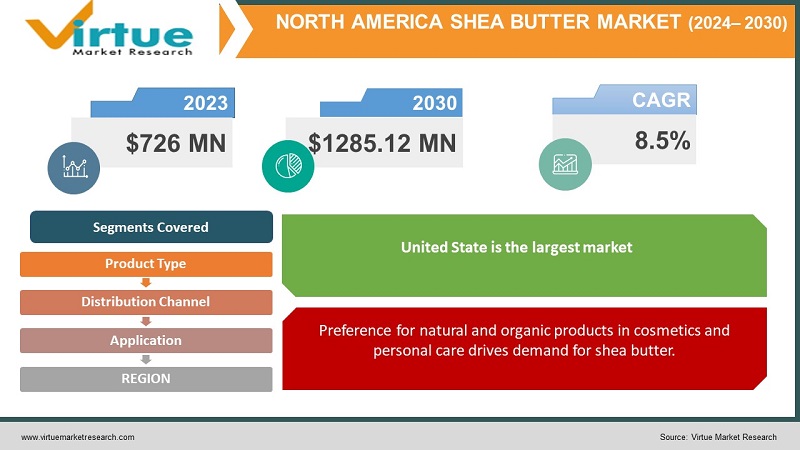

North America Shea Butter Market Size (2024-2030)

The North American shea butter market was valued at USD 726 million in 2023 and is projected to reach a market size of USD 1285.12 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.5%.

The North American shea butter market is on an upward trajectory, fueled by several trends. Consumers are increasingly seeking natural and organic products, particularly in cosmetics and food, driving demand for shea butter. As awareness of its moisturizing, healing, and anti-inflammatory properties grows, so does its popularity. Additionally, shea butter's versatility across industries like cosmetics, personal care, food & beverage, and pharmaceuticals further expands its market potential. The United States currently leads the North American market, driven by the growing popularity of natural beauty products and the increasing demand for organic food. With these trends continuing, the North American shea butter market is expected to see consistent and healthy growth in the future.

Key Market Insights:

The North American shea butter market is experiencing a surge in popularity, driven by several key trends. Consumers are increasingly seeking natural and organic alternatives, particularly in cosmetics and food products. This shift in preference has led to a growing demand for shea butter, which is recognized for its numerous benefits. Its natural moisturizing, healing, and anti-inflammatory properties are resonating with health-conscious consumers, propelling the market forward. Furthermore, shea butter's versatility across various industries contributes significantly to its market potential. It finds applications in a diverse range of products, including cosmetics, personal care items, food and beverage goods, and even pharmaceuticals. This widespread applicability ensures a broader market base for shea butter, creating a more stable and resilient market structure. The United States currently holds the leading position in the North American shea butter market. This dominance is attributed to two key factors: the increasing popularity of natural beauty products and the rising demand for organic food products. With these trends expected to continue in the future, the North American shea butter market is poised for consistent and healthy growth in the coming years.

North American Shea Butter Market Drivers:

Preference for natural and organic products in cosmetics and personal care drives demand for shea butter.

Consumers in North America are increasingly opting for natural and organic alternatives, particularly in cosmetics and personal care. This shift in preference fuels the demand for shea butter, a natural ingredient with numerous benefits, perfectly aligning with this trend.

Shea butter's moisturizing, healing, and anti-inflammatory properties fuel market growth.

Beyond its natural origin, shea butter boasts several desirable properties, like deep moisturizing, healing minor skin irritations, and potentially managing skin conditions due to its anti-inflammatory properties. As awareness of these benefits spreads, the demand for shea butter rises.

Applications in food & beverage, pharmaceuticals, and beyond broaden shea butter's market base.

The versatility of shea butter contributes significantly to its market potential. It finds applications in various sectors like food & beverage (natural fat and flavor enhancer), pharmaceuticals (potential for topical ointments), and even as a vegan butter substitute. This broadens the market base and creates a more stable market structure.

Increased spending power fuels demand for premium natural ingredients like shea butter.

As disposable income increases in North America, consumers allocate more resources towards personal care and beauty products. This increased spending power fuels the demand for premium and natural offerings like shea butter, which often command higher price points compared to synthetic alternatives.

North American Shea Butter Market Restraints and Challenges:

Despite the promising outlook for the North American shea butter market, there are certain challenges and restraints to consider. One major obstacle lies in the inconsistent quality and limited standardization of shea butter. This can lead to variations in product effectiveness and consumer dissatisfaction. Additionally, the fragmented nature of the supply chain, with numerous small-scale producers, raises concerns about ethical sourcing practices and sustainability in the shea butter industry. Addressing these concerns through improved quality control, standardization efforts, and a focus on ethical sourcing initiatives is crucial for long-term market growth. Furthermore, intense competition from established cosmetic brands and readily available synthetic alternatives can pose challenges for shea butter producers. Additionally, fluctuations in the price of raw shea nuts and potential trade barriers can impact production costs and market stability. To overcome these challenges, market players need to focus on product differentiation, highlighting the unique benefits of shea butter, and building strong brand recognition. Additionally, collaboration among stakeholders to ensure sustainable and ethical sourcing practices can further strengthen the market's long-term position.

North American Shea Butter Market Opportunities:

The North American shea butter market offers exciting opportunities for various players. Consumers' increasing demand for sustainable and ethically sourced products creates a space for shea butter to be highlighted for its positive social and environmental impact, particularly through initiatives that empower local communities involved in production. Additionally, the vast potential for innovation in product development across various sectors like cosmetics, food & beverage, and even pharmaceuticals can unlock new market segments and drive growth. The booming e-commerce market presents an opportunity for producers and brands to reach wider audiences, promote their offerings, and connect directly with consumers. Furthermore, collaboration and partnerships across the supply chain can address challenges like inconsistent quality and ethical sourcing, leading to a more transparent and beneficial market for everyone involved. Finally, educational initiatives aimed at consumers can further amplify the market by increasing awareness of the unique benefits, diverse uses, and positive aspects of shea butter, ultimately strengthening consumer trust and brand loyalty. By capitalizing on these opportunities, the North American shea butter market can solidify its position for continued growth and success in the future.

NORTH AMERICA SHEA BUTTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Product Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United States, Canada, Rest of North America |

|

Key Companies Profiled |

IOI Loders Croklaan, Wilmar Africa Ltd., Ghana Specialty Fats, Ghana Nuts Company Limited, Shebu Industries, Timiniya Tuma Company Ltd, The Pure Company, The Savannah Fruits Company, VINK CHEMICALS GMBH & CO. KG, Akoma Cooperative |

North American Shea Butter Market Segmentation:

North American Shea Butter Market Segmentation: By Product Type:

- Raw and Unrefined Shea Butter

- Refined Shea Butter

While both segments hold promise, the North American shea butter market is currently dominated by refined shea butter due to its wider application in various products and its enhanced consistency and color compared to raw and unrefined shea butter. However, the raw and unrefined shea butter segment is expected to witness the fastest growth due to the increasing consumer preference for natural and unprocessed ingredients in personal care and DIY applications.

North American Shea Butter Market Segmentation: By Application:

- Cosmetics and Personal Care

- Food and Beverage

- Pharmaceuticals

The cosmetics & personal care segment reigns supreme in the North American shea butter market by application, while the food & beverage segment boasts the fastest growth. The dominance of cosmetics & personal care stems from the widespread use of shea butter in lotions, creams, and hair products. Conversely, the food & beverage segment's rapid growth is fueled by the rising demand for natural ingredients and the diverse applications of shea butter in chocolates, baked goods, and even vegan alternatives.

North American Shea Butter Market Segmentation: By Distribution Channel:

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retail

Among distribution channels, supermarkets & hypermarkets hold the dominant position in the North American shea butter market, catering to a broad consumer base. Besides, customers can visually inspect the quality of the product. Furthermore, the availability of this channel is easier. However, online retailers are experiencing the fastest growth, driven by the increasing convenience and accessibility they offer to consumers. This shift towards online shopping is expected to continue, potentially challenging the dominance of traditional brick-and-mortar stores in the future.

North American Shea Butter Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

The US is the undisputed leader in the North American shea butter market. This dominant position is fueled by the widespread popularity of natural and organic beauty products, strong demand for organic food options, and high consumer awareness of shea butter's multiple benefits. The well-established distribution channels and infrastructure across the country further support the robust market for shea butter products in the US. The Canadian shea butter market is an emerging one, experiencing steady growth. The growing Canadian focus on natural and organic products, increasing awareness of shea butter's benefits, and rising demand for ethically and sustainably sourced products mirror the trends in the US market. These factors contribute to the growing popularity of shea butter among Canadian consumers. Mexico represents the fastest-growing market for shea butter in North America. The growing middle class in Mexico and increasing disposable income offer potential for future market expansion. Strategic marketing and educational initiatives targeted at consumers could play a crucial role in driving awareness and acceptance of shea butter in the Mexican market.

COVID-19 Impact Analysis on the North American Shea Butter Market:

The COVID-19 pandemic brought both challenges and unexpected opportunities to the North American shea butter market. While initial disruptions in the global supply chain hampered production and product availability due to lockdowns and trade restrictions, the market faced additional pressure from reduced retail activity due to non-essential store closures and cautious consumer spending. However, the pandemic also presented unforeseen positive influences. The heightened focus on health and wellness during this time led consumers to seek out natural and organic ingredients for self-care, indirectly benefiting the shea butter market. Additionally, the surge in e-commerce, driven by the need for convenience and safety, provided a lifeline for brands and producers, allowing them to reach a wider audience and overcome the limitations posed by closed brick-and-mortar stores. Overall, while the COVID-19 pandemic undoubtedly caused disruptions, the North American shea butter market has remained resilient due to the growing demand for natural products and the adaptability of market players. As the situation stabilizes, the market is projected to continue its projected growth trajectory in the long term.

Latest Trends/ Developments:

The North American shea butter market is witnessing exciting trends and developments. Sustainability and ethical sourcing are taking center stage, with consumers demanding transparency and responsible practices. This presents a unique opportunity for brands to differentiate themselves by highlighting their commitment to ethical production.

Product innovation is another key trend, with formulations addressing specific needs in cosmetics, food, and even pharmaceuticals. Shea butter is finding new applications in haircare and even exploring potential uses in industrial sectors.

Meanwhile, the e-commerce boom continues to drive market growth, offering convenient access and direct brand interactions. Additionally, the burgeoning men's grooming market presents an opportunity for targeted products and marketing strategies, further expanding the market potential. By embracing these trends and adapting to evolving consumer preferences, the North American shea butter market is well-positioned for continued success and exploration in the years to come.

Key Players:

- IOI Loders Croklaan

- Wilmar Africa Ltd.

- Ghana Specialty Fats

- Ghana Nuts Company Limited

- Shebu Industries

- Timiniya Tuma Company Ltd

- The Pure Company

- The Savannah Fruits Company

- VINK CHEMICALS GMBH & CO. KG

- Akoma Cooperative

Chapter 1. North America Shea Butter Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Shea Butter Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Shea Butter Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Shea Butter Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Shea Butter Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Shea Butter Market– By Product Type

6.1. Introduction/Key Findings

6.2. Raw and Unrefined Shea Butter

6.3. Refined Shea Butter

6.4. Y-O-Y Growth trend Analysis By Product Type

6.5. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Shea Butter Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Online Retail

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. North America Shea Butter Market– By Application

8.1. Introduction/Key Findings

8.2. Cosmetics and Personal Care

8.3. Food and Beverage

8.4. Pharmaceuticals

8.5. Y-O-Y Growth trend Analysis By Application

8.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 9. North America Shea Butter Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By Application

9.1.3. By Distribution Channel

9.1.4. product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Shea Butter Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. IOI Loders Croklaan

10.2. Wilmar Africa Ltd.

10.3. Ghana Specialty Fats

10.4. Ghana Nuts Company Limited

10.5. Shebu Industries

10.6. Timiniya Tuma Company Ltd

10.7. The Pure Company

10.8. The Savannah Fruits Company

10.9. VINK CHEMICALS GMBH & CO. KG

10.10. Akoma Cooperative

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North American shea butter market was valued at USD 726 million in 2023 and is projected to reach a market size of USD 1285.12 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.5%.

Growing consumer preference for natural products, rising awareness of shea butter's benefits, diverse applications of shea butter, and increasing disposable income are the main drivers

Based on distribution channels, the market is divided into supermarkets, hypermarkets, specialty stores, and online retail.

The United States holds the dominant position in the North American shea butter market, driven by factors like strong consumer awareness and a well-established infrastructure.

IOI Loders Croklaan, Wilmar Africa Ltd, Ghana Specialty Fats, Ghana Nuts Company Limited, Shebu Industries, Timiniya Tuma Company Ltd, The Pure Company, The Savannah Fruits Company, VINK CHEMICALS GMBH & CO. KG, and Akoma Cooperative are the key players.