Organic Fertilizer Market Size (2024 – 2030)

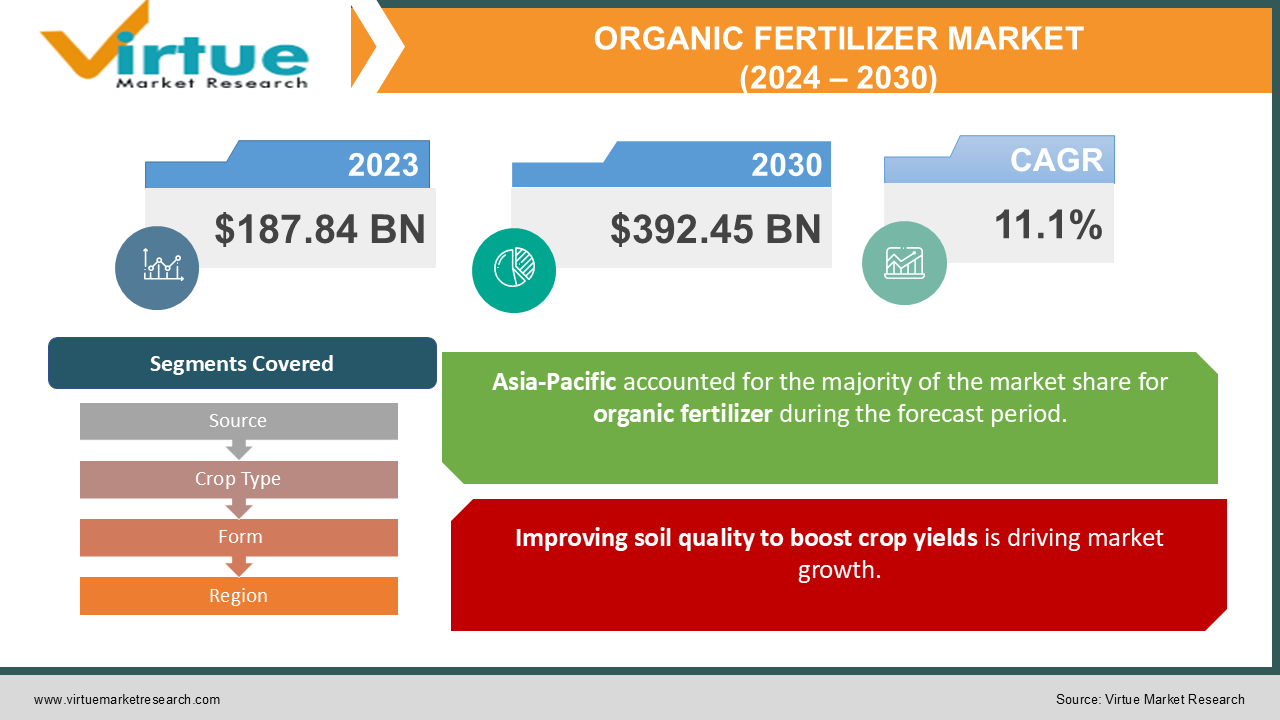

The Organic Fertilizer Market was valued at USD 187.84 billion in 2023 and is projected to reach a market size of USD 392.45 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 11.1%.

Organic fertilizer is generated from natural resources such as animal waste, agricultural waste, earthworm castings, and cow dung. Owing to their high concentrations of organic matter and minerals, these compounds are helpful for enhancing soil fertility and plant growth. The capacity of organic fertilizers to rise soil water retention is one of their primary benefits. Resultantly, they aid in soil moisture retention and guarantee that plants get water even during dry spells. By loosening the soil and changing it into gaseous forms, organic fertilizers also increase soil structure and enhance soil aeration for plant roots. The improved soil structure curbs harmful salts from gathering and harming the soil's health. The usage of organic fertilizers has risen majorly over the past several years as people have become more conscious of the detrimental effects that chemical fertilizers have on the environment and human health. As more individuals choose to eat organic food, there is a growth in demand for organic agriculture methods.

Key Market Insights:

-

Recent studies have represented the effect of bio-organic fertilizers on food grains. Bio-organic fertilizer that showed various qualities, such as nutrient acquisition and plant growth support for rice, is an organic-based biofertilizer that constitutes RP (5%), biochar (15%), and the living cells of Plant Growth Promoting Bacteria (PGPB), mostly Bacillus, Proteus, and Paenibacillus spp., which were separated from the floodplain, terrace, and saline soils.

-

The final observation from 16 field experiments and 18 farmers' demonstration trials conducted by Bangladesh Rice proved that added PGPB supplemented the 30% synthetic N necessity of rice production through biological nitrogen fixation and fully complemented available P from rock phosphate by solubilization during the plant development period.

-

The cumulative effect of living ingredients and organic matter of the bio-organic fertilizer saved 30% urea-N, removed 100% Triple Super Phosphate fertilizer applied in rice production, and simultaneously bettered nutrient uptake, N, P use efficiencies, rice yield, and soil health, eventually increasing the adoption of biological organic fertilizers.

Organic Fertilizer Market Drivers:

Improving soil quality to boost crop yields is driving market growth.

Farmers are on a pressure to maximize crop production and return due to the limited amount of agricultural land that is approachable for agriculture. To secure food security for a growing world population, this is particularly significant. Farmers must effectively utilize the resource to produce increased agricultural yields. A crucial strategy for rising agricultural output is to increase the soil's quality. Crop health and yield are majorly influenced by soil quality. Bettered soil quality has benefits such as enhanced microbial activity, better water retention, and greater nutrient content. For the establishment of healthy plants and increased crop yields, each of these components is needed.

Many governments identify the value of the agriculture sector and are actively seeking to improve it. They aid farmers by implementing a range of regulations, rewards, and initiatives. Encouragement of farmers to take part in international agricultural fairs and expos is one such method. These occasions provide farmers a venue to represent their goods and discover best practices from around the world. The market for organic fertilizer is majorly affected by the emphasis on improving the quality of agricultural commodities, which typically has an eye on international markets. Organic fertilizers are popularly known for upgrading the nutritional value and quality of crops. Necessity for organic fertilizers is expected to rise as farmers work to create high-quality agricultural goods that align with both international standards and customer preferences. These fertilizers encourage the development of nutrient-rich crops, crops that please customers and stick to worldwide standards of quality, and soil that is in better health.

Organic Fertilizer Market Restraints and Challenges:

Fluctuating climatic conditions

Agriculture is majorly impacted by climate change's increasing temperatures and sea levels. Crop yields are reduced and their growth patterns are modified by escalating temperatures. As a result of accelerating sea levels, saline water penetrates into inland regions, making the soil imperfect for several crops like rice, palm oil, melons, peanuts, and sweet potatoes. This saltwater intrusion majorly lowers crop output. In response to climate-related concerns and the requirement for higher agricultural returns, farmers are changing more and more to synthetic fertilizers. Synthetic fertilizers provide crops a rapid push in nutrients in regions where conventional farming practices are being impacted by climate change.

Instability in the prices of organic fertilizers

Expensive process of manufacturing is considered as a significant aspect that is expected to affect demand for organic fertilizers. Some of the organic fertilizers can take longer to transform the lawn green and may cause plant deficiencies in the months following the initial usage of fertilizer. Additionally, the quantity of nutrients involved in organic fertilizer is mostly ambiguous. Organic fertilizers' use is restricted since they lower nutrients more slowly than synthetic fertilizers do, and some of them have unpleasant odour that curbs them from being utilized in indoor gardens. The aforementioned restrictions are preventing market widening.

Organic Fertilizer Market Opportunities:

Initiatives by Government

Governments are not only supporting sustainable agriculture but are also implementing policies to enhance domestic organic fertilizer manufacturing abilities. These regulations offer to enhance domestic output, reduce dependency on imports, and aid small businesses. During the estimated period, it is expected that the integrated effects of factors involving environmental issues, governmental initiatives, growing demand, and efforts to widen domestic production capacity would open up profitable abilities for the development of the global organic fertilizer market. As eco-friendly agriculture practices gain momentum, the organic fertilizer market is prone to develop as a primary component of these methods.

ORGANIC FERTILIZER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.1% |

|

Segments Covered |

By Source, Crop Type, Form, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Biostar Renewables, LLC, Coromandel International Limited, Hello Nature International Srl, Mirimichi Green, NatureSafe, Qilian International Holding Group Limited, Sigma AgriScience, LLC, Suståne Natural Fertilizer, Inc., Tata Chemicals Ltd., The Scotts Company LLC, Windfall |

Organic Fertilizer Market Segmentation: By Source

-

Plant

-

Animal

-

Minerals

The Animal segment held the greatest share in the organic fertilizers market in 2023. One of the main elements playing a pivotal role in organic agriculture which dedicates to market growth are the Organic fertilizers derived from animal sources. It is mixed with respect to particular crop varieties, soil types, and environmental considerations.

However, the Mineral segment is considered as rapidly growing segment owing to its escalating offers in organic fertilizers market. Issues about soil erosion, water pollution, and the detrimental traditional chemical fertilizers on the environment have prompted a change to more eco-friendly farming techniques. Mineral organic fertilizers are suggested as a way to lessen agriculture's harmful effects on the environment.

Organic Fertilizer Market Segmentation: By Crop Type

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

The Cereals & Grains segment led the organic fertilizers market size in terms of revenue and volume. Throughout the estimated period for the market for organic fertilizers, it is expected to widen at a noteworthy CAGR of 6.0%. Cereal grains are seeds of crops like wheat, millet, rice, barley, oats, rye, triticale, sorghum, and maize (corn). Cereal grains offer approximately half of the calories and over 80% of the protein that people and livestock ingest.

Organic Fertilizer Market Segmentation: By Form

-

Dry

-

Liquid

The Dry fertilizers segment held the major share in the organic fertilizers market owing to its highest revenue contribution in 2023. Dry organic fertilizers have a major market opportunity owing to the growing demand for organic foods and services. Farmers are asking organic certification and adopting organic farming techniques to meet this demand. However, liquid fertilizers are estimated to dominate the organic fertilizers market growth in the future time. Liquid organic fertilizers be accurately used through various methods, including drip irrigation and foliar spraying, encouraging precision farming practices. The combination of digital technologies, such as precision agriculture techniques and data analytics, is increasing the efficiency and effectiveness of liquid organic fertilizer applications.

Organic Fertilizer Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Organic fertilizers market is anticipated to grow at the rapid rate during the future period, with the Asia-Pacific region estimated to continue leading the market in 2023. One of the biggest and most primary markets for fertilizers globally is Asia-Pacific. In order to make sure of food security for its widening population and contribute to the world's food supply, the agricultural industry is significant. The primary drivers of the growth of the Asia-Pacific Fertilizer Market are the growing food demand brought on by population increasing, improving farming techniques, and government measures to enhance agricultural output.

Impact and Analysis of COVID-19 on the Organic Fertilizer Market:

The spread of COVID-19 enhanced the awareness about eating clean and quality food among consumers. This rise made sure that in order to maintain the high quality of food, plant and crop sources were sufficiently supplied with necessary nutrients. Hence, this preserved the organic fertilizer market especially in India from a greater drop. This market is progressively rebounding from losses, impacting in positive sales growth in the Organic Fertilizer landscape across the globe. Escalating prospects of organic fertilizers in growing crop production in various states are also anticipated to boost the demand for these fertilizers over the future years.

Latest Trends:

Increasing Organic Farming

The growing popularity of organic products and consumption has compelled the expansion of organic farming across the world. Subsequently, the market for biological organic fertilizers has grown exponentially in response to the emerging interest in regenerative agriculture, organic farming, and soil health. Natural organic fertilizers constitute particular levels of microorganisms (such as nitrogen-fixing bacteria); organic fertilizers similarly contain microorganisms and typically derive from animals and plants, such as livestock manure and crop residues, which are largely suitable for Organic Farming.

Additionally, the regional statistics of both developed and developing nations have depicted the development of organic agriculture in the country. For example, as per the statistics by the government of India, the land under the organic farming certification process in India has almost doubled in 2021-2022, exhibiting the growing initiatives and adoption of organic farming, with the complete production accounting for 20,540.63 metric tons. Thus, due to the enhancing organic area under cultivation and the growing demand for good-quality crops, cultivators are expected to use biological organic fertilizers instead of excessive synthetic fertilizers, propelling the market.

Key Players:

-

Biostar Renewables, LLC

-

Coromandel International Limited

-

Hello Nature International Srl

-

Mirimichi Green

-

NatureSafe

-

Qilian International Holding Group Limited

-

Sigma AgriScience, LLC

-

Suståne Natural Fertilizer, Inc.

-

Tata Chemicals Ltd.

-

The Scotts Company LLC

-

Windfall

Chapter 1. Organic Fertilizer Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Organic Fertilizer Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Organic Fertilizer Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Organic Fertilizer Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Organic Fertilizer Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Organic Fertilizer Market – By Source

6.1 Introduction/Key Findings

6.2 Plant

6.3 Animal

6.4 Minerals

6.5 Y-O-Y Growth trend Analysis By Source

6.6 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Organic Fertilizer Market – By Crop Type

7.1 Introduction/Key Findings

7.2 Cereals & Grains

7.3 Oilseeds & Pulses

7.4 Fruits & Vegetables

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Crop Type

7.7 Absolute $ Opportunity Analysis By Crop Type, 2024-2030

Chapter 8. Organic Fertilizer Market – By Form

8.1 Introduction/Key Findings

8.2 Dry

8.3 Liquid

8.4 Y-O-Y Growth trend Analysis By Form

8.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 9. Organic Fertilizer Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Crop Type

9.1.4 By Form

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Crop Type

9.2.4 By Form

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Crop Type

9.3.4 By Form

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Crop Type

9.4.4 By Form

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Crop Type

9.5.4 By Form

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Organic Fertilizer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Biostar Renewables, LLC

10.2 Coromandel International Limited

10.3 Hello Nature International Srl

10.4 Mirimichi Green

10.5 NatureSafe

10.6 Qilian International Holding Group Limited

10.7 Sigma AgriScience, LLC

10.8 Suståne Natural Fertilizer, Inc.

10.9 Tata Chemicals Ltd.

10.10 The Scotts Company LLC

10.11 Windfall

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Organic Fertilizer Market was valued at USD 187.84 billion in 2023 and is projected to reach a market size of USD 392.45 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 11.1%.

The heightened demand for increasing soil quality is propelling the Organic Fertilizer Market.

Organic Fertilizer Market is segmented based Source, Crop Type, Nutrient Contents, Form and Region.

Asia- Pacific is the most dominant region for the Organic Fertilizer Market.

Qilian International Holding Group Limited, Sigma AgriScience, LLC, Suståne Natural Fertilizer, Inc., Tata Chemicals Ltd., The Scotts Company LLC, Windfall Bio are the few of the key players operating in the Organic Fertilizer Market.