Protein Supplements Market Size (2024 – 2030)

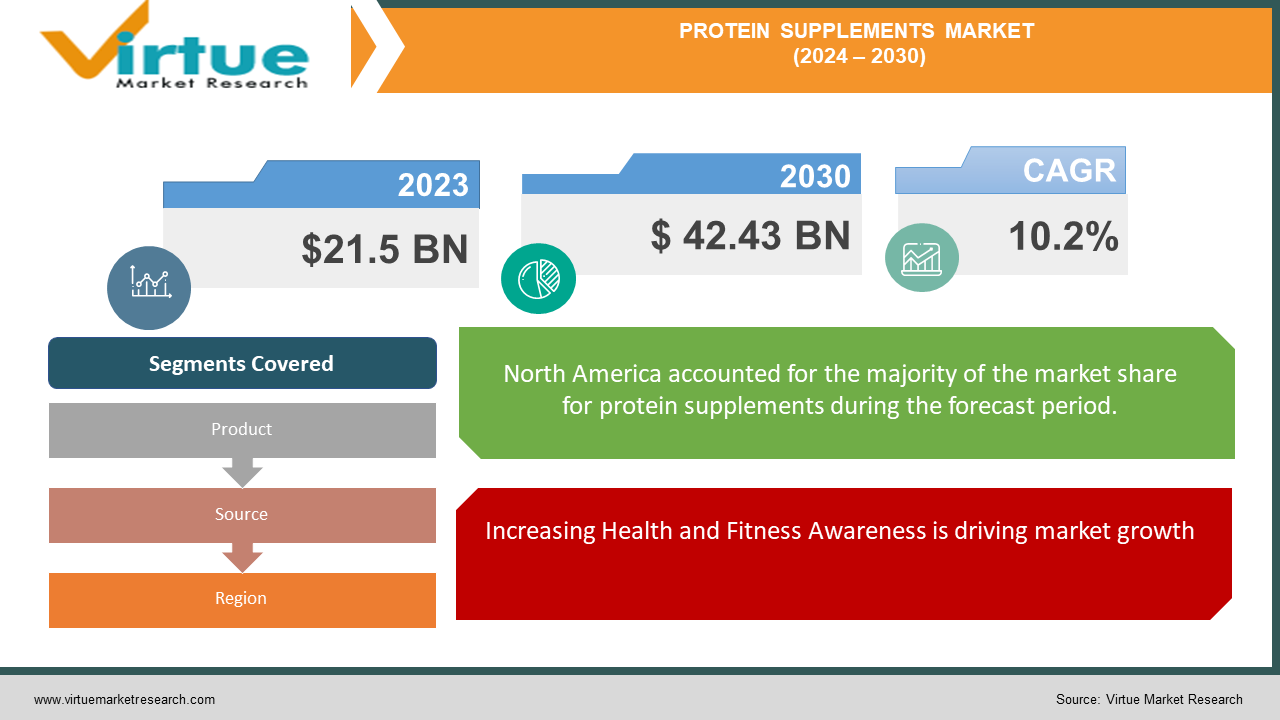

The global protein supplements market was valued at USD 21.5 billion in 2023 and is expected to reach USD 42.43 billion by 2030, growing at a CAGR of 10.2% from 2024 to 2030.

This market encompasses a wide range of products including protein powders, protein bars, ready-to-drink (RTD) shakes, and other supplements derived from sources like whey, soy, casein, and plant-based proteins. The growth is driven by increasing health consciousness, the rise of fitness trends, and the growing demand for nutritional products that aid in muscle growth, weight management, and overall health.

Key Market Insights

The popularity of fitness and bodybuilding activities is boosting the demand for protein supplements. Many consumers use these supplements to enhance performance, recover from workouts, and build muscle mass.

There is a growing demand for plant-based protein supplements due to increasing veganism and lactose intolerance among consumers. Products made from soy, pea, and rice proteins are gaining popularity.

The protein supplements market is witnessing significant growth in emerging markets such as China, India, and Brazil. Increasing disposable income and changing dietary patterns are contributing to this growth.

Manufacturers are continuously innovating to introduce new flavors, formulations, and packaging to attract consumers. Innovations like protein coffee, protein chips, and fortified protein supplements are expanding the market.

Global Protein Supplements Market Drivers

Increasing Health and Fitness Awareness is driving market growth:

The growing awareness about health and fitness is a significant driver for the protein supplements market. As more people adopt healthier lifestyles, the demand for nutritional supplements, including protein, is rising. Protein is essential for muscle repair, growth, and overall body function, making it a crucial component of fitness regimes. Additionally, the rise of social media fitness influencers and public health campaigns is educating consumers about the benefits of protein supplements, thus boosting market demand. The trend is not limited to athletes and bodybuilders; a broader demographic, including busy professionals and elderly individuals, is incorporating protein supplements into their daily routines for better health and wellness.

Rise of E-commerce and Online Retail is driving market growth:

The proliferation of e-commerce platforms has revolutionized the distribution of protein supplements. Online retail offers consumers the convenience of purchasing products from the comfort of their homes, access to a wide range of brands and products, and the ability to compare prices and read reviews. This convenience has significantly increased the accessibility and availability of protein supplements, especially in regions where physical stores may be limited. Furthermore, subscription services and direct-to-consumer models are gaining traction, allowing consumers to receive their preferred supplements regularly without the hassle of reordering. The digital transformation of retail is thus a major driver of the protein supplements market.

Innovative Product Development is driving market growth:

Continuous innovation in product development is another key driver of the protein supplements market. Manufacturers are investing in research and development to create new and improved products that cater to evolving consumer preferences. This includes the introduction of plant-based protein supplements for vegans and lactose-intolerant individuals, protein-fortified foods and beverages, and products with added vitamins and minerals for enhanced health benefits. Flavor innovation is also a significant focus, with companies offering a variety of flavors to cater to diverse taste preferences. Such innovations not only attract new consumers but also encourage existing users to try different products, thereby driving market growth.

Global Protein Supplements Market Challenges and Restraints

Regulatory and Quality Concerns are restricting market growth:

One of the major challenges facing the protein supplements market is the regulatory environment. Different countries have varying regulations regarding the production, labeling, and sale of dietary supplements, which can be difficult for manufacturers to navigate. Ensuring compliance with these regulations can be costly and time-consuming, particularly for smaller companies. Additionally, the quality of protein supplements can vary significantly between brands, leading to concerns about product efficacy and safety. Instances of contamination, false labeling, and misleading health claims have led to consumer skepticism and calls for stricter regulations, which could impact market growth.

High Cost of Protein Supplements is restricting market growth:

The cost of protein supplements can be a barrier for many consumers. High-quality protein supplements, especially those derived from organic or specialty sources, can be expensive. This limits their affordability and accessibility, particularly in price-sensitive markets. The cost is driven by factors such as raw material prices, production processes, and the need for extensive marketing and branding efforts. While there is a segment of the population willing to pay a premium for high-quality supplements, the high cost can deter price-conscious consumers, thereby restraining market growth.

Market Opportunities

The global protein supplements market presents numerous opportunities for growth and expansion. One of the significant opportunities lies in the growing demand for plant-based protein supplements. With increasing awareness about the environmental impact of animal-based products and the rise of veganism, there is a substantial market for plant-based alternatives. Companies can capitalize on this trend by developing innovative plant-based protein products that cater to the needs of vegans, vegetarians, and those with lactose intolerance. Another promising opportunity is the expansion into emerging markets. Regions such as Asia-Pacific, Latin America, and the Middle East are witnessing rising disposable incomes, urbanization, and changing dietary patterns. These factors are driving the demand for protein supplements in these regions. Companies can tap into these markets by understanding local preferences, investing in marketing and distribution channels, and offering affordable products that meet the needs of these consumers. Furthermore, there is potential for growth in the elderly population segment. As the global population ages, there is an increasing focus on maintaining muscle mass and strength among older adults. Protein supplements can play a crucial role in addressing age-related muscle loss and promoting healthy aging. Developing specialized products tailored to the nutritional needs of the elderly can open up new avenues for growth in this segment.

PROTEIN SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.2% |

|

Segments Covered |

By Product, Source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Glanbia PLC, Abbott Laboratories, Hormel Foods Corporation, Amway Corporation, GlaxoSmithKline PLC, PepsiCo Inc., Herbalife Nutrition Ltd., The Bountiful Company, NOW Foods, Garden of Life LLC |

Protein Supplements Market Segmentation - By Product

-

Protein Powder

-

Protein Bars

-

Ready-to-drink (RTD) Shakes

Protein Powder is the dominant segment in the protein supplements market. This dominance is due to its widespread use among fitness enthusiasts, bodybuilders, and athletes. Protein powders are versatile, easy to use, and can be mixed with various beverages, making them a convenient choice for consumers looking to increase their protein intake. The high protein content, variety of flavors, and availability of different formulations (whey, plant-based, etc.) contribute to the popularity of protein powders in the market.

Protein Supplements Market Segmentation - By Source

-

Whey Protein

-

Soy Protein

-

Casein Protein

-

Egg Protein

-

Pea Protein

Whey Protein is the most dominant segment by source in the protein supplements market. This dominance is attributed to whey protein's high bioavailability, rapid absorption, and rich amino acid profile. It is considered one of the most effective sources of protein for muscle building and recovery, making it a preferred choice among athletes and fitness enthusiasts. The availability of various forms of whey protein (concentrate, isolate, hydrolysate) caters to different consumer preferences and needs, further solidifying its leading position in the market.

Protein Supplements Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the global protein supplements market. This dominance is driven by the high health awareness among consumers, the presence of a large number of fitness centers and health clubs, and the widespread availability of protein supplements in various retail channels. The strong influence of fitness and wellness trends, coupled with the presence of key market players, further contributes to the region's leading position. Additionally, the growing trend of preventive healthcare and the increasing adoption of protein supplements by older adults for maintaining muscle mass and overall health are boosting the market in North America.

COVID-19 Impact Analysis on the Protein Supplements Market

The COVID-19 pandemic had a mixed impact on the protein supplements market. On one hand, the pandemic led to an increased focus on health and wellness, driving demand for nutritional supplements, including protein supplements. Consumers became more health-conscious and sought products that could boost their immunity and overall health. This trend was particularly evident during the initial phases of the pandemic when there was a surge in demand for dietary supplements. However, the market also faced challenges due to disruptions in the supply chain, manufacturing, and distribution channels. Lockdowns and restrictions imposed to curb the spread of the virus led to production delays, shortages of raw materials, and logistical challenges. These disruptions impacted the availability of protein supplements in the market. Additionally, the closure of gyms, fitness centers, and sports facilities during lockdowns affected the demand for protein supplements, particularly among fitness enthusiasts and athletes. The economic uncertainties and reduced disposable incomes also led some consumers to cut back on non-essential expenditures, impacting the market. As the world gradually recovers from the pandemic, the protein supplements market is expected to rebound and grow, driven by the sustained focus on health and wellness, the reopening of fitness centers, and the normalization of supply chains.

Latest Trends

The protein supplements market is experiencing significant trends driven by evolving consumer preferences and technological advancements. One notable trend is the increasing demand for plant-based protein supplements. With growing awareness about the environmental impact of animal farming and the rise in vegan and vegetarian lifestyles, consumers are seeking plant-based alternatives. This shift is prompting manufacturers to innovate and introduce a variety of plant-based protein products made from sources like peas, soy, and rice. Another trend is the emphasis on clean labeling and natural ingredients. Consumers are becoming more health-conscious and prefer products with minimal processing and natural ingredients. This trend is pushing companies to focus on transparency and the use of organic and non-GMO ingredients in their protein supplements. The convenience of ready-to-drink (RTD) protein beverages is also gaining popularity. Busy lifestyles and the need for on-the-go nutrition are driving the demand for RTD protein shakes and beverages. These products offer a quick and convenient way to consume protein, appealing to fitness enthusiasts and busy professionals alike. Technological advancements in protein extraction and processing are enabling the production of high-quality protein supplements with enhanced nutritional profiles and better taste. Innovations such as microencapsulation and advanced filtration techniques are improving the bioavailability and flavor of protein products, making them more appealing to consumers. Additionally, personalized nutrition is becoming a key trend in the protein supplements market. Consumers are seeking products tailored to their specific dietary needs and fitness goals. Companies are leveraging data and technology to offer personalized protein supplement solutions, catering to individual preferences and requirements.

Key Players

-

Glanbia PLC

-

Abbott Laboratories

-

Hormel Foods Corporation

-

Amway Corporation

-

GlaxoSmithKline PLC

-

PepsiCo Inc.

-

Herbalife Nutrition Ltd.

-

The Bountiful Company

-

NOW Foods

-

Garden of Life LLC

Chapter 1. Protein Supplements Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Protein Supplements Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Protein Supplements Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Protein Supplements Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Protein Supplements Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Protein Supplements Market – By Product

6.1 Introduction/Key Findings

6.2 Protein Powder

6.3 Protein Bars

6.4 Ready-to-drink (RTD) Shakes

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Protein Supplements Market – By Source

7.1 Introduction/Key Findings

7.2 Whey Protein

7.3 Soy Protein

7.4 Casein Protein

7.5 Egg Protein

7.6 Pea Protein

7.7 Y-O-Y Growth trend Analysis By Source

7.8 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 8. Protein Supplements Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Source

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Source

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Source

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Source

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Source

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Protein Supplements Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Glanbia PLC

9.2 Abbott Laboratories

9.3 Hormel Foods Corporation

9.4 Amway Corporation

9.5 GlaxoSmithKline PLC

9.6 PepsiCo Inc.

9.7 Herbalife Nutrition Ltd.

9.8 The Bountiful Company

9.9 NOW Foods

9.10 Garden of Life LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global protein supplements market was valued at USD 21.5 billion in 2023 and is expected to reach USD 42.43 billion by 2030, growing at a CAGR of 10.2% from 2024 to 2030.

The primary drivers of the global protein supplements market include increasing health and fitness awareness, the rise of e-commerce and online retail, and continuous innovation in product development.

The global protein supplements market is segmented by product type (protein powder, protein bars, RTD shakes, and others) and by source (whey protein, soy protein, casein protein, egg protein, pea protein, and others).

North America is the most dominant region in the global protein supplements market, driven by high health awareness, the presence of numerous fitness centers, and a strong influence on fitness and wellness trends.

Leading players in the global protein supplements market include Glanbia PLC, Abbott Laboratories, Hormel Foods Corporation, Amway Corporation, GlaxoSmithKline PLC, PepsiCo Inc., Herbalife Nutrition Ltd., The Bountiful Company, NOW Foods, and Garden of Life LLC.