Middle East and Africa Organic Fertilizers Market Size (2024-2030)

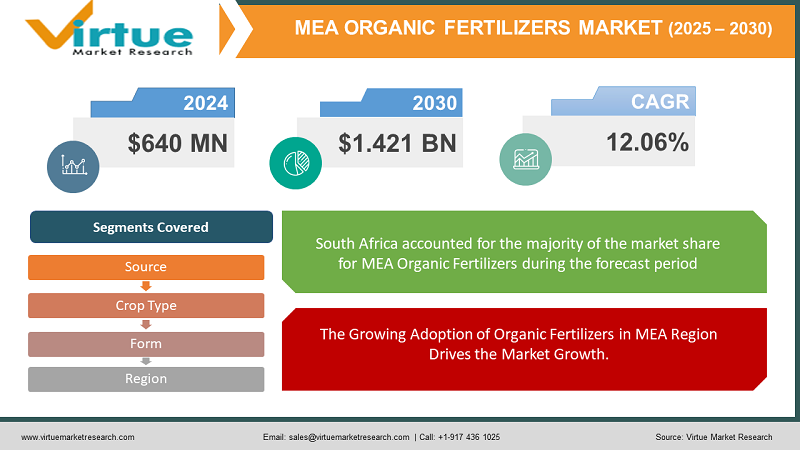

The Middle East and Africa Organic Fertilizers Market was valued at USD 640 million and is projected to reach a market size of USD 1.421 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 12.06% between 2024 and 2030.

While organic farming encourages food systems that improve living standards and food security, it now occupies barely 0.2% of Africa's agricultural area. This resulted from a lack of understanding regarding the production, processing, and marketing of organic goods. On the other hand, the conflict in Ukraine has seriously disrupted global supply chains, especially those that deal with food, fertilizers, and energy. In Africa, the impact of the violence on fertilizer prices worldwide has been particularly noticeable. This short examines how the conflict in Ukraine has affected local fertilizer costs immediately and how it may affect food production in the future. Fertilizer costs were greater in Africa than in other parts of the world even before the start of the conflict in Ukraine. Because of this, farmers are switching to organic fertilizers, and in the past ten years, the amount of organic farmland in Africa has doubled to 2.1 million hectares. North and East Africa are home to the most significant organic centers, according to FiBL. Kenya's organic output is dominated by nuts and coconuts. It is olives in Tunisia. Although Uganda is home to the majority of Africa's organic producers, chocolate is the preferred crop there. Ethiopia and Tanzania are major producers of coffee.

Key Market Insights:

- Data from the Research Institute of Organic Agriculture (FiBL) indicate that subsistence farming and natural agriculture are extensively practiced on this continent. A farmer's ability to export goods overseas is hampered by high expenses, corruption, and a lack of government backing, according to farmers who eschew synthetic fertilizers and pesticides yet are unable to obtain organic certificates.

- The primary drivers of Africa's rising use of organic fertilizers are the region's emphasis on organic farming and the requirement for sustainable agricultural methods. It is anticipated that several government initiatives and incentives for sustainable organic farming in developing nations will sustain the market's ongoing expansion. To keep the market expanding, farmers must become more aware of their responsibilities. There would be plenty of room for expansion in Africa's unexplored and emerging markets.

Middle East and Africa Organic Fertilizers Market Drivers:

The Growing Adoption of Organic Fertilizers in MEA Region Drives the Market Growth.

Demand for sustainable farming practices has noticeably increased in response to growing worries about the environmental effects of traditional farming. Growing knowledge of the damaging impacts of traditional farming on soil health, water quality, and general ecosystem balance is the main driver of this change. The use of organic fertilizers has become a ray of hope in the fight for sustainability. Organic fertilizers, in contrast to their chemical equivalents, provide a more environmentally friendly option by enhancing soil fertility and health without causing soil deterioration or water contamination. Organic fertilizers boost soil microbial activity and nourish crops by using natural components like compost, manure, and plant-based materials. Furthermore, applying organic fertilizers supports long-term sustainability and climate change resilience in line with the tenets of regenerative agriculture. Demand for organic fertilizers is expected to rise further as people become more aware of their environmental impact. This will lead to a paradigm change in agriculture and a move towards more sustainable practices.

Growing and Satisfying Demand with Sustainable Agriculture is increasing the Organic Food market.

An enormous increase in consumer demand for organic food is changing the face of agriculture in the Middle East and Africa. This development is the result of several variables coming together, such as growing interest in healthier nutritional options and increased worries about food safety. Using organic fertilizers is essential to producing organic food since they are a key component of growing crops without the use of artificial fertilizers or pesticides. The demand for produce cultivated organically is rising as customers become pickier about the source and ingredients of the food they consume. By promoting soil health and fertility naturally, organic fertilizers help meet this demand by guaranteeing that crops are fed without the use of hazardous chemicals. This move toward organic agricultural methods not only reflects a greater dedication to environmental sustainability but also reflects customer desires for safer and more nutrient-dense food options. The Middle East and Africa are positioned to meet the growing demand for organic food while advancing a more sustainable agricultural future by giving organic fertilizers priority in food production.

Middle East and Africa Organic Fertilizers Market Restraints and Challenges:

Despite its promise, the market for organic fertilizer in the Middle East and Africa has obstacles. First off, there is still a lack of knowledge among farmers regarding the advantages of using organic fertilizers. Second, compared to conventional fertilizers, organic fertilizers frequently have lower nutrient concentrations, requiring higher amounts to get comparable effects. This can deter adoption, along with the region's sometimes erratic weather patterns that might alter fertilizer performance. Lastly, there are few financial incentives for farmers to switch due to increasing government rules about organic farming and subsidies for organic fertilizers in many nations. For the market to prosper, it will be essential to overcome these obstacles through education, research into enhancing the potency of organic fertilizer, and government regulations that are helpful.

Middle East and Africa Organic Fertilizers Market Opportunities:

The market for organic fertilizer in the Middle East and Africa has promising prospects. The demand for organic food is rising due to growing health consciousness, which in turn is raising the requirement for organic fertilizers. This makes it easier for businesses that provide cutting-edge organic solutions to get started. Furthermore, the area is seeing a rise in emphasis on sustainable practices. This gives manufacturers of organic fertilizers a chance to highlight the advantages of their products for the environment, such as enhanced soil health and less water pollution. Furthermore, there is a great deal of potential for producing fertilizer from locally sourced organic wastes, which would benefit both waste management and agricultural demands. Companies can take advantage of the mostly unrealized potential by creating new, concentrated organic fertilizer blends and solving knowledge gaps through farmer education programs.

MIDDLE EAST AND AFRICA ORGANIC FERTILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.06% |

|

Segments Covered |

By Source, crop type, form, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

Rizobacter, Argentina, S.A.Novozymes , Symborg, International Panaacea Limited |

Middle East and Africa Organic Fertilizers Market Segmentation:

Middle East and Africa Organic Fertilizers Market Segmentation By Source:

- Plant

- Animal

- Mineral

The Middle East and Africa Organic Fertilizers Market Segmented by Source, an animal held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The market for organic fertilizers in the Middle East and Africa is currently dominated by animal-based fertilizers, especially blood meal. This will probably not change. This is due to two main factors. First off, the livestock industries in many of the region's nations are well-established, providing a ready supply of raw materials for fertilizers derived from animals. Second, switching to animal-based organic fertilizers is a more logical step because farmers in the area may already be accustomed to utilizing manure as a soil amendment. Due to their established supply chain and farmer familiarity, animal-based fertilizers have a prominent position, even though alternative sources such as plant- or mineral-based choices may become more popular in the future.

Middle East and Africa Organic Fertilizers Market Segmentation By Crop Type:

- Cereals And Grains

- Oilseeds& Pulses

- Fruits& Vegetables

The Middle East and Africa Organic Fertilizers Market Segmented by Crop Type, Fruits & Vegetables held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The market for organic fertilizers in the Middle East and Africa is now led by the fruits and vegetables segment, and this trend is anticipated to persist. Here, a few variables come into play. First of all, compared to other commodities like grains, fruits, and vegetables often have a higher market value. To increase output and quality, this encourages growers to spend money on premium-producing techniques, such as organic fertilizers. Second, the region's customers are becoming more health-conscious and are prepared to pay more for organic produce. This drives the use of organic fertilizers in fruit and vegetable cultivation by creating a strong demand signal for farmers to adopt organic practices. Shortly, fruits and vegetables are probably going to continue to be the main users of organic fertilizers due to the increased emphasis on high-value products and a healthy diet.

Middle East and Africa Organic Fertilizers Market Segmentation By Form:

- Dry

- Liquid

The Middle East and Africa Organic Fertilizers Market Segmented by Form, Liquid held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Liquid fertilizers are the market leaders in organic fertilizers for the Middle East and Africa, and this trend is predicted to continue for some time. Numerous factors contribute to this supremacy. First off, liquid fertilizers are more exact in their nutrient distribution and need less labor to apply than solid fertilizers. This is especially advantageous in areas with scarce water supplies since irrigation systems can effectively disperse liquid nutrients. Furthermore, liquid fertilizers often take effect more quickly than solid ones, giving farmers who want to observe improvements in crop health more quickly. The Middle East and Africa's organic fertilizer market favors liquid fertilizers due to their ease of application and quicker nutrient delivery, even though solid choices like granules may have advantages in terms of storage and transportation.

Middle East and Africa Organic Fertilizers Market Segmentation By Region:

- UAE

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The Middle East and Africa Organic Fertilizers Market Segmented by Region, South Africa held the largest market share last year and is poised to maintain its dominance throughout the forecast period. Surprisingly, South Africa leads the organic fertilizer market in both the Middle East and Africa, and this trend is anticipated to persist. Several variables come together to cause this domination. South Africa has a comparatively developed agricultural sector with a heavy emphasis on commercial farming as compared to several other African countries. This makes the market open to creative fixes, such as organic fertilizers. Furthermore, environmental issues in South Africa, such as soil degradation, make organic fertilizers a desirable choice for environmentally friendly farming methods. Furthermore, the usage of organic fertilizer is supported by an ecosystem created by government programs that encourage sustainable agriculture and the expanding domestic organic food industry. Given these circumstances, South Africa is most likely to continue leading the organic fertilizer market in the Middle East and Africa shortly.

COVID-19 Impact Analysis on the Middle East and Africa Organic Fertilizers Market:

The COVID-19 pandemic caused disruptions in the Middle East and Africa's organic fertilizer market. Initial lockdowns and restrictions on movement hampered supply chains, making it difficult for farmers to access organic fertilizers. Additionally, the pandemic's economic impact may have led some farmers to tighten budgets and prioritize lower-cost conventional fertilizers. However, there could be a silver lining. A growing focus on food security and self-sufficiency in the region, along with heightened consumer interest in health and wellness post-pandemic, could lead to a renewed interest in organic food production. This, in turn, could stimulate demand for organic fertilizers in the long run. The overall impact of COVID-19 on the market remains to be seen, but it could potentially act as a turning point for increased awareness and adoption of organic fertilizers in the region.

Latest Trends/ Developments:

Interesting trends are a buzz in the organic fertilizer sector in the Middle East and Africa. A significant advancement in soil health and nutrient uptake is the use of biofertilizers, which use beneficial microorganisms to boost soil health. This environmentally friendly choice is becoming more popular as farmers look for long-term fixes. Furthermore, studies into more nutrient-dense concentrated organic fertilizers are being conducted to overcome a historical shortcoming in comparison to conventional alternatives. This may increase the affordability of organic fertilizers and promote their broader use. Additionally, using organic materials that may be found locally, such as manure and compost, to produce fertilizer is becoming increasingly popular. Waste management benefits from this, and fertilizer firms have easy access to resources. The Middle East and Africa's organic fertilizer industry is positioned for interesting changes in the next years by embracing innovation, filling knowledge gaps through farmer education, and taking advantage of the increased interest in sustainable agriculture.

Key players:

- Rizobacter

- Argentina

- S.A.Novozymes

- Symborg

- International Panaacea Limited

Chapter 1. Middle East and Africa Organic Fertilizers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Organic Fertilizers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Organic Fertilizers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Organic Fertilizers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Organic Fertilizers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Organic Fertilizers Market– By Source

6.1. Introduction/Key Findings

6.2. Plant

6.3. Animal

6.4. Mineral

6.5. Y-O-Y Growth trend Analysis By Source

6.6. Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Middle East and Africa Organic Fertilizers Market– By Crop Type

7.1. Introduction/Key Findings

7.2. Cereals And Grains

7.3. Oilseeds& Pulses

7.4. Fruits& Vegetables

7.5. Y-O-Y Growth trend Analysis By Crop Type

7.6. Absolute $ Opportunity Analysis By Crop Type , 2024-2030

Chapter 8. Middle East and Africa Organic Fertilizers Market– By Form

8.1. Introduction/Key Findings

8.2. Dry

8.3. Liquid

8.4. Y-O-Y Growth trend Analysis By Form

8.5. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 9 . Middle East and Africa Organic Fertilizers Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Crop Type

9.1.3. By Source

9.1.4. Form

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa Organic Fertilizers Market– Company Profiles – (Overview, Source Type Portfolio, Financials, Strategies & Developments)

10.1. Rizobacter

10.2. Argentina

10.3. S.A.Novozymes

10.4. Symborg

10.5. International Panaacea Limited

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

By 2023, the Middle East and Africa Organic Fertilizers market is expected to be valued at USD 640 million

Through 2030, the Middle East and Africa Organic Fertilizers market is expected to grow at a CAGR of 12.06%.

By 2030, the Middle East and Africa Organic Fertilizers market is expected to grow to a value of USD 1.421 billion

South Africa is predicted to lead the market for Middle East and Africa Organic Fertilizers.

The Middle East and Africa Organic Fertilizers market has segments Source, Crop Type, form, and Region