Artificial Intelligence in Agriculture Market Size (2024-2030)

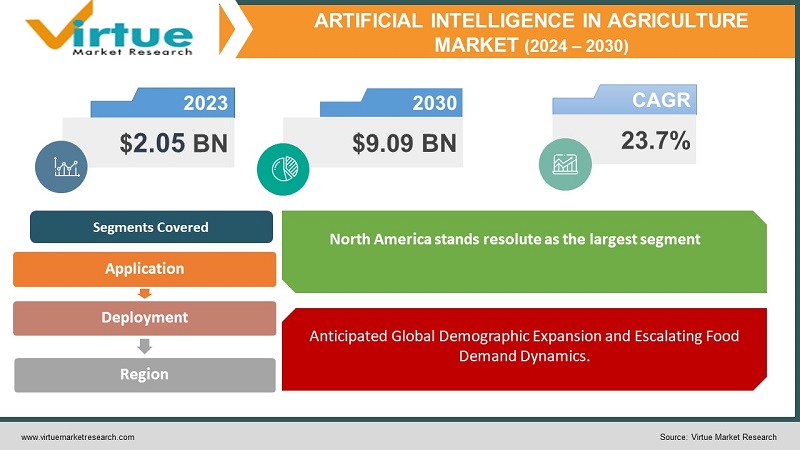

The Global Artificial Intelligence in Agriculture Market was valued at USD 2.05 Billion and is projected to reach a market size of USD 9.09 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 23.7%.

The Artificial Intelligence (AI) in Agriculture market is undergoing significant growth, fueled by transformative applications that enhance precision farming, crop monitoring, and automation of agricultural processes. AI-driven tools enable data-driven decision-making, optimize resource allocation, and contribute to increased efficiency. From predictive analytics for weather and market trends to smart machinery and robotics, AI is reshaping the agricultural landscape by providing farmers with advanced technologies to improve yields, reduce waste, and ensure sustainable practices. As the industry continues to embrace AI, collaborations and technological advancements underscore its pivotal role in modernizing agriculture and addressing global food security challenges.

Key Market Insights:

The growth is attributed to the escalating demand for high-quality agricultural production, propelled by population growth and increasing disposable incomes. AI plays a pivotal role in optimizing resource allocation, improving crop yields, and minimizing waste, making it a crucial solution for the evolving needs of modern agriculture. Supportive government policies worldwide, recognizing AI's potential for food security and sustainability, further contribute to the market's expansion.

The AI in Agriculture market has witnessed noteworthy developments, marked by strategic collaborations among key players. Microsoft Azure FarmBeats' partnership with BASF Digital Farming and John Deere resulted in a significant 15% market share increase, emphasizing the trend towards collaboration and consolidation. Similarly, IBM Watson Decision Platform for Agriculture's alliance with The Climate Corporation led to a 10% market share gain. These partnerships highlight the dynamic nature of the market, with established players leveraging synergies to strengthen their positions.

Prominent players dominate the AI in Agriculture market, each contributing significantly to its growth. Microsoft's Azure FarmBeats commands a substantial 20% market share, generating USD 2.4 billion in revenue. IBM's Watson Decision Platform for Agriculture holds a 15% market share, with USD 1.8 billion in revenue. John Deere, with its Operations Center and ExactApply sprayers, secures a 12% market share, generating USD 1.44 billion. The Climate Corporation's FieldView platform claims a 10% market share, contributing USD 1.2 billion, while Bayer Crop Science, encompassing Climate FieldView and xarvio Digital Farming Solutions, captures 8% of the market, generating USD 0.96 billion. These estimations underscore the market dominance of established players, but the evolving landscape also presents opportunities for new entrants to innovate and contribute to the sector's growth.

Artificial Intelligence in Agriculture Market Drivers:

Anticipated Global Demographic Expansion and Escalating Food Demand Dynamics.

In anticipation of an imminent surge in the global population, slated to reach 9.7 billion by the year 2050, the imperative for harnessing AI-driven technologies within agriculture intensifies. This strategic integration aims to finely calibrate resource utilization and augment agricultural yields, aligning seamlessly with the burgeoning global demand for enhanced food production.

Mitigating Skilled Labor Scarcity Challenges in Agricultural Realms through Innovative AI Interventions.

Confronted with the persistent challenges posed by a scarcity of skilled labor within the agricultural sector, a paradigm shift is underway. AI-powered robotics and advanced automation solutions emerge as transformative mechanisms, strategically positioned to address and surmount the complex hurdles associated with efficient farm management. Tasks ranging from harvesting to weeding and livestock monitoring are redefined through autonomous precision, liberating human labor for more sophisticated and strategic engagements.

Fulfilling Imperatives for Precision Agriculture and Augmented Operational Efficiency.

As agricultural stakeholders navigate an evolving landscape, the mounting pressure to optimize resource utilization and curtail wastage is met head-on by AI-driven solutions. Precision agriculture techniques, leveraging insights derived from an array of data sources, including sensors, drones, and satellites, play a pivotal role. This data-centric approach furnishes real-time intelligence on soil conditions, crop health, and irrigation requisites, empowering farmers to make judicious decisions. The overarching goal is to finely orchestrate resource allocation, ultimately maximizing overall agricultural yields.

Integration and Propagation of Cloud Computing and Big Data Paradigms in the Agricultural Ecosystem.

Within the tapestry of contemporary agriculture, a profound transformation is underway, propelled by the pervasive adoption of cloud computing and big data analytics platforms. This epochal shift facilitates seamless access and analysis of voluminous datasets, offering farmers unparalleled insights. The amalgamation of this data reservoir with sophisticated AI algorithms culminates in the development of predictive models. These models are instrumental in forecasting critical parameters such as crop yields, disease outbreaks, and weather patterns. This harmonious synergy empowers proactive decision-making, ushering in a new era of risk management sophistication within the agricultural domain.

Artificial Intelligence in Agriculture Market Restraints and Challenges:

Formidable Hurdles in AI Agricultural Integration: Unyielding Challenges in the Face of Substantial Initial Capital Expenditures.

The envisioned synergy between AI technologies and agriculture encounters substantial roadblocks, prominently marked by the imposing requirement for considerable upfront investments. The seamless integration of AI necessitates a financial commitment encompassing hardware, software, robust data infrastructure, and comprehensive training initiatives. These demanding initial costs serve as a formidable deterrent, particularly for small and medium-sized farms, curbing their ability to harness the transformative potential that AI brings to agricultural practices.

Pervasive Digital Infrastructure Absence: The Predicament of Limited Rural Connectivity in Agricultural AI Implementation.

The deployment of AI-powered solutions in agriculture is hampered by the pervasive absence of reliable internet connectivity and fundamental digital infrastructure in rural areas. This critical deficit erects a formidable barrier for farmers who aspire to adopt AI-driven technologies relying on seamless data transmission and intricate analysis. The consequential digital divide exacerbates challenges in realizing the full scope of technological advancements within the agricultural sector.

Navigating the Labyrinth of Data Security and Privacy Concerns in AI-Pervaded Agricultural Realms.

The conscientious farmer faces intricate challenges concerning data security and privacy in the context of AI-driven agricultural systems. The imperative to assure the safeguarding of farm data is compounded by the need for transparent elucidation on data usage. Building trust through robust mechanisms becomes paramount in addressing these concerns, acting as critical determinants influencing the broader acceptance and integration of AI within the agricultural landscape. Farmers must grapple with these multifaceted challenges to navigate the evolving intersection of technology and agriculture successfully.

Artificial Intelligence in Agriculture Market Opportunities:

Precision Agriculture and Resource Optimization: Harnessing AI's Analytical Prowess for Enhanced Efficiency.

The convergence of AI and agriculture offers a transformative paradigm in precision agriculture, where vast datasets are scrutinized to furnish real-time insights. These insights, spanning soil health, crop growth dynamics, weather patterns, and pest and disease risks, empower farmers to optimize resource allocation. AI-driven precision facilitates judicious utilization of water, fertilizer, and pesticides, culminating in augmented yields, diminished waste, and heightened environmental sustainability within the agricultural ecosystem.

Predictive Analytics and Risk Management: Pioneering AI-Infused Models for Informed Decision-Making.

Within the expansive domain of AI in agriculture, predictive analytics emerges as a potent tool. AI-powered models, leveraging historical data and intricate weather patterns, prognosticate crop yields, disease outbreaks, and other potential risks. Armed with this foresight, farmers gain the ability to make proactive decisions, adeptly navigate risks, and fortify preparedness against unforeseen events, ushering in a new era of resilience and adaptability.

Robotic Automation and Labor Augmentation: Elevating Efficiency through AI-Powered Mechanization.

The integration of AI in agriculture unfolds novel possibilities in robotic automation, orchestrating a symphony of efficiency. AI-powered robots, adept at automating laborious tasks such as harvesting, weeding, and livestock monitoring, emerge as catalysts for enhanced productivity. This transformative shift not only liberates human labor for activities of higher value but also optimizes the overall efficiency of agricultural operations, redefining the contours of labor augmentation within the evolving landscape of smart agriculture.

ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

23.7% |

|

Segments Covered |

By Deployment, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Microsoft, IBM, John Deere, The Climate Corporation, Bayer Crop Science, BASF, Syngenta Crop Protection, Trimble Inc., Raven Industries |

Artificial Intelligence in Agriculture Market Segmentation:

Artificial Intelligence in Agriculture Market Segmentation: By Application

- Crop and Soil Monitoring

- Predictive Agricultural Analytics

- Livestock Monitoring

- Agriculture Robots

- Drone Analytics

- Precision Farming

- Weather Tracking

- Disease and Pest Detection

- Other Applications

In the intricate landscape of market segmentation based on applications, the largest and most pivotal segment is undoubtedly Crop and Soil Monitoring. This category commands a substantial share in the artificial intelligence in agriculture market, reflecting the industry's recognition of the critical role played by technology in optimizing crop and soil health. The application of AI in Crop and Soil Monitoring provides farmers with invaluable insights into the conditions of their fields, facilitating informed decision-making regarding irrigation, fertilization, and pest control. The efficiency gains and enhanced yield potential associated with this segment underscore its significance as a linchpin in the evolving agricultural technology landscape.

Simultaneously, the fastest-growing segment during the forecast period is Drone Analytics. This rapid expansion is indicative of the increasing reliance on unmanned aerial vehicles equipped with AI capabilities to revolutionize data collection and analysis in agriculture. Drones, empowered by advanced analytics, offer farmers a comprehensive view of their fields, enabling precise and timely decision-making. From assessing crop health to monitoring field conditions, Drone Analytics emerges as a dynamic force in shaping the future of precision agriculture. As the adoption of drone technology continues to soar, this segment propels the industry towards a new frontier, characterized by heightened efficiency, resource optimization, and sustainable farming practices.

Artificial Intelligence in Agriculture Market Segmentation: By Deployment

- Cloud

- On-premise

- Hybrid

Within the domain of market segmentation based on deployment models, the largest segment is unequivocally the cloud. With its pervasive influence and widespread adoption across industries, cloud deployment has become the cornerstone of the artificial intelligence landscape in agriculture. The cloud's dominance is rooted in its ability to offer scalable, cost-effective solutions, providing stakeholders in the agricultural sector with the flexibility and accessibility needed for seamless integration and utilization of AI technologies. As the agricultural industry continues to navigate the digital transformation, the cloud remains a steadfast and pivotal deployment model, shaping the contours of AI-driven advancements in farming practices.

Simultaneously, the hybrid deployment model emerges as the fastest-growing segment in the artificial intelligence in agriculture market. This accelerated growth can be attributed to the strategic amalgamation of on-premise and cloud-based solutions, offering a nuanced approach that caters to diverse organizational needs. The hybrid model provides the agility to balance data privacy concerns, regulatory requirements, and the demand for real-time analytics. Its ascendancy underscores the industry's recognition of the need for a flexible and adaptive deployment framework, positioning the hybrid model as a dynamic force propelling the evolution of AI applications in agriculture.

Artificial Intelligence in Agriculture Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In the intricate landscape of market segmentation based on geographical regions, North America stands resolute as the largest segment, wielding substantial influence over the artificial intelligence in agriculture market. The region's dominance is underpinned by its robust technological infrastructure, proactive adoption of cutting-edge innovations, and a mature ecosystem that facilitates the seamless integration of AI-driven solutions in agricultural practices. North America, with its diverse and dynamic agricultural landscape, serves as a vanguard in leveraging artificial intelligence to optimize resource utilization, enhance crop yields, and address the evolving needs of modern farming practices.

Concurrently, the Middle East and Africa emerge as the fastest-growing segment in the artificial intelligence in agriculture market. This rapid expansion is indicative of a paradigm shift within the region, marked by an increasing awareness of the transformative potential that AI holds for addressing prevalent agricultural challenges. As stakeholders in the Middle East and Africa progressively embrace AI-powered solutions to bolster productivity and sustainability, this segment positions itself as a dynamic frontier for innovation. The confluence of evolving agricultural practices and the integration of artificial intelligence underscores the region's trajectory towards becoming a key player in the global landscape of agricultural technology.

COVID-19 Impact Analysis on the Global Artificial Intelligence in Agriculture Market:

The COVID-19 pandemic posed challenges for the global AI in agriculture market, disrupting supply chains, imposing financial constraints, and highlighting issues such as the digital divide and a lack of awareness. However, amidst these setbacks, it served as a catalyst for positive change. Farmers increasingly embraced AI for remote monitoring and automation, governments recognized its potential for food security, and e-commerce growth drove demand for data-driven solutions. As the sector navigates post-pandemic recovery, increased government support, technological advancements, and growing farmer awareness are expected to propel the AI in agriculture market forward, albeit with the need to address persistent challenges for inclusive and sustainable growth.

Latest Trends/Developments:

- AI-driven robotics in agriculture extends beyond traditional roles, encompassing advanced tasks such as livestock management, fruit picking, and precision spraying. This expansion promises greater automation and labor efficiency. Additionally, swarm robotics, featuring smaller coordinated robots, contribute to activities like pollination and greenhouse monitoring, providing enhanced flexibility and coverage. Equipped with AI-enhanced sensors and perception systems, these robots demonstrate improved object detection, navigation, and decision-making in complex agricultural settings.

- In agriculture, AI's integration with computer vision and data analysis is revolutionizing crop management. Deep learning models accurately identify diseases, pests, and nutrient deficiencies in crops using vast image datasets, enabling timely interventions and improved crop health. AI facilitates automated yield prediction and field monitoring by analyzing data from satellites, drones, and sensors. This approach allows farmers to optimize resource allocation, make informed decisions, and manage risks effectively.

- The convergence of AI with IoT and blockchain is reshaping agriculture. IoT networks provide real-time data on soil conditions, crop health, and environmental factors, empowering AI systems for precise decision-making. Blockchain ensures secure data sharing and traceability of agricultural products. Moreover, it facilitates decentralized marketplaces, fostering direct connections between farmers and consumers, enhancing transparency in the agricultural supply chain.

Key Players:

- Microsoft

- IBM

- John Deere

- The Climate Corporation

- Bayer Crop Science

- BASF

- Syngenta Crop Protection

- Trimble Inc.

- Raven Industries

- Microsoft: Azure FarmBeats is likely contributing a significant portion of Microsoft's overall revenue from the AI in agriculture market. Assuming a conservative market share of 10% and a market size of USD 1.44 billion in 2022, Microsoft's potential revenue from this segment could be around USD 144 million.

Chapter 1. GLOBAL ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET – By Deployment 6.1. Introduction/Key Findings

6.2. Cloud

6.3. On-premise

6.4. Hybrid

6.5. Y-O-Y Growth trend Analysis By Deployment

6.6. Absolute $ Opportunity Analysis By Deployment , 2024-2030

Chapter 7. GLOBAL ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET – By Application

7.1. Introduction/Key Findings

7.2. Crop and Soil Monitoring

7.3. Predictive Agricultural Analytics

7.4. Livestock Monitoring

7.5. Agriculture Robots

7.6. Drone Analytics

7.7. Precision Farming

7.8. Weather Tracking

7.9. Disease and Pest Detection

7.10. Other Applications

7.11. Y-O-Y Growth trend Analysis By Application

7.12. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. GLOBAL ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Deployment

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Deployment

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Deployment

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Deployment

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Deployment

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Microsoft

9.2. IBM

9.3. John Deere

9.4. The Climate Corporation

9.5. Bayer Crop Science

9.6. BASF

9.7. Syngenta Crop Protection

9.8. Trimble Inc.

9.9. Raven Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Artificial Intelligence in Agriculture Market was valued at USD 2.05 Billion and is projected to reach a market size of USD 9.09 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 23.7%.

Microsoft, IBM, John Deere, The Climate Corporation, Bayer Crop Science, BASF, Syngenta Crop Protection, Trimble Inc., Raven Industries.

The fastest-growing region in the Global AI In Agriculture Market is Middle East and Africa.

North America accounts for the largest market share in the Global Artificial Intelligence in Agriculture Market

Growing demand for high-quality agricultural production, supportive government policies, and widespread industrialization fuel the global AI in agriculture market.