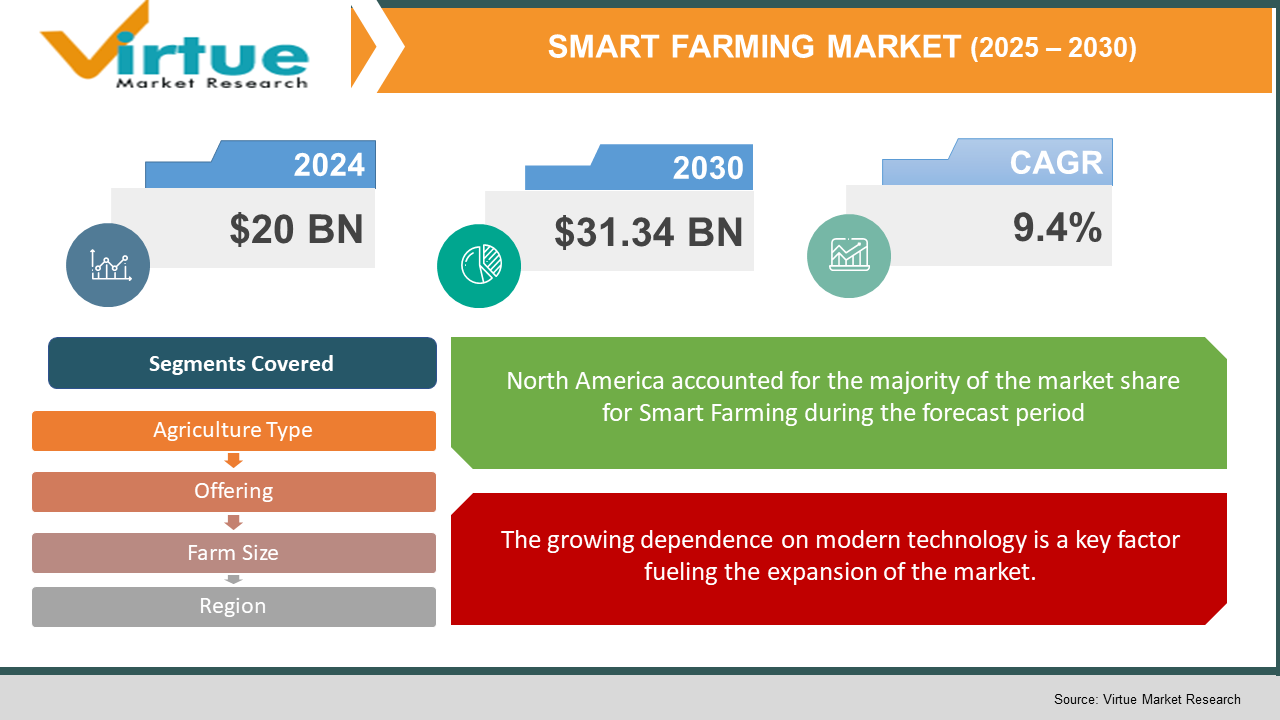

Smart Farming Market Size (2025 - 2030)

The Smart Farming Market was valued at USD 20 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 31.34 billion by 2030, growing at a CAGR of 9.4%.

Smart agriculture refers to the approach of equipping the agricultural sector with the necessary infrastructure to leverage cutting-edge technologies. In this context, various tools such as wireless sensors, low-power wide-area networks, WiFi, Zigbee, and other connected technologies play a key role in helping farmers perform tasks efficiently, including harvesting, purchasing, planting, and managing inventories.

Moreover, the growing integration of the Internet of Things (IoT) and artificial intelligence in farming enhances the monitoring of crop fields and automates irrigation systems. This combination provides farmers with cost-effective, optimized solutions that require minimal human involvement, thereby contributing to the expansion of the smart agriculture sector. From both product and service perspectives, smart agriculture is experiencing significant advancements. The evolution of business models, technological innovations, and organizational changes present both exciting opportunities and challenges. Consequently, the global smart agriculture market is witnessing a steady rise in sales value, driven by the ongoing technological advancements in the field.

Key Market Insights:

- The widespread integration of artificial intelligence (AI), the Internet of Things (IoT), and data analytics in precision farming is a key driver of market expansion.

- The growing need to optimize resource usage, address food security challenges, and improve productivity is significantly contributing to the market's growth.

- Additionally, the rising awareness of sustainable farming practices, along with the increasing demand for traceability in food production, is further propelling market development.

- The impact of climate change and unpredictable weather patterns has created a demand for advanced solutions such as smart sensors, automated irrigation systems, and drone monitoring.

- These innovations are playing a crucial role in driving the global growth of the smart agriculture market.

Smart Farming Market Drivers:

The growing dependence on modern technology is a key factor fueling the expansion of the market.

Precision farming, often referred to as "smart agriculture," offers significant potential for generating substantial returns within the agricultural sector. By collecting geospatial data on soil, livestock, plants, and other field-specific information, this farming approach enables farmers to mitigate the negative impacts of environmental factors on crops. Precision farming provides crucial data on the optimal amounts of irrigation water, liquid fertilizers, nutrients, herbicides, and pesticides, helping to minimize resource waste. The integration of advanced technologies enhances productivity and reduces farming costs.

The adoption of smart agricultural tools is primarily driven by several key factors, including improved business efficiency through process automation and enhanced output resulting from lower farming costs. Consequently, farmers with a business focus have increasingly embraced various precision farming and smart agriculture technologies to boost crop yields and increase profitability.

Smart Farming Market Restraints and Challenges:

The high cost of equipment presents a significant challenge to the growth of the market.

A major factor limiting the growth of the market is the high cost of precision farming equipment. Precision agriculture relies on advanced technologies and expensive tools such as intelligent sensors, drones, Variable Rate Technology (VRT), GPS, GNSS, guidance systems, and receivers. While these technologies are highly effective, their cost can be a significant barrier. Additionally, the installation and operation of such equipment require skilled personnel. Farmers in developing countries with limited resources, such as India, China, and Brazil, often prefer traditional farming methods over adopting new technological solutions, as the latter demands a larger financial and time investment.

Smart Farming Market Opportunities:

The growing adoption of AI-based precision farming solutions is expected to significantly enhance market opportunities.

AI-based applications and tools play a crucial role in enabling farmers to practice precise and controlled farming by offering essential guidance on fertilizer usage, water management, crop rotation, pest control, soil types, optimal planting, and nutrient management. AI-powered tools are particularly effective in pest control, where they utilize satellite imagery and AI algorithms to analyze data against historical trends, identifying the presence of insects and determining their species. Additionally, AI is employed in weather forecasting, helping farmers make informed decisions on crop selection and providing insights into soil quality and nutritional levels. By leveraging artificial intelligence, precision farming techniques allow farmers to monitor the health of their crops more accurately, leading to higher-quality harvests.

SMART FARMING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.4% |

|

Segments Covered |

By agriculture Type, offering, farm size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AGCO Corporation, Deere & Company and CNH Industrial. |

Smart Farming Market Segmentation:

Smart Farming Market Segmentation By Agriculture Type:

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Others

Precision farming is leading the market by utilizing advanced technologies such as GPS, remote sensing, and data analytics to offer farmers detailed insights into the conditions of their fields. These tools enable farmers to make informed, real-time decisions, driving the growing demand for precision farming techniques and devices. This surge in demand is contributing to the recent growth of the smart agriculture market. Numerous farm owners are partnering with technology providers to implement precision farming practices. For example, in October 2023, Zuari FarmHub, a prominent agritech company in India, joined forces with CropX Technologies, a global leader in digital agronomic solutions. This partnership aims to transform farming practices by introducing real-time monitoring technology that equips farmers with data-driven insights to boost productivity and sustainability.

Smart Farming Market Segmentation By Offering:

- Hardware

- Software

- Service

Hardware components are driving the smart agriculture market. Essential devices such as sensors, drones, GPS devices, and automated machinery form the core of data collection and execution of precision tasks. These hardware tools are crucial for farmers, as they provide accurate, real-time information on various parameters, including soil moisture, temperature, crop health, and weather conditions. As a result, leading companies in the market are offering advanced devices to help farmers gain valuable insights and make informed decisions about agricultural practices. For example, in August 2023, Bhu-Vision was launched at AICRP (ICAR-IIRR) in Hyderabad. This IoT-based automated soil testing and agronomy advisory platform revolutionizes soil testing by conducting 12 essential soil parameter tests in just 30 minutes, delivering quick and accurate results to farmers via a soil health card on their mobile devices. Innovations like these are expected to have a positive impact on the smart agriculture market in the coming years.

Smart Farming Market Segmentation By Farm Size:

- Small

- Medium

- Large

Medium-sized farms are leading the market due to their unique position that allows them to balance scale and resources effectively, benefiting from both efficiency and flexibility. These farms typically have the necessary resources and infrastructure to adopt modern smart agriculture technologies without the complexities faced by larger operations. They can invest in precision farming equipment, such as sensors, drones, and data analytics systems, which enable them to optimize crop management and resource use efficiently. Additionally, medium-sized farms are in a strong position to implement technological advancements while maintaining the personal oversight that larger farms might struggle to provide. This flexibility allows them to adapt quickly to changing conditions and make data-driven decisions in real time.

Smart Farming Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America stands as the most advanced region in agricultural technologies, leading the world in the adoption of digital solutions that go beyond traditional farming equipment and services to enable more efficient crop production. The region is driving a transformation in global agricultural practices by focusing on sustainable and profitable farming methods. As an early adopter of advanced technologies, North America has been responding to the rising food demand with innovative solutions.

Additionally, North America remains a key player in the smart farming sector, with a significant portion of the revenue generated by leading original equipment manufacturers (OEMs) in the region. The rise in urban populations and the year-round demand for agricultural products have fueled the growth of indoor farming, making it a prominent industry in the region.

The Asia Pacific region is expected to experience growth during the forecast period. While smart farming technologies are still in the adoption phase in this region, increased government support and rising awareness among farmers are anticipated to drive demand. For example, Japan’s Ministry of Agriculture has been providing funding to develop precision agriculture, and farmers' associations and community-based organizations are playing a crucial role in promoting sustainable agricultural practices.

Singapore’s market is also expected to see significant growth, as the country relies on imports to meet 90% of its food consumption. The increasing adoption of organic farming by small farmers in South America is projected to boost regional market demand during the forecast period as well.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had significant effects on the smart agriculture market, accelerating the adoption of digital technologies and automation in the agricultural sector. As operational continuity and food supply became critical, farmers increasingly sought more efficient and remote management solutions. This shift led to a rise in the use of precision agriculture tools, remote monitoring systems, and data analytics. Supply chain disruptions further underscored the need for better inventory and resource management, driving greater interest in smart agriculture solutions. While the pandemic presented initial challenges, it ultimately emphasized the pivotal role of technology in agriculture, likely spurring innovation and growth in the market moving forward.

Latest Trends/ Developments:

April 2024: FMC India introduced its precision agriculture platform, Arc™ Farm Intelligence, in India. This platform integrates real-time data with predictive modeling to assist farmers in monitoring field conditions and pest pressure. It facilitates the precise application of crop care products, aiming to enhance yields and improve return on investment for farmers, advisers, and channel partners.

January 2024: Precision Planting launched its latest product, the CornerStone Planting System, a fully custom, factory-built planting solution. The CornerStone system is pre-assembled with all components, except for the planter bar, and is integrated with Precision Planting's advanced technology to optimize planting operations.

November 2023: ABZ Innovation, a Hungarian company, unveiled a new crop-spraying drone capable of carrying 30 liters of pesticides per flight. The L30, powered by a 25,000mAh battery, is designed for farms ranging from 80 to 100 hectares and can spray up to 21 hectares per hour, providing efficient and scalable solutions for pesticide application.

Key Players:

These are top 10 players in the Smart Farming Market :-

- AGCO Corporation

- Deere & Company

- CNH Industrial

- Kubota Corporation

- Hexagon Agriculture

- Allflex USA Inc.

- Afimilk Ltd.

- General Hydroponics

- Nedap N.V.

- Osram Licht AG

Chapter 1. Smart Farming Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Smart Farming Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Smart Farming Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Agriculture Type Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Smart Farming Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Smart Farming Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Smart Farming Market – By Agriculture Type

6.1 Introduction/Key Findings

6.2 Precision Farming

6.3 Livestock Monitoring

6.4 Smart Greenhouse

6.5 Others Y-O-Y Growth trend Analysis By Agriculture Type :

6.6 Absolute $ Opportunity Analysis By Agriculture Type :, 2025-2030

Chapter 7. Smart Farming Market – By Offering

7.1 Introduction/Key Findings

7.2 Hardware

7.3 Software

7.4 Service

7.5 Y-O-Y Growth trend Analysis By Offering

7.6 Absolute $ Opportunity Analysis By Offering , 2025-2030

Chapter 8. Smart Farming Market – By Farm Size

8.1 Introduction/Key Findings

8.2 Small

8.3 Medium

8.4 Large

8.5 Y-O-Y Growth trend Analysis Farm Size

8.6 Absolute $ Opportunity Analysis Farm Size , 2025-2030

Chapter 9. Smart Farming Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Offering

9.1.3. By Farm Size

9.1.4. By Agriculture Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Offering

9.2.3. By Farm Size

9.2.4. By Agriculture Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Offering

9.3.3. By Farm Size

9.3.4. By Agriculture Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Farm Size

9.4.3. By Offering

9.4.4. By Agriculture Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Farm Size

9.5.3. By Offering

9.5.4. By Agriculture Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Smart Farming Market – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

10.1 AGCO Corporation

10.2 Deere & Company

10.3 CNH Industrial

10.4 Kubota Corporatio

10.5 Hexagon Agriculture

10.6 Allflex USA Inc.

10.7 Afimilk Ltd.

10.8 General Hydroponic

10.9 Nedap N.V.

10.10 Osram Licht AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The widespread integration of artificial intelligence (AI), the Internet of Things (IoT), and data analytics in precision farming is a key driver of market expansion

The top players operating in the Smart Farming Market are - AGCO Corporation, Deere & Company and CNH Industrial

The COVID-19 pandemic had significant effects on the smart agriculture market, accelerating the adoption of digital technologies and automation in the agricultural sector

The growing adoption of AI-based precision farming solutions is expected to significantly enhance market opportunities.

Asia-Pacific is the fastest-growing region in the Smart Farming Market.