Europe Shea Butter Market size (2024-2030)

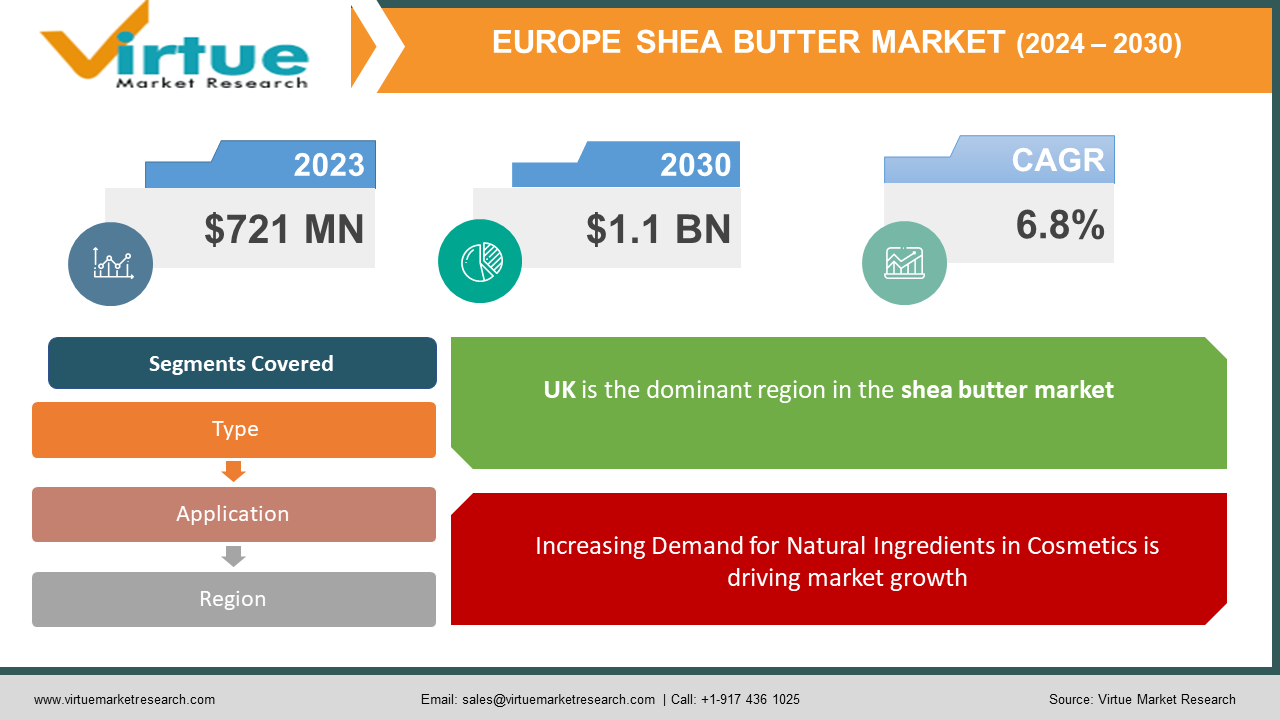

The Europe Shea Butter Market was valued at USD 721 million in 2023 and will grow at a CAGR of 6.8% from 2024 to 2030. The market is expected to reach USD 1.1 billion by 2030.

The Europe Shea Butter Market refers to the industry centered on the production, distribution, and consumption of shea butter within European countries. Shea butter, derived from the nuts of the shea tree native to Africa, is widely used in cosmetics, personal care products, pharmaceuticals, and food applications across Europe. The market is characterized by increasing consumer preference for natural skincare products and sustainable ingredients, driving demand for shea butter due to its moisturizing, anti-inflammatory, and antioxidant properties. Regulatory support for natural products and growing awareness of shea butter's health benefits further bolster market growth. Manufacturers and suppliers in Europe focus on quality standards, sustainable sourcing practices, and product innovation to cater to diverse consumer needs and regulatory requirements, making the Europe Shea Butter Market a dynamic and expanding sector within the cosmetics and food industries.

Key Market Insights:

- Europe imports a significant portion of its shea butter from West African countries, particularly Ghana and Nigeria. In 2023, imports from these countries constituted approximately 23% of the total shea butter used in Europe.

- There is a growing preference among European consumers for sustainable and ethically sourced products. Shea butter, being a natural and traditionally harvested product, aligns well with these preferences, thereby boosting its market demand.

- Innovations in extraction and processing technologies have enhanced the quality and shelf-life of shea butter. Advanced refining techniques reduce impurities and improve the product’s suitability for various applications, further propelling market growth.

Europe Shea Butter Market Drivers:

Increasing Demand for Natural Ingredients in Cosmetics is driving market growth:

The cosmetics industry in Europe is witnessing a significant shift towards natural and organic ingredients. Consumers are becoming increasingly aware of the potential side effects of synthetic chemicals, leading to a preference for natural alternatives. Shea butter, with its exceptional moisturizing and anti-inflammatory properties, is a key ingredient in various skincare and haircare products. The trend towards “clean beauty” is further reinforcing the demand for shea butter. Additionally, major cosmetic brands are focusing on sustainable sourcing and fair-trade practices, aligning with consumer values and enhancing the market growth for shea butter.

Health and Wellness Trends are driving market growth:

The health and wellness trend in Europe is driving the demand for shea butter in the food industry. Shea butter is rich in vitamins A and E, essential fatty acids, and antioxidants, making it a sought-after ingredient for health-conscious consumers. It is used as a substitute for cocoa butter in confectionery and as a healthy fat in various food products. The increasing awareness of the health benefits associated with shea butter, such as improved skin health and reduced inflammation, is contributing to its growing popularity. Moreover, the rise of veganism and plant-based diets is boosting the demand for shea butter as a natural and ethical food ingredient.

Sustainable and Ethical Sourcing Practices are driving market growth:

Sustainability and ethical sourcing have become crucial factors influencing consumer purchasing decisions. The shea butter market is benefiting from initiatives aimed at promoting fair-trade practices and empowering women in shea-producing regions of West Africa. Organizations and companies are increasingly adopting sustainable practices to ensure fair wages and better working conditions for shea butter producers. These efforts not only improve the livelihoods of local communities but also enhance the traceability and quality of shea butter. As consumers in Europe become more conscious of the environmental and social impact of their purchases, the demand for ethically sourced shea butter is expected to rise significantly.

Europe Shea Butter Market challenges and restraints:

Supply Chain Disruptions is a significant hurdle for Europe Shea Butter:

One of the primary challenges faced by the Europe shea butter market is the potential for supply chain disruptions. Shea butter production is highly dependent on the harvesting of shea nuts, which is a seasonal activity predominantly carried out in West Africa. Factors such as adverse weather conditions, political instability, and logistical issues can impact the supply of shea nuts and, consequently, shea butter. These disruptions can lead to price volatility and supply shortages, affecting the availability of shea butter for European manufacturers. Ensuring a stable and consistent supply chain is critical for the sustained growth of the market.

Regulatory and Quality Standards are throwing a curveball at the Europe Shea Butter market:

Compliance with regulatory and quality standards is a significant challenge for the shea butter market in Europe. Different countries within Europe have varying regulations regarding the import and use of cosmetic and food ingredients. Ensuring that shea butter meets these standards can be complex and resource-intensive for manufacturers. Additionally, maintaining consistent quality and purity of shea butter is essential to meet consumer expectations and avoid potential health risks. Manufacturers need to invest in robust quality control measures and stay updated with evolving regulations to navigate these challenges effectively.

Market Opportunities:

The Europe shea butter market presents several lucrative opportunities for growth and expansion. One of the primary opportunities lies in the increasing adoption of shea butter in the pharmaceutical industry. Shea butter’s natural healing and anti-inflammatory properties make it an ideal ingredient for topical medications and therapeutic formulations. As consumers seek natural remedies for skin conditions such as eczema, psoriasis, and dermatitis, the demand for shea butter-based pharmaceutical products is expected to rise. Additionally, there is significant potential for product innovation and diversification within the cosmetics and personal care industry. Manufacturers can explore the development of specialized shea butter formulations, such as anti-aging creams, sunscreens, and hair care treatments, to cater to specific consumer needs. Furthermore, the trend towards sustainability and ethical sourcing provides an opportunity for companies to differentiate themselves by promoting their commitment to fair-trade practices and environmental responsibility. By establishing transparent supply chains and supporting local communities, businesses can build brand loyalty and attract environmentally conscious consumers. The growing popularity of online retail channels also presents an avenue for market expansion. E-commerce platforms enable companies to reach a broader audience and offer personalized product recommendations, enhancing consumer engagement and driving sales. Overall, the Europe shea butter market is poised for significant growth, driven by opportunities in the pharmaceutical sector, product innovation, sustainability initiatives, and the expanding e-commerce landscape.

EUROPE SHEA BUTTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of the Europe |

|

Key Companies Profiled |

BASF SE, Croda International Plc, AAK AB, Bunge Loders Croklaan, Cargill Incorporated, Clariant AG, OLVEA Group, Sophim, IOI Oleo GmbH, and The Savannah Fruits Company. |

Europe Shea Butter Market Segmentation Market Segmentation

Europe Shea Butter Market Segmentation Market Segmentation By Type:

- Raw/Unrefined Shea Butter

- Refined Shea Butter

In the Europe Shea Butter Market, the refined shea butter sector stands out as the most prominent segment. Refined shea butter undergoes a filtration and deodorization process, resulting in a product with a lighter color and milder scent compared to raw/unrefined shea butter. This makes it highly suitable for cosmetic and personal care applications where color and odor neutrality are preferred. The refining process also removes impurities, extending the product's shelf life and enhancing its consistency, which is particularly valued in formulations requiring precise texture and performance characteristics. As European consumers increasingly prioritize high-quality skincare products with consistent sensory profiles and performance attributes, refined shea butter holds a significant market share due to its versatility and compatibility with a wide range of cosmetic formulations.

Europe Shea Butter Market Segmentation By Application:

- Cosmetics & Personal Care

- Food

- Others

In the Europe Shea Butter Market, the cosmetics sector emerges as the most prominent segment between cosmetics and food. Shea butter is widely favored in cosmetics due to its rich moisturizing properties and natural composition, making it a key ingredient in various skincare, haircare, and personal hygiene products. European consumers are increasingly inclined towards natural and organic cosmetic formulations, driving the demand for shea butter in creams, lotions, lip balms, and hair masks. Its ability to nourish and protect the skin without synthetic additives aligns with growing consumer preferences for sustainable and skin-friendly skincare solutions. While shea butter is also utilized in the food industry, primarily in confectionery and baking for its nutritional benefits, its prominence in cosmetics remains more pronounced due to higher demand and broader application scope in personal care formulations across Europe.

Europe Shea Butter Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The UK is the dominant region in the shea butter market. The region’s well-established cosmetics industry, coupled with a high preference for natural and organic ingredients, drives significant demand for shea butter. The presence of major cosmetic brands and the increasing consumer awareness about the benefits of shea butter contribute to its market dominance. Additionally, Europe’s stringent regulations on cosmetic ingredients ensure the use of high-quality and ethically sourced shea butter, further boosting its market position.

COVID-19 Impact Analysis on the Europe Shea Butter Market

The COVID-19 pandemic had a multifaceted impact on the Europe shea butter market. Initially, the market faced significant disruptions due to lockdowns and restrictions, which affected the supply chain and production processes. The closure of borders and transportation limitations led to delays in the import of shea nuts from West Africa, causing a temporary shortage of raw materials. Additionally, the economic uncertainty and reduced consumer spending during the pandemic affected the demand for non-essential products, including cosmetics and personal care items. However, the market demonstrated resilience and adaptability. As consumers shifted their focus towards health and wellness during the pandemic, the demand for natural and organic products, including shea butter, saw a resurgence. The increased awareness of the benefits of shea butter in maintaining skin health and combating dryness and irritation, especially with frequent handwashing and the use of sanitizers, drove the market recovery. E-commerce platforms played a crucial role in sustaining the market during the pandemic, as consumers increasingly turned to online shopping for their skincare and wellness needs. The post-pandemic period is expected to witness a robust recovery, with the market benefiting from the sustained interest in natural ingredients and the gradual normalization of supply chains. Overall, the COVID-19 pandemic highlighted the importance of supply chain resilience and the growing consumer preference for natural and health-focused products.

Latest trends/Developments

The Europe shea butter market is experiencing several notable trends and developments that are shaping its growth trajectory. One of the key trends is the increasing incorporation of shea butter in premium and luxury skincare products. High-end brands are leveraging the moisturizing and anti-aging properties of shea butter to create exclusive formulations that cater to discerning consumers. Another significant trend is the rise of vegan and cruelty-free cosmetics, with shea butter being a popular ingredient due to its plant-based origin and ethical sourcing. The market is also witnessing advancements in shea butter extraction and processing technologies. Innovations such as cold-press extraction and enzymatic refining are enhancing the purity and efficacy of shea butter, making it more appealing for use in high-performance skincare products. Additionally, there is a growing focus on sustainable packaging solutions. Companies are increasingly adopting eco-friendly packaging materials and reducing plastic usage to align with the environmental values of their consumers. Furthermore, collaborations and partnerships are becoming a common strategy among market players. Cosmetic brands are partnering with NGOs and local communities in shea-producing regions to ensure fair-trade practices and sustainable sourcing. These collaborations not only enhance the social impact of the business but also strengthen the traceability and quality of the shea butter supply chain. Overall, the Europe shea butter market is evolving with a focus on premiumization, sustainability, technological advancements, and strategic collaborations, setting the stage for continued growth and innovation.

Key Players:

- BASF SE

- Croda International Plc

- AAK AB

- Bunge Loders Croklaan

- Cargill Incorporated

- Clariant AG

- OLVEA Group

- Sophim

- IOI Oleo GmbH

- The Savannah Fruits Company

Chapter 1. Europe Shea Butter Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Shea Butter Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Shea Butter Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Shea Butter Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Shea Butter Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Shea Butter Market– By Type

6.1. Introduction/Key Findings

6.2. Raw/Unrefined Shea Butter

6.3. Refined Shea Butter

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Shea Butter Market– By Application

7.1. Introduction/Key Findings

7.2 Cosmetics & Personal Care

7.3. Food

7.4. Others

7.5. Y-O-Y Growth trend Analysis By Application

7.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Shea Butter Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Shea Butter Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. BASF SE

9.2. Croda International Plc

9.3. AAK AB

9.4. Bunge Loders Croklaan

9.5. Cargill Incorporated

9.6. Clariant AG

9.7. OLVEA Group

9.8. Sophim

9.9. IOI Oleo GmbH

9.10. The Savannah Fruits Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Shea Butter Market was valued at USD 721 million in 2023 and will grow at a CAGR of 6.8% from 2024 to 2030. The market is expected to reach USD 1.1 billion by 2030.

The key drivers include the rising demand for natural ingredients in cosmetics, health and wellness trends, and sustainable and ethical sourcing practices.

Based on Application it is divided into two segments – Cosmetics, Food.

The UK is the most dominant region for the Europe Shea Butter Market.

Leading players include BASF SE, Croda International Plc, AAK AB, Bunge Loders Croklaan, Cargill Incorporated, Clariant AG, OLVEA Group, Sophim, IOI Oleo GmbH, and The Savannah Fruits Company