Probiotic Drinks Market Size (2025 – 2030)

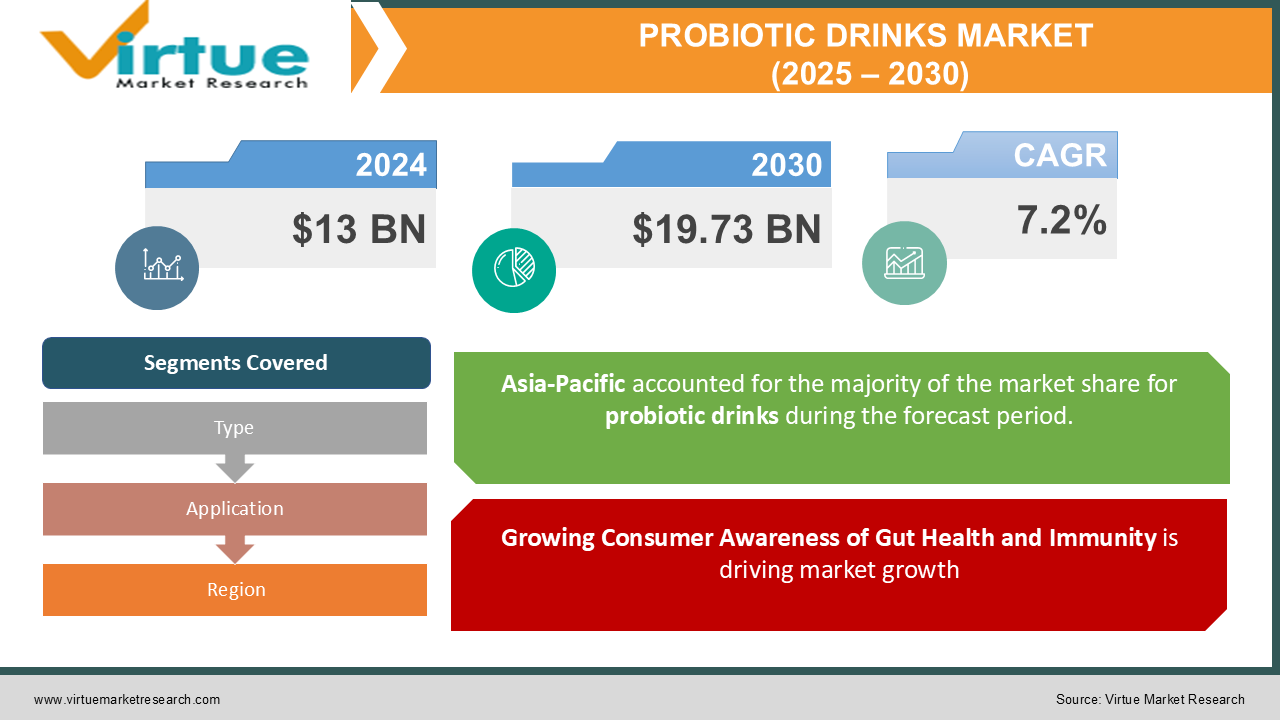

The Global Probiotic Drinks Market was valued at USD 13 billion in 2024 and will grow at a CAGR of 7.2% from 2025 to 2030. The market is expected to reach USD 19.73 billion by 2030.

Probiotic drinks are functional beverages enriched with live microorganisms, primarily aimed at improving gut health and enhancing immunity. These beverages, often available as dairy-based or plant-based drinks, have gained popularity due to growing awareness of digestive health and the increasing demand for natural and healthy beverages. The market’s growth is fueled by a rise in the adoption of healthier lifestyles, innovative product launches, and expanding distribution channels.

Key Market Insights

-

The dairy-based segment holds approximately 65% of the market share, driven by the popularity of yogurt-based drinks like kefir.

-

Plant-based probiotic drinks are witnessing rapid growth, with an estimated CAGR of 9.1%, driven by the rise in veganism and lactose intolerance.

-

Asia-Pacific is the largest market, accounting for 40% of global consumption, with significant contributions from China, Japan, and India due to cultural habits and increasing disposable income.

-

The market saw a surge in demand post-COVID-19 as consumers prioritized immunity-boosting products. Functional health claims and regulatory endorsements by global organizations, such as EFSA and FDA, are positively impacting consumer trust and adoption. Leading players in the market invest significantly in R&D, contributing to innovative flavors, improved formulations, and better packaging.

-

Distribution through e-commerce grew by 12% year-on-year, highlighting a shift in consumer buying patterns toward convenience.

-

Emerging markets in Africa and South America are expected to see growth rates exceeding 8%, fueled by urbanization and improved health awareness.

Global Probiotic Drinks Market Drivers

Growing Consumer Awareness of Gut Health and Immunity is driving market growth:

The increasing global prevalence of digestive disorders and rising consumer interest in maintaining optimal gut health are driving the demand for probiotic drinks. With mounting scientific evidence linking gut microbiota to overall health, consumers are seeking functional beverages that promote a healthy digestive system. In addition, the post-pandemic focus on immunity has amplified interest in probiotic drinks. The ability of these beverages to enhance gut microbiota balance, reduce bloating, and strengthen the immune response makes them a preferred choice among health-conscious individuals. This trend is further bolstered by widespread marketing campaigns that educate consumers on the benefits of probiotics.

Shifting Preferences Towards Natural and Functional Beverages is driving market growth:

Consumers are increasingly moving away from sugar-laden soft drinks to healthier alternatives like probiotic beverages. The functional food and beverage trend has grown due to its perceived benefits in preventing lifestyle-related diseases. Furthermore, the clean-label movement has fueled demand for natural, organic, and minimally processed probiotic drinks. Innovations such as non-dairy probiotics, low-sugar options, and multi-functional drinks that combine probiotics with vitamins or prebiotics cater to diverse dietary needs, further expanding the consumer base.

Expansion of Distribution Channels and Digital Marketing is driving market growth:

The proliferation of modern retail chains and the rise of e-commerce platforms have played a pivotal role in enhancing the availability of probiotic drinks. Key players leverage online platforms not only for sales but also for targeted digital marketing campaigns that reach tech-savvy, health-focused demographics. Subscription models for probiotic drinks are also gaining traction, ensuring regular consumption and fostering brand loyalty. The convenience of doorstep delivery and the growing penetration of online grocery platforms are accelerating market growth.

Global Probiotic Drinks Market Challenges and Restraints

High Costs and Regulatory Challenges is restricting market growth:

The production of probiotic drinks involves advanced processing techniques and quality control measures, leading to higher costs compared to traditional beverages. The market also faces stringent regulatory scrutiny regarding the health claims associated with probiotics. Inconsistencies in regulatory frameworks across regions can create challenges for global manufacturers. For example, while the European Union enforces rigorous assessments under EFSA, other regions may lack harmonized guidelines. These challenges can hinder product launches and market entry for smaller players.

Short Shelf Life and Storage Limitations is restricting market growth:

Probiotic drinks contain live microorganisms that require specific storage conditions to maintain their efficacy. Factors such as temperature sensitivity and limited shelf life pose significant hurdles in transportation and retailing. Improper storage can lead to a reduction in the number of active probiotic strains, compromising product quality and consumer trust. These challenges are particularly pronounced in developing regions where cold chain infrastructure is underdeveloped. Manufacturers must invest in innovative packaging and logistics solutions to address these limitations effectively.

Market Opportunities

The increasing demand for plant-based and vegan products presents significant opportunities in the probiotic drinks market. The growing number of lactose-intolerant and vegan consumers globally has led to the introduction of plant-based probiotic drinks made from almond, soy, oat, and coconut milk. Additionally, the inclusion of diverse flavors, such as tropical fruits and exotic herbs, appeals to a broad consumer base, further driving sales. Emerging markets in Latin America and Africa, where disposable incomes are rising, also provide untapped potential for probiotic drink manufacturers. Collaborations with local distributors, along with awareness campaigns, can help penetrate these regions effectively. Furthermore, the incorporation of cutting-edge technologies, such as encapsulation and fermentation, offers manufacturers a chance to improve strain stability and product efficacy, thereby creating new avenues for market growth.

PROBIOTIC DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Yakult Honsha Co. Ltd., Danone S.A., Nestlé S.A., PepsiCo Inc., Lifeway Foods Inc., Bio-K Plus International Inc., Harmless Harvest, Chobani LLC,The Coca-Cola Company, GT’s Living Foods |

Probiotic Drinks Market Segmentation - By Type

-

Dairy-Based Probiotic Drinks

-

Plant-Based Probiotic Drinks

Dairy-based probiotic drinks dominate the market due to their long-standing popularity and established consumer trust in products like yogurt-based drinks. The plant-based segment, however, is growing rapidly due to the rising trend of veganism and plant-based diets.

Probiotic Drinks Market Segmentation - By Application

-

Digestive Health

-

Immunity Boosting

-

Weight Management

-

Others

Digestive health applications lead the market, accounting for the highest share, as most consumers purchase probiotic drinks to address gut health issues. However, immunity-boosting applications are seeing increased traction, especially post-pandemic.

Probiotic Drinks Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific dominates the global probiotic drinks market, contributing over 40% of the total revenue. This dominance can be attributed to traditional consumption habits, such as fermented milk in Japan and curd in India, combined with growing health consciousness among urban populations. The region also benefits from the presence of major manufacturers and the availability of affordable options for middle-income consumers.

COVID-19 Impact Analysis on the Probiotic Drinks Market

The COVID-19 pandemic had a profound impact on the probiotic drinks market as consumers increasingly sought products to enhance their immune systems. With a heightened focus on overall health and wellness, particularly gut health, people turned to probiotic drinks to strengthen immunity. This surge in demand led to significant growth in sales, both through online platforms and in physical stores. Manufacturers quickly adapted by ramping up production and introducing smaller packaging options, which catered to budget-conscious consumers looking for affordable health solutions. In addition to this, the pandemic accelerated a broader trend of digitalization. Online grocery shopping and subscription-based models gained significant traction, as people became more reliant on home delivery services. The convenience of purchasing probiotic drinks online, combined with the growing demand for health-related products, fueled this shift. However, the market also faced challenges during the pandemic, such as disruptions to supply chains and difficulties in sourcing raw materials. These issues briefly hindered the growth of the probiotic drinks sector, but companies responded by adjusting their logistics and finding alternative sources to meet demand. Looking ahead, the post-pandemic market is expected to continue its upward trajectory. The awareness of the connection between gut health and overall well-being remains strong, and health-conscious consumers are likely to continue prioritizing products that support their immune systems. The growing popularity of functional beverages, coupled with ongoing innovation in product offerings, will drive the continued expansion of the probiotic drinks market. As demand for these health-focused beverages remains robust, the sector is poised for sustained growth in the coming years.

Latest Trends/Developments

Probiotic drinks are undergoing a wave of innovation, driven by the integration of multi-functional ingredients like prebiotics, vitamins, and adaptogens. These additions aim to provide consumers with more holistic health benefits, expanding the appeal of probiotic beverages beyond gut health. In addition to this, there is a noticeable shift toward sustainability within the industry, as manufacturers adopt eco-friendly packaging and implement sustainable sourcing practices. This environmental consciousness resonates with today’s eco-aware consumers, further driving demand for these products. The rise of personalized nutrition has also played a significant role in the evolution of the probiotic drinks market. Companies are increasingly developing targeted probiotic drinks tailored to individual health needs, such as those designed for stress relief or enhanced energy. This move towards customization reflects a broader consumer trend of seeking products that meet their specific wellness goals, offering a more tailored and effective experience. Moreover, collaborations between probiotic brands and foodservice providers are opening up new distribution channels, with probiotic-infused drinks and menu items becoming increasingly common in cafes, restaurants, and other dining establishments. These partnerships not only expand the reach of probiotic drinks but also introduce consumers to the benefits of probiotics in more everyday settings. Technological advancements are also playing a key role in the market’s evolution. Innovations such as microencapsulation are improving the stability and efficacy of probiotic drinks, ensuring that the beneficial bacteria remain viable throughout the product’s shelf life. These advancements give manufacturers a competitive edge, enabling them to offer higher-quality, longer-lasting products that meet the growing demand for functional beverages. As a result, the probiotic drinks market is poised for continued growth, fueled by innovation, sustainability, and personalization.

Key Players

-

Yakult Honsha Co. Ltd.

-

Danone S.A.

-

Nestlé S.A.

-

PepsiCo Inc.

-

Lifeway Foods Inc.

-

Bio-K Plus International Inc.

-

Harmless Harvest

-

Chobani LLC

-

The Coca-Cola Company

-

GT’s Living Foods

Chapter 1. Probiotic Drinks Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Probiotic Drinks Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Probiotic Drinks Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Probiotic Drinks Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Probiotic Drinks Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Probiotic Drinks Market – By Type

6.1 Introduction/Key Findings

6.2 Dairy-Based Probiotic Drinks

6.3 Plant-Based Probiotic Drinks

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Probiotic Drinks Market – By Application

7.1 Introduction/Key Findings

7.2 Digestive Health

7.3 Immunity Boosting

7.4 Weight Management

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Probiotic Drinks Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Probiotic Drinks Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Yakult Honsha Co. Ltd.

9.2 Danone S.A.

9.3 Nestlé S.A.

9.4 PepsiCo Inc.

9.5 Lifeway Foods Inc.

9.6 Bio-K Plus International Inc.

9.7 Harmless Harvest

9.8 Chobani LLC

9.9 The Coca-Cola Company

9.10 GT’s Living Foods

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Probiotic Drinks Market was valued at USD 13 billion in 2024 and will grow at a CAGR of 7.2% from 2025 to 2030. The market is expected to reach USD 19.73 billion by 2030.

Key drivers include growing consumer awareness of gut health, the shift towards functional beverages, and the expansion of digital marketing and distribution channels.

The market is segmented by type (dairy-based and plant-based) and by application (digestive health, immunity boosting, weight management, and others).

Asia-Pacific is the dominant region, contributing over 40% of the global revenue due to cultural habits and increasing health awareness.

Leading players include Yakult Honsha Co. Ltd., Danone S.A., Nestlé S.A., PepsiCo Inc., and Lifeway Foods Inc.