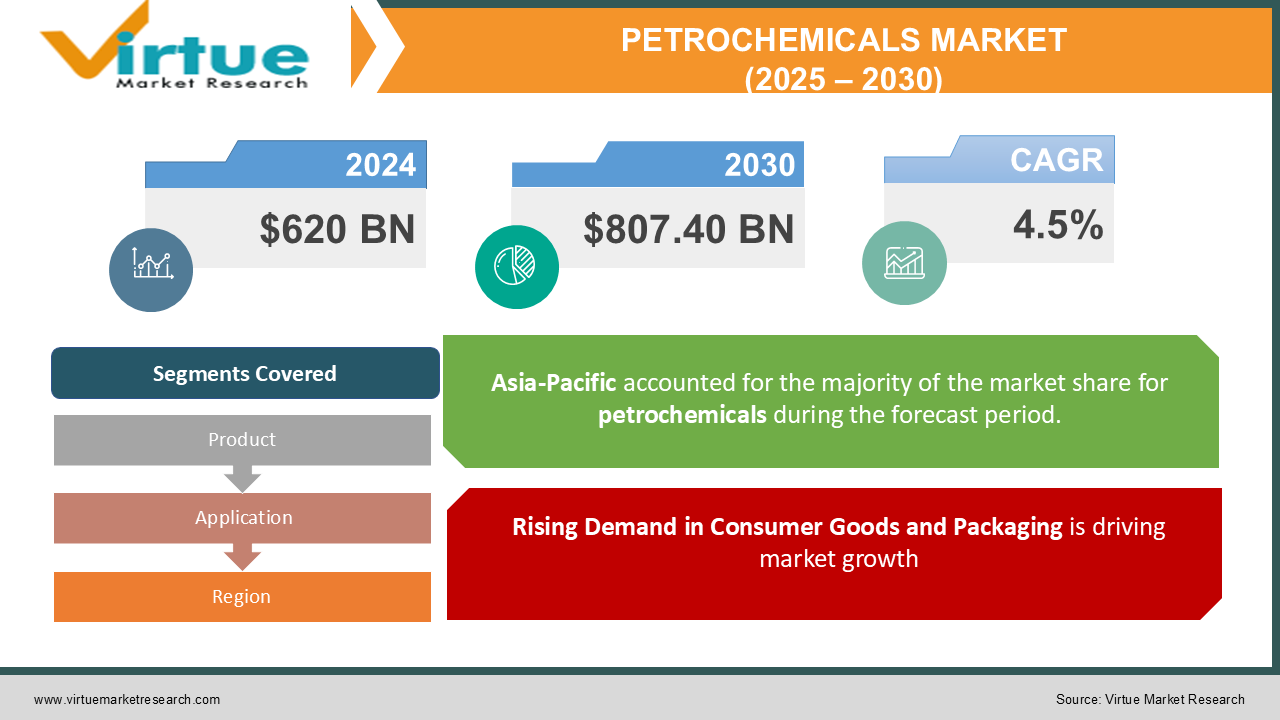

Petrochemicals Market Size (2025 – 2030)

The Global Petrochemicals Market was valued at USD 620 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2030. The market is expected to reach USD 807.40 billion by 2030.

Petrochemicals are chemical products derived from hydrocarbons such as crude oil and natural gas. They form the backbone of many industries, including plastics, chemicals, textiles, automotive, construction, and agriculture. With increasing industrialization and urbanization, the demand for petrochemicals continues to rise globally. The market growth is further driven by advancements in technology and the rising focus on sustainable and bio-based alternatives.

Key Market Insights

-

In 2024, the global production of petrochemicals surpassed 1.2 billion metric tons, with ethylene and propylene being the most produced chemicals.

-

The plastics segment accounts for over 50% of the total demand for petrochemicals, with polyethylene and polypropylene being the most widely used polymers.

- Ethylene, a key petrochemical, is expected to grow at a CAGR of 5% during the forecast period due to its widespread application in polyethylene production.

Global Petrochemicals Market Drivers

Rising Demand in Consumer Goods and Packaging is driving market growth:

The demand for petrochemicals is largely driven by their extensive use in the production of plastics, which are integral to consumer goods and packaging industries. Polyethylene and polypropylene, derived from petrochemicals, are widely used in packaging applications such as food containers, bottles, and wraps due to their lightweight, durability, and cost-effectiveness. The rise of e-commerce has further amplified the need for efficient and sustainable packaging solutions, driving the demand for flexible plastics. Additionally, the global shift toward single-use plastics, despite environmental concerns, continues to bolster short-term market growth. Innovations in biodegradable plastics, supported by petrochemical derivatives, are emerging as a viable solution to address sustainability challenges while meeting the rising demand.

Industrialization and Infrastructure Development is driving market growth:

Rapid industrialization and urbanization in emerging economies are fueling the demand for petrochemicals in construction and infrastructure projects. Products like polyvinyl chloride (PVC) and polystyrene, derived from petrochemicals, are essential in manufacturing pipes, insulation materials, and flooring. Developing regions, particularly in Asia-Pacific and the Middle East, are experiencing a surge in infrastructure development projects, including housing, transportation, and energy facilities. This creates a robust demand for petrochemical-based products. Additionally, the growing emphasis on green and sustainable construction materials is driving innovation in the sector, with petrochemical derivatives playing a vital role in enhancing the performance and energy efficiency of construction products.

Advancements in Feedstock Flexibility is driving market growth:

The petrochemical industry is undergoing significant transformation with the shift toward diverse feedstocks, such as natural gas, shale gas, and biomass. This flexibility in raw material sourcing not only ensures cost efficiency but also reduces dependence on traditional crude oil. Natural gas-based production, in particular, is gaining traction due to its lower carbon footprint and abundant availability in regions like North America. Technological advancements, such as steam cracking and catalytic reforming, are further optimizing feedstock utilization and boosting production efficiency. These innovations are enabling producers to adapt to changing market dynamics, mitigate price volatility, and explore sustainable alternatives to traditional petrochemical manufacturing processes.

Global Petrochemicals Market Challenges and Restraints

Environmental Impact and Regulatory Challenges is restricting market growth:

The petrochemical industry faces mounting pressure to address its environmental impact, particularly with regard to carbon emissions, plastic waste, and pollution. Petrochemicals are derived from fossil fuels, contributing significantly to greenhouse gas emissions during production and disposal stages. Governments worldwide are implementing stringent regulations to curb emissions and reduce plastic waste. Initiatives like the European Green Deal and China's plastic ban aim to minimize the environmental footprint of petrochemical products. While these regulations encourage innovation and sustainability, they also pose challenges for traditional manufacturers, who must invest heavily in cleaner technologies and recycling infrastructure. The lack of globally unified regulations adds complexity, as companies need to adapt to varying compliance standards across regions.

Volatility in Feedstock Prices is restricting market growth:

The petrochemical industry's reliance on raw materials such as crude oil and natural gas makes it highly susceptible to feedstock price fluctuations. Geopolitical tensions, production cuts by oil-producing nations, and supply-demand imbalances can lead to significant price volatility. This unpredictability affects production costs and profitability, particularly for manufacturers dependent on imported feedstocks. The rise of alternative feedstocks, such as bio-based and recycled materials, provides opportunities but also increases production costs due to limited scalability and higher initial investment requirements. Navigating these challenges requires strategic planning, diversification of feedstock sources, and adoption of advanced technologies to enhance production efficiency and cost management.

Market Opportunities

The transition toward a circular economy presents significant growth opportunities for the petrochemical market. Recycling and reuse of petrochemical products, particularly plastics, are gaining momentum globally. Advanced recycling technologies, such as chemical recycling, are enabling the conversion of plastic waste into high-quality petrochemical feedstocks, reducing environmental impact and dependence on virgin raw materials.

Emerging economies in Asia, Africa, and Latin America offer untapped markets for petrochemical products in packaging, construction, and automotive applications. As urbanization and industrialization accelerate in these regions, the demand for durable, lightweight, and cost-effective materials is expected to rise.

Moreover, the development of bio-based petrochemicals, derived from renewable resources like corn and sugarcane, aligns with global sustainability goals. Companies investing in research and development to scale up the production of bio-based alternatives can gain a competitive edge. Additionally, the increasing adoption of petrochemicals in renewable energy technologies, such as wind turbine components and solar panels, opens new avenues for market growth.

PETROCHEMICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Dow Chemical Company, ExxonMobil Corporation, SABIC, LyondellBasell Industries, INEOS Group, Reliance Industries Limited, Chevron Phillips Chemical, TotalEnergies SE, Sinopec |

Petrochemicals Market Segmentation - By Product

-

Ethylene

-

Propylene

-

Benzene

-

Methanol

-

Xylene

-

Others

Ethylene dominates the product segment, accounting for the largest market share. Its wide-ranging applications in the production of polyethylene, PVC, and ethylene oxide make it a critical component of the petrochemical industry.

Petrochemicals Market Segmentation - By Application

-

Plastics

-

Construction

-

Automotive

-

Textiles

-

Pharmaceuticals

-

Others

Plastics hold the dominant position in the application segment, driven by their extensive use in packaging, consumer goods, and industrial applications. The versatility, durability, and cost-effectiveness of plastic products contribute to their widespread adoption.

Petrochemicals Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing region in the petrochemical market, accounting for more than 45% of global revenue. Rapid industrialization, urbanization, and population growth in countries like China, India, and Southeast Asia drive the demand for petrochemicals in various sectors, including packaging, construction, and automotive. The region's robust manufacturing base and significant investments in petrochemical plants further bolster its market dominance.

COVID-19 Impact Analysis on the Petrochemicals Market

The COVID-19 pandemic had a profound and dual impact on the petrochemical market. In the early stages, stringent lockdowns and movement restrictions disrupted global supply chains, leading to delays in production and a sharp decline in industrial activity. This caused significant drops in demand from key sectors such as automotive, construction, and manufacturing. The reduction in these end-use sectors contributed to a slump in overall petrochemical consumption. However, not all areas within the petrochemical industry were negatively affected. Some sectors, particularly those related to healthcare and packaging, experienced a surge in demand. Petrochemicals played a pivotal role in producing personal protective equipment (PPE), medical supplies, and hygiene products, which were in high demand to combat the pandemic. This shift helped stabilize certain parts of the petrochemical market and provided much-needed support for frontline healthcare workers and essential services. As the global economy began to recover, the petrochemical market saw a robust rebound, driven by pent-up demand and the stimulation of infrastructure projects through government recovery packages. This recovery phase saw a renewed interest in petrochemicals for various applications, such as construction, automotive, and packaging. Moreover, the pandemic accelerated the focus on sustainability within the petrochemical sector. With changing consumer preferences and growing environmental concerns, companies increasingly prioritized investment in recycling technologies and bio-based alternatives. This shift towards more sustainable practices highlighted the petrochemical industry's commitment to meeting future environmental challenges, ensuring long-term resilience, and aligning with evolving global expectations for cleaner, greener solutions. The pandemic thus not only tested the industry's resilience but also helped chart a new course toward sustainability.

Latest Trends/Developments

The petrochemical industry is undergoing significant transformation, driven by several key trends. Sustainability has emerged as a central priority, with companies increasingly focusing on circular economy initiatives and advanced recycling technologies. These efforts aim to reduce waste and minimize the environmental footprint of petrochemical production, responding to both consumer demands and regulatory pressures. The rise of bio-based petrochemicals, which are derived from renewable resources, is gaining momentum as a viable, eco-friendly alternative to traditional petrochemical products, further enhancing sustainability efforts. In addition to sustainability, digitalization and automation are reshaping the petrochemical sector. The integration of digital technologies is enhancing operational efficiency and reducing costs. Innovations such as predictive maintenance, which anticipates equipment failures before they occur, and AI-driven process optimization, which fine-tunes production for maximum efficiency, are enabling companies to better navigate market fluctuations and meet stringent regulatory standards. These advancements also allow for real-time data analysis, improving decision-making and ensuring greater responsiveness to changing market conditions. Another transformative trend is the integration of petrochemicals into renewable energy technologies. Petrochemical materials are increasingly used in the production of key components for renewable energy systems, such as wind turbines and solar panels. This shift is opening new growth opportunities for the petrochemical industry, aligning it with the global transition toward cleaner energy solutions. As the industry adapts to these emerging trends, it is poised to play a crucial role in both advancing sustainability and driving innovation in the evolving energy landscape.

Key Players

-

BASF SE

-

Dow Chemical Company

-

ExxonMobil Corporation

-

SABIC

-

LyondellBasell Industries

-

INEOS Group

-

Reliance Industries Limited

-

Chevron Phillips Chemical

-

TotalEnergies SE

-

Sinopec

Chapter 1. Petrochemicals Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Petrochemicals Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Petrochemicals Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Petrochemicals Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Petrochemicals Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Petrochemicals Market – By Product

6.1 Introduction/Key Findings

6.2 Ethylene

6.3 Propylene

6.4 Benzene

6.5 Methanol

6.6 Xylene

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Petrochemicals Market – By Application

7.1 Introduction/Key Findings

7.2 Plastics

7.3 Construction

7.4 Automotive

7.5 Textiles

7.6 Pharmaceuticals

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Petrochemicals Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Petrochemicals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Dow Chemical Company

9.3 ExxonMobil Corporation

9.4 SABIC

9.5 LyondellBasell Industries

9.6 INEOS Group

9.7 Reliance Industries Limited

9.8 Chevron Phillips Chemical

9.9 TotalEnergies SE

9.10 Sinopec

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Petrochemicals Market was valued at USD 620 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2030. The market is expected to reach USD 807.40 billion by 2030.

Key drivers include rising demand in consumer goods and packaging, rapid industrialization and infrastructure development, and advancements in feedstock flexibility.

The market is segmented by product (Ethylene, Propylene, Benzene, Methanol, Xylene, Others) and by application (Plastics, Construction, Automotive, Textiles, Pharmaceuticals, Others).

Asia-Pacific is the most dominant region, driven by high demand in packaging, construction, and automotive sectors, along with significant investments in manufacturing facilities.

Leading players include BASF SE, Dow Chemical Company, ExxonMobil Corporation, SABIC, and LyondellBasell Industries, among others.