ANIMAL-BASED PROTEIN SUPPLEMENTS MARKET SIZE (2024 -2030)

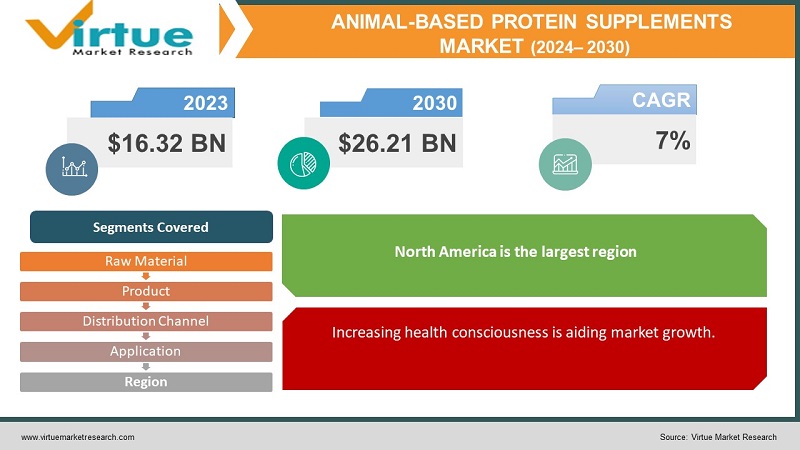

The Global Animal-based Protein Supplements Market was valued at USD 16.32 billion and is projected to reach a market size of USD 26.21 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7%.

Animal-based protein supplements are usually taken to improve overall health. Whey protein, egg white protein, casein, collagen, and beef protein isolate are examples of common animal-based protein powders. These substances have had a significant presence in the past owing to their nutritional benefits. Presently, they have seen tremendous growth due to a wider range of options and wellness trends. In the future, with sustainable practices, personalized products, and other innovations, this market is set to expand.

Key Market Insights:

The production of livestock has a major impact on greenhouse gas emissions. The Food and Agriculture Organization of the United Nations (FAO) estimates that 14.5% of the world's greenhouse gas emissions are caused by the livestock industry. To tackle this, methane reduction technologies, biogas, and sustainable farming practices like grassland management and animal waste treatment are being emphasized.

Animal-based Protein Supplements Market Drivers:

Increasing health consciousness is aiding market growth.

Over the last decade, there have been significant changes in people's lifestyles. Urbanization, the rising middle class, and increasing disposable incomes have contributed as well. After the outbreak of the COVID-19 pandemic, the statistics for the number of people leaning towards a healthy lifestyle increased drastically, according to surveys and polls. People have begun to understand the importance of having a healthy mind and body. This has led to an increased consumption of healthy foods. Animal-based protein supplements help in building muscle health and stronger bones, controlling blood sugar, lowering the risk of chronic diseases like diabetes and cancer, improving cholesterol levels, and repairing overall health. Moreover, a greater number of people are interested in joining gyms. Trainers and other instructors advise individuals to use these products pre- or post-workout to gain strength. Furthermore, the importance of sports activities through various government initiatives and schemes encouraged a greater percentage of the population to participate in the contests. Due to this, the market can generate more revenue as the consumption of these food substances is a requirement for athletes and other sportspeople.

Product diversification and innovation are fueling the expansion.

New products are continuously being introduced for commercialization. They are associated with better taste, quality, shelf life, and texture. The food industry is constantly working on finding better formulations, alternatives, and flavors. The overall nutritional profile is being improved. Marketing strategies are being prioritized. Moreover, clean labeling and transparency of food products are helping to attract a broader consumer base. Furthermore, consumers tend to look for products that cater to the specific needs of their diet. Tailoring and customizing solutions accordingly has been facilitating the enlargement.

Animal-based Protein Supplements Market Restraints and Challenges:

Environmental concerns, health hurdles, veganism, competition, and labeling issues are the main barriers that the market is currently facing.

Livestock breeding is responsible for huge carbon footprints. Additionally, resources are utilized extensively. This can include enormous amounts of land and water. Secondly, there is growing popularity for the consumption of plant-based foods. Social media has played a crucial role in spreading awareness about the harsh realities of the animal industry. The ethical aspect is often questioned by environmentalists. After the pandemic, there was an increase in the number of people who chose to consume vegan diets. Besides, these products face heavy competition from plant-based alternatives. Thirdly, animal-based protein supplements are associated with high amounts of fat and cholesterol. If not consumed in a proportional intake, they may lead to serious ill effects. Furthermore, misleading ingredients can lead to severe allergies.

Animal-based Protein Supplements Market Opportunities:

Worldwide operations have been providing the market with an ample number of opportunities. Measures are being taken to improve supply chain activities. Startups are coming up with innovative ideas for formulations. Additionally, e-commerce has been a boon. This market can engage in more sales due to various online retail platforms. Secondly, R&D activities are being carried out to find novel protein sources. Besides this, products specifically for an aging population and for raising immunity to specific kinds of diseases are being prioritized.

ANIMAL-BASED PROTEIN SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Raw Material, Product, Distribution Channel, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Glanbia plc, Abbott Laboratories, GNC Holdings Inc., MuscleTech, Optimum Nutrition, NOW Foods, MusclePharm Corporation, BSN (Bio-Engineered Supplements and Nutrition), Dymatize, Quest Nutrition |

Animal-based Protein Supplements Market Segmentation:

Market Segmentation: By Raw Material:

- Whey

- Casein

- Egg

- Fish

- Others

Whey is the largest segment, holding a share of around 55%. Whey contains essential amino acids, which are known to improve body composition. Additionally, it is easier to absorb. Other than this, it helps with digestion, lowers blood pressure, and reduces inflammation, making it a popular choice. Fish protein supplements are the fastest-growing. Fish is a high-quality, low-fat protein. Omega-3 fatty acids and vitamins B2 (riboflavin) and D are abundant in fish. Moreover, fish is a fantastic source of nutrients, including iron, zinc, iodine, magnesium, and potassium, in addition to being high in calcium and phosphorus.

Market Segmentation: By Product:

-

Protein Powder

-

Protein Bars

-

Ready-to-Drink Supplements

-

Others

Based on product, protein powder is the largest segment, with a share of approximately 60%. This is because of an upsurge in the number of gym facilities, which encourages people to try out these products. Besides, a greater number of people are leaning towards protein powder due to its easier availability, taste, formulations, and health impact. Ready-to-drink supplements are considered to be the fastest-growing due to their convenience and flexibility. Dual income is the new norm. Due to this, working couples are unable to find time for cooking because of their hectic schedules. Ongoing fitness trends are also aligning well. During the forecast period, this segment is predicted to further enlarge.

Market Segmentation: By Distribution Channel:

-

Supermarkets/ Hypermarkets

-

Online Stores

-

Specialty Stores

-

Others

Online stores are the largest distribution channel, holding a share exceeding 30%. This is because of the benefits it offers, which include shopping from the comfort of the house, discounts, deals, convenience, user-friendly features, customer experience, availability of local and international brands, home delivery, and product quality. This segment saw a significant increase after the pandemic. Supermarkets/hypermarkets are the fastest-growing owing to availability, face-to-face interaction, bargaining, comfort, customer satisfaction, a greater number of shops, and visual inspection.

Market Segmentation: By Application:

-

Sports Nutrition

-

Functional Food

Sports nutrition is the largest application, holding a share of around 60%. This is because of the nutritional benefits like enhanced strength, immunity, bone strength, and muscle mass these supplements offer. Besides, there has been a lot of progress regarding prominence for different sports like cricket, badminton, hockey, football, etc. due to governmental schemes, initiatives, awards, and funding. Beverages are a very popular type of category for this segment. Functional foods are the fastest-growing owing to increasing health awareness, changes in lifestyles, population, consumer demand, nutritional profile, availability, and rising needs for consumption due to the prevalence of chronic diseases and obesity.

Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest region, holding a rough share of 34%. Canada and the United States are the leading regions. The causes of this include the rising population, mass production, expanding industry, global operations, the presence of important firms, investments, demand, import-export trade activities, and economic developments. Asia-Pacific is the fastest-growing, with regions like India, China, Japan, and Australia at the forefront. This is due to several factors, such as increased demand, urbanization, innovative startups, product diversification, partnerships, changes in lifestyle, investments, government support, and sustainability-related activities. This region holds a share of around 25%. Europe, which includes nations like Germany, the UK, and Italy, is likewise developing significantly as a result of technological advancements, environmental measures, awareness, and R&D activities.

COVID-19 Impact Analysis on the Global Animal-based Protein Supplements Market:

Lockdowns, restricted movement, and social isolation were all part of the new normal. This has an impact on supply chain management, transportation, and logistics. Trade between imports and exports deteriorated significantly as a result. Additionally, operational challenges were brought about by labor scarcity. Many companies and manufacturing sites were shut down. This caused an economic downfall. Moreover, veganism was gaining immense popularity owing to increased awareness about sustainability and other eco-friendly practices. As per Statista, a survey carried out in August 2022 revealed that throughout the COVID-19 epidemic, consumer knowledge in India has risen about sustainability and health. Of those surveyed, about 35% were open to switching to more environmentally friendly and sustainable goods, and 44% were willing to pay a higher price for such brands. However, the outbreak of the virus also highlighted the importance of health. Proteins aid in immune protection. Many health and fitness trends emerged during this period. People started to exercise and meditate, along with consuming foods rich in proteins. As a result, the market saw profits due to demand and stockpiling. Furthermore, online retail helped with the purchase of products.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing technologies and formulations while maintaining competitive pricing.

Organizations are focusing on the creation of products that help enhance the immunity of individuals. Research activities regarding dosage and a blend of products are emphasized. This is a major source of revenue especially amongst the sports industry to have a better strength.

Key Players:

-

Glanbia plc

-

Abbott Laboratories

-

GNC Holdings Inc.

-

MuscleTech

-

Optimum Nutrition

-

NOW Foods

-

MusclePharm Corporation

-

BSN (Bio-Engineered Supplements and Nutrition)

-

Dymatize

-

Quest Nutrition

In September 2022, Essentia introduced a very sustainable and nutrient-dense protein derived from crickets. The cricket protein was introduced by Essentia under the OmniTM brand, joining the spectrum of nutritious ingredients that already include powdered bone broth and collagen peptides. Crickets are a good source of high-quality protein, vitamins, and the right quantity of each of the nine essential amino acids needed for the body's normal metabolism. It is reported that cricket protein is 50% more digestible than whey protein and is easily absorbed.

In February 2020, the Chicago-based producer of meals, drinks, and supplements with collagen as an ingredient, Vital Proteins, was fully acquired by Nestle Health Science, a division of Nestle SA. The objectives were to increase brand awareness in new markets, intensify R&D, and develop cutting-edge goods.

Chapter 1. Global Animal-based Protein Supplements Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Animal-based Protein Supplements Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Animal-based Protein Supplements Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Animal-based Protein Supplements Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Animal-based Protein Supplements Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Animal-based Protein Supplements Market – By Raw Material

6.1. Introduction/Key Findings

6.2. Hardware

6.3. Software/Platform

6.4. Solution and Services

6.5. Y-O-Y Growth trend Analysis By Component

6.6. Absolute $ Opportunity Analysis By Component , 2024-2030

Chapter 7. Global Animal-based Protein Supplements Market – By Product

7.1. Introduction/Key Findings

7.2. Consumer IoT

7.3. Industrial IoT

7.4. Commercial IoT

7.5. Y-O-Y Growth trend Analysis By Application

7.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Global Animal-based Protein Supplements Market – By Distribution Channel

8.1. Introduction/Key Findings

8.2. On-premise

8.3. Cloud

8.4. Y-O-Y Growth trend Analysis Deployment

8.5. Absolute $ Opportunity Analysis Deployment , 2024-2030

Chapter 9. Global Animal-based Protein Supplements Market – By Application

9.1. Introduction/Key Findings

9.2. Manufacturing

9.3. Healthcare

9.4. Logistics

9.5. Government

9.6. Agriculture

9.7. Others

9.8. Y-O-Y Growth trend Analysis End-use

9.9. Absolute $ Opportunity Analysis End-use , 2024-2030

Chapter 10. Global Animal-based Protein Supplements Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Raw Material

10.1.3. By Product

10.1.4. By Distribution Chanel

10.1.5. By Application

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Raw Material

10.2.3. By Product

10.2.4. By Distribution Channel

10.2.5. By Application

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Raw Material

10.3.3. By Product

10.3.4. By Distribution Channel

10.3.5. By Application

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Raw Material

10.4.3. By Product

10.4.4. By Distribution Channel

10.4.5. By Application

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Raw Material

10.5.3. By Product

10.5.4. By Distribution Channel

10.6.5. By Application

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Animal-based Protein Supplements Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1. Glanbia plc

11.2. Abbott Laboratories

11.3. GNC Holdings Inc.

11.4. MuscleTech

11.5. Optimum Nutrition

11.6. NOW Foods

11.7. MusclePharm Corporation

11.8. BSN (Bio-Engineered Supplements and Nutrition)

11.9. Dymatize

11.10. Quest Nutrition

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Animal-based Protein Supplements Market was valued at USD 16.32 billion and is projected to reach a market size of USD 26.21 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7%.

Increasing health consciousness as well as product diversification and innovation are propelling the Global Animal-based Protein Supplements Market.

Based on Service Provider, the Global Animal-based Protein Supplements Market is segmented into Public and Private.

North America is the most dominant region for the Global Animal-based Protein Supplements Market.

Glanbia plc, Abbott Laboratories, and GNC Holdings Inc. are the key players operating in the Global Animal-based Protein Supplements Market.