Automotive Motor Market Size (2025 – 2030)

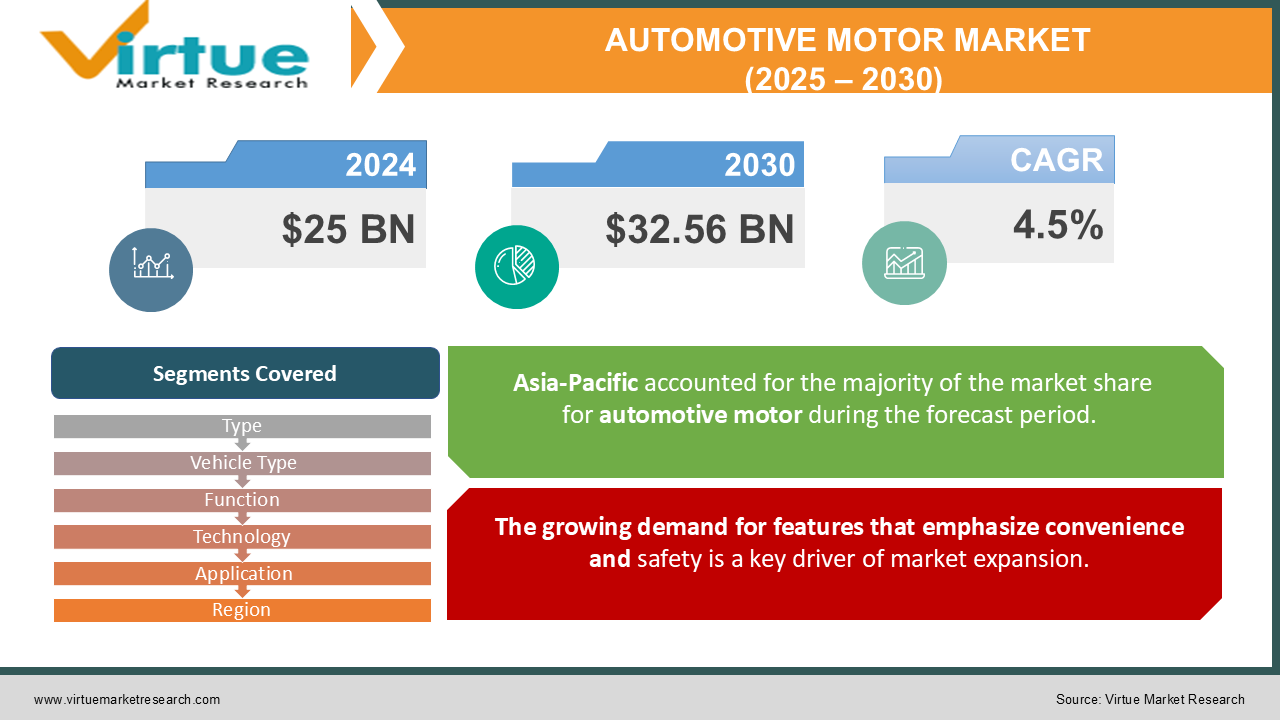

The Automotive Motor Market was valued at USD 25 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 32.56 billion by 2030, growing at a CAGR of 4.5%.

Motors play a crucial role in vehicles, ensuring smooth and uninterrupted operation. They are integral to any vehicle's functionality, particularly in systems requiring continuous rotational motion. These motors are utilized in multiple vehicle applications, such as power steering, seat cooling fans, battery cooling fans, power windows, engine cooling fans, wiper systems, and more. Their use extends to areas where enhancing passenger comfort is just as vital as ensuring the vehicle operates effectively and efficiently.

Key Market Insights:

-

The growth of the market is being fueled by multiple factors, such as the rising global production of vehicles, a growing demand for safety and convenience features, and the increasing need for electric vehicles.

-

However, it is expected that the higher weight and cost associated with the overall system may pose challenges to market growth.

-

Furthermore, the widespread use of electric motors in various applications and the emergence of autonomous vehicle technology are expected to open up numerous opportunities for market expansion.

Automotive Motor Market Drivers:

The growing demand for features that emphasize convenience and safety is a key driver of market expansion.

The automotive industry has seen a rising demand for more advanced technological features, such as power steering systems, climate control systems, anti-lock braking systems, and other similar technologies. This growing demand has led to an increase in the number of motor applications within vehicles, driving the expansion of the market. Additionally, consumers in developed markets are increasingly seeking enhanced convenience, safety, and comfort in their vehicles. High-demand features include steering-mounted controls, heads-up displays, advanced infotainment systems, gesture control systems, telematics, and central controllers.

Automotive Motor Market Restraints and Challenges:

The rising popularity of shared mobility is expected to hinder the growth of the market.

Mobility services provide an accessible and stress-free travel experience for individuals who may not be able to afford their own vehicles. Car-sharing and ride-hailing platforms like Uber and Lyft help reduce transportation costs by optimizing vehicle usage. This, in turn, leads to less urban traffic and a reduction in vehicle emissions. Digitally-enabled car-sharing and ride-hailing services offer an efficient and environmentally friendly solution for managing travel needs. A

single mobile application can handle everything from trip planning to payment processing. Ride-hailing services, particularly platforms like Uber, are anticipated to play a significant role in the future by reducing both time and travel expenses. As a result of this growing trend, the automotive motors market is expected to experience a decline, as ride-sharing apps continue to gain popularity in recent years.

Automotive Motor Market Opportunities:

The introduction of driverless cars is set to create new opportunities in the market.

Self-driving vehicles are powered by electric motors and leverage artificial intelligence (AI), light detection and ranging (LiDAR), and RADAR sensing technologies. These systems monitor a 60-meter radius around the vehicle, creating an active 3D map of the surrounding environment. Designed to operate without a human driver, autonomous vehicles can travel from one location to another independently. Unlike traditional vehicles, which consume substantial amounts of fuel due to frequent high-speed driving, braking, and acceleration, autonomous vehicles tend to be more energy-efficient.

These vehicles have a relatively low environmental impact, as they use smaller battery capacities and consume less fuel compared to conventional cars. This offers additional environmental benefits, making them a more sustainable option. Consumer interest in connected vehicles, which utilize the Internet of Things (IoT), and successful management of traffic congestion are driving market growth. Moreover, the ongoing development of the automotive sector, rising demand for luxury vehicles, and government regulations are expected to create ample opportunities for key players in the global automotive motors market.

AUTOMOTIVE MOTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Vehicle Type, Function, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BorgWarner Inc., DENSO CORPORATION, Continental AG, Mitsuba Corporation, Johnson Electric Holdings Limited ,Nidec Corporation, MABUCHI MOTOR CO.LTD., Robert Bosch GmbH, Magna International Inc , Siemens AG |

Automotive Motor Market Segmentation: By Type

-

D.C. Brushed Motors

-

Brushless D.C. Motors

-

Stepper Motors

-

Traction Motors

The D.C. brushed motors segment is the leading contributor to the market during the forecast period. Several factors drive the growth of this segment, including the availability of simple and cost-effective controllers, low overall construction costs, and the ability to be refurbished for extended service life. These motors excel in demanding environments, even with frequent temperature fluctuations, making them ideal for automotive applications and driving market expansion.

The brushless D.C. motors (BLDC) segment is the second-largest and is expected to experience growth throughout the forecast period. Due to the lack of brushes, BLDC motors require less maintenance compared to their brushed counterparts. Additionally, BLDC motors operate efficiently across all speeds with a rated load, offering a high power-to-size ratio and superior performance, which further supports their growing adoption in the market.

Automotive Motor Market Segmentation: By Vehicle Type

-

Two-wheelers

-

Electric Two-wheelers

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

Plug-in hybrid electric vehicle (PHEV)

-

Hybrid electric vehicle (HEV)

The passenger cars segment is the largest contributor to the market and is expected to grow throughout the forecast period. Rising discretionary income levels in countries such as India and China are projected to boost the demand for passenger vehicles, subsequently increasing the need for automotive motors in these cars. Additionally, the automotive industry is incorporating aluminum to reduce vehicle weight and enhance fuel efficiency, further driving growth in this segment.

The two-wheelers segment is the second-largest and is also expected to experience growth during the forecast period. Two-wheelers generally have lower operating costs, making them a more economical option compared to other vehicles. Moreover, their versatility in serving various purposes—such as daily commuting, off-road riding, long-distance travel, and cruising—contributes significantly to the expansion of the market.

Automotive Motor Market Segmentation: By Function

-

Performance

-

Comfort & Convenience

-

Safety & Security

The comfort and convenience segment is the largest contributor to the market and is expected to experience growth during the forecast period. The expansion of the automotive motors market in this segment is primarily driven by increasing disposable income and greater awareness of vehicle safety, security, and convenience features. Additionally, the growing population in developing countries presents significant opportunities for market growth.

The performance segment is the second-largest and is also projected to grow during the forecast period. Motors designed for performance applications are key drivers of market expansion, as they enhance the smooth operation of a vehicle's systems, including steering, driving, and braking. For instance, electric steering motors are integral to the electric power steering (EPS) system, contributing to improved vehicle performance.

Automotive Motor Market Segmentation: By Technology

-

PWM

-

DTC54

The PWM (Pulse-Width Modulation) segment is the largest contributor to the market and is expected to grow during the forecast period. Pulse-width modulation is widely regarded as the most effective method for controlling the amount of power delivered to a load without wasting energy, which is a primary factor driving market growth. Additionally, the minimal power loss in switching devices further supports the expansion of this segment.

The DTC (Direct Torque Control) segment is the second-largest and is also anticipated to grow during the forecast period. Direct torque control is commonly used in electric vehicles to directly manage the vehicle's torque. This technology ensures high efficiency and minimizes energy loss, which is a key driver of market growth. Furthermore, the increasing popularity of electric vehicles presents significant opportunities for key players currently operating in the market

Automotive Motor Market Segmentation: By Application

-

Alternator

-

ETC

-

Electric Parking Brake

-

SunRoof Motor

-

Fuel Pump Motor

-

Wiper Motor

-

Engine Cooling Fan

-

Starter Motor

-

Anti-lock Brake System

-

EPS

-

Others

The ETC (Electronic Throttle Control) segment is the largest contributor to the market and is expected to grow during the forecast period. For market growth, it is crucial that electronic throttle control integrates seamlessly with other systems, such as traction control, engine control, electronic stability control, and cruise control. ETCs improve vehicle convenience, safety, and fuel economy, all of which drive the expansion of the market.

The ECM (Electronically Commutated Motors) segment is the second-largest and is projected to grow throughout the forecast period. Electronically commutated motors offer superior energy efficiency, with energy consumption reduced by up to 90 percent. This allows EC fans to consume approximately 70 percent less energy compared to traditional fans. As a result, energy usage decreases, operating expenses are lowered, comfort is enhanced, noise is reduced, and the motor’s lifespan is extended, all contributing to market growth.

Automotive Motor Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region is the largest revenue contributor to the automotive motors market and is expected to continue growing during the forecast period. Government policies in the region promote environmentally responsible manufacturing and investment, further driving market expansion. Additionally, the rising number of vehicles and passenger cars being registered in Asia and the Pacific presents significant opportunities for the development of the automotive motors market.

The growth in the region is also fueled by increasing demand for technologically advanced vehicles among consumers, as well as the growing implementation of the Internet of Things (IoT) in the automotive industry. Numerous technological advancements in the sector, supported by government initiatives and investments in research and development related to automotive production, further contribute to the market’s expansion.

Europe is the second-largest contributor to the global automotive motors market and is projected to grow during the forecast period. The market's growth in Europe can be attributed to the development of new technologies and the continuous improvement of vehicle standards. Moreover, the increasing sales of premium cars in the region are driving the development of more advanced vehicles, which in turn boosts the growth of the automotive motors market in Europe.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic led to a slowdown in the automotive manufacturing process, primarily due to a reduced workforce, which may hinder the market's growth during the forecast period. The pandemic's impact was further compounded by firm government regulations aimed at curbing the spread of the virus, which significantly affected the global automobile industry. Manufacturing restrictions and strict regulations on workforce movement led to lower production rates in automotive factories, directly impacting the demand for automotive motors in 2020. Additionally, disruptions in the supply chain and distributor networks caused shortages of raw materials needed for automotive motor production.

However, as pandemic conditions improve and control measures are eased, the market is expected to recover and experience robust growth. The increasing demand for advanced vehicles, particularly in developing countries, is anticipated to provide strong growth opportunities for the global automotive motors market during the forecast period.

Latest Trends/ Developments:

In June 2024, Nidec Corporation announced the launch of a new air suspension motor developed by its Chinese subsidiary, Nidec Motor (Dalian) Limited. The motor is designed with a compact form, high power output, long lifespan, and fast start-up and response times.

In August 2023, MAHLE unveiled the development of an innovative "perfect motor" that combines the advantages of superior continuous torque (SCT) and a magnet-free contactless transmitter (MCT) electric motor. This new system is expected to deliver continuous high peak power, contactless power transmission, and other integrated benefits. The solution was showcased at the IAA Mobility event in Munich in September 2023 and is anticipated to contribute to the ongoing expansion of the market.

Key Players:

These are top 10 players in the Automotive Motor Market :-

-

BorgWarner Inc.

-

DENSO CORPORATION

-

Continental AG

-

Mitsuba Corporation

-

Johnson Electric Holdings Limited

-

Nidec Corporation

-

MABUCHI MOTOR CO.LTD.

-

Robert Bosch GmbH

-

Magna International Inc

-

Siemens AG

Chapter 1. Automotive Motor Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Motor Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Motor Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Motor Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Motor Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Motor Market – BY TYPE

6.1 Introduction/Key Findings

6.2 D.C. Brushed Motors

6.3 Brushless D.C. Motors

6.4 Stepper Motors

6.5 Traction Motors

6.6 Y-O-Y Growth trend Analysis BY TYPE

6.7 Absolute $ Opportunity Analysis BY TYPE, 2025-2030

Chapter 7. Automotive Motor Market – BY VEHICLE TYPE

7.1 Introduction/Key Findings

7.2 Two-wheelers

7.3 Electric Two-wheelers

7.4 Passenger Cars

7.5 Light Commercial Vehicles (LCVs)

7.6 Heavy Commercial Vehicles (HCVs)

7.7 Plug-in hybrid electric vehicle (PHEV)

7.8 Hybrid electric vehicle (HEV)

7.9 Y-O-Y Growth trend Analysis BY VEHICLE TYPE

7.10 Absolute $ Opportunity Analysis BY VEHICLE TYPE, 2025-2030

Chapter 8. Automotive Motor Market – BY FUNCTION

8.1 Introduction/Key Findings

8.2 Performance

8.3 Comfort & Convenience

8.4 Safety & Security

8.5 Y-O-Y Growth trend Analysis By Function

8.6 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 9. Automotive Motor Market – By Technology

9.1 Introduction/Key Findings

9.2 PWM

9.3 DTC54

9.4 Y-O-Y Growth trend Analysis By Technology

9.5 Absolute $ Opportunity Analysis By Technology, 2025-2030

Chapter 10. Automotive Motor Market – BY APPLICATION

10.1 Introduction/Key Findings

10.2 Alternator

10.3 ETC

10.4 Electric Parking Brake

10.5 SunRoof Motor

10.6 Fuel Pump Motor

10.7 Wiper Motor

10.8 Engine Cooling Fan

10.9 Starter Motor

10.10 Anti-lock Brake System

10.11 EPS

10.12 Others

10.13 Y-O-Y Growth trend Analysis BY APPLICATION

10.14 Absolute $ Opportunity Analysis BY APPLICATION, 2025-2030

Chapter 11. Automotive Motor Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 BY TYPE

11.1.2.1 BY VEHICLE TYPE

11.1.3 BY FUNCTION

11.1.4 BY APPLICATION

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 BY TYPE

11.2.3 BY VEHICLE TYPE

11.2.4 BY FUNCTION

11.2.5 By Vehicle Type

11.2.6 BY APPLICATION

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 BY TYPE

11.3.3 BY VEHICLE TYPE

11.3.4 BY FUNCTION

11.3.5 By Vehicle Type

11.3.6 BY APPLICATION

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 BY TYPE

11.4.3 BY VEHICLE TYPE

11.4.4 BY FUNCTION

11.4.5 By Vehicle Type

11.4.6 BY APPLICATION

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 BY TYPE

11.5.3 BY VEHICLE TYPE

11.5.4 BY FUNCTION

11.5.5 By Vehicle Type

11.5.6 BY APPLICATION

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Automotive Motor Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 BorgWarner Inc.

12.2 DENSO CORPORATION

12.3 Continental AG

12.4 Mitsuba Corporation

12.5 Johnson Electric Holdings Limited

12.6 Nidec Corporation

12.7 MABUCHI MOTOR CO.LTD.

12.8 Robert Bosch GmbH

12.9 Magna International Inc

12.10 Siemens AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of the market is being fueled by multiple factors, such as the rising global production of vehicles, a growing demand for safety and convenience features, and the increasing need for electric vehicles.

The top players operating in the Automotive Motor Market are - BorgWarner Inc., DENSO CORPORATION, Continental AG and Mitsuba Corporation.

The COVID-19 pandemic led to a slowdown in the automotive manufacturing process, primarily due to a reduced workforce, which may hinder the market's growth during the forecast period.

In June 2024, Nidec Corporation announced the launch of a new air suspension motor developed by its Chinese subsidiary, Nidec Motor (Dalian) Limited.

Asia Pacific is the fastest-growing region in the Automotive Motor Market.