Latin America Organic Fertilizers Market Size (2024-2030)

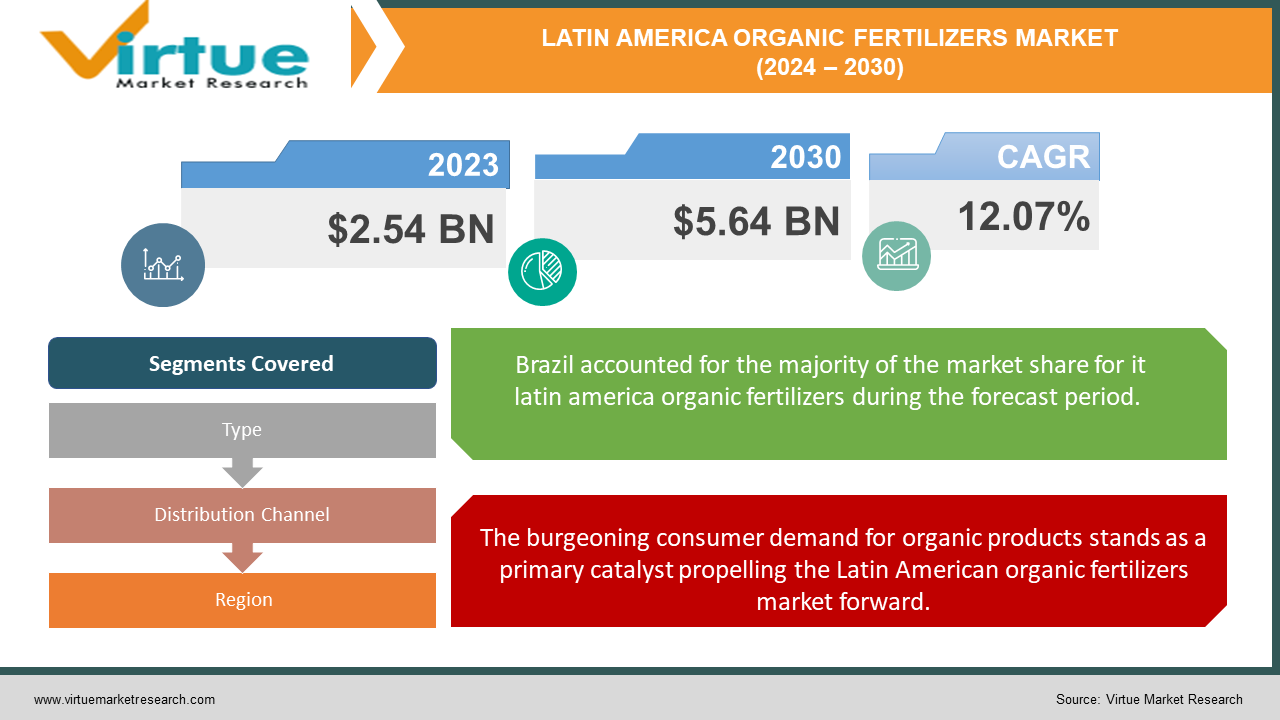

The Latin America Organic Fertilizers Market was valued at USD 2.54 Billion in 2023 and is projected to reach a market size of USD 5.64 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.07%.

Due to a convergence of regionally specific environmental, economic, and social variables, the organic fertilizers business in Latin America is undergoing rapid expansion and reform. Organic fertilizers have become a key component in the search for more environmentally and health-conscious food production systems as knowledge of sustainable agricultural techniques increases and worries about the long-term effects of traditional farming methods develop.

The development of this industry is closely linked to the rich agricultural legacy of Latin America, a continent endowed with a variety of environments, from the lush pampas of Argentina to the tropical settings of Brazil and the highlands of the Andes. Adoption of organic fertilizer has unique difficulties and potential in each of these discrete geographic zones.

Key Market Insights:

- Organic fertilizer exports from Latin America increased by 25% last year. The region saw a 50% rise in the production of organic fertilizers in 2023. 65% of small-scale farmers in Latin America use organic fertilizers.

- Bio-fertilizer demand in Latin America grew by 40% in 2023. Compost usage in organic fertilizers increased by 30% over the past five years. Seaweed-based organic fertilizers saw a 35% rise in popularity in 2023.

- Latin America accounts for 20% of the global organic fertilizer market. 80% of organic fertilizer producers in Latin America are small to medium enterprises.

- The organic fertilizer market in Brazil grew by 55% in 2023.

- 60% of Latin American organic fertilizers are produced domestically.Latin American farmers reported a 25% yield increase using organic fertilizers. 75% of Latin American organic farms use animal manure-based fertilizers.

- Organic fertilizer sales in Mexico rose by 50% last year.

- 85% of Latin American organic fertilizers are used in crop farming. 90% of certified organic farms in Latin America use organic fertilizers.

Unlock Market Insights : Get Your Sample Report Today

Latin America Organic Fertilizers Market Drivers:

The burgeoning consumer demand for organic products stands as a primary catalyst propelling the Latin American organic fertilizers market forward.

At the heart of this driver is a fundamental shift in consumer consciousness. Latin American consumers, particularly in urban centers and among the growing middle class, are becoming increasingly aware of the health and environmental implications of their food choices. This awareness is not merely a passive acknowledgment but an active force shaping purchasing decisions and, by extension, agricultural practices.

The rise of health-conscious consumerism in Latin America is closely tied to global trends but also reflects unique regional dynamics. As information about the potential risks associated with pesticide residues and synthetic fertilizers becomes more widespread, consumers are seeking alternatives that they perceive as safer and more natural. Organic products, grown without synthetic pesticides and fertilizers, have emerged as the preferred choice for this demographic.

The second major driver propelling the Latin American organic fertilizers market is the growing awareness of soil health and environmental sustainability within the agricultural sector.

At the core of this driver is the recognition that soil is not merely a substrate for growing crops but a complex, living ecosystem that plays a crucial role in agricultural productivity and environmental health. Decades of intensive farming practices, reliant on synthetic fertilizers and pesticides, have led to widespread soil degradation across Latin America.

Issues such as soil erosion, loss of organic matter, and declining biodiversity have become increasingly apparent, threatening long-term agricultural sustainability. Organic fertilizers are seen as a vital tool in reversing these trends. Unlike their synthetic counterparts, organic fertilizers contribute to soil health in multiple ways. They add organic matter to the soil, improving its structure and water-holding capacity. They foster beneficial microbial activity, enhancing nutrient cycling and availability. Moreover, they help sequester carbon in the soil, contributing to climate change mitigation efforts.

Latin America Organic Fertilizers Market Restraints and Challenges:

The Latin American organic fertilizers market, while experiencing significant growth and potential, faces several notable restraints and challenges that impact its development and widespread adoption. These obstacles span economic, technical, and cultural dimensions, creating a complex landscape for market participants to navigate.

One of the primary challenges is the higher cost associated with organic fertilizers compared to their synthetic counterparts. In many Latin American countries, where small-scale farmers operate on tight budgets, the initial investment required for organic fertilizers can be prohibitive.

The transition period required for conventional farms to switch to organic practices presents another significant hurdle. During this transition, which can take several years, farmers may experience reduced yields as the soil ecosystem adjusts to the new organic inputs. This temporary dip in productivity can be financially challenging for farmers, especially those operating on slim margins.

Latin America Organic Fertilizers Market Opportunities:

The Latin American organic fertilizers market, despite its challenges, presents a wealth of opportunities for growth, innovation, and sustainable development. These opportunities span various aspects of the agricultural sector and extend into broader economic and environmental realms, offering potential benefits for a wide range of stakeholders.

Technological advancements present numerous opportunities for innovation in the organic fertilizers market. The development of more efficient composting techniques, precision application methods, and enhanced formulations can improve the efficacy and ease of use of organic fertilizers.

The integration of organic fertilizers with smart farming technologies, such as IoT sensors and data analytics, could lead to more precise and effective nutrient management systems, making organic fertilizers more competitive with synthetic alternatives.

The growing emphasis on soil health and regenerative agriculture offers a platform for positioning organic fertilizers as a key component of sustainable farming systems. As more farmers recognize the long-term benefits of building soil health, there's an opportunity to market organic fertilizers not just as a nutrient source but as a soil health management tool.

LATIN AMERICA ORGANIC FERTILIZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.07% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Brazil, Argentina, Chile and Rest of Latin America |

|

Key Companies Profiled |

BASF SE (Germany), Bayer AG (Germany), The Scotts Miracle-Gro Company (US), Yara International ASA (Norway), Coromandel International Limited (India), Tata Chemicals Ltd (India), Biológica Argentina (Argentina), Brazil EcoAgro (Brazil), Eco Fertil (Brazil), Fertijet do Brazil (Brazil), Agroleader (Colombia), Tecno Huerta (Mexico), Bio-Insumos (Mexico). |

Segmentation Analysis

Latin America Organic Fertilizers Market Segmentation: By Types:

- Animal-based Organic Fertilizers

- Plant-based Organic Fertilizers

- Mineral-based Organic Fertilizers

- Microbial Fertilizers

- Liquid Organic Fertilizers

Among these categories, microbial fertilizers stand out as the fastest-growing segment in the Latin American organic fertilizers market. Recent research has shed light on the crucial role of the soil microbiome in plant nutrition and health. This has driven innovation in microbial products tailored to specific crops and soil conditions common in Latin America.

Microbial fertilizers can offer more targeted effects compared to bulk organic fertilizers. For instance, specific strains of rhizobia can be matched to particular legume crops for optimal nitrogen fixation. This precision appeals to farmers looking to optimize their nutrient management strategies.

Animal-based organic fertilizers, particularly manure-based products, remain the most dominant type in the Latin American market. The extensive livestock sector in many Latin American countries ensures a steady, local supply of raw materials.

Farmers have centuries of experience with manure application, making it a trusted option. Animal manures provide a wide range of macro and micronutrients, often in forms readily available to plants. This makes them a "one-stop-shop" for many farmers' fertilizer needs. For many farmers, especially those with integrated crop-livestock systems, manure represents a low-cost or even free fertilizer option. This is crucial in a region where many farmers operate on thin margins.

Latin America Organic Fertilizers Market Segmentation: By Distribution Channel:

- Direct to Farm

- Agricultural Input Retailers

- Online Platforms

- Supermarkets and Garden Centers

- Government and NGO Programs

- Farmer-to-Farmer Networks

Traditional agricultural input retailers remain the most dominant distribution channel for organic fertilizers in Latin America. These retailers have long-standing, extensive networks across rural Latin America, often serving as community hubs for agricultural information and supplies.

Many farmers have multi-generational relationships with local agricultural supply stores, valuing face-to-face interactions and personalized service. Retailers offer the advantage of immediate product availability, crucial during critical growing periods when farmers can't wait for deliveries. These stores typically stock a wide range of agricultural inputs, allowing farmers to purchase organic fertilizers alongside other necessary supplies in one visit.

E-commerce sites have been the fastest-growing organic fertilizer delivery method in Latin America in recent years. An atmosphere that is favorable to online commerce has been established in rural Latin America by the rising use of cell phones and internet access. Farmers are getting access to online markets even in isolated farming regions. A new breed of tech-savvy farmers is coming up in the agriculture industry. These younger farmers frequently choose the convenience of digital platforms and are more at ease making purchases online.

Latin America Organic Fertilizers Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

With a dominant 45% of the Latin American market for organic fertilizers, Brazil is without a doubt the industry leader. Several factors that have put Brazil in the forefront of the region's organic agricultural movement can be ascribed to this supremacy. Above all, Brazil's immense agricultural area is very important.

Brazil, the largest nation in South America, has a wide range of climatic zones and significant areas of fertile land that make it possible to cultivate a wide range of crops. Due to the complexity of farming practices, there is a strong need for organic fertilizers in a variety of farming sectors, including tiny fruit and vegetable farms and large-scale soybean and maize production.

While Colombia currently holds a 12% share of the Latin American organic fertilizers market, it has emerged as the fastest-growing country in this sector. Several factors are contributing to Colombia's rapid ascent in the organic fertilizers landscape. Colombia's agricultural sector has been undergoing a significant transformation in recent years, with a strong push towards sustainable and organic farming practices. This shift has been driven by both domestic and international factors, creating a fertile ground for the organic fertilizers market to flourish.

COVID-19 Impact Analysis on the Latin America Organic Fertilizers Market:

Lockdowns and travel restrictions disrupted global supply chains, impacting the import of raw materials and finished organic fertilizer products into Latin America. This created shortages and price fluctuations, leaving farmers scrambling for essential soil amendments.

The initial phase of the pandemic saw a dip in demand for organic fertilizers. Lockdowns and restaurant closures disrupted food service industries, leading to a temporary decrease in the need for organic produce, and consequently, a reduced demand for organic fertilizers among some farmers. Social distancing measures and travel restrictions hampered the movement of agricultural labour, impacting fertilizer production and distribution. This, coupled with limitations on transportation and logistics, posed significant challenges for getting organic fertilizers to farmers.

The pandemic exposed vulnerabilities in global food supply chains, prompting a renewed focus on food security and self-sufficiency in many Latin American countries. This could lead to increased government support for sustainable agricultural practices, including the use of organic fertilizers. Lockdowns and social distancing measures accelerated the adoption of e-commerce platforms in Latin America. This trend can be leveraged by organic fertilizer companies to reach a wider audience of farmers and offer online purchasing options, improving accessibility.

Latest Trends/ Developments:

The power of soil microbes is being harnessed. Organic fertilizers enriched with beneficial bacteria and fungi are gaining traction. These "living fertilizers" promote nutrient cycling, improve soil structure, and enhance plant resilience. Imagine bio-fertilizers teeming with microscopic allies, working in harmony with plant roots to unlock the soil's natural potential.

The practice of planting cover crops between cash crop cycles is gaining popularity. These cover crops, nourished by organic fertilizers, suppress weeds, retain soil moisture, and fix nitrogen back into the soil, creating a natural fertility cycle. This eliminates the need for synthetic nitrogen fertilizers, promoting a more sustainable agricultural ecosystem.

Precision agriculture techniques are being applied to the organic fertilizer domain. Soil testing and data analysis are used to create customized blends tailored to specific crops, soil types, and regional climates. Imagine farmers armed with soil data, selecting organic fertilizer blends that precisely address their unique needs, optimizing nutrient delivery and minimizing waste. Blockchain technology can be used to track the origin of organic ingredients in fertilizers, ensuring transparency and building consumer trust. This fosters a more ethical and sustainable supply chain for organic fertilizers.

Key Players:

- BASF SE

- Bayer AG

- The Scotts Miracle-Gro Company

- Yara International ASA

- Coromandel International Limited

- Tata Chemicals Ltd

- Biológica Argentina

- Brazil EcoAgro

- Eco Fertil

- Fertijet do Brazil

- Agroleader

- Tecno Huerta

- Bio-Insumos

Chapter 1. Latin America Organic Fertilizers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Organic Fertilizers Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Organic Fertilizers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Organic Fertilizers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Organic Fertilizers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Organic Fertilizers Market– By Type

6.1. Introduction/Key Findings

6.2. Animal-based Organic Fertilizers

6.3. Plant-based Organic Fertilizers

6.4. Mineral-based Organic Fertilizers

6.5. Microbial Fertilizers

6.6. Liquid Organic Fertilizers

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Organic Fertilizers Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Direct to Farm

7.3. Agricultural Input Retailers

7.4. Online Platforms

7.5. Supermarkets and Garden Centers

7.6. Government and NGO Programs

7.7. Farmer-to-Farmer Networks

7.8. Y-O-Y Growth trend Analysis By Distribution Channel

7.9. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Latin America Organic Fertilizers Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Organic Fertilizers Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. BASF SE (Germany)

9.2. Bayer AG (Germany)

9.3. The Scotts Miracle-Gro Company (US)

9.4. Yara International ASA (Norway)

9.5. Coromandel International Limited (India)

9.6. Tata Chemicals Ltd (India)

9.7. Biológica Argentina (Argentina)a

9.8. Brazil EcoAgro (Brazil)

9.9. Eco Fertil (Brazil)

9.10. Fertijet do Brazil (Brazil)

9.11. Agroleader (Colombia)

9.12. Tecno Huerta (Mexico)

9.13. Bio-Insumos (Mexico)

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Latin America Organic Fertilizers Market was valued at USD 2.54 Billion in 2023 and is projected to reach a market size of USD 5.64 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 12.07%.

Organic fertilizers can be more expensive than their conventional counterparts. This can be a barrier for some farmers, particularly small-scale growers operating on tight margins.

BASF SE (Germany), Bayer AG (Germany), The Scotts Miracle-Gro Company (US), Yara International ASA (Norway), Coromandel International Limited (India), Tata Chemicals Ltd (India), Biológica Argentina (Argentina), Brazil EcoAgro (Brazil), Eco Fertil (Brazil), Fertijet do Brazil (Brazil), Agroleader (Colombia), Tecno Huerta (Mexico), Bio-Insumos (Mexico).

The market is dominated by Brazil, which commands a market share of around 45%.

With a market share of about 12%, Columbia is expanding the quickest.