Permanent Magnet Motor Market Size (2024 – 2030)

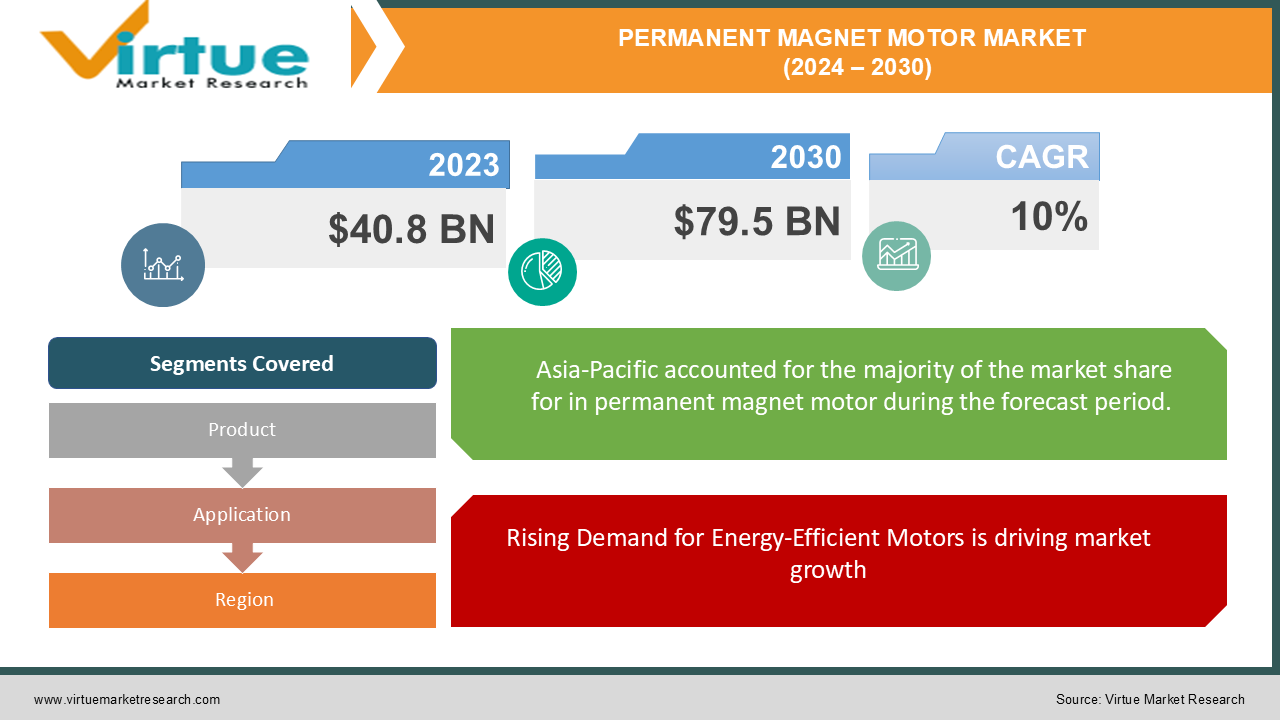

The Global Permanent Magnet Motor Market was valued at USD 40.8 billion in 2023 and is projected to grow at a CAGR of 10% from 2024 to 2030. The market is expected to reach USD 79.5 billion by 2030.

Permanent magnet motors are widely used across various industries due to their high efficiency, reliability, and compact size. These motors employ permanent magnets to generate a magnetic field, reducing the need for an external power supply for magnetization. The market is witnessing significant growth driven by the rising demand for energy-efficient motors, advancements in magnetic materials, and increasing adoption in electric vehicles (EVs) and industrial automation.

Key Market Insights:

The industrial segment held the largest share of the Permanent Magnet Motor Market in 2023, accounting for over 30% of the total market value, driven by the growing need for energy-efficient motors in machinery and manufacturing processes.

Electric vehicles (EVs) are expected to be the fastest-growing application segment, with a CAGR of 15% during the forecast period, owing to the increasing global shift towards sustainable transportation solutions.

The Asia-Pacific region dominated the global market in 2023, capturing over 40% of the market share due to the rapid industrialization and the growing automotive industry in countries like China, Japan, and India.

Ferrite permanent magnets accounted for more than 50% of the market share in terms of material type in 2023, primarily due to their cost-effectiveness and extensive use in low-cost applications.

In terms of motor type, brushless DC motors are anticipated to witness the highest growth, with a CAGR of 12%, driven by their superior efficiency and lower maintenance requirements.

Global Permanent Magnet Motor Market Drivers:

Rising Demand for Energy-Efficient Motors is driving market growth: The global push for energy efficiency, coupled with stringent regulations aimed at reducing carbon emissions, is a significant driver for the Permanent Magnet Motor Market. Permanent magnet motors are known for their high efficiency and ability to reduce energy consumption compared to traditional motors. As industries seek to lower operational costs and comply with environmental standards, the demand for energy-efficient solutions, such as permanent magnet motors, is on the rise. The increasing emphasis on green manufacturing and sustainable practices across various sectors, including automotive, industrial, and commercial, is further boosting the adoption of these motors. Moreover, governments worldwide are providing incentives and subsidies to promote energy-efficient technologies, which is expected to drive market growth.

Growing Adoption in Electric Vehicles (EVs) is driving market growth: The electric vehicle industry is experiencing exponential growth, and permanent magnet motors play a crucial role in the performance of EVs. These motors are preferred in EVs for their compact size, lightweight, high power density, and excellent efficiency. As the global automotive industry shifts towards electrification to reduce dependence on fossil fuels and curb greenhouse gas emissions, the demand for permanent magnet motors is expected to soar. Countries such as China, the United States, and several European nations are investing heavily in EV infrastructure and offering incentives to boost EV adoption, further propelling the market for permanent magnet motors. The ongoing advancements in motor technologies, such as the development of high-performance magnets, are likely to enhance the efficiency and performance of EVs, providing additional momentum to the market.

Expansion of Industrial Automation and Robotics is driving market growth: The expansion of industrial automation and the increasing use of robotics in manufacturing processes are key drivers of the Permanent Magnet Motor Market. Permanent magnet motors are essential components in automated systems due to their precision, reliability, and ability to operate at varying speeds. Industries such as automotive, electronics, and packaging are increasingly adopting automation to improve productivity and reduce labor costs. The growing trend towards Industry 4.0, which emphasizes smart manufacturing and the use of advanced robotics, is further contributing to the demand for these motors. As businesses strive to optimize operations and enhance efficiency, the integration of permanent magnet motors in automated systems is expected to increase, driving market growth over the forecast period.

Global Permanent Magnet Motor Market Challenges and Restraints:

High Cost of Rare-Earth Materials is restricting market growth: One of the significant challenges faced by the Permanent Magnet Motor Market is the high cost of rare-earth materials, which are essential for manufacturing high-performance permanent magnets. Rare-earth elements such as neodymium and dysprosium are crucial for producing strong and efficient magnets used in motors. However, these materials are expensive and subject to price volatility due to limited supply and geopolitical factors. The majority of rare-earth mining and processing is concentrated in a few countries, particularly China, which controls a significant portion of the global supply. This dependency on a limited number of sources can lead to supply chain disruptions and price hikes, posing a challenge for manufacturers in maintaining competitive pricing. To mitigate this issue, companies are investing in research and development to find alternative materials and improve recycling techniques, but it remains a restraint on the market growth.

Complex Manufacturing Process is restricting market growth: The manufacturing process of permanent magnet motors is complex and requires specialized equipment and expertise, which can pose a challenge for market growth. Unlike conventional motors, the production of permanent magnet motors involves precise alignment and embedding of magnets within the motor structure. This complexity increases the production cost and limits the scalability of manufacturing operations, particularly for small and medium-sized enterprises (SMEs). Additionally, maintaining high quality and performance standards throughout the production process is critical, as any deviation can affect the efficiency and reliability of the motor. This complexity in manufacturing can lead to longer lead times and higher costs, making it challenging for manufacturers to meet the growing demand for these motors, especially in price-sensitive markets.

Market Opportunities:

The growing demand for renewable energy and the integration of permanent magnet motors in wind energy systems present significant opportunities for the market. As the world moves towards sustainable energy sources, the need for efficient and reliable components in renewable energy systems is increasing. Permanent magnet motors are used in wind turbines for their high efficiency, reduced maintenance, and ability to operate at variable speeds. With governments and organizations around the world investing heavily in renewable energy projects to reduce carbon emissions and achieve energy security, the demand for permanent magnet motors in this sector is expected to rise. Additionally, advancements in motor technologies, such as the development of direct-drive systems that eliminate the need for gearboxes in wind turbines, are further enhancing the adoption of these motors in the renewable energy industry. The increasing focus on electrification and the use of permanent magnet motors in hybrid and electric ships, trains, and aircraft also provide growth opportunities. As industries seek to reduce fuel consumption and comply with stringent emission regulations, the integration of these motors in various transportation applications is likely to increase, driving market growth in the coming years.

PERMANENT MAGNET MOTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd., Siemens AG, Nidec Corporation, Toshiba Corporation, Johnson Electric Holdings Limited, Yaskawa Electric Corporation, Rockwell Automation, Inc., Allied Motion Technologies, Inc., Ametek, Inc., Maxon Motor AG |

Permanent Magnet Motor Market Segmentation: By Product

-

Brushless DC Motors

-

Permanent Magnet Synchronous Motors (PMSMs)

-

Brushless AC Motors

-

Ferrite Permanent Magnet Motors

Permanent Magnet Synchronous Motors (PMSMs) are the most dominant segment due to their high efficiency, precision, and widespread use in automotive and industrial applications.

Permanent Magnet Motor Market Segmentation: By Application

-

Automotive

-

Industrial

-

Consumer Electronics

-

Energy

-

Aerospace & Defense

-

Others

The automotive segment is the most dominant due to the increasing use of these motors in electric vehicles and hybrid cars for their high performance and energy efficiency.

Permanent Magnet Motor Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is the dominant market for permanent magnet motors, accounting for over 40% of the global market share in 2023. This dominance is attributed to rapid industrialization, the growth of the automotive sector, and significant investments in renewable energy projects in countries such as China, Japan, and India. The region's strong manufacturing base and the presence of leading motor manufacturers also contribute to its leading position in the market.

COVID-19 Impact Analysis on the Permanent Magnet Motor Market:

The COVID-19 pandemic had a mixed impact on the Permanent Magnet Motor Market. Initially, the market faced challenges such as disruptions in the supply chain, reduced manufacturing activities, and delays in industrial projects due to lockdowns and restrictions. The automotive sector, one of the key end-users of permanent magnet motors, experienced a significant decline in vehicle production and sales, which negatively affected the demand for these motors. However, as the global economy started to recover, there was a surge in demand for electric vehicles, which boosted the market. The pandemic also accelerated the adoption of automation and robotics in various industries to minimize human contact and ensure business continuity. This shift towards automation and the increasing focus on energy-efficient solutions provided growth opportunities for the market. Furthermore, the renewable energy sector saw continued investments and expansion, particularly in wind and solar power, which supported the demand for permanent magnet motors in these applications. Overall, while the pandemic posed challenges in the short term, it also highlighted the importance of advanced technologies and sustainable solutions, creating a positive outlook for the Permanent Magnet Motor Market.

Latest Trends/Developments:

The Permanent Magnet Motor Market is witnessing several key trends and developments. One of the significant trends is the growing adoption of advanced materials, such as high-performance rare-earth magnets, to improve motor efficiency and performance. These materials are enabling the development of more compact and powerful motors, suitable for a wide range of applications, from electric vehicles to industrial automation. Another trend is the increasing focus on the integration of IoT and smart technologies in permanent magnet motors. Manufacturers are incorporating sensors and connectivity features into motors to enable real-time monitoring, predictive maintenance, and enhanced operational efficiency. This development is particularly relevant in the context of Industry 4.0 and the push towards smart manufacturing. Additionally, there is a growing emphasis on sustainable manufacturing practices and the recycling of rare-earth materials to reduce environmental impact and ensure the long-term availability of these critical resources. In the automotive sector, the trend towards electrification and the development of next-generation electric vehicles are driving innovations in motor technology, with a focus on improving power density, reducing weight, and enhancing thermal management. These trends are expected to shape the future of the Permanent Magnet Motor Market and open new avenues for growth and innovation.

Key Players:

-

ABB Ltd.

-

Siemens AG

-

Nidec Corporation

-

Toshiba Corporation

-

Johnson Electric Holdings Limited

-

Yaskawa Electric Corporation

-

Rockwell Automation, Inc.

-

Allied Motion Technologies, Inc.

-

Ametek, Inc.

-

Maxon Motor AG

Chapter 1. Permanent Magnet Motor Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Permanent Magnet Motor Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Permanent Magnet Motor Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Permanent Magnet Motor Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Permanent Magnet Motor Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Permanent Magnet Motor Market – By Product

6.1 Introduction/Key Findings

6.2 Brushless DC Motors

6.3 Permanent Magnet Synchronous Motors (PMSMs)

6.4 Brushless AC Motors

6.5 Ferrite Permanent Magnet Motors

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Permanent Magnet Motor Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Industrial

7.4 Consumer Electronics

7.5 Energy

7.6 Aerospace & Defense

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Permanent Magnet Motor Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Permanent Magnet Motor Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ABB Ltd.

9.2 Siemens AG

9.3 Nidec Corporation

9.4 Toshiba Corporation

9.5 Johnson Electric Holdings Limited

9.6 Yaskawa Electric Corporation

9.7 Rockwell Automation, Inc.

9.8 Allied Motion Technologies, Inc.

9.9 Ametek, Inc.

9.10 Maxon Motor AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Permanent Magnet Motor Market was valued at USD 40.8 billion in 2023 and is expected to reach USD 79.5 billion by 2030, growing at a CAGR of 10% from 2024 to 2030.

Key drivers include rising demand for energy-efficient motors, growing adoption in electric vehicles (EVs), and the expansion of industrial automation and robotics.

The market is segmented by product (Brushless DC Motors, Permanent Magnet Synchronous Motors, Brushless AC Motors, Ferrite Permanent Magnet Motors) and by application (Automotive, Industrial, Consumer Electronics, Energy, Aerospace & Defense, Others).

The Asia-Pacific region is the most dominant, accounting for over 40% of the market share due to rapid industrialization and the growth of the automotive sector.

Leading players include ABB Ltd., Siemens AG, Nidec Corporation, Toshiba Corporation, Johnson Electric Holdings Limited, and Yaskawa Electric Corporation.