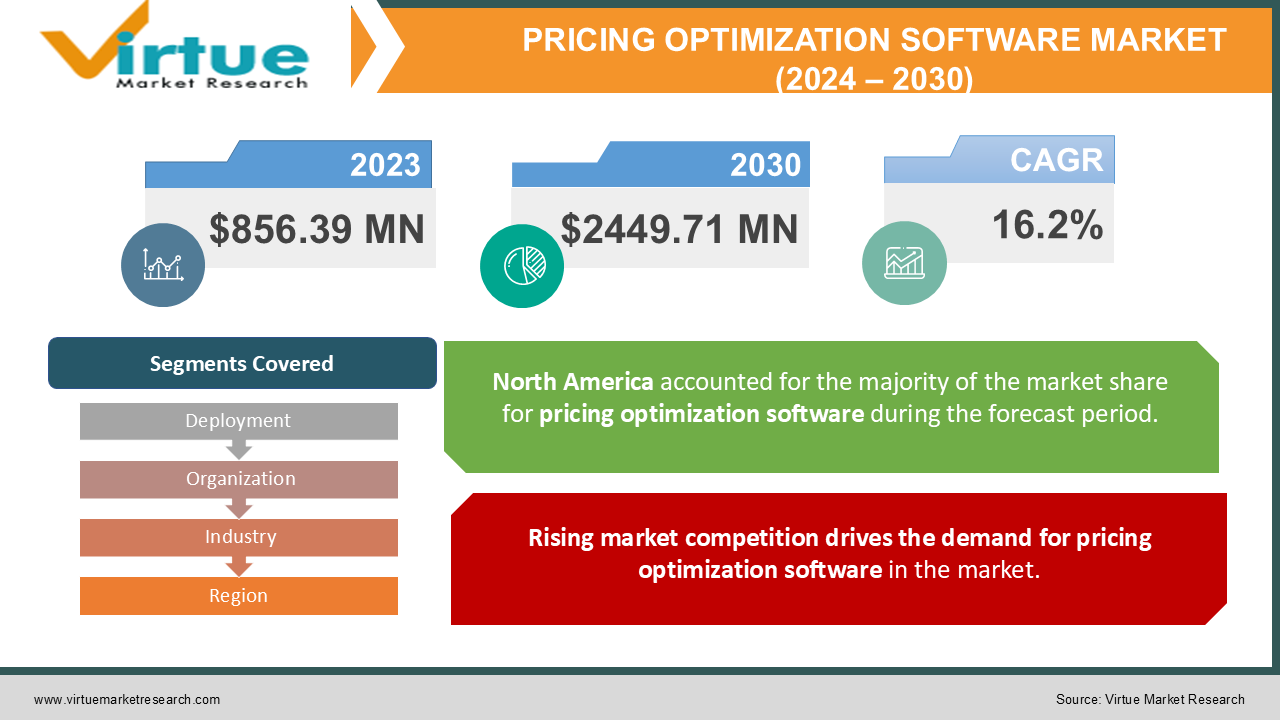

Pricing Optimization Software Market Size (2024 – 2030)

The Pricing Optimization Software Market is valued at USD 856.39 million in 2023 and is projected to reach a market size of USD 2449.71 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 16.2%.

Earlier methods of price optimization involved manually attracting customers through hoardings, sales, and discounts. In addition, many businesses require professionals to manage and forecast prices. However, technological advancements reduced human intervention and enabled businesses to automate pricing strategies using technology. These include the use of AI and machine-learning-driven price optimization software that managed business inventory, and cost structure, performed historical price analysis, analyzed competitor’s pricing, and others. In addition, it offers forecasting modeling that enables businesses to analyze the profit or losses of a particular price strategy.

The future holds positive for the pricing optimization software market, as businesses opt for more smart solutions that completely automate their pricing strategy, which includes automated marketing, sending promotional emails, providing offers to customers, analyzing inventory for low or excess stocks, and then deciding price strategy accordingly, and others.

Key Market Insights:

- As per Prisync, 65% of consumers consider e-commerce pricing.

- Further, 86% of consumers believe that it is necessary to compare prices online from different sellers.

- Furthermore, as per Prisync company’s findings, 54% of online shoppers are more likely to purchase cart-abandoned products online, if they are offered at a lower price.

- As per E-marketer’s blog 30% of internet users in the US have purchased directly from a social media platform.

Pricing Optimization Software Market Drivers:

Rising market competition drives the demand for pricing optimization software in the market.

Market saturation induced companies to improve their marketing and pricing strategies helped them to stand out from the crowded marketplace. In such a case, pricing optimization software proved beneficial for them, as the software allows tracking of competitor pricing of products, real-time updates on average market prices, and personalized pricing recommendations for the company’s product.

Moreover, it also enabled them to monitor customer behavior toward sales and discounts for their products and helped them leverage their position in the market. In addition to that, inventory management, cost management, cross-selling, and upselling features of the software helped companies devise pricing strategies for excess stocks in inventories, manage the cost of premium products, and offer complementary products to maintain customer relationships with the brand.

The rapidly expanding e-commerce industry has boosted the market demand for pricing optimization software.

E-commerce has provided opportunities for millions of businesses to reach customers and expand their market base. Furthermore, this led to the production of more or less similar goods at varying prices, leading to a shift in consumers’ purchase of affordable products with high quality. This has further increased the demand for pricing optimization software by e-commerce businesses that enable them to differentiate their pricing strategies from their competitors and gain a larger share of the market.

Many of this pricing strategies provided by pricing optimization software include bringing down the prices of premium products for a limited period, analyzing the price elasticity of a product based on the market situation, offering specialized offers to exclusive consumers based on their membership, providing free goodies with the products, offering personalized sales & discounts, which include applying coupon code, participating in referrals, and others.

Pricing Optimization Software Market Restraints and Challenges:

Inaccuracy in deciding on price strategy can decrease the demand for pricing optimization software in the market. The pricing optimization software is built using automated tools and algorithms that can sometimes result in inaccurate pricing strategies and forecasted models, impacting the profitability of the company.

Moreover, constant fluctuations in market prices can become difficult to track and capture by the pricing optimizing software, leading to difficulty in devising a pricing strategy for a company.

Pricing Optimization Software Market Opportunities:

The Pricing Optimization Software Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing demand for marketing and advertising of new products and services in the market is predicted to develop the market for pricing optimization software and enhance its future growth opportunities.

GLOBAL PRICING OPTIMIZATION SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

16.2% |

|

Segments Covered |

By Deployment, Organization, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Prisync, Pricebeam, Blue Yonder Price Optimization, Competera, Intelligent Node, Price2spy, OTA Insight, Priceva, Revionics, Seller Public |

SEGMENTATION ANALYSIS

Pricing Optimization Software Market Segmentation: By Deployment

-

Cloud

-

On-Premise

In 2022, cloud-based occupied the highest share of about 25% in the market for pricing optimization software. Cloud-based software offers greater scalability, increased flexibility, and accessibility to companies that enable them to operate and manage their business operations easily from any device.

Moreover, cloud-based pricing optimization software saves time and money, as it is cost-effective in terms of subscription minimizes the company’s task of software maintenance, as it is managed by third-party hosting platforms, and further enables them to focus more on the core tasks. Moreover, it offers a secured network to companies and prevents the risk of customer data leaks.

On-premise is the fastest-growing segment during the forecast period. On-premise pricing optimization software is managed and stored on local servers of companies and therefore offers enhanced security and increased control over the company’s confidential data.

Pricing Optimization Software Market Segmentation: By Organization

-

SMEs

-

Large Enterprises

In 2022, large enterprises occupied the highest share of about 36% in the market. Large enterprises, typically finance, tech, and e-commerce companies require price-optimizing software for managing their products & and services, for managing their budget, and for expanding their market base. Moreover, they utilize specialized price optimization software with analytics and reporting capabilities that offer them unique pricing strategies that help them increase their market base. Often, these software are equipped with automated research abilities that help them understand competitor pricing and optimize their pricing strategies.

SMEs are the fastest-growing segment during the forecast period. Small and medium-sized businesses typically include small retailers, local e-commerce companies, small or medium-sized advertising and marketing agencies, and others. Due to their limited budget, they utilize pricing-optimizing software with basic or paid versions that enable them to leverage the pricing of their products in the market. They usually use pricing-optimizing software for launching new products or services in the market that enable them to capture the attention of the consumer in a limited period.

Pricing Optimization Software Market Segmentation: By Industry

-

E-commerce

-

Healthcare

-

Financial

-

Telecom

-

Entertainment

-

Others

In 2022, e-commerce occupied the highest share of about 29.5% in the market. E-commerce companies are the major users of prime optimization software, as they are required to deal with a wide range of products to cater to various customer needs. Furthermore, many e-commerce companies use cloud-based specialized software that focuses on tracking and analyzing market prices of products and devising pricing strategies for their products. Moreover, integration with marketing tools help e-commerce companies to increase the demand for their product by placing their product listings with limited edition and limited period offers to customers, which eventually help them increase their sales.

The financial segment is the fastest-growing segment during the forecast period. The financial sector is highly influenced by pricing decisions in the market. They are required to optimize prices for their financial products and services such as insurance services, loan services, credit & and risk management services, and others. Moreover, they use premium pricing optimization software that complies with the financial laws of the nation and helps in analyzing price fluctuations in the market.

Additionally, this software helps to track and analyze prevailing interest rates and stock market fluctuations, which can help the financial sector such as banks and other financial institutions in preparing the pricing strategies for their financial products & services. Moreover, pricing optimization software designed specifically for the financial sector ensures a robust encrypted data network that prevents customer data from online threats.

Pricing Optimization Software Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle-East & Africa

In 2022, North America occupied the highest share of about 31% in the market. Rising demand for advertising and marketing of products & services from the e-commerce sector and the booming financial services sector with increased consumer demand for financial risk assessment and management services, portfolio management services, and others have contributed to the growth of pricing optimization software in the region.

Asia-Pacific is the fastest-growing sector during the forecast period. The fast booming e-commerce and retail sector and the emergence of various start-ups in recent times, demanding price optimization software for launching their product or service in the market, have contributed to the demand for pricing optimization software in the region.

COVID-19 Impact Analysis on the Pricing Optimization Software Market:

The pandemic had a significant impact on the pricing optimization software market. Due to increasing trends in digitization, consumers shifted towards online platforms for almost everything, which included shopping, working, studying, streaming movies, and others. This benefitted e-commerce companies & websites the most, as users spent most of their time online, which helped e-commerce sectors increase their sales during the pandemic.

Furthermore, remote working further increased the usage of pricing optimization software, as it enabled them to remotely monitor, track, and analyze prevailing market prices as per consumer’s budget and consumer behavior towards it from any device. In addition, e-pharmacy companies and online grocery platforms benefitted from the pricing optimization software, as consumers shifted their budget toward essential items such as food, medicine, sanitizers, and others.

Latest Developments:

- The market for pricing optimizing strategies is witnessing an upward trend due to constant developments in the software industry and increased use of AI and machine learning for setting pricing strategies. Moreover, rising business demand for automation tools has further propelled the development of pricing optimization software in the market.

Key Players:

-

Prisync

-

Pricebeam

-

Blue Yonder Price Optimization

-

Competera

-

Intelligent Node

-

Price2spy

-

OTA Insight

-

Priceva

-

Revionics

-

Seller Public

- In January 2023, First Insight launched price optimization software for supporting retailers and brands in devising pricing strategies. The software caters to the wide needs of businesses such as inventory management, inventory and supply chain logistics, customer retention & acquisition, store operations, and others. Moreover, it can help businesses in promotional pricing, marking down price points for their products, and gathering feedback from customers for further improvement.

- In April 2022, Zilliant launched PriceIQ, which is a transparent price optimization application that allows businesses to improve their market position. The features of the software include calculation of price elasticity, searching for drivers that influence price, AI-optimized speed, margin and revenue prediction, and others. Additionally, it allows publishing of prices immediately into CRM, CPQ, and ERP platforms.

Chapter 1. Pricing Optimization Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pricing Optimization Software Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pricing Optimization Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pricing Optimization Software Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pricing Optimization Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pricing Optimization Software Market – By Deployment

6.1 Introduction/Key Findings

6.2 Cloud

6.3 On-Premise

6.4 Y-O-Y Growth trend Analysis By Deployment

6.5 Absolute $ Opportunity Analysis By Deployment, 2024-2030

Chapter 7. Pricing Optimization Software Market – By Organization

7.1 Introduction/Key Findings

7.2 SMEs

7.3 Large Enterprises

7.4 Y-O-Y Growth trend Analysis By Organization

7.5 Absolute $ Opportunity Analysis By Organization, 2024-2030

Chapter 8. Pricing Optimization Software Market – By Industry

8.1 Introduction/Key Findings

8.2 E-commerce

8.3 Healthcare

8.4 Financial

8.5 Telecom

8.6 Entertainment

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Industry

8.9 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 9. Pricing Optimization Software Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Deployment

9.1.3 By Organization

9.1.4 By Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Deployment

9.2.3 By Organization

9.2.4 By Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Deployment

9.3.3 By Organization

9.3.4 By Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Deployment

9.4.3 By Organization

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Deployment

9.5.3 By Organization

9.5.4 By Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Pricing Optimization Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Prisync

10.2 Pricebeam

10.3 Blue Yonder Price Optimization

10.4 Competera

10.5 Intelligent Node

10.6 Price2spy

10.7 OTA Insight

10.8 Priceva

10.9 Revionics

10.10 Seller Public

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Pricing Optimization Software Market is valued at USD 856.39 million in 2023 and is projected to reach a market size of USD 2449.71 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 16.2%.

Rising market competition and the rapidly expanding e-commerce industry are the market drivers of the Pricing Optimization Software market.

Cloud and On-Premise, are the segments under the Pricing Optimization Software Market by deployment.

North America is the most dominant country for the Pricing Optimization Software Market.

Asia-Pacific is the fastest-growing country in the Pricing Optimization Software Market.