Natural Gas Liquid Market Size (2023 - 2030)

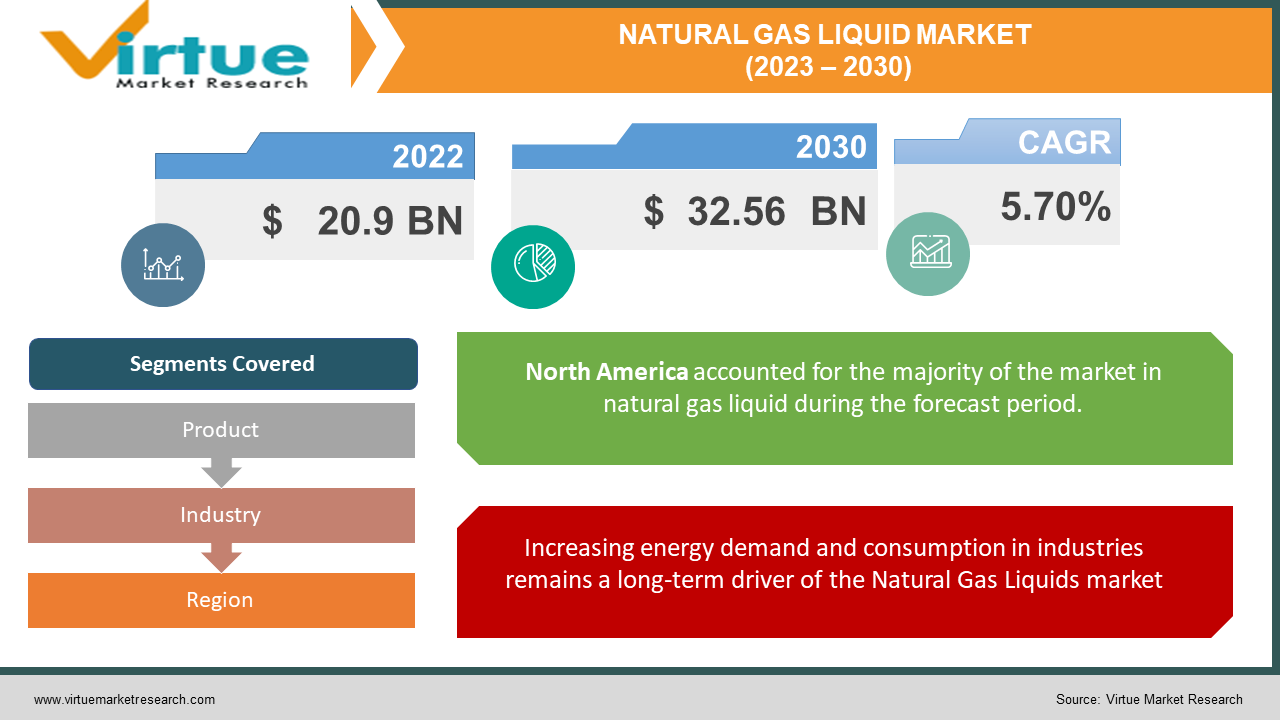

Global Natural Gas Liquid Market is estimated to be worth USD 20.9 Billion in 2022 and is projected to reach a value of USD 32.56 Billion by 2030, growing at a CAGR of 5.70% during the forecast period 2023-2030.

Natural Gas Liquids or NGLs are mainly hydrocarbons found in association with natural gas deposits. These are essential components of the energy industry globally. Natural Gas Liquids are extracted during the production of crude oil and natural gas and are composed of propane, ethane, butane, and natural gasoline. The NGLs are separated from raw natural gas by the process known as gas processing which is done at processing plants and refineries. The components of Natural Gas Liquids have various applications such as feedstock in the petrochemical industry for the production of plastics and fuel for residential and commercial purposes, etc. Factors like weather conditions, industrial growth, requirements, and energy prices affect the demand for Natural Gas Liquids and shape the market dynamics. Competing energy sources like natural gas and crude oil also influence the prices of NGLs. These Natural Gas Liquids are transported through pipelines, trucks, ships, and railcars, among which pipelines are widely used as they are cost-effecting in moving large quantities over long distances. The NGL market faces price fluctuation due to geopolitical events, economic conditions, and changes in supply-demand dynamics.

Global Natural Gas Liquid Market Drivers:

Increasing energy demand and consumption in industries remains a long-term driver of the Natural Gas Liquids market

Natural Gas Liquids are used in various energy-related industries, among which the petrochemical industry is a major consumer, where ethane is utilized as a feedstock for the production of plastics and other chemical products. Various applications like residential and commercial heating, cooking, and fuel for vehicles require NGLs. Hence, the demand for Natural Gas Liquids is closely related to the consumption pattern and industrial growth. With an increase in industrialization and expanding economies, the consumption of energy is increasing, leading to high demand for Natural Gas Liquids.

High crude oil and natural gas prices increase the production of Natural Gas Liquids

The prices of natural gas and crude oil impact the Natural Gas Liquids market significantly. As NGLs are synthesized alongside natural gas and crude oil, their prices are also influenced by the prices of these commodities. When the prices of crude oil and natural gas are high, there is more production of Natural Gas Liquids, leading to increased supply, because the cost of extracting and processing NGLs is lower as compared to the price at which these liquids can be sold in the market, which favors the cost-to-prize relationship.

Global Natural Gas Liquid Market Challenges:

Price volatility and supply-demand imbalance hinder the natural gas liquids market

Prices of Natural Gas Liquids fluctuate concerning crude oil and natural gas prices. Changes or imbalance in supply-demand dynamics leads to oversupply or tightness of NGLs. These imbalances could be contributed to changes in production level, infrastructure restrictions, and sudden shifts in demand. Geopolitical events and adverse economic conditions affect the Natural Gas Liquid market and create uncertainty among producers, consumers, and investors.

Infrastructure Constraints limit opportunities in the natural gas liquids market

From the production of Natural Gas Liquids to their distribution, there is a requirement for well-developed infrastructure like pipelines, equipment, storage and processing facilities, etc. Limited infrastructure hinders the development and efficient movement of NGLs.

COVID-19 Impact on Global Natural Gas Liquid Market:

The pandemic had a significant impact on Global Natural Gas Liquid Market, as it led to a sharp decline in energy demand, because of slowed industrial and economic activities. The prices of oil collapsed impacting the market of NGLs and supply disruptions occurred due to challenges in production during lockdowns.

The petrochemical industry faced reduced demand for its products, negatively impacting the demand for Natural Gas Oils. As industries and countries adapted to changing circumstances, businesses started shifting towards alternative energy resources, reducing the dependence on NGLs. The supply chain of Natural Gas Oils was adversely affected because of restrictions on shipping and logistics, leading to delays.

Latest Developments in Global Natural Gas Liquids Market:

-

In May 2023, ONEOK, a U.S. company that transports natural gas liquids and natural gas bought Magellan Midstream Partners, a U.S. pipeline operator, in a cash-and-stock deal of $18.8 billion, which will give ONEOK access to Magellan’s refined products and crude oil.

-

In the 2023 budget, $43.4 billion was granted for the advancement of the Wales Gas-to-Energy project, established for the transportation of natural gas from the offshore of Guyana, South America to Wales. The new budget allocated to the project aims to lower the costs involved in rapid growth in industrial activity.

-

In December 2022, Stonepeak Partners LLP, an alternative investment firm funding infrastructure assets, agreed to acquire a 50% interest in KAPS, a Canadian Natural Gas Liquids pipeline system that connects Northwest Alberta to Edmonton and Fort Saskatchewan. This acquisition aims to benefit the liquefied natural gas corridor from Western Canada to Asia and strengthen the economic viability of Western Canada LNG facilities.

NATURAL GAS LIQUID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.70% |

|

Segments Covered |

By Product, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ExxonMobil Corporation, Royal Dutch Shell plc, Chevron Corporation, Total Energies (formerly Total S.A.), BP plc, ConocoPhillips, Occidental Petroleum Corporation, Enterprise Products Partners L.P., TC Energy Corporation (formerly TransCanada Corporation), Enbridge Inc. |

Global Natural Gas Liquid Market Segmentation: By Product

-

Ethane

-

Propane

-

Butane

-

Isobutane

-

Natural Gasoline

Ethane is a feedstock used in the petrochemical industry for ethylene production, which is utilized in the production of plastics and petrochemical products. Propane is utilized in various sectors including residential, commercial, industrial, and transportation for heating, steam generation, cooking, and fuel for industrial machinery, equipment, and vehicles. Butane is used with motor gasoline and also in the petrochemical industry as a feedstock. Isobutane is used as a gasoline blending component in refineries, and natural gasoline is also used as a blending component for motor gasoline. The ethane segment holds the largest share and dominated the global natural gas liquids market. It is also anticipated to be the fastest-growing segment during the forecast period, because of its increasing demand in heavy industries and the petrochemical sector.

Global Natural Gas Liquid Market Segmentation: By Industry

-

Petrochemical

-

Residential and Commercial

-

Industrial

-

Transportation

The petrochemical industry utilizes ethane for the production of ethylene and various petrochemical products like rubber, plastics, and textiles. In the residential and commercial sectors, propane is widely used for household and commercial purposes like heating and cooking, Industrial sector also uses propane as a fuel in machinery, and for steam generation and heating. Ethane and propane are used as feedstock in manufacturing industries. In the transportation industry, propane and butane act as alternative fuels in fleets like school buses, commercial vehicles, and taxis. The industrial sector dominates the natural gas liquids market and is projected to remain the fastest-growing segment, due to an increase in industrialization and urbanization.

Global Natural Gas Liquid Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is one of the major producers and consumers of Natural Gas Liquids, as the shale gas revolution significantly increased the production of NGLs in the region. Europe has an active NGL production and consumption, with increasing demand for NGLs as alternative vehicle fuel in the transportation sector. Asia-Pacific countries are seeing growing demand for Natural Gas Liquids due to increasing consumption and industrialization. In South America, some countries like Brazil and Argentina have Natural Gas Liquids production and consumption, being used in various industries. Middle East region is a significant producer of Natural Gas Liquids, as many regions are having abundant natural gas reserves. Some African countries like Algeria, Nigeria, and Egypt have significant NGL production and consumption.

North America holds the largest share in the natural gas liquids market and is projected to be the fastest growing in coming years because of expanding shale gas sector, and low natural gas liquid costs.

Global Natural Gas Liquid Market Key Players:

-

ExxonMobil Corporation

-

Royal Dutch Shell plc

-

Chevron Corporation

-

Total Energies (formerly Total S.A.)

-

BP plc

-

ConocoPhillips

-

Occidental Petroleum Corporation

-

Enterprise Products Partners L.P.

-

TC Energy Corporation (formerly TransCanada Corporation)

-

Enbridge Inc.

Chapter 1. Natural Gas Liquid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sour

1.5 Secondary Sources

Chapter 2. Natural Gas Liquid Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Natural Gas Liquid Market – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Natural Gas Liquid Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Natural Gas Liquid Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Natural Gas Liquid Market - By Product

6.1 Ethane

6.2 Propane

6.3 Butane

6.4 Isobutane

6.5 Natural Gasoline

Chapter 7. Natural Gas Liquid Market - By Industry

7.1 Petrochemical

7.2 Residential and Commercial

7.3 Industrial

7.4 Transportation

Chapter 8. Natural Gas Liquid Market – By Region

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Latin America

8.5 The Middle East

8.6 Africa

Chapter 9. Natural Gas Liquid Market – Key Players

9.1 ExxonMobil Corporation

9.2 Royal Dutch Shell plc

9.3 Chevron Corporation

9.4 Total Energies (formerly Total S.A.)

9.5 BP plc

9.6 ConocoPhillips

9.7 Occidental Petroleum Corporation

9.8 Enterprise Products Partners L.P.

9.9 TC Energy Corporation (formerly TransCanada Corporation)

9.10 Enbridge Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Natural Gas Liquid Market is estimated to be worth USD 20.9 Billion in 2022 and is projected to reach a value of USD 32.56 Billion by 2030, growing at a CAGR of 5.70% during the forecast period 2023-2030.

The Global Natural Gas Liquid Market Drivers are energy demand and consumption in industries along with increased crude oil and natural gas prices.

Based on the fleet type, the Global Natural Gas Liquid Market is segmented into Ethane, Propane, Butane, Isobutane, and Natural Gasoline.

North America holds the largest share of the Global Natural Gas Liquid Market.

ExxonMobil Corporation, Royal Dutch Shell plc, and Chevron Corporation are a few of the leading players in the Global Natural Gas Liquid Market.