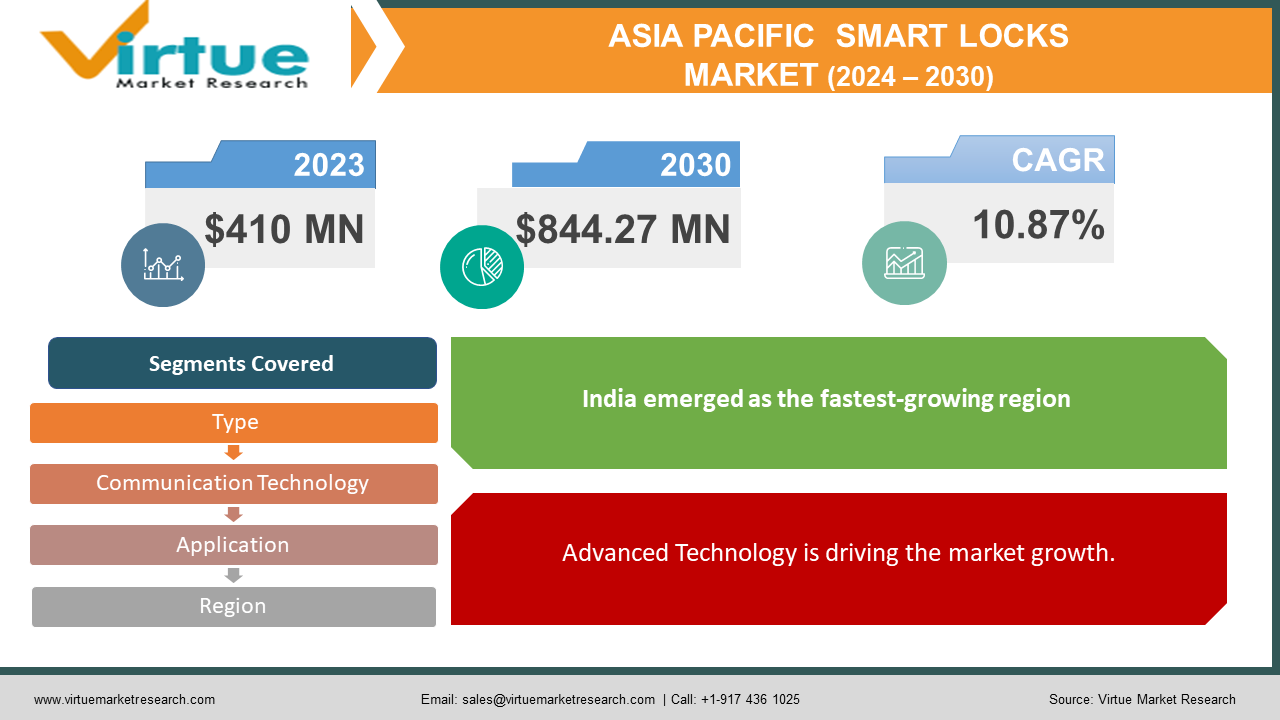

Asia-Pacific Smart Locks Market Size (2024-2030)

The Asia-Pacific Smart Locks Market was valued at USD 410 Million in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 844.27 Million by 2030, growing at a CAGR of 10.87%.

The utilization of intelligent locks provides convenience through the incorporation of communication technologies like Bluetooth, Wi-Fi, and NFC. In contemporary daily practices within burgeoning economies, the adoption of smartphones has become an essential component. A considerable number of individuals are procuring these sophisticated devices to streamline their everyday activities, thereby substantiating the notable advancement of the smart locks market.

Key Market Insights:

The inclination towards ecosystem integration persists as manufacturers of smart locks establish collaborations with other producers of smart home devices. Such partnerships yield interoperable solutions, delivering users a seamless and consolidated smart home experience. The market is witnessing an increasing emphasis on the incorporation of energy-efficient functionalities and the utilization of sustainable materials. Manufacturers are actively exploring environmentally friendly designs and energy-conserving systems to meet the growing consumer inclination towards sustainable technology.

Moreover, these locks are bringing about a revolution in the hospitality sector by offering a seamless and secure guest experience. The adoption of these locks in hotels and short-term rental properties is on the rise, streamlining check-in processes. Guests can utilize digital keys on their smartphones, enhancing convenience and eliminating the inconvenience associated with physical keycards. Additionally, hotel management benefits from the capability to remotely monitor and manage room access, leading to improved operational efficiency.

Healthcare facilities are also incorporating these advanced locks to enhance security and regulate access to sensitive areas such as patient rooms, laboratories, and pharmaceutical storage. The integration of biometric authentication ensures that only authorized personnel can access restricted zones, thereby safeguarding patient privacy and maintaining a secure environment for medical resources.

Asia-Pacific Smart Locks Market Drivers:

Advanced Technology is driving the market growth.

Technological advancements within the Asia Pacific smart locks market are being propelled by various market players who are incorporating artificial intelligence (AI), machine learning (ML), and similar technologies into their smart lock offerings. The integration of AI and ML in door locks enhances home security by monitoring the individuals who access and secure the doors. Additionally, these locks provide enhanced control over the authorization to lock and unlock specific doors, allowing users to automate the locking or unlocking process as they depart from or approach their homes. The AI- or ML-integrated locks are designed to potentially recognize break-in or tampering attempts. An illustrative instance is Viomi's introduction of the Viomi AI Smart Door Lock Super 2E in December 2022, featuring fully automatic functionality and supporting six unlocking methods: fingerprint, password, virtual password, temporary password, door card, and key. Notably, this smart door lock incorporates AI self-learning technology, which heightens its sensitivity with usage.

Asia-Pacific Smart Locks Market Restraints and Challenges:

Lack of Awareness about Intelligent Door Locks May hamper the market growth

While smart locks provide an array of technological features, a significant portion of users harbors security concerns. Moreover, impediments to market growth include the limited awareness and elevated costs associated with intelligent locks, particularly in rural areas. Factors such as government rules and regulations, along with the insufficient implementation of advanced technologies, are anticipated to act as deterrents to market expansion.

While certain fingerprint door locks may alleviate concerns related to physical picking, there remains a prevalent and significant issue with smart locks—hackers attempting to circumvent the entry codes required for unlocking doors. Smart locks, as IoT-enabled devices, are susceptible to cyberattacks. Hackers may exploit vulnerabilities in the device's software or network communication, gaining unauthorized access to the security system and compromising property safety. Smart locks frequently store sensitive user data, including access logs and biometric information. In the absence of robust security measures, these devices become potential targets for cybercriminals aiming to pilfer or manipulate such data, resulting in potential privacy breaches. The capacity to remotely control smart locks, often facilitated through mobile apps, introduces a new vulnerability that can be exploited in cyber-attacks.

Asia-Pacific Smart Locks Market Opportunities:

The momentum towards ecosystem integration persists, as manufacturers of smart locks engage in partnerships with other producers of smart home devices. This collaborative effort leads to the development of interoperable solutions, providing users with a consolidated and seamless smart home experience. The market is witnessing an increasing emphasis on the incorporation of energy-efficient features and the utilization of sustainable materials. Manufacturers are actively exploring environmentally friendly designs and power-saving systems to align with the growing consumer

ASIA-PACIFIC SMART LOCKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.87% |

|

Segments Covered |

By Type, Communication technolofy, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, India, Japan, rest of asia-pacific |

|

Key Companies Profiled |

Samsung, GANTNER Electronic GmbH, Wyze Labs, Inc., Schlage, AMADAS Inc., Zhejiang Dahua Technology Co., Ltd., Honeywell International Inc., Unikey Technologies Inc., Assa Abloy AB, Allegion Plc |

Asia-Pacific Smart Locks Market Segmentation:

Asia-Pacific Smart Locks Market Segmentation By Type:

- Padlocks

- Deadbolt

- Lever Handle

- RFID

The deadbolt segment asserts its dominance in the market, commanding the largest share of revenue at more than 43.8% throughout the forecast period. This prominence can be attributed to the widespread adoption of the product across various industries, coupled with its straightforward installation process. The market growth is facilitated by the combination of low installation costs, high durability, and effective security measures inherent in deadbolt locks. Additionally, companies are strategically focusing on diversifying their product portfolios, further contributing to the overall expansion of the lock market.

Asia-Pacific Smart Locks Market Segmentation By Communication Technology:

- Wi-Fi

- Bluetooth

- NFC

- Others

In 2023, the Asia Pacific smart door lock market witnessed the Bluetooth segment securing the largest share. Fingerprint recognition stands out as a rapid and convenient method for identifying and authenticating individuals. Complementing the escalating smart home trend, biometric authentication adds substantial value to contemporary home security systems. In contrast to password-protected smart locks, biometric authentication relies on personally identifiable information securely stored on the device, whether it be the lock itself or a fingerprint-secured access card, ensuring maximum security. Consequently, biometrics prove challenging to compromise.

Asia-Pacific Smart Locks Market Segmentation By Application:

- Residential

- Commercial

- Industrial

In 2023, the commercial segment dominated the Asia Pacific smart door lock market, capturing a substantial share. Commercial door locks, characterized by robust locking mechanisms, are tailored to provide heightened security for businesses. Typically installed on the exterior doors of diverse establishments such as hospitals, retail stores, office buildings, and medical facilities, these locks are engineered to meet the specific security requirements of commercial spaces and storage areas. Meanwhile, the residential segment is anticipated to experience growth during the forecasted period. The burgeoning modern architecture and real estate sector are continually introducing affordable housing and technologically-equipped commercial spaces to cater to a diverse population. Door locks are now perceived as not just security measures but also as elements complementing the overall design and decor.

Asia-Pacific Smart Locks Market Segmentation By region:

- Australia & New Zealand

- China

- India

- Japan

- South Korea

- Rest of APAC

The region encompasses emerging economies such as India, China, Indonesia, and the Philippines, where there is a gradual uptick in the adoption of advanced technologies. These countries are experiencing an increased focus from their respective governments on investments in smart city development projects. In 2023, the China segment claimed the largest share in the Asia Pacific smart door lock market, while India emerged as the fastest-growing region. Notably, in the Union budget for 2021–2022, India earmarked US$ 868 million (INR 6,450 crore) under the Smart Cities Mission. Such governmental initiatives are expected to fuel the demand for smart door locks in the region. The escalating reliance on the Internet of Things (IoT) in smart cities, however, introduces a substantial security threat.

COVID-19 Pandemic: Impact Analysis

The market experienced growth during the COVID-19 pandemic due to an increased demand for smart door locks. The global health crisis heightened the need for advanced home security systems, particularly for individuals affected by COVID-19 or those who failed to observe appropriate precautions like mask-wearing and sanitization, leading to a heightened risk of transmission. To mitigate the spread of the virus, individuals worldwide started adopting smart home devices that necessitate minimal human interaction and contact, resulting in the displacement of traditional security systems.

Latest Trends/ Developments:

- In February 2023, Xiaomi unveiled the Xiaomi Smart Door Lock M20 series, featuring the innovative Smart Guardian Can See model. This new release is enhanced with an integrated peephole camera and a display screen, offering users a comprehensive real-time view of their front door. Additionally, the model includes a doorbell function, adding further convenience for users.

- In April 2023, Tuchware, a prominent manufacturer specializing in electronic and RFID locks, introduced the smart lock series XS along with dedicated hotel management services

Key Players:

These are top players in the Asia-Pacific Smart Locks Market:-

- Samsung

- GANTNER Electronic GmbH

- Wyze Labs, Inc.

- Schlage

- AMADAS Inc.

- Zhejiang Dahua Technology Co., Ltd.

- Honeywell International Inc.

- Unikey Technologies Inc.

- Assa Abloy AB

- Allegion Plc

Chapter 1. Asia-Pacific Smart Locks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Communication Technology s

1.5. Secondary Communication Technology s

Chapter 2. Asia-Pacific Smart Locks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Smart Locks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Smart Locks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Smart Locks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Smart Locks Market– By Communication Technology

6.1. Introduction/Key Findings

6.2. Wi-Fi

6.3. Bluetooth

6.4. NFC

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Communication Technology

6.7. Absolute $ Opportunity Analysis By Communication Technology , 2024-2030

Chapter 7. Asia-Pacific Smart Locks Market– By Type

7.1. Introduction/Key Findings

7.2 Padlocks

7.3. Deadbolt

7.4. Lever Handle

7.5. RFID

7.6. Y-O-Y Growth trend Analysis By Type

7.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 8. Asia-Pacific Smart Locks Market– By Application

8.1. Introduction/Key Findings

8.2. Residential

8.3. Commercial

8.4. Industrial

8.5. Y-O-Y Growth trend Analysis Application

8.6. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 9. Asia-Pacific Smart Locks Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Application

9.1.3. By Communication Technology

9.1.4. By type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia-Pacific Smart Locks Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Samsung

10.2. GANTNER Electronic GmbH

10.3. Wyze Labs, Inc.

10.4. Schlage

10.5. AMADAS Inc.

10.6. Zhejiang Dahua Technology Co., Ltd.

10.7. Honeywell International Inc.

10.8. Unikey Technologies Inc.

10.9. Assa Abloy AB

10.10. Allegion Plc

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The inclination towards ecosystem integration persists as manufacturers of smart locks establish collaborations with other producers of smart home devices. Such partnerships yield interoperable solutions, delivering users a seamless and consolidated smart home experience.

These are top players in the Asia-Pacific Smart Locks Market :- Samsung, GANTNER Electronic GmbH, Wyze Labs, Inc., Schlage, AMADAS Inc., Zhejiang Dahua Technology Co., Ltd., Honeywell International Inc., Unikey Technologies Inc., Assa Abloy AB, Allegion Plc.

The market experienced growth during the COVID-19 pandemic due to an increased demand for smart door locks. The global health crisis heightened the need for advanced home security systems, particularly for individuals affected by COVID-19 or those who failed to observe appropriate precautions like mask-wearing and sanitization, leading to a heightened risk of transmission.

In February 2023, Xiaomi unveiled the Xiaomi Smart Door Lock M20 series, featuring the innovative Smart Guardian Can See model. This new release is enhanced with an integrated peephole camera and a display screen, offering users a comprehensive real-time view of their front door. Additionally, the model includes a doorbell function, adding further convenience for users

India emerged as the fastest-growing region. India earmarked US$ 868 million (INR 6,450 crore) under the Smart Cities Mission. Such governmental initiatives are expected to fuel the demand for smart door locks in the region.