting steel rebar demand and sales. Even after economic recovery, there's often a lag before the construction industry fully bounces back due to the time required for new projects to get funded, approved, and initiated. This delay impacts the rebar market. Market speculation and sentiment can further amplify volatility in the construction sector, influencing rebar demand even if underlying conditions are relatively stable. News headlines can sometimes drive market reactions beyond the actual needs on the ground.

North America Steel Rebar Market Opportunities:

North America has a vast stock of existing infrastructure much of which is reaching the end of its intended lifespan. Repair, replacement, and reinforcement projects for these aging assets will be a persistent source of rebar demand for decades to come. Targeting this niche with rebar products specifically designed for repair work holds potential. Sustainability is taking center stage. Governments often mandate the use of environmentally friendly products and practices in infrastructure. Developing rebar with a high recycled content or focusing on coatings that significantly reduce corrosion, thereby extending the lifespan of concrete structures, can open doors in this space. Climate change is leading to more extreme weather. Infrastructure projects specifically geared towards flood resilience, hurricane-resistant structures, or fire protection offer a chance to capitalize on the need for extra durable concrete, usually requiring more rebar. Powerful structural engineering software allows for ever more complex and efficient concrete beam and pillar designs. This can drive the need for more intricate and specialized rebar shapes to match these designs with high precision. Rebar's biggest enemy is corrosion. Developing coatings far superior to those currently used, such as advanced epoxy or galvanization technologies, can command a premium price in areas with aggressive environments like coastal regions. Embedding sensors within rebar to monitor the health of concrete structures over time is an emerging field. While niche, it highlights how rebar's function could expand further in high-value applications.

NORTH AMERICA STEEL REBAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CANADA, MEXICO |

|

Key Companies Profiled |

Nucor Corporation , ArcelorMittal, Gerdau S.A., Commercial Metals Company, Steel Dynamics, Inc., Evraz North America, Acerinox S.A. , Riva Group |

North America Steel Rebar Market Segmentation:

North America Steel Rebar Market Segmentation: By Product Type

- Deformed Rebar

- Mild Steel Rebar

Deformed Rebar: Deformed rebar, with its ridges and deformations, is the absolute king of the North American rebar market. The most common type, features ridges, ribs, or deformations along its surface. These deformations provide exceptional bonding with concrete, preventing slippage, and greatly enhancing the strength of reinforced concrete structures. Mild Steel Rebar: Mild steel rebar, with its smooth surface, plays a smaller but important role in the market. Features a smooth surface, lacking the deformations of its counterpart. It's generally less strong, but more pliable, and is used in scenarios where extreme tensile strength isn't the primary requirement, but some level of concrete reinforcement is still needed. The popularity of epoxy-coated and galvanized rebar is on the rise. Projects in coastal areas, or those emphasizing long lifespans, drive the demand for rebar with superior protection against rust. Expect this segment to see significant growth. Fiber-reinforced polymers (FRP) are slowly entering the scene. If costs come down and they gain wider acceptance in building codes, they could see rapid growth but currently remain niche.

North America Steel Rebar Market Segmentation: By Distribution Channel

- Grade 40

- Grade 60

- Grade 75

Grade 40: At least 40,000 pounds per square inch (psi) of yield strength is required. For smaller projects and less important structural components, this grade is adaptable. widely used in smaller building projects, residential settings where heavy structural loads aren't a big issue, or places where having more flexibility to bend and shape is beneficial. Grade 60: Because of its exceptional blend of affordability and strength, Grade 60 steel rebar leads the North American steel rebar industry. the industry workhorse, with a minimum yield strength of 60,000 psi. Large infrastructure projects, bridges, and high-rise buildings where extra strength is required frequently employ it. A fantastic mix of strength and cost-effectiveness is provided by grade 60. Engineers and contractors choose it because of its strength, which is sufficient for the majority of large-scale infrastructure and building projects. The rebar of grade 75 is stronger and has a minimum yield strength of 75,000 psi. It finds specialized usage in structures resistant to earthquakes and other applications requiring even greater strength. It still fills a niche, even if demand for it is higher than for Grade 40. This grade is mostly used for highly fortified structures or high-rise buildings in seismically active areas that need to be exceptionally strong. Its greater price may occasionally be a barrier.

North America Steel Rebar Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

The United States: Accounts for approximately 70-80% of the North American steel rebar market. This is by far the largest market for steel rebar in North America. Its mature infrastructure, massive construction industry, and government spending programs drive substantial and consistent demand. Canada: Represents an estimated 15-25% of the market. While smaller than the U.S. market, Canada has its own significant infrastructure needs, resource development projects, and a growing housing market, fueling rebar demand. Mexico: Holds the remaining 5-10%. Mexico's developing economy, urbanization efforts, and manufacturing sector offer a growing market for steel rebar, although its overall size currently lags behind the U.S. and Canada. The U.S. economy's sheer size drives significant construction activity across residential, commercial, and infrastructure sectors. It dwarfs the economies of its North American neighbors. The U.S. has large population centers and a continuous trend of urbanization, necessitating the construction of new buildings and infrastructure to support them. Mexico is positioned for significant growth in the steel rebar market. Mexico is experiencing a growth spurt in its manufacturing sector. New factories, warehouses, and associated infrastructure require substantial reinforcement, hence creating greater demand for rebar. Mexico's cities are growing, creating a need for new housing projects and supporting infrastructure, just like any growing population center.

COVID-19 Impact Analysis on the North American Steel Rebar Market:

With construction sites idle, steel mills producing rebar significantly scaled back production. This not only impacted their bottom lines but also led to temporary layoffs or furloughs for workers. Border restrictions and global lockdowns disrupted the smooth flow of raw materials needed for rebar production. Scrap steel, a key component in rebar manufacturing, faced shortages in some regions. The initial shock to demand triggered a period of price volatility in the rebar market. Uncertainty and a temporary oversupply led to price fluctuations, making it difficult for construction companies to accurately budget for projects. Government infrastructure spending programs, launched as a stimulus measure during the pandemic, proved to be a lifeline for the rebar market. These projects continued even during lockdowns, as they were often deemed essential, and provided a steady source of demand. Interestingly, the housing market in many parts of North America boomed during the pandemic. People spending more time at home, coupled with historically low-interest rates, fueled demand for new homes, creating a positive impact on the rebar market in that sector. Project delays and cancellations during the pandemic may have created a backlog of construction projects. This pent-up demand could lead to a surge in rebar needs in the coming years.

Latest Trends/ Developments:

Rebar manufactured using a significant percentage of recycled steel is in demand. This reduces the need to mine virgin iron ore and cuts down on the energy needed for production, making it an attractive option for eco-conscious developers. Projects aiming for LEED certification or similar sustainability benchmarks often mandate the use of rebar with high recycled content or having undergone environmentally responsible manufacturing processes. While coatings are used to prevent rusting, new coatings with minimal environmental impact are emerging. These replace traditional coatings that might contain potentially harmful chemicals. Beyond simple epoxy coatings, researchers are developing advanced materials to combat corrosion. These could include self-healing coatings or highly advanced polymers, significantly extending the lifespan of rebar-reinforced structures. Embedding sensors within rebar to monitor stresses and strains in concrete over time is a niche but growing field. This data can provide valuable insights into the health of structures, allowing for proactive maintenance.

Key Players:

- Nucor Corporation

- ArcelorMittal

- Gerdau S.A.

- Commercial Metals Company

- Steel Dynamics, Inc.

- Evraz North America

- Acerinox S.A.

- Riva Group

Chapter 1. North America Steel Rebar Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Steel Rebar Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Steel Rebar Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Steel Rebar Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Steel Rebar Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Steel Rebar Market– By Product Type

6.1. Introduction/Key Findings

6.2. Deformed Rebar

6.3. Mild Steel Rebar

6.4. Y-O-Y Growth trend Analysis By Product Type

6.5. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Steel Rebar Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Grade 40

7.3. Grade 60

7.4. Grade 75

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. North America Steel Rebar Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Steel Rebar Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Nucor Corporation

9.2. ArcelorMittal

9.3. Gerdau S.A.

9.4. Commercial Metals Company

9.5. Steel Dynamics, Inc.

9.6. Evraz North America

9.7. Acerinox S.A.

9.8. Riva Group

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

As more people move to cities and populations grow, the need for both residential and commercial spaces increases, driving the construction of apartments, offices, and supporting infrastructure

The price of rebar is heavily dependent on the cost of steel scrap, its key ingredient. Global steel markets are subject to fluctuations due to supply chain issues, trade policies, and demand shifts from sectors like auto manufacturing.

Nucor Corporation, ArcelorMittal, Gerdau S.A., Commercial Metals

The US currently holds the largest market share, estimated at around 70%.

Mexico exhibits the fastest growth, driven by its increasing population, and expanding economy