Asia-Pacific Protein Supplements Market Size (2024-2030)

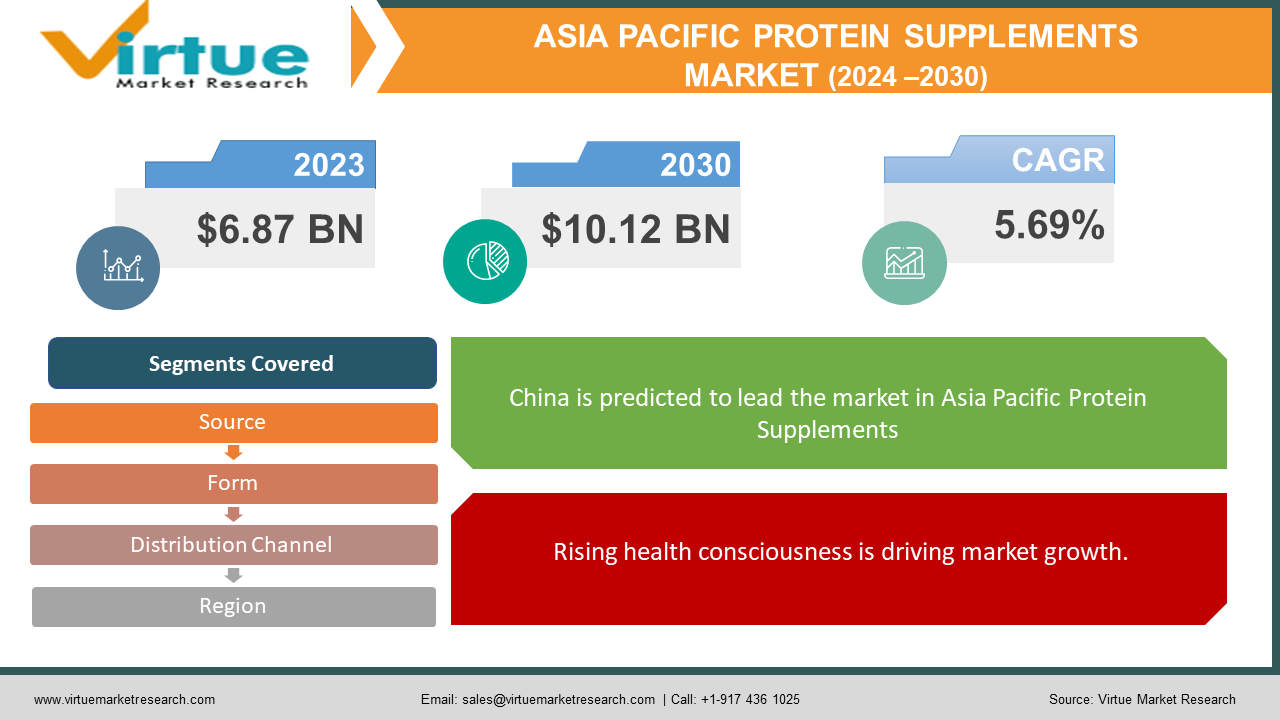

The Asia-Pacific protein supplements market was valued at USD 6.87 billion in 2023 and is projected to reach a market size of USD 10.12 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.69%.

Protein supplements are dietary supplements that provide nutrients. They are frequently promoted to athletes and fitness enthusiasts as a means of enhancing performance and promoting muscle growth. Protein supplements can be found in a variety of formats, such as bars, pills, powders, premade shakes, and meal replacements.

Key Market Insights:

- The Asia-Pacific Protein Supplements Market is experiencing explosive growth. A health-conscious population with rising disposable income across the region is a major driver. Consumers of all ages are recognizing the benefits of protein for muscle health, weight management, and overall well-being. Busy lifestyles and an aging population further contribute to the market's expansion. Busy individuals seek convenient protein sources, while those concerned about maintaining muscle mass and bone health as they age turn to protein supplements.

- This booming market is also being shaped by key trends. Plant-based protein sources are gaining significant traction due to environmental and ethical concerns. E-commerce is another major trend, rapidly becoming a preferred channel for purchasing protein supplements. The convenience and wider selection offered by online retailers are driving this shift, with a significant portion of the market expected to move online in the coming years.

- Manufacturers are constantly innovating to meet these evolving consumer preferences. New formats, like ready-to-drink beverages and protein-infused snacks, cater to those seeking on-the-go protein options. Additionally, manufacturers are developing protein blends and a wider variety of flavors to cater to diverse dietary needs and taste preferences. This focus on innovation ensures the market remains dynamic and caters to the ever-changing needs of health-conscious consumers in the Asia-Pacific region.

Asia-Pacific Protein Supplement Market Drivers:

Rising health consciousness is driving market growth.

A growing population across the region has more money to spend on their well-being. Protein supplements are seen as a convenient and effective way to improve muscle health, manage weight, and boost overall vitality. This trend extends beyond gym enthusiasts, with all age groups recognizing the benefits of protein. The fast-paced nature of modern life and an aging population are fueling market growth in two distinct ways. Busy individuals crave convenient protein sources like bars and drinks to fit their hectic schedules. On the other hand, an aging population seeks protein supplements to maintain muscle mass and bone health as they mature.

Plant-based protein options are gaining traction due to environmental and ethical concerns.

Environmental and ethical concerns are driving a significant rise in demand for plant-based protein options like pea, soy, and brown rice. This trend is expected to continue, catering to a growing segment of environmentally conscious consumers.

E-commerce has been boosting the market.

Online retail is rapidly becoming a preferred channel for purchasing protein supplements. The ease of access, wider product variety, and competitive pricing offered by online retailers are propelling this shift. Expect a significant portion of the market to move online in the coming years.

Manufacturers are constantly innovating to meet evolving consumer preferences.

Manufacturers are constantly innovating to meet evolving consumer preferences. This includes developing new formats like ready-to-drink beverages and protein-infused snacks, creating protein blends to cater to diverse dietary needs, and offering a wider variety of flavors to meet taste preferences. This focus on innovation ensures the market remains dynamic and caters to the ever-changing needs of health-conscious consumers.

Asia-Pacific Protein Supplements Market Restraints and Challenges:

While the market is experiencing significant growth, there are hurdles to overcome. Stringent regulations governing product labeling, health claims, and safety standards can be a roadblock, particularly for smaller companies struggling with the costs and time involved in navigating these complexities. Another challenge lies in ensuring consistent product quality. Concerns about contaminants or adulterants can erode consumer trust and damage brands. Manufacturers must prioritize maintaining high standards throughout the supply chain. Price sensitivity among some consumers in the region presents another obstacle. Striking a balance between affordability and quality can be tricky for manufacturers. Additionally, a lack of awareness about the benefits of protein supplements or their appropriate use exists in certain parts of the Asia-Pacific. Educational initiatives are needed to bridge this knowledge gap and encourage informed consumer choices. The market's increasing competitiveness, with both domestic and international players vying for market share, is a final challenge. This fierce competition can lead to price wars and squeeze profit margins for manufacturers.

Asia-Pacific Protein Supplement Market Opportunities:

The untapped potential exists in countries like India and Southeast Asia, where rising disposable income and growing health awareness create a prime market for protein supplements. Manufacturers can capitalize on this by diversifying their offerings. Developing innovative formats like protein-infused snacks and beverages caters to the demand for convenient protein sources. Additionally, exploring plant-based blends and a wider flavor variety can attract consumers with specific dietary needs and preferences. The booming e-commerce sector presents another golden opportunity. By leveraging online platforms, manufacturers can expand their reach, particularly in remote areas, while offering competitive pricing and a wider product selection. Beyond muscle building, there's room to position protein supplements for overall wellness. Highlighting benefits like weight management, immune system support, and bone health can attract a broader consumer base. Targeted marketing and educational campaigns can further unlock this market's potential. Raising awareness about protein's benefits and dispelling myths is key. Educating consumers on proper usage based on age, activity level, and dietary needs builds trust and encourages responsible consumption. By addressing these opportunities, the market can solidify its position as a dynamic and thriving industry.

ASIA-PACIFIC PROTEIN SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.69% |

|

Segments Covered |

By Source, distribution channel, form, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Rest of the Asia-Pacific |

|

Key Companies Profiled |

Archer Daniels Midland Company, Darling Ingredients, Inc., Fonterra Co-operative Group, Cargill, Incorporated, Glanbia, Abbott Laboratories, PepsiCo, Unilever, Danone, Nestle |

Asia-Pacific Protein Supplements Market Segmentation:

Asia-Pacific Protein Supplements Market Segmentation: By Source:

- Plant-Based

- Animal-Based

- Others

Animal-based supplements are the largest growing type. Important sources of animal proteins are whey, casein, collagen, and eggs. Given their numerous nutritional advantages, animal-based protein supplements should see rapid development in demand over the coming years. Animal sources are favored for supplement manufacture since they have a greater protein concentration. Plant-based sources are the fastest-growing. A move toward new protein sources is being driven by consumers' growing awareness of the need to lead a healthy lifestyle. A growing number of customers are adopting a vegan diet due to worries about animal welfare and the environmental effects of the meat industry, even despite the strong demand for animal-based foods. Supplements containing soy protein have demonstrated tremendous development potential as more customers choose plant-based proteins.

Asia-Pacific Protein Supplements Market Segmentation: By Form:

- Powder

- Ready-to-drink (RTD) Liquids

- Protein Bars

- Other Formats

The powder segment is the largest growing form. This is favored for its versatility and affordability. However, the fastest-growing segment is Ready-to-Drink (RTD) Liquids, capitalizing on the demand for convenient protein sources for busy lifestyles. This trend is expected to continue as consumers seek on-the-go protein options.

Asia-Pacific Protein Supplements Market Segmentation: By Distribution Channel:

- Specialty Stores

- Online Retailers

- Hypermarkets/Supermarkets

- Others

The most dominant distribution channel for Asia-Pacific protein supplements is likely supermarkets and hypermarkets, catering to everyday consumers with a wider range of products beyond just protein supplements. However, the fastest-growing segment is expected to be online retailers. This is driven by the convenience, wider selection, and competitive pricing offered by online platforms, making them an increasingly attractive option for consumers.

Asia-Pacific Protein Supplements Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

China is the largest growing market. China boasts a strong and growing market fueled by rising disposable income, increasing protein awareness, and a robust food and beverage industry. Consumers are receptive to innovative products, and the market is dominated by animal-based protein sources like whey and casein. However, the plant-based protein segment is showing promising growth potential. India is the fastest-growing market. This is driven by rising disposable income, increasing urbanization, and a growing awareness of the benefits of protein for overall health and fitness. While whey protein is gaining popularity, the market is expected to see significant growth in the plant-based protein segment due to its affordability and cultural preferences. Japan is a well-established market with a strong focus on research and development. Japan is known for its innovative protein supplements. Whey protein is a dominant player, and consumers are willing to pay a premium for high-quality products. With a growing health-conscious population and a focus on fitness, the Japanese market is expected to see steady growth in the coming years. Like Japan, South Korea has a health-conscious population with a growing interest in protein supplements. The market is driven by fitness trends and a focus on appearance. Whey protein dominates here as well, but the plant-based segment is gaining traction due to rising awareness of environmental and ethical concerns. Australia & New Zealand have a well-developed fitness culture and a high health consciousness among consumers. Whey protein is the dominant source, and there's a strong demand for performance-oriented protein supplements. However, the plant-based segment is emerging as a significant player, driven by growing environmental concerns and veganism. The rest of Asia-Pacific, comprising Southeast Asian nations like Indonesia, Vietnam, and Thailand, is showing promising growth potential in the protein supplements market. Rising disposable income, increasing awareness of health and wellness, and a growing fitness culture are driving the demand here. The market is expected to see diversification in protein sources, with both animal-based and plant-based options gaining traction.

COVID-19 Impact Analysis on the Asia-Pacific Protein Supplements Market:

The COVID-19 pandemic's impact on the Asia-Pacific protein supplement market was a double-edged sword. Initial disruptions occurred as lockdowns hampered supply chains, leading to temporary shortages and price fluctuations. Gym closures and a decline in fitness activities also caused a dip in demand, particularly for performance-oriented supplements. However, an unexpected boost emerged. Heightened awareness of health and immunity during the pandemic led many to seek out protein supplements to bolster their well-being. The importance of protein for maintaining muscle mass, especially during periods of limited mobility, further fuels demand. Additionally, the surge of home workouts and online fitness trends created a new market for convenient protein sources, propelling the growth of ready-to-drink beverages and protein snacks. Social distancing measures and restrictions on movement accelerated the shift towards online retail for protein supplements. The convenience, wider selection, and competitive pricing offered by online platforms attracted a new wave of consumers. Looking ahead, the pandemic's emphasis on health is expected to have a lasting impact, driving continued demand for protein supplements in the region. The rise of e-commerce as a preferred channel is likely here to stay, and manufacturers are likely to focus on developing immunity-boosting formulas and convenient formats to cater to evolving consumer needs in a post-pandemic world.

Latest Trends/ Developments:

The market is brimming with exciting developments. The plant-based protein segment continues its surge, fueled by environmental and ethical concerns. Manufacturers are exploring new protein sources like peas, brown rice, and mung beans, offering a wider variety beyond just soy. Protein supplements themselves are evolving beyond just muscle building. Functional protein powders are being formulated to target specific health benefits like immunity, weight management, and bone health, catering to a broader audience seeking overall well-being. Personalization is another trend on the rise, with companies offering subscription boxes or customized protein blends based on individual needs and dietary restrictions. This caters to the growing desire for targeted solutions. Sustainability is also becoming a priority, with manufacturers opting for eco-friendly and biodegradable packaging materials. Finally, technological advancements are influencing the market in various ways. Blockchain technology can ensure product authenticity, while wearable fitness trackers and smartphone apps integrated with protein supplements offer personalized recommendations and usage tracking. These trends highlight the dynamic nature of the market, with manufacturers constantly innovating to cater to evolving consumer preferences and leverage technology to enhance the overall experience.

Key Players:

- Archer Daniels Midland Company

- Darling Ingredients, Inc.

- Fonterra Co-operative Group

- Cargill, Incorporated

- Glanbia

- Abbott Laboratories

- PepsiCo

- Unilever

- Danone

- Nestle

Chapter 1. Asia-Pacific Protein Supplements Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Protein Supplements Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia-Pacific Protein Supplements Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Protein Supplements Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Protein Supplements Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Protein Supplements Market– By Source

6.1. Introduction/Key Findings

6.2. Plant-Based

6.3. Animal-Based

6.4. Others

6.5. Y-O-Y Growth trend Analysis By Source

6.6. Absolute $ Opportunity Analysis By Source , 2023-2030

Chapter 7. Asia-Pacific Protein Supplements Market– By Form

7.1. Introduction/Key Findings

7.2. Powder

7.3. Ready-to-drink (RTD) Liquids

7.4. Protein Bars

7.5. Other Formats

7.6. Y-O-Y Growth trend Analysis By Form

7.7. Absolute $ Opportunity Analysis By Form , 2023-2030

Chapter 8. Asia-Pacific Protein Supplements Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2 Specialty Stores

8.3. Online Retailers

8.4. Hypermarkets/Supermarkets

8.5. Others

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia-Pacific Protein Supplements Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Source

9.1.3. By Form

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia-Pacific Protein Supplements Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Archer Daniels Midland Company

10.2. Darling Ingredients, Inc.

10.3. Fonterra Co-operative Group

10.4. Cargill, Incorporated

10.5. Glanbia

10.6. Abbott Laboratories

10.7. PepsiCo

10.8. Unilever

10.9. Danone

10.10. Nestle

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia-Pacific protein supplements market was valued at USD 6.87 billion in 2023 and is projected to reach a market size of USD 10.12 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.69%.

Health-conscious consumers, a plant-based protein surge, an e-commerce boom, and innovation are the main factors driving the market

Based on source, the market is divided into plant-based, animal-based, and others.

China is the most dominant region in the Asia-Pacific protein supplements market.

Archer Daniels Midland Company, Darling Ingredients Inc., Fonterra Co-operative Group, Cargill, Incorporated, Glanbia, Abbott Laboratories, PepsiCo, Unilever, and Danone are the major players in the Asia-Pacific protein supplements market.