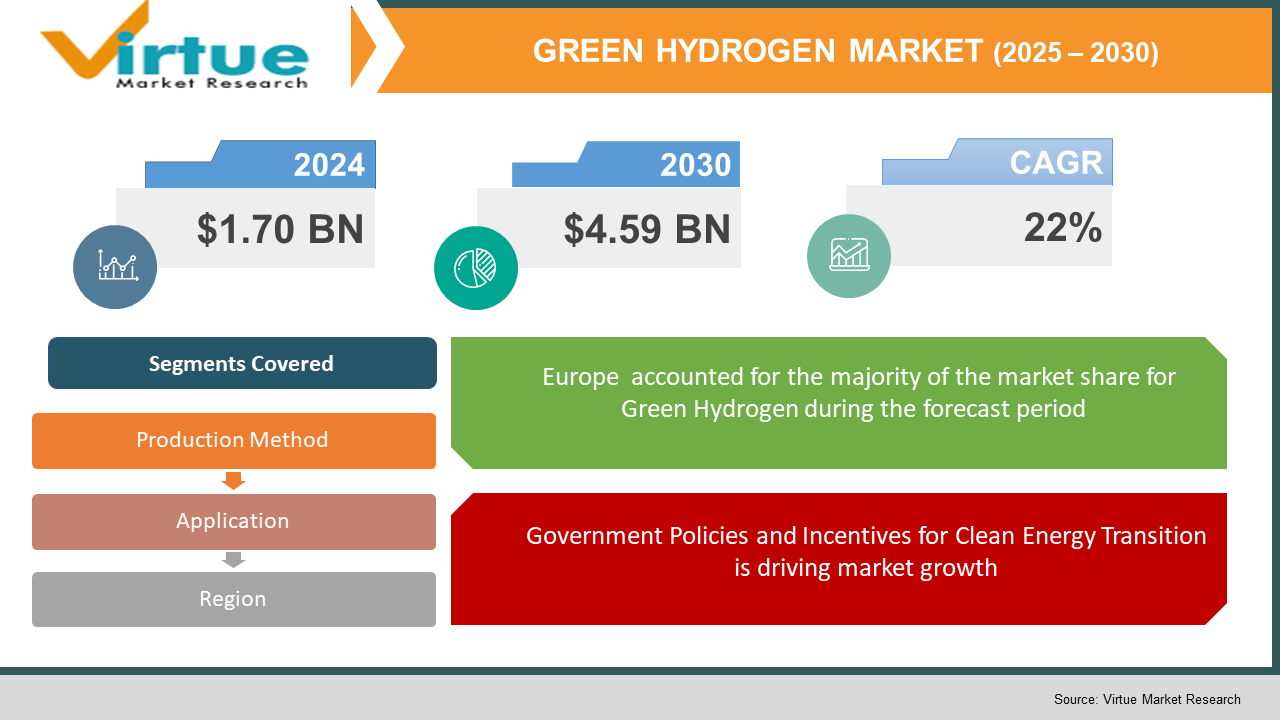

Green Hydrogen Market Size (2025-2030)

The Global Green Hydrogen Market was valued at USD 1.70 billion in 2024 and is projected to grow at a CAGR of 22% from 2025 to 2030. The market is expected to reach USD 4.59 billion by 2030.

Green hydrogen, produced using renewable energy sources such as wind, solar, or hydropower, is gaining significant traction due to its potential to decarbonize multiple industries, including energy, transportation, and industrial sectors. As countries strive to meet their climate goals and achieve net-zero emissions, green hydrogen is considered a key enabler for reducing carbon footprints. The market is being driven by rising investments in renewable energy technologies, government policies promoting clean energy, and increasing demand for sustainable alternatives to fossil fuels. Green hydrogen offers a zero-emission solution for hard-to-abate sectors, which are difficult to electrify, such as steel manufacturing, heavy transportation, and chemicals.

Key Market Insights:

- Electrolysis, the process of using renewable electricity to split water into hydrogen and oxygen, is the dominant method for producing green hydrogen, with ongoing improvements in efficiency and cost-effectiveness.

- The transportation sector, particularly in heavy-duty vehicles such as trucks, buses, and trains, is expected to be one of the largest applications for green hydrogen in the coming years.

- Green hydrogen is gaining significant interest as an energy storage solution, helping to address the intermittency issues of renewable energy sources like wind and solar.

- Leading energy companies and industrial players are increasingly investing in green hydrogen projects to diversify their energy portfolios and meet sustainability targets.

- The cost of green hydrogen production is expected to decrease significantly as technology advances, economies of scale are realized, and renewable energy costs continue to decline.

Global Green Hydrogen Market Drivers:

Government Policies and Incentives for Clean Energy Transition is driving market growth:

As climate change concerns intensify, governments around the world are increasingly implementing policies aimed at reducing carbon emissions and promoting the transition to cleaner energy sources. Green hydrogen plays a crucial role in achieving these goals, particularly in sectors that are difficult to decarbonize, such as heavy industry, transportation, and heating. The implementation of carbon pricing, tax credits, subsidies, and grants to support green hydrogen production is driving the growth of the market. For example, the European Union's Green Deal and hydrogen roadmaps in countries such as Germany, Japan, and South Korea are laying the foundation for large-scale green hydrogen projects. These policies not only promote the development of hydrogen infrastructure but also incentivize investments in research and development to improve the efficiency and cost-effectiveness of green hydrogen technologies. As more countries commit to achieving net-zero emissions by 2050, green hydrogen is seen as a key enabler of these ambitious goals, further driving its demand and market growth.

Declining Costs of Renewable Energy and Electrolysis Technology is driving market growth:

The declining costs of renewable energy, particularly solar and wind power, are a significant factor driving the adoption of green hydrogen. Renewable electricity is the main source of energy used in electrolysis, the process that splits water into hydrogen and oxygen. As the cost of renewable electricity continues to fall, the production of green hydrogen becomes increasingly cost-competitive with other forms of hydrogen, such as grey hydrogen, which is produced from natural gas and has a higher carbon footprint. Additionally, improvements in electrolysis technology have led to higher efficiency and lower operational costs. The development of new, more efficient electrolyzers has increased the scalability of green hydrogen production, making it a viable solution for large-scale industrial use. This combination of cheaper renewable energy and more efficient electrolysis technology is expected to drive the growth of the green hydrogen market, making it more accessible and competitive in comparison to conventional hydrogen production methods.

Demand for Clean Energy and Decarbonization of Hard-to-Abate Sectors is driving market growth:

The growing global demand for clean energy solutions and the need to decarbonize hard-to-abate sectors are key drivers for the green hydrogen market. Green hydrogen offers a sustainable alternative to fossil fuels for industries that are difficult to electrify, such as steel production, cement manufacturing, and shipping. These sectors contribute significantly to global carbon emissions and are under increasing pressure to reduce their environmental impact. Green hydrogen can serve as a clean feedstock or fuel for these industries, providing a viable option to replace carbon-intensive processes. Furthermore, the use of green hydrogen in long-distance transportation, including freight trucks, trains, and ships, is gaining traction as an emission-free alternative to diesel and other traditional fuels. As governments, industries, and consumers increasingly prioritize sustainability, the demand for green hydrogen as a clean energy source is expected to rise substantially in the coming years.

Global Green Hydrogen Market Challenges and Restraints:

High Cost of Green Hydrogen Production is restricting market growth:

One of the main challenges facing the green hydrogen market is the high cost of production. The process of electrolysis, while environmentally friendly, requires significant amounts of electricity, and the cost of producing renewable electricity remains high compared to traditional energy sources. The capital expenditures required for building large-scale electrolyzers and hydrogen production plants are also substantial. These costs are passed down to end consumers, making green hydrogen less economically competitive compared to grey hydrogen, which is produced from natural gas at a lower cost. While the costs of renewable energy and electrolysis technology are expected to decline over time, the current high cost of green hydrogen remains a significant barrier to its widespread adoption, especially in industries with tight margins, such as transportation and manufacturing.

Infrastructure Development and Distribution Challenges is restricting market growth:

Another key challenge for the green hydrogen market is the lack of infrastructure to produce, store, and distribute hydrogen efficiently. Hydrogen is difficult to transport and requires specialized storage solutions, such as cryogenic tanks or high-pressure containers. Developing a comprehensive infrastructure, including hydrogen refueling stations, pipelines, and storage facilities, is essential for the widespread adoption of green hydrogen. However, this infrastructure is costly to build and requires significant investment. Additionally, the transportation and storage of hydrogen at scale pose safety concerns, particularly due to hydrogen's flammability and low energy density. Without robust infrastructure, green hydrogen will struggle to reach the end-user markets, particularly in remote or less-developed regions. The lack of infrastructure remains a major bottleneck for the global expansion of the green hydrogen market.

Market Opportunities:

The green hydrogen market presents numerous opportunities for growth in the coming years. With increasing government support and rising investments in renewable energy, green hydrogen has the potential to revolutionize the energy, transportation, and industrial sectors. One of the primary opportunities lies in the development of green hydrogen as a means of energy storage. As the demand for renewable energy grows, there is a need for efficient energy storage solutions to mitigate the intermittency issues associated with solar and wind power. Green hydrogen offers a scalable and long-term solution for storing excess renewable energy, which can be converted back to electricity or used as a fuel when needed. Additionally, green hydrogen can help decarbonize hard-to-abate sectors such as steel production, shipping, and heavy-duty transportation. The ongoing research and development in hydrogen fuel cell technology and infrastructure will further accelerate the adoption of green hydrogen. As hydrogen production becomes more cost-competitive and the necessary infrastructure is developed, new applications and markets for green hydrogen will continue to emerge, creating significant growth opportunities for businesses and investors.

GREEN HYDROGEN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

22% |

|

Segments Covered |

By Production method, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens Energy, Air Products and Chemicals, Nel ASA, Plug Power, and ITM Power. |

Green Hydrogen Market Segmentation:

Green Hydrogen Market Segmentation By Production Method:

- Electrolysis (Alkaline Electrolyzer)

- Proton Exchange Membrane (PEM) Electrolysis

- High-Temperature Electrolysis (HTE)

Electrolysis, particularly PEM electrolysis, is expected to dominate the green hydrogen production segment. This method involves splitting water into hydrogen and oxygen using renewable electricity, making it a clean and efficient process. As PEM electrolyzers improve in efficiency and cost, this method is expected to become the preferred choice for large-scale green hydrogen production. The flexibility of PEM electrolysis, along with its ability to integrate with renewable energy sources, will be key to its dominance in the market.

Green Hydrogen Market Segmentation By Application:

- Energy

- Industrial Applications

- Transportation

- Power Generation

The energy sector is expected to be the dominant application for green hydrogen. As renewable energy sources such as wind and solar become more prevalent, there is a growing need for energy storage solutions to balance supply and demand. Green hydrogen offers a flexible and scalable solution for storing excess renewable energy and using it for power generation when needed. Additionally, the increasing push for decarbonization of the power sector makes green hydrogen a critical component in achieving net-zero emissions targets. The energy sector’s adoption of green hydrogen will drive market growth and pave the way for its use in other industries.

Green Hydrogen Market Regional Segmentation:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Europe is the dominant region in the green hydrogen market, with countries like Germany, France, and the Netherlands leading the charge in terms of policy support and investments in hydrogen technologies. The European Union’s Green Deal and hydrogen strategy have set ambitious goals to establish hydrogen as a key component of the continent’s energy transition. Governments are providing subsidies and tax incentives to accelerate the development of green hydrogen infrastructure, and numerous large-scale green hydrogen projects are underway. Additionally, Europe has a strong manufacturing base for renewable energy and electrolyzer technologies, which further strengthens its position in the market.

COVID-19 Impact Analysis on the Green Hydrogen Market:

The COVID-19 pandemic had a mixed impact on the green hydrogen market. On the one hand, the economic slowdown and the prioritization of immediate health and safety measures slowed down some hydrogen projects and delayed investments in infrastructure. On the other hand, the pandemic highlighted the importance of sustainability and resilience, prompting governments and industries to accelerate their efforts toward decarbonization. Green hydrogen was increasingly recognized as a key solution to achieving these goals, and in many cases, the pandemic accelerated the focus on clean energy investments. The pandemic also provided an opportunity to build back greener, and many green hydrogen projects resumed or received additional funding as part of recovery plans. As the world recovers from the pandemic, the green hydrogen market is poised for strong growth, driven by supportive government policies and a renewed focus on sustainability.

Latest Trends/Developments:

Recent trends in the green hydrogen market include increasing collaboration between governments, energy companies, and technology providers to develop large-scale hydrogen infrastructure. Partnerships are being formed to build electrolyzers, storage solutions, and refueling stations to support the growing demand for green hydrogen. Additionally, hydrogen fuel cell technology is being adopted in various sectors, particularly in heavy-duty transportation, where it is seen as a cleaner alternative to diesel and gasoline. Moreover, advancements in electrolysis technology, including improvements in electrolyzer efficiency and cost reduction, are expected to make green hydrogen more competitive. As investments in research and development continue, new applications for green hydrogen are emerging, particularly in the industrial sector, where it is being used to decarbonize manufacturing processes.

Key Players:

- Siemens Energy

- Air Products and Chemicals

- Linde

- Nel ASA

- Plug Power

- ITM Power

- Ballard Power Systems

- Air Liquide

- Thyssenkrupp

- McPhy Energy

Chapter 1. GREEN HYDROGEN MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GREEN HYDROGEN MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GREEN HYDROGEN MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GREEN HYDROGEN MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. GREEN HYDROGEN MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GREEN HYDROGEN MARKET – By Production Method

6.1 Introduction/Key Findings

6.2 Electrolysis (Alkaline Electrolyzer)

6.3 Proton Exchange Membrane (PEM) Electrolysis

6.4 High-Temperature Electrolysis (HTE)

6.5 Y-O-Y Growth trend Analysis By Production Method

6.6 Absolute $ Opportunity Analysis By Production Method , 2025-2030

Chapter 7. GREEN HYDROGEN MARKET – By Application

7.1 Introduction/Key Findings

7.2 Energy

7.3 Industrial Applications

7.4 Transportation

7.5 Power Generation

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. GREEN HYDROGEN MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Production Method

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Production Method

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Production Method

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Production Method

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Production Method

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GREEN HYDROGEN MARKET– Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

9.1 Siemens Energy

9.2 Air Products and Chemicals

9.3 Linde

9.4 Nel ASA

9.5 Plug Power

9.6 ITM Power

9.7 Ballard Power Systems

9.8 Air Liquide

9.9 Thyssenkrupp

9.10 McPhy Energy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Green Hydrogen Market was valued at USD 1.70 billion in 2024 and is projected to grow at a CAGR of 22% from 2025 to 2030. The market is expected to reach USD 4.59 billion by 2030

Key drivers include government policies, declining costs of renewable energy, and the need to decarbonize hard-to-abate sectors

The market is segmented by production method (electrolysis, PEM, HTE) and application (energy, industry, transport, power).

Europe is the dominant region, driven by strong policy support and investments in green hydrogen infrastructure.

Leading players include Siemens Energy, Air Products and Chemicals, Nel ASA, Plug Power, and ITM Power.