Shea Butter Market Size (2024 – 2030)

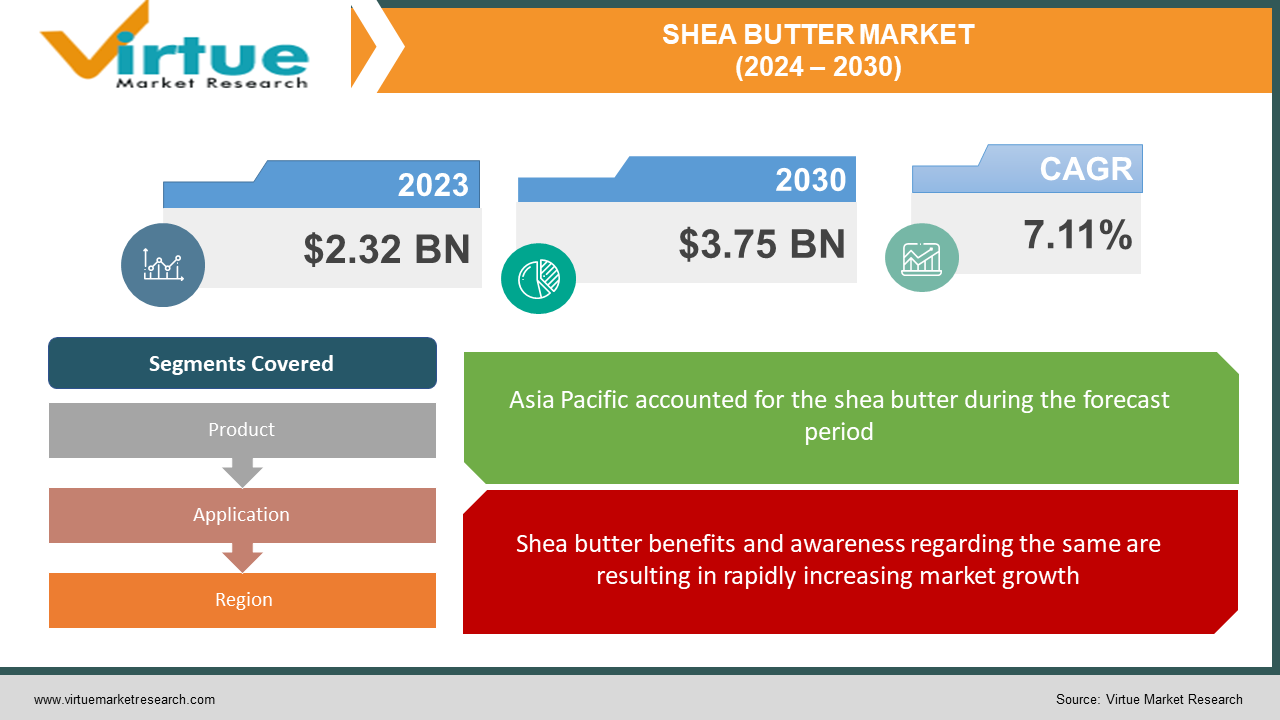

The Shea Butter Market was valued at USD 2.32 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 3.75 billion by 2030, growing at a CAGR of 7.11%.

Shea butter, derived from the nut of the African shea tree, is a natural fat renowned for its versatile applications. When in its raw form, it bears an ivory color, often tinted yellow using borututu root or palm oil. Widely utilized in cosmetics, it serves as a moisturizer, salve, or lotion. Additionally, it is edible and incorporated into food preparation in certain African regions. Sometimes blended with other oils, it serves as a substitute for cocoa butter, though its distinct taste sets it apart.

Key Market Insights:

In recent years, there has been a notable surge in demand for shea butter within the confectionery and baked goods sectors. This natural ingredient has gained popularity for its ability to impart a rich, creamy flavor to a wide range of food items such as chocolates, pastries, cakes, cookies, bread, and similar delicacies. Recognized for its distinctive texture and nutty taste, shea butter has emerged as a preferred substitute for conventional butter in various recipes, offering a healthier and more flavorful alternative. This trend has led to its increased adoption among eateries, restaurants, bakeries, and food manufacturers.

Shea butter boasts advantageous properties suitable for diverse culinary uses, making it a versatile option for baking and frying purposes. Its smooth consistency, neutral flavor, lack of odor, and high tolerance to heat make it well-suited to traditional culinary techniques found in local cuisines. Furthermore, it serves as a viable plant-based substitute for dairy-based butter. Growing awareness of the therapeutic advantages of shea butter for skincare, including its anti-aging, moisturizing, and healing attributes, further contributes to its appeal.

Shea Butter Market Drivers:

Shea butter benefits and awareness regarding the same are resulting in rapidly increasing market growth.

Shea butter offers multifaceted advantages and finds application across diverse industries, encompassing food, beverages, cosmetics, pharmaceuticals, and more. Extensive research has highlighted its efficacy in addressing various conditions. Beyond its existing uses, ongoing investigations are exploring the potential benefits of shea butter in additional areas. This ongoing exploration is anticipated to expand the scope of shea butter applications, paving the way for the introduction of numerous novel products tailored to address emerging indications.

Consumers preferring shea butter as a natural ingredient drives market growth.

The global increase in health consciousness among consumers, fueled by the escalation of lifestyle-related ailments, has led to a notable trend towards favoring products with natural ingredients like shea butter, perceived as safer and healthier compared to processed or chemical counterparts. Additionally, the substantial level of consumer acceptance significantly propels the growth of the shea butter market. Over millennia, consumers worldwide have been acquainted with its benefits and applications, alleviating the need for extensive consumer education efforts by manufacturers regarding its advantages and uses.

Shea Butter Market Restraints and Challenges:

The accessibility of more affordable alternatives like mango butter, shea oil, avocado butter, and cupuacu butter is anticipated to hinder the expansion of the shea butter market. Throughout the forecast period, the shea butter market is expected to encounter obstacles stemming from a lack of standardization.

Shea Butter Market Opportunities:

Recent advancements in extraction methodologies have facilitated the utilization of shea butter in its most refined state. Moreover, the integration of enhanced preservative techniques has enabled manufacturers to prolong the shelf-life of their products, aligning with customer demands and thereby bolstering demand in recent times. Additionally, personal care enterprises venturing into the shea butter market prioritize the avoidance of synthetic ingredients, thereby enhancing consumer attractiveness.

SHEA BUTTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.11% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Shea Butter HQ, Patanjali Ayurved, Aloe Plus Lanzarote S.L, Herbalife International of America, Inc., Lakewood Inc, Lily of the Desert, NOW foods., Forever Living.com, L.L.C., Real Aloe Solutions Inc., LR Health & Beauty, Warren Laboratories LLC |

Shea Butter Market Segmentation: By Product

-

Raw & Unrefined

-

Refined

In 2023, the raw and unrefined shea butter segment commanded the majority market share at 62.4%, a position it is anticipated to maintain throughout the forecast period. Growing consumer interest in minimally processed oils, driven by their perceived benefits such as enhanced skin moisture, wound healing properties, and acne-fighting capabilities, underpins this dominance. Such product launches are poised to bolster the positive market growth trajectory.

Conversely, the refined segment is forecasted to exhibit the second-highest growth rate during the forecast period, with a projected compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. The increasing consumer preference for refined shea butter is attributed to its extended shelf life. Moreover, the refining process eliminates the product's scent and color, thereby expanding its applicability in skincare formulations, particularly in the development of hypoallergenic products by manufacturers.

Shea Butter Market Segmentation: By Application

-

Cosmetics & Personal Care

-

Food

-

Others

The food segment is anticipated to demonstrate the most rapid growth during the forecast period, with a projected compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. The escalating trend towards premiumization in the food and beverage sector is driving the increased utilization of shea butter within this segment. Moreover, the expanding chocolate market is expected to contribute to a proportional surge in demand, as shea butter is utilized to enhance the consistency, texture, and other properties of chocolate products. According to insights from Tastewise, an AI-powered data platform for food and beverage, published in October 2022, shea butter experienced notable consumption growth, with an annual rate of 8.63%.

On the other hand, the cosmetics and personal care segment emerged as the dominant market share holder in 2023. The segment's growth is propelled by rising consumer interest in cosmetic shea butter, utilized as an alternative ingredient in creams, lotions, color cosmetics, soaps, and toiletries. Notably, a January 2022 article by Wonderflow indicates that approximately 24% of U.S. adults are patrons of natural skincare products. Consequently, the increasing health and beauty consciousness among consumers, coupled with the mounting significance of sustainability among product developers, is driving a consistent uptick in demand for organic and natural cosmetics. This trend is poised to create opportunities for key players to innovate and introduce new products.

Shea Butter Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

In the European region, shea butter finds extensive application in the manufacturing of various products such as body lotions, moisturizers, and chocolates, owing to the region's abundance of cosmetics and pharmaceutical companies. Germany's shea butter industry was projected to maintain a value share of 7.2% in 2023, while the United Kingdom market is expected to advance and grow at a remarkable rate of 9.1% during the forecast period, 2024-2030.

The burgeoning clean beauty trend, which emphasizes non-toxic and natural ingredients, has significantly propelled the growth of shea butter in the United Kingdom market. This is due to its perceived safety and efficacy as a skincare ingredient.

Meanwhile, the Asia Pacific regional shea butter market is poised for rapid expansion, fueled by the region's substantial population. With more than half of the world's population residing in the Asia Pacific region, according to United Nations data, these demographic insights are invaluable for manufacturers seeking to understand their target market and develop new products.

The Chinese shea butter market is anticipated to capture a considerable market share, while the Indian market is forecasted to progress at a rate of 9.8% during the forecast period, 2024-2030. Both Chinese and Indian consumers are increasingly seeking high-quality and sustainable skincare solutions, making shea butter an attractive option and contributing to its market growth.

COVID-19 Pandemic: Impact Analysis

The onset of the COVID-19 pandemic had a detrimental effect on the market, primarily due to disruptions in the supply chain of raw materials to manufacturing facilities caused by stringent lockdown measures. Furthermore, the closure of businesses and retail outlets led to a significant decline in sales of products containing shea butter.

Latest Trends/ Developments:

In June 2022, Beurre Shea Butter Skincare unveiled a new line of products designed to protect and soothe the skin, featuring shea butter as the primary ingredient. This new launch is aimed to widen the company portfolio in the personal and skin care genre and reach new heights in the global shea butter market.

Key Players:

-

Shea Butter HQ

-

Patanjali Ayurved

-

Aloe Plus Lanzarote S.L

-

Herbalife International of America, Inc.

-

Lakewood Inc

-

Lily of the Desert

-

NOW foods.

-

Forever Living.com, L.L.C.

-

Real Aloe Solutions Inc.

-

LR Health & Beauty

-

Warren Laboratories LLC

Chapter 1. Shea Butter Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Shea Butter Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Shea Butter Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Shea Butter Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Shea Butter Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Shea Butter Market – By Product

6.1 Introduction/Key Findings

6.2 Raw & Unrefined

6.3 Refined

6.4 Others (Biosensors, magnetic sensors, chemical sensors, gas sensors, inertial sensors)

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Shea Butter Market – By Application

7.1 Introduction/Key Findings

7.2 Cosmetics & Personal Care

7.3 Food

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Shea Butter Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Shea Butter Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Shea Butter HQ

9.2 Patanjali Ayurved

9.3 Aloe Plus Lanzarote S.L

9.4 Herbalife International of America, Inc.

9.5 Lakewood Inc

9.6 Lily of the Desert

9.7 NOW foods.

9.8 Forever Living.com, L.L.C.

9.9 Real Aloe Solutions Inc.

9.10 LR Health & Beauty

9.11 Warren Laboratories LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Shea butter boasts advantageous properties suitable for diverse culinary uses, making it a versatile option for baking and frying purposes. Its smooth consistency, neutral flavor, lack of odor, and high tolerance to heat make it well-suited to traditional culinary techniques found in local cuisines.

The top players operating in the Shea Butter Market are - Shea Butter HQ, Patanjali Ayurved, Aloe Plus Lanzarote S.L, Herbalife International of America, Inc., Lakewood Inc., Lily of the Desert, NOW Foods., Forever Living.com, L.L.C., Real Aloe Solutions Inc., LR Health & Beauty, Warren Laboratories LLC.

The onset of the COVID-19 pandemic had a detrimental effect on the market, primarily due to disruptions in the supply chain of raw materials to manufacturing facilities caused by stringent lockdown measures. Furthermore, the closure of businesses and retail outlets led to a significant decline in sales of products containing shea butter.

Fuji Oil Holdings, Inc. declared its commitment to responsible sourcing of shea kernels, with a focus on preserving green areas of shea trees and minimizing or eliminating deforestation, thereby promoting sustainable development within the industry.

The Asia Pacific shea butter market is poised for rapid expansion, fueled by the region's substantial population. With more than half of the world's population residing in the Asia Pacific region, according to United Nations data, these demographic insights are invaluable for manufacturers seeking to understand their target market and develop new products.