Smart Lock Market Size (2024 – 2030)

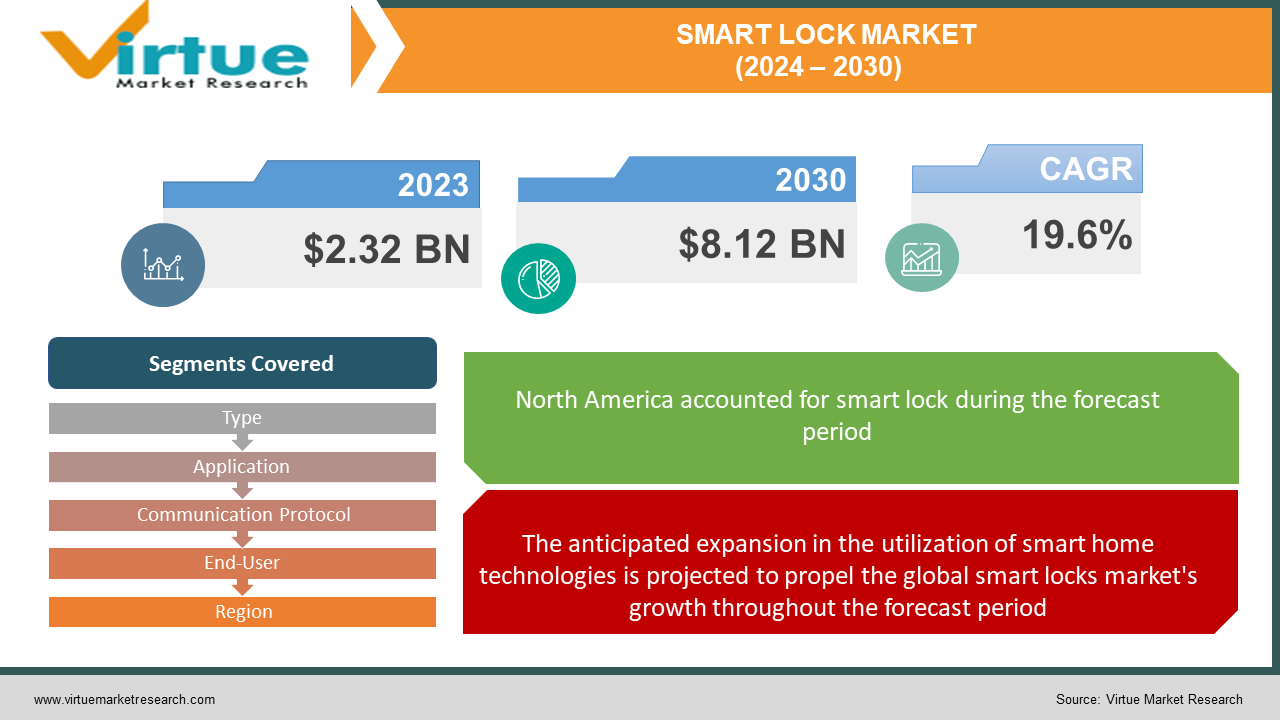

The Global Smart Lock Market size was exhibited at USD 2.32 billion in 2023 and is projected to hit around USD 8.12 billion by 2030, growing at a CAGR of 19.6% during the forecast period from 2024 to 2030.

Smart locks represent sophisticated electronic locking systems developed to deliver secure and convenient access control for residences, enterprises, and other premises. These systems replace conventional mechanical locks and keys with digital technology. Users can secure and open doors without relying on physical keys; instead, methods such as PIN codes, smartphone applications, keycards, or biometrics (fingerprint or facial recognition) are commonly employed for access.

A multitude of smart locks can be managed remotely through a smartphone application or web interface, allowing users to supervise and manipulate their locks from any location with an internet connection. The rising popularity of smart locks is attributed to the convenience and heightened security they provide. They find applications in residential spaces, vacation rentals, commercial structures, and any setting where controlled access is imperative.

Key Market Insights:

The anticipated surge in the adoption of smart locks is fueled by the advent of emerging technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and Machine Learning (ML). Furthermore, the increasing consumer awareness regarding the benefits and security features of smart door locks is a driving force behind market growth. The intricate design and superior efficiency of these locks have led to their deployment in diverse locations to fortify security.

The global proliferation of smart homes and the influx of companies specializing in home automation technology contribute to the escalating demand for smart locks. Industry players are concentrating on delivering commercially viable products and advancing solutions, including the remote locking/opening of doors and windows. Additionally, with the steady rise in the number of homes equipped with voice assistants, manufacturers are integrating their products with such devices to enable voice-controlled lock operations.

These innovations are anticipated to elevate the popularity of smart door locks with cameras as consumers increasingly seek advanced locking and unlocking systems. There is a growing imperative to secure various properties, such as individual residences, hotels, supermarkets, banks, financial institutions, corporate structures, smart lockers, and commercial buildings, with advanced security solutions, thereby propelling market growth throughout the forecast period.

Global Smart Lock Market Drivers:

The anticipated expansion in the utilization of smart home technologies is projected to propel the global smart locks market's growth throughout the forecast period.

Smart home locks play a pivotal role in smart home ecosystems, delivering automation and access capabilities through smartphones, tablets, and various devices. The profound shift in the lifestyle of urban households has led to an increased demand for intelligent electronic devices, allowing users to monitor their residences through a unified platform. Some devices utilize non-acoustic sensors, such as mechanical accelerometers, to detect surface vibrations, converting them into programmable actions through Wi-Fi connectivity. Investors are particularly drawn to the promising future of smart home technologies. Consequently, these factors are expected to drive the global smart locks market's growth in the forecast period. Notably, industry leader Yale Home is enhancing Wi-Fi connectivity for the Yale Assure Lever, providing even greater convenience at a reduced cost.

The growth of the global smart locks market is predicted to be propelled by technological advancements that make mobile communication cost-effective during the forecast period.

Smart locks are integral components of the broader smart home ecosystem, offering heightened security, convenience, and remote access control. The incorporation of mobile communication technologies, including Bluetooth, Wi-Fi, and cellular connectivity, empowers users to remotely monitor and control door locking and unlocking through smartphones and connected devices. This level of convenience aligns with consumers' escalating demand for smarter, more efficient, and digitally integrated home solutions. The convergence of cost-effective mobile communication technology and the increasing interest in smart home solutions is expected to fuel the global smart locks market's growth. As technological progress persists and consumer preferences evolve, the market is poised to witness heightened adoption and innovation in the realm of smart locks.

Global Smart Lock Market Restraints and Challenges:

Concerns related to system compromise and hacking threats are projected to impede the growth of the global smart locks market throughout the forecast period.

A study conducted by the University of Michigan has highlighted the vulnerability of the Samsung smart things platform, which controls locks, thermostats, appliances, and security systems, to potential attacks and takeovers by hackers. The feasibility of retrieving smart locks' PIN codes from a hacker application raises security issues, allowing unauthorized access to reset safety modes and trigger alarms. Even with Bluetooth encryption, skilled hackers can introduce corrupted versions of applications on platforms like the Google Play Store. Recovering from such vulnerabilities is challenging and expensive. The use of Wired Equivalent Privacy (WEP) encryption on Wi-Fi networks could enable authorized users to swiftly obtain network passwords, leading to the launch of "man-in-the-middle attacks" that alter messages without detection.

The global smart locks market's growth is expected to face hindrances due to low awareness among customers during the forecast period.

The relatively new and evolving nature of smart lock technology contributes to low awareness among potential customers. Lack of familiarity with the concept, and misconceptions regarding its complexity, reliability, and compatibility with existing security systems, could create hesitancy among consumers. The diversity in the smart locks market, encompassing various features, connectivity options, and price points, adds to the confusion for customers seeking informed decisions. Concerns about data privacy and cybersecurity may also deter customers, leading them to opt for traditional lock systems over smart locks. To address these challenges, industry leaders should invest in comprehensive marketing strategies and awareness campaigns. Emphasis should be placed on educating consumers about the convenience, enhanced security, and remote access features offered by smart locks. Manufacturers need to simplify the user experience, providing clear information about product specifications and compatibility to reduce confusion among potential buyers.

Global Smart Lock Market Opportunities:

The ongoing global expansion of smart city initiatives has generated an increased demand for smart devices, including smart locks, to enhance security for residents in these cities. Advanced smart home devices, such as smart door locks and intelligent alarm systems, come equipped with enhanced features and are anticipated to witness widespread adoption in the upcoming years. Wireless systems, known for their easy installation, are extensively utilized. The integration of smart access control systems in homes and cities not only enhances security but also contributes to energy efficiency. The Indian government initiated the Smart Cities Mission (SCM), selecting approximately 100 smart cities through four competition rounds. The progress of SCM projects has been significant, with 6,452 projects worth USD 24 billion tendered. Among these, 5,809 projects worth USD 20 billion are either under implementation or completed. Consequently, the increasing focus on long-term government initiatives for developing smart cities is poised to create growth opportunities for the smart lock market.

SMART LOCK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

19.6% |

|

Segments Covered |

By Type, Application, Communication Protocol, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

August Home, Inc. (ASSA ABLOY), Avent Security, Cansec Systems Ltd., HavenLock, Inc., Kwikset (Spectrum Brands Holdings, Inc.), MUL-T-LOCK TECHNOLOGIES LTD. (ASSA ABLOY), Schlage (Allegion Plc), Zigbang Co., Ltd. (Previously Samsung SDS), Sentrilock, LLC, Smart Locking Logic Proprietary Limited, UniKey Technologies, Inc., Yale Locks (ASSA ABLOY), Goji, Onity Inc. (Carrier Global Corporation), Honeywell International Inc. |

Global Smart Lock Market Segmentation: By Type

-

Deadbolt

-

Level Handlers

-

Padlock

-

Server Locks & Latches

-

Knob Locks

-

Others

The deadbolt category, accounting for the largest revenue share in 2023 in terms of volume, is projected to continue its upward trajectory throughout the forecast period. The growth of the smart lock deadbolt segment is attributed to its increasing deployment across diverse sectors and its ease of installation. Factors such as low installation costs, high durability, and effective protection against intrusion contribute to the segment's expansion. Companies are actively expanding their product portfolios; for instance, Kwikset introduced innovative deadbolts with features like single-touch locks, low battery warnings, and personalized user codes, garnering significant customer interest.

The lever handle segment is anticipated to experience notable growth at a CAGR of over 25% from 2024 to 2030 in terms of volume. Modernization initiatives in the hospitality sector, aimed at addressing tourist security needs, are expected to drive the segment's growth. Smart lever handles, commonly used in commercial environments on interior doors, offer simplified locking/unlocking processes, including the push-down style handle, providing an advantage over knob-based mechanisms.

The padlock market is poised to witness significant growth at a notable CAGR, driven by the widespread adoption of smart locks globally. Smart padlocks, known for advantages such as high-end security, user activity management, convenience, and smartphone connectivity, are increasingly being utilized beyond residential sectors, ensuring complete security for luggage during travel.

Global Smart Lock Market Segmentation: By Application

-

Residential

-

Individual Household

-

Commonhold

-

Commercial

-

Hospitality

-

Healthcare

-

Banking & Financial Institutes

-

Enterprise

-

Critical Infrastructure

-

Educational Institution

-

Industrial

-

Manufacturing

-

Energy & Utilities

-

Oil & Gas

-

Transportation & Logistics

-

Institutional & Government

-

Others

The residential application segment, with a revenue share exceeding 60% in 2023, is poised to maintain its dominance throughout the forecast period. The substantial revenue output is linked to the increasing global penetration of smart homes and a rise in new construction and restoration projects. The affordability of modern security solutions, such as motion detectors, door and window opening sensors, fingerprint door locks, and remote door locking and unlocking, is projected to further drive adoption. The development of locks compatible with technologies like Z-Wave, ZigBee, and BLE is gaining traction, especially for mass-market residential applications.

The hospitality segment is expected to grow at a CAGR of over 23% from 2024 to 2030, fueled by the rapid implementation of smart locks to address growing security concerns among consumers during their visits. The obligation for hotels to enhance in-room security is anticipated to boost the usage of keyless access devices in the coming years.

Global Smart Lock Market Segmentation: By Communication Protocol

-

Bluetooth

-

Wi-Fi

-

NFC

In the segmentation of the Smart Lock Market based on Communication Protocol, the options include Bluetooth, Wi-Fi, and NFC. In 2022, NFC dominated the market share. NFC technology is increasingly establishing itself as a prominent communication protocol in the smart lock industry, offering users a secure and convenient alternative to traditional locks. Smart locks equipped with NFC enable users to unlock doors effortlessly by tapping their smartphone or key fob, proving particularly beneficial in environments with multiple users. The utilization of NFC technology in smart locks brings several security advantages, including encrypted communication that thwarts unauthorized interception of data exchanged between the lock and the user's device. Moreover, the proximity required for NFC communication adds an additional layer of difficulty for hackers attempting remote access. Users appreciate the high convenience provided by NFC-enabled smart locks, as they eliminate the need to carry keys or memorize intricate access codes. This functionality proves especially valuable in scenarios like rental properties and shared office spaces.

Global Smart Lock Market Segmentation: By End-User

-

Commercial

-

Government

In terms of end-user segmentation, the Smart Lock Market encompasses commercial and government sectors. In the year 2023, the commercial sector held the predominant market share. Smart locks find applications across various industries for commercial purposes, spanning hospitality, healthcare, education, government, retail, and commercial offices. These locks bring forth numerous advantages in commercial settings, including heightened security, enhanced access control, and increased convenience for both employees and customers. In the hospitality industry, smart locks emerge as a favored choice for hotel rooms and vacation rentals, ensuring secure and seamless access for guests. These locks can be programmed to permit entry solely to authorized guests, while simultaneously providing hotel managers with an audit trail detailing access to each room. The healthcare industry leverages smart locks to safeguard medical facilities, ensuring that only approved personnel gain access to sensitive areas. Similarly, in educational institutions, smart locks are deployed to secure classrooms, laboratories, and other campus buildings.

Global Smart Lock Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America, with the largest market share in 2023 accounting for approximately 39% in terms of volume, is poised for significant growth throughout the forecast period, driven by advancements in smart lock technology. This growth is attributed to widespread technology adoption and the rapid expansion of smart homes in the United States. Notably, 30% of internet households in the U.S. express a desire to acquire a smart lock for a sliding door by the end of 2023. The combination of substantial consumer spending power and escalating safety concerns, particularly in critical infrastructure and domestic applications, has fostered a supportive regulatory environment, facilitating the adoption of smart locks.

Asia Pacific is anticipated to experience substantial growth at a CAGR exceeding 25% from 2024 to 2030, measured in terms of volume. This growth is propelled by a significant surge in residential and commercial projects and ongoing smart city programs in developing countries such as India. Moreover, door locks with keypads exhibit higher penetration across the region and have witnessed noteworthy growth, contributing to the dissemination of awareness about advanced gadgets and technologies. Numerous smart lock manufacturers in the Asia-Pacific region continually innovate, introducing new features for smart locks. Additionally, several startup companies are experimenting with novel smart lock applications to enhance safety. The increasing urbanization in countries including India, Singapore, Indonesia, Australia, and New Zealand within the Asia-Pacific region creates opportunities for global smart lock manufacturers.

COVID-19 Impact on the Global Smart Lock Market:

The global smart locks market encountered substantial impacts due to the COVID-19 pandemic. As the virus spread globally, governments implemented various lockdown measures and restrictions, leading to disruptions in the construction and real estate sectors. These sectors play a pivotal role in the adoption of smart locks, often integrated into new housing developments and commercial buildings. The pandemic induced a shift in consumer behavior, with an increasing emphasis on contactless solutions to minimize the risk of transmission. Although smart locks offer the convenience of remote access and touchless entry, the economic uncertainties and reduced purchasing power of consumers hindered market growth during the pandemic's peak. Additionally, supply chain disruptions and manufacturing delays, caused by global lockdowns, impacted the production and distribution of smart locks, resulting in inventory shortages and escalated prices. Numerous manufacturers faced challenges in sourcing essential components, affecting their ability to promptly meet market demands.

Recent Trends and Innovations in the Global Smart Lock Market:

In April 2023, the ASSA ABLOY Group, a global leader in access solutions, executed a distinctive assignment in South Africa, showcasing its commitment to securing businesses and homes worldwide through its smart lock solution.

During March 2023, HavenLock Inc., a Tennessee-based veteran organization and developer of the innovative Haven Lockdown System, announced the introduction of a Power G version of its smart locking system designed for secure applications in schools and commercial establishments.

Also in March 2023, Honeywell International Inc., an American multinational conglomerate, announced the successful implementation of the Bengaluru Safe City project. The initiative aims to create a secure environment for citizens by leveraging the organization's smart lock and security technology.

In February 2023, Sentrilock, LLC, a leading provider of electronic lockbox solutions for the real estate sector, announced a new collaboration with the Chesapeake Bay and Rivers Association of REALTORS (CBRAR). Together, they aim to establish a marketplace for smart electronic lockbox solutions catering to the members of REALTORS.

In January 2023, Schlage, a prominent supplier of access and home security solutions under Allegion Plc, unveiled the Schlage EncodeTM Smart Wi-Fi Lever, a residential smart lock, at the NAHB International Builders’ Show (IBS) 2023.

Key Players:

-

August Home, Inc. (ASSA ABLOY)

-

Avent Security

-

Cansec Systems Ltd.

-

HavenLock, Inc.

-

Kwikset (Spectrum Brands Holdings, Inc.)

-

MUL-T-LOCK TECHNOLOGIES LTD. (ASSA ABLOY)

-

Schlage (Allegion Plc)

-

Zigbang Co., Ltd. (Previously Samsung SDS)

-

Sentrilock, LLC

-

Smart Locking Logic Proprietary Limited

-

UniKey Technologies, Inc.

-

Yale Locks (ASSA ABLOY)

-

Goji

-

Onity Inc. (Carrier Global Corporation)

-

Honeywell International Inc.

Chapter 1. Smart Lock Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Lock Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Lock Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Lock Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Lock Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Lock Market – By Type

6.1 Introduction/Key Findings

6.2 Deadbolt

6.3 Level Handlers

6.4 Padlock

6.5 Server Locks & Latches

6.6 Knob Locks

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Smart Lock Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Individual Household

7.4 Commonhold

7.5 Commercial

7.6 Hospitality

7.7 Healthcare

7.8 Banking & Financial Institutes

7.9 Enterprise

7.10 Critical Infrastructure

7.11 Educational Institution

7.12 Industrial

7.13 Manufacturing

7.14 Energy & Utilities

7.15 Oil & Gas

7.16 Transportation & Logistics

7.17 Institutional & Government

7.18 Others

7.19 Y-O-Y Growth trend Analysis By Application

7.20 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Smart Lock Market – By Communication Protocol

8.1 Introduction/Key Findings

8.2 Bluetooth

8.3 Wi-Fi

8.4 NFC

8.5 Y-O-Y Growth trend Analysis By Communication Protocol

8.6 Absolute $ Opportunity Analysis By Communication Protocol, 2024-2030

Chapter 9. Smart Lock Market – By End-User

9.1 Introduction/Key Findings

9.2 Commercial

9.3 Government

9.4 Y-O-Y Growth trend Analysis End-User

9.5 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Smart Lock Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.2.1 By Application

10.1.3 By Communication Protocol

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Application

10.2.4 By Communication Protocol

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Application

10.3.4 By Communication Protocol

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Application

10.4.4 By Communication Protocol

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Application

10.5.4 By Communication Protocol

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Smart Lock Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 August Home, Inc. (ASSA ABLOY)

11.2 Avent Security

11.3 Cansec Systems Ltd.

11.4 HavenLock, Inc.

11.5 Kwikset (Spectrum Brands Holdings, Inc.)

11.6 MUL-T-LOCK TECHNOLOGIES LTD. (ASSA ABLOY)

11.7 Schlage (Allegion Plc)

11.8 Zigbang Co., Ltd. (Previously Samsung SDS)

11.9 Sentrilock, LLC

11.10 Smart Locking Logic Proprietary Limited

11.11 UniKey Technologies, Inc.

11.12 Yale Locks (ASSA ABLOY)

11.13 Goji

11.14 Onity Inc. (Carrier Global Corporation)

11.15 Honeywell International Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Smart Lock Market size is valued at USD 2.32 billion in 2023.

The worldwide Global Smart Lock Market growth is estimated to be 19.6% from 2024 to 2030.

The Global Smart Lock Market is segmented By Type (Deadbolt, Lever Handle, Padlock), By Application (Residential, Commercial, Industrial, Oil & Gas, Transportation & Logistics, Institutional & Government, Others), By Communication Protocol (Bluetooth, Wi-Fi, and NFC), By End-User (Commercial and Government).

The Global Smart Lock Market is poised for significant growth with anticipated future trends and opportunities. Innovations in biometrics, increased IoT integration, and expanding smart city initiatives are expected. Rising awareness, coupled with heightened security concerns, presents promising opportunities for market expansion in residential, commercial, and government sectors.

The COVID-19 pandemic significantly impacted the Global Smart Lock Market. Disruptions in construction and real estate sectors, economic uncertainties, and altered consumer behavior favoring contactless solutions led to a slowdown. Supply chain disruptions and manufacturing delays further affected production, causing shortages and increased prices.