Smart Retail Market Size (2024 – 2030)

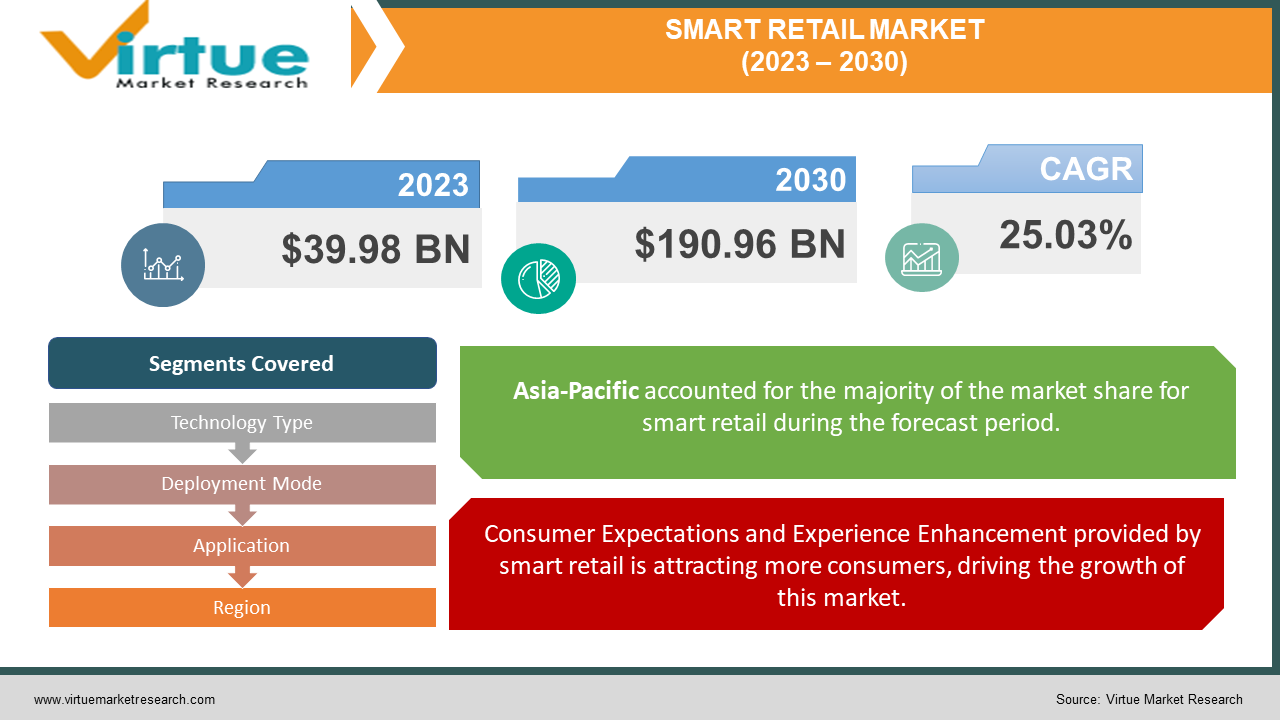

The Smart Retail Market was valued at USD 39.98 Billion in 2023 and is projected to reach a market size of USD 190.96 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 25.03%.

The smart retail market encompasses a range of technological advancements and innovations aimed at transforming the retail experience. This sector integrates various solutions such as IoT sensors, AI-driven analytics, RFID tracking, and mobile payment systems to optimize inventory management, personalize customer experiences, and streamline operations. These technologies facilitate data-driven insights for retailers, enabling them to understand consumer behavior, enhance engagement through personalized marketing, implement efficient supply chain management, and create seamless omnichannel experiences. The smart retail market continues to evolve rapidly, driven by the growing demand for enhanced customer experiences and operational efficiency across the global retail landscape.

Key Market Insights:

Increasing internet usage is a big reason why the market is growing. More people are using smart devices, and as technology gets better, smaller shops can use it too. For example, from 2016 to 2021, the number of people using the Internet went up from 3,215 million in 2016 to 4,900 million in 2021.

People want more from stores, so shops are teaming up with tech companies to improve. These partnerships help shops get better with technology and improve how they work. Stores are working more with tech companies to create good, long-lasting solutions, helping the market grow.

People between 18 and 50 years old are buying a lot, especially in beauty and personal care. All these things together are helping the beauty and personal care market grow even more.

Smart Retail Market Drivers:

Consumer Expectations and Experience Enhancement provided by smart retail is attracting more consumers, driving the growth of this market.

Increasingly tech-savvy consumers are demanding personalized and seamless shopping experiences. Smart retail technologies cater to these expectations by offering personalized recommendations, interactive in-store experiences, and convenient payment options. Consumers seek convenience, customization, and efficiency in their shopping journeys, driving retailers to adopt smart technologies to meet these demands and enhance overall customer satisfaction.

Data Analytics and Operational Efficiency in smart retail technology are helping the market to boom.

Retailers are leveraging data-driven insights derived from smart retail technologies to optimize their operations. These technologies collect vast amounts of data from various touchpoints such as online platforms, in-store interactions, and inventory management systems. Advanced analytics enable retailers to gain actionable insights into consumer behavior, inventory trends, and operational efficiencies. By utilizing these insights, retailers can make informed decisions about inventory stocking, marketing strategies, and resource allocation, thereby increasing operational efficiency and profitability.

Smart Retail Market Restraints and Challenges:

Data Security and Privacy Concerns associated with the smart retail market are a major hindrance to the growth of the market.

The implementation of smart retail technologies involves the collection and utilization of vast amounts of consumer data. Ensuring the security and privacy of this data presents a significant challenge. There's a constant risk of cyber threats, data breaches, and potential misuse of sensitive customer information. Striking a balance between leveraging consumer data for personalized experiences while safeguarding privacy rights requires robust encryption methods, compliance with evolving regulations like GDPR, and building consumer trust through transparent data-handling practices.

Integration and Compatibility Issues might pose challenges for retailers and businesses in the smart retail market.

The diverse array of smart retail technologies often originates from different vendors, leading to compatibility and integration challenges. Retailers might face difficulties in integrating these technologies seamlessly into existing infrastructure. Ensuring interoperability between various systems, legacy software, and new technological solutions becomes essential. Standardization efforts and developing open-source platforms can help mitigate these challenges by fostering compatibility and smoother integration processes. Additionally, navigating the complexities of combining offline and online retail components in an omnichannel environment adds another layer of complexity to integration efforts.

Smart Retail Market Opportunities:

The smart retail market presents a lot of opportunities driven by technological advancements and evolving consumer preferences. Leveraging data analytics, AI-driven insights, and IoT devices, retailers can personalize customer experiences, optimize inventory management, and refine supply chain operations. The integration of augmented reality and virtual reality technologies offers immersive shopping experiences, while contactless payment systems and seamless omnichannel strategies cater to changing consumer behaviors. Moreover, the expansion of smart devices and connectivity paves the way for innovative approaches like smart shelves, predictive maintenance, and location-based marketing, fostering a landscape ripe for enhanced customer engagement and operational efficiency.

SMART RETAIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

25.03% |

|

Segments Covered |

By Technology Type, Deployment Mode, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amazon, Alibaba Group, IBM, Microsoft, Google, NCR Corporation, Cisco Systems, Intel Corporation, Adobe, Zebra Technologies |

Smart Retail Market Segmentation: By Technology Type:

-

IoT devices

-

AI and machine learning solutions

-

RFID systems

-

Beacon technology

-

Analytics software

-

Augmented reality (AR)/virtual reality (VR)

The largest segment in the smart retail market by technology type is often AI and Machine Learning Solutions having a market share of 68%. AI's dominance stems from its pivotal role in driving data-driven decision-making, personalized customer experiences, and operational efficiency. AI and machine learning algorithms analyze vast amounts of data, enabling retailers to forecast demand accurately, optimize inventory levels, personalize marketing strategies, and enhance overall customer engagement. Its adaptability across various retail functions, from supply chain management to customer service, positions AI as a foundational technology driving transformative changes in the industry, leading to its prominence as the largest segment in the smart retail market. The fastest-growing segment in the smart retail market by technology type is also AI and Machine Learning Solutions expected to grow at a CAGR of 23%. This rapid growth is primarily attributed to the transformative potential of AI-driven tools in revolutionizing retail operations. AI enables retailers to harness vast amounts of data, providing actionable insights into consumer behavior, preferences, and trends. With machine learning algorithms, retailers can deliver personalized marketing strategies, optimize inventory management, predict demand accurately, and automate various processes, resulting in improved operational efficiency and enhanced customer experiences.

Smart Retail Market Segmentation: By Deployment Mode:

-

Cloud-based solutions

-

On-premises installations

-

Hybrid models

The largest segment by deployment mode in the smart retail market is Cloud-based solutions. Cloud deployment offers scalability, flexibility, and cost-effectiveness for retailers. It enables seamless integration of various technologies, facilitates remote access to data and applications, and allows for quicker implementation of updates or new features. Cloud-based solutions also streamline collaboration among different stakeholders and vendors in the retail ecosystem. The fastest-growing segment by deployment mode in the smart retail market is also the Cloud-based Solutions segment. The adoption of cloud-based deployment has been accelerating due to several factors. Cloud-based deployments facilitate rapid implementation and accessibility to advanced analytics, AI, and IoT capabilities, enabling retailers to swiftly adapt to changing market dynamics, customer preferences, and operational needs. The scalability and agility provided by cloud-based solutions have been driving its rapid growth within the smart retail market, offering a competitive edge to retailers seeking efficient and innovative ways to enhance their operations and customer experiences.

Smart Retail Market Segmentation: By Application:

-

Inventory Management Solutions

-

Customer Experience Enhancement

-

Supply Chain Optimization

-

Smart Payment Systems

-

Smart Shelves and Product Tracking

-

Personalized Marketing and Recommendations

The largest segment by application in the smart retail market is typically Customer Experience Enhancement having a market share of 59%. This segment encompasses a wide range of technologies and strategies aimed at optimizing the customer journey within retail environments. It includes initiatives such as personalized marketing, augmented reality (AR) and virtual reality (VR) experiences, interactive displays, and various engagement tools designed to enhance customer satisfaction and loyalty. Retailers prioritize this segment as delivering exceptional customer experiences becomes increasingly crucial in staying competitive and building lasting relationships with consumers in the evolving retail landscape. The fastest-growing segment by application in the smart retail market is Customer Experience Enhancement. This surge in growth is propelled by the increasing emphasis on delivering exceptional and personalized experiences to consumers. The demand for unique and engaging shopping experiences has intensified, prompting retailers to invest significantly in enhancing customer interactions both online and in physical stores.

Smart Retail Market Segmentation: Regional Analysis:

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific stands out as the largest region in the smart retail market having a market share of 39%. This dominance is primarily attributed to the region's robust technological adoption, particularly in countries like China, Japan, and South Korea, where there's a thriving tech infrastructure and a strong inclination toward innovation. The expanding e-commerce landscape, rapid urbanization, and a tech-savvy consumer base have fueled the adoption of smart retail technologies in various sectors. The Asia-Pacific region stands out as the fastest-growing region in the smart retail market. This growth is primarily attributed to several factors, including rapid urbanization, expanding populations, and increasing technology adoption across retail sectors. Government initiatives supporting smart city developments, coupled with robust investments in IoT, AI, and automation technologies, further accelerate the adoption of smart retail solutions. The burgeoning e-commerce sector, coupled with a rising middle-class population demanding enhanced shopping experiences, drives the swift expansion of smart retail initiatives throughout the Asia-Pacific region.

COVID-19 Impact Analysis on the Smart Retail Market:

The COVID-19 pandemic acted as a catalyst for transformative changes in the smart retail market. With lockdowns and social distancing measures, there was an accelerated adoption of contactless technologies, mobile payments, and online shopping. Retailers prioritized health and safety, implementing AI-driven solutions for crowd management, occupancy tracking, and sanitation monitoring. This crisis emphasized the importance of omnichannel strategies, prompting retailers to strengthen their online presence and implement curbside pickup options. Data analytics became crucial for understanding shifting consumer behaviors and preferences, driving the demand for smart retail solutions that offer real-time insights for agile decision-making. While initially disruptive, the pandemic propelled the smart retail market towards greater innovation and resilience in adapting to evolving consumer needs.

Latest Trends/ Developments:

One significant trend in the smart retail market is the rise of unified commerce. Unified commerce goes beyond omnichannel retailing by integrating various sales channels like online, brick-and-mortar, and mobile into a seamless, unified experience for customers. It breaks down the barriers between different retail channels, providing consumers with a consistent and personalized shopping journey regardless of how they interact with the brand. This trend emphasizes the convergence of physical and digital retail spaces, enabling retailers to offer a cohesive experience, from browsing products online to making purchases in-store or via mobile apps.

A notable advancement is the increasing use of Artificial Intelligence and Machine Learning in optimizing inventory management and supply chain operations. Retailers are leveraging AI-powered predictive analytics to forecast demand accurately, manage inventory levels more efficiently, and minimize overstock or stockouts. Machine learning algorithms analyze historical data, market trends, and consumer behavior patterns to provide actionable insights, enabling retailers to make informed decisions in real time. This development significantly enhances operational efficiency, reduces costs, and ensures that products are available to meet customer demand, both online and in physical stores.

Key Players:

-

Amazon

-

Alibaba Group

-

IBM

-

Microsoft

-

Google

-

NCR Corporation

-

Cisco Systems

-

Intel Corporation

-

Adobe

-

Zebra Technologies

In October 2023, ECS Industrial Computer Co., Ltd. (ECSIPC), a prominent brand renowned for motherboards and mini PCs, unveiled its involvement in Infocomm India 2023, marking a strategic move in its expanded presence within the Indian market. The spotlight will be on showcasing the latest LIVA Z5 series Mini PCs, a range of industry-specific motherboards, and a cutting-edge Smart Retail solution.

In January 2023, Microsoft's "Resilient Retail” initiative focused on enhancing in-store customer experiences by empowering employees with advanced digital tools and addressing supply chain disruptions. In collaboration with AiFi, Microsoft launched "Smart Store Analytics," a computer vision-based system for automated stores. This tool tracks shopping behavior from product discovery to purchase, providing insights through the Microsoft Cloud for Retail platform. Smart Store Analytics enables operators to optimize store layout and enhance product recommendations based on new customer behavior signals.

Chapter 1. Smart Retail Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Retail Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Retail Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Retail Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Retail Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Retail Market – By Technology Type

6.1 Introduction/Key Findings

6.2 IoT devices

6.3 AI and machine learning solutions

6.4 RFID systems

6.5 Beacon technology

6.6 Analytics software

6.7 Augmented reality (AR)/virtual reality (VR)

6.8 Y-O-Y Growth trend Analysis By Technology Type

6.9 Absolute $ Opportunity Analysis By Technology Type, 2024-2030

Chapter 7. Smart Retail Market – By Deployment Mode

7.1 Introduction/Key Findings

7.2 Cloud-based solutions

7.3 On-premises installations

7.4 Hybrid models

7.5 Y-O-Y Growth trend Analysis By Deployment Mode

7.6 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 8. Smart Retail Market – By Application

8.1 Introduction/Key Findings

8.2 Inventory Management Solutions

8.3 Customer Experience Enhancement

8.4 Supply Chain Optimization

8.5 Smart Payment Systems

8.6 Smart Shelves and Product Tracking

8.7 Personalized Marketing and Recommendations

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Smart Retail Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology Type

9.1.3 By Deployment Mode

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology Type

9.2.3 By Deployment Mode

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology Type

9.3.3 By Deployment Mode

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology Type

9.4.3 By Deployment Mode

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology Type

9.5.3 By Deployment Mode

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Smart Retail Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Quest Diagnostics Inc.

10.2 Centogene N.V.

10.3 Invitae Corp.

10.4 3billion, Inc.

10.5 Arup Laboratories

10.6 Eurofins Scientific

10.7 Strand Life Sciences

10.8 Ambry Genetics

10.9 Perkin Elmer, Inc.

10.10 Macrogen, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Smart Retail Market was valued at USD 39.98 Billion in 2023 and is projected to reach a market size of USD 190.96 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 25.03%.

Consumer Expectations and Experience Enhancement provided by smart retail along with Data Analytics and Operational Efficiency are drivers of the Smart Retail market

Based on components, the Smart Retail Market is segmented into Cloud-based solutions, On-premises installations, and Hybrid models

Asia Pacific is the most dominant region for the Smart Retail Market.

Amazon, Alibaba Group, IBM, Microsoft, and Google are a few of the key players operating in the Smart Retail Market.