Europe Smart Lock Market Size (2024-2030)

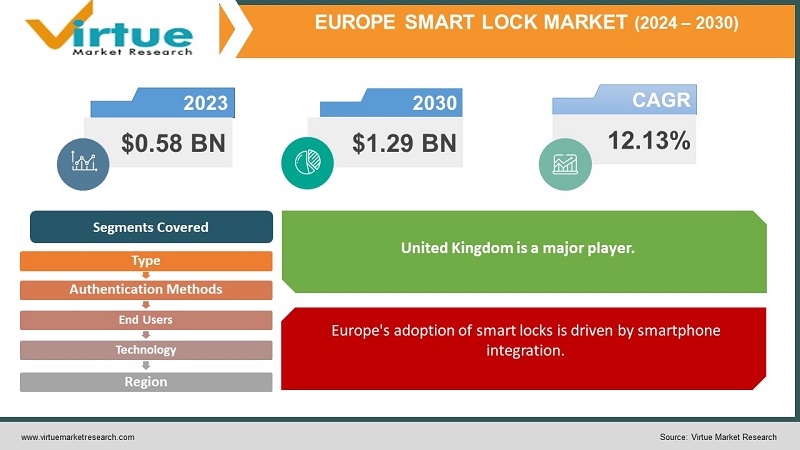

The cmarket was valued at USD 0.58 billion and is projected to reach a market size of USD 1.29 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 12.13% between 2024 and 2030.

Smart locks are becoming more and more popular among businesses and households because of their superior security features, like fingerprint scanners and smartphone-based keyless entry. Their popularity has increased because of their integration with WiFi connectivity; at the moment, business use dominates the market. But residential adoption is expected to soar, especially in major European nations like Germany, which is closely followed by The United Kingdom, France, and Italy. This pattern suggests that smart locks will eventually become a standard installation in both European homes and businesses. Smart locks are set to revolutionize access control systems with better security, ease of use, and technological compatibility. They provide a smooth and effective way to unlock doors while fortifying security measures. The incorporation of smart locks is expected to become a regular feature as smart home technology advances, revolutionizing the way individuals manage access to their properties and guaranteeing a more convenient and safe experience for users throughout Europe.

As smart home design, which incorporates functions like voice control, remote access, and seamless communication, becomes more extensively used globally, smart locks for residential buildings are growing in popularity. Residential owners have been drawn to it as well because it eliminates the need to carry mechanical keys. The growing number of companies offering home automation technology and the global spread of smart home usage are other factors contributing to the growing demand for smart locks. The players in the market focus on creating innovative methods and profitable products, like remote locking and unlocking doors and windows. Furthermore, as the proportion of households possessing voice assistants rises continuously, manufacturers combine their goods with these gadgets to allow voice control of locks. As a result of these developments, customers are projected to grow in popularity as they seek out more complex yet simple locking and unlocking solutions. An increasing number of properties, including private residences, motels, supermarkets, banks, financial institutions, corporate buildings, and commercial buildings, need to be recognized and certified.

Europe Smart Lock Market Drivers:

Europe's adoption of smart locks is driven by smartphone integration.

The use of smart locks is being accelerated by the increasing rate of smartphone penetration in Europe. People are loving the ease of keyless entry, remote access, and seamless connection with other smart home equipment as smartphones become more and more commonplace. It is possible to operate smart appliances, change the thermostat, and control lighting from a smartphone. This convergence of features provides unmatched ease and control while also streamlining daily tasks. The option to remotely lock or unlock doors adds even more convenience and security to the mix. The ability for homeowners to control who has access to their houses via their smartphones from anywhere is empowering, regardless of whether they are at work, on vacation, or just relaxing on the couch. Customers find a significant connection between this degree of control and connectedness.

Market demand has surged due to the growing need for convenience and security.

Security-conscious customers find smart locks especially enticing since they include a range of cutting-edge security features, including remote monitoring and biometric identification, such as fingerprint or facial recognition. Smart locks improve security measures over conventional locks by removing the possibility of misplaced or stolen keys and keeping an extensive record of all property access. Keyless entry and remote access are becoming more and more popular because they make it easy for users to manage access to their homes and companies from anywhere. Furthermore, the programmable characteristics of smart locks allow for customized access permissions, allowing admittance to particular people at specific times. Because of their easy connection with other smart home appliances, such as thermostats and security systems, smart locks offer an extra degree of convenience to consumers looking to improve convenience and security in their homes or businesses.

Europe Smart Lock Market Restraints and Challenges:

To realize the full potential of this rapidly expanding sector, it is essential to address the multitude of barriers to the adoption of smart locks in Europe. Security and privacy issues are major concerns that need strong security measures and clear user control over data to allay worries about hacking or breaches. In addition, manufacturers must broaden their range of pricing options to cater to cost-conscious consumers. Additionally, they should address compatibility difficulties by advocating for common protocols among brands to guarantee smooth integration with other smart home devices. Furthermore, the challenges associated with integration and unfamiliarity with smart lock technology can be mitigated by streamlining installation procedures and increasing consumer awareness through educational initiatives, which will ultimately position smart locks as a mainstream security and convenience solution in Europe.

Europe Smart Lock Market Opportunities:

Manufacturers have a plethora of options to develop and grow in the European smart lock industry. Advanced security solutions, such as smart locks, are in greater demand as smart home technology becomes more widely used. Manufacturers can meet changing security requirements by emphasizing technological innovations like greater encryption and better biometric authentication. Further boosting growth and market penetration strategies include leveraging the rising residential market, establishing key alliances for interoperability, providing customization choices, guaranteeing regulatory compliance, and spearheading consumer education and awareness campaigns. Manufacturers of smart locks can take advantage of these chances to become market leaders in Europe and offer dependable, practical, and safe access control solutions to consumers for their residences and commercial spaces.

EUROPE SMART LOCK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.13% |

|

Segments Covered |

By Type, Authentications methods, end users, technology, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

August Inc. (ASSA ABLOY AB), Allegion plc (Schlage), Salto Systems, S.L., U-TEC Group, Inc., Yale Locks & Hardware, Dormakaba, Kwikset (Spectrum Brands Holdings), Nuki, Danalock, Securemme, SimonsVoss Technologies GmbH |

Europe Smart Lock Market Segmentation:

Europe Smart Lock Market Segmentation: By Type:

- Deadbolt

- Level Handlers

- Padlock

- Server Locks & Latches

- Knob Locks

- Others

The deadbolt segment is the largest and fastest-growing. Smart deadbolt locks may be installed within doors and are compatible with current keyed cylinders and deadbolt hardware. They only need to press a few easy buttons to enter the house with their code, and they only need to click one button to lock it. Moreover, the user may operate the lock from any location using an internet-connected smartphone, tablet, or other device. Overall, the convenience and security of door locks and deadbolts vary. A smart lock also enables entry into a house using an access code on a smartphone or LED touchscreen.

Europe Smart Lock Market Segmentation: By Authentication Methods:

- Keypad

- Card Key

- Touch Based

- Key Fob

- Smartphone-Based

- Biometric

The biometric method is the largest growing segment. The technique of confirming or identifying a person's identification using distinct physiological or behavioral traits is known as biometric authentication. Since each individual possesses these qualities by nature, biometric identification is an extremely safe and trustworthy way to confirm identity. Fingerprints, face recognition, iris scanning, voice recognition, and even behavioral biometrics like typing patterns or gait detection are among the biometric authentication techniques frequently utilized in smart locks and other security systems. In the market for smart locks, touch-based authentication is the one that is expanding the fastest. This is because of its practicality, stylish appearance, and strong security measures. Fingerprint recognition technology is used in the touch-based unlocking process, providing a quick and simple means of identifying and authenticating individuals.

Europe Smart Lock Market Segmentation: By End-Users:

- Commercial

- Residential

Although both residential and business consumers are served by the European smart lock market, the commercial sector has a dominant position. Businesses find smart locks very appealing, especially in offices, hotels, and rental properties. They include capabilities like remote security monitoring, simplified key management, and access control for various employees or tenants. For businesses, this means increased operational security and efficiency. The business segment's proven need for access control and key management is projected to secure its leading market position shortly, despite the residential segment's growing adoption due to convenience and security benefits. The residential category is the fastest-growing. Its significant revenue production may be attributed to the growing global use of smart homes as well as the rise in new building and restoration projects in the industry in recent years. It is anticipated that increased use would result from the lower cost of contemporary security systems such as fingerprint door locks, motion detectors, door and window opening sensors, and remote door locking and unlocking.

Europe Smart Lock Market Segmentation: By Technology:

- Bluetooth

- Wi-Fi

- Z-Wave

- Others

In terms of smart lock technology, Bluetooth is the largest growing segment. The most practical smart lock technology on the market is Bluetooth-enabled smart lock technology. Since nearly all smartphones on the market have Bluetooth capabilities, it is easy for homeowners to link their smart locks to both their smartphones and other home automation devices. Furthermore, because Bluetooth-enabled smart locks don't require constant internet connectivity, which lowers the possibility of hacking, they are safer. Additionally, the adoption of Bluetooth-enabled smart locks, which are anticipated to fuel the growth of this market, may be accelerated by increased awareness, falling installation costs, low battery needs, and device efficiency. Wi-fi is the fastest-growing technology. Users can now operate the lock remotely from a greater distance and lock or unlock doors from almost any location with an internet connection. Wi-Fi integration also makes it possible to link other smart home appliances with ease, which results in a more automatic and complete smart home experience.

Europe Smart Lock Market Segmentation: By Region:

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Germany is the largest growing market. Multiple variables lead to Germany's supremacy. Consumer interest in cutting-edge smart home technologies has increased in a robust economy. Furthermore, Germans are recognized for being security-conscious, which makes feature-rich smart locks desirable. Additionally, a sizable rental market generates demand for smart lock access control solutions that appeal to property managers and landlords. Ultimately, Germany leads the European smart lock industry because of a combination of factors, including a favorable regulatory framework and an increasing number of German-based producers of smart home appliances. The United Kingdom is the fastest-growing market. The United Kingdom (UK) is a prominent player in the smart lock industry because of its inventive R&D activities, strong technical infrastructure, and rising demand for smart home solutions. The UK has emerged as a hub for businesses creating cutting-edge smart lock technology because of its customer base of tech-savvy individuals and vibrant innovation culture. Furthermore, consumers' confidence in the adoption of smart lock solutions has been strengthened by the UK's developing regulatory framework and emphasis on data privacy and security regulations. The nation's booming e-commerce industry and rising urbanization further contribute to the demand for practical and safe access control solutions, which in turn propels market growth.

COVID-19 Impact Analysis on the European Smart Lock Market:

When the COVID-19 epidemic struck, lockdowns and limitations on the building and real estate industries hindered expansion, which in turn caused delays in new construction and renovations—which frequently occur at the same time as smart lock installations. This initially disrupted the European smart lock market. But the pandemic also sparked a long-term movement for contactless remedies and increased awareness of cleanliness. Touchless entry and remote access features of smart locks have made them attractive as potential hygienic solutions, particularly in commercial settings where reducing physical contact has become crucial. Given that people spent more time at home during the pandemic, this shift in emphasis may also increase interest in smart locks for domestic applications. Consequently, the pandemic offered long-term opportunities for the European smart lock market, highlighting the significance of hygiene and contactless access control and possibly spurring increased adoption in the post-pandemic landscape in both the commercial and residential sectors, despite the short-term challenges.

Latest Trends/ Developments:

Several major trends are driving a considerable evolution in the European smart lock market. In response to consumer concerns and to raise security standards, manufacturers are putting more emphasis on cutting-edge security features like multi-factor authentication and facial recognition technology. Furthermore, seamless connectivity with well-known smart home ecosystems like Google Home, Amazon Alexa, and Apple HomeKit is becoming increasingly important. This allows customers to automate tasks and operate their smart locks with voice commands. The popularity of invisible smart locks, which fit inside the door frame for a sleeker, more minimalist look that goes well with contemporary house designs, is another new trend. Manufacturers continue to place a high priority on user control over data and strong encryption techniques, ensuring data security and privacy. To meet the needs of a wide range of users, businesses are also looking into subscription-based business models that include benefits like extended warranties and remote guest access management. All of these developments point to a change in the European smart lock market that is more convenient, safe, and easy to use—all of which are in line with the current state of smart homes.

Key Players:

- August Inc. (ASSA ABLOY AB)

- Allegion plc (Schlage)

- Salto Systems, S.L.

- U-TEC Group, Inc.

- Yale Locks & Hardware

- Dormakaba

- Kwikset (Spectrum Brands Holdings)

- Nuki

- Danalock

- Securemme

- SimonsVoss Technologies GmbH

Chapter 1. Europe Smart Lock Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Smart Lock Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Smart Lock Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Smart Lock Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Smart Lock Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Smart Lock Market – By Type

6.1. Introduction/Key Findings

6.2. Deadbolt

6.3. Level Handlers

6.4. Padlock

6.5. Server Locks & Latches

6.6. Knob Locks

6.7. Others

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Smart Lock Market – By Authentication Methods

7.1. Introduction/Key Findings

7.2 Keypad

7.3. Card Key

7.4. Touch Based

7.5. Key Fob

7.6. Smartphone-Based

7.7. Biometric

7.8. Y-O-Y Growth trend Analysis By Authentication Methods

7.9. Absolute $ Opportunity Analysis By Authentication Methods, 2024-2030

Chapter 8. Europe Smart Lock Market – By Technology

8.1. Introduction/Key Findings

8.2 Bluetooth

8.3. Wi-Fi

8.4. Z-Wave

8.5. Others

8.6. Y-O-Y Growth trend Analysis Technology

8.7. Absolute $ Opportunity Analysis Technology , 2024-2030

Chapter 9. Europe Smart Lock Market – By End-Use Industry

9.1. Introduction/Key Findings

9.2 Commercial

9.3. Residential

9.4. Y-O-Y Growth trend Analysis End-Use Industry

9.5. Absolute $ Opportunity Analysis End-Use Industry , 2024-2030

Chapter 10. Europe Smart Lock Market , By Geography – Market Size, Forecast, Trends & Insights

10.1. Europe

10.1.1. By Country

10.1.1.1. U.K.

10.1.1.2. Germany

10.1.1.3. France

10.1.1.4. Italy

10.1.1.5. Spain

10.1.1.6. Rest of Europe

10.1.2. By Type

10.1.3. By Authentication Methods

10.1.4. By Technology

10.1.5. End-Use Industry

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Europe Smart Lock Market – Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

11.1 August Inc. (ASSA ABLOY AB)

11.2. Allegion plc (Schlage)

11.3. Salto Systems, S.L.

11.4. U-TEC Group, Inc.

11.5. Yale Locks & Hardware

11.6. Dormakaba

11.7. Kwikset (Spectrum Brands Holdings)

11.8. Nuki

11.9. Danalock

11.10. Securemme

11.11. SimonsVoss Technologies GmbH

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The market is anticipated to expand at a compound annual growth rate (CAGR) of 12.13% between 2024 and 2030.

The European smart lock market is expected to reach USD 1.29 billion by 2030.

The Bluetooth sector drives the European smart lock market based on technology

In 2023, the European smart lock market was expected to be valued at USD 0.58 billion.

Germany dominates the European smart lock market.