Oat Milk Market Size (2025 – 2030)

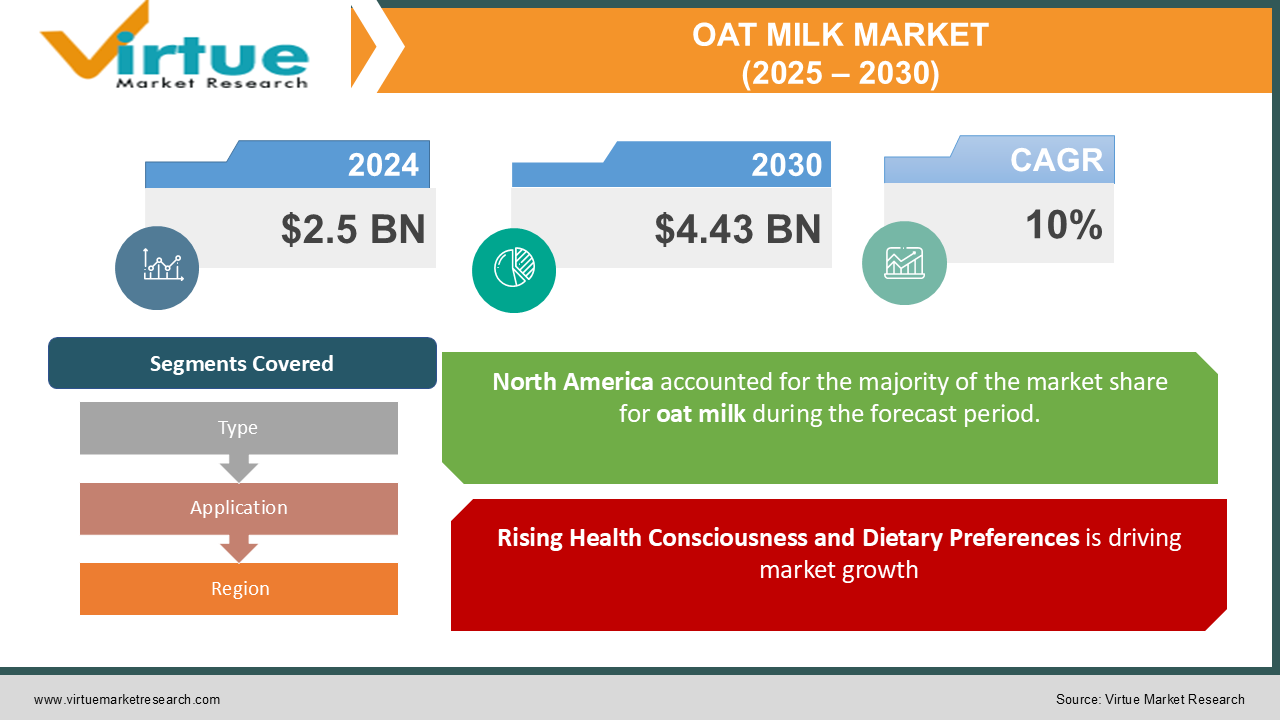

The Global Oat Milk Market was valued at USD 2.5 billion in 2024 and will grow at a CAGR of 10% from 2025 to 2030. The market is expected to reach USD 4.43 billion by 2030.

The Oat Milk Market focuses on plant-based milk derived from oats, known for its creamy texture, nutritional benefits, and environmental sustainability. This market is gaining traction due to the rising demand for lactose-free and vegan alternatives, growing health consciousness among consumers, and the increasing prevalence of lactose intolerance. Oat milk's rich nutrient profile, including beta-glucans that support heart health, and its sustainable production process position it as a preferred choice among plant-based milk options.

Key Market Insights

The rising demand for plant-based beverages is driving the growth of the oat milk market, with plant-based milk accounting for over 15% of the global milk market in 2024.

North America dominated the oat milk market in 2024, contributing approximately 40% of the total revenue, driven by increased adoption of vegan diets and a growing lactose-intolerant population.

Flavored oat milk products are gaining popularity, with vanilla and chocolate variants contributing over 30% of sales in the product segment.

The e-commerce segment for oat milk distribution witnessed a growth rate of 18% in 2024 due to the convenience of online shopping and increased availability of premium oat milk brands.

Oat milk’s role in promoting sustainability is a major selling point, with its production requiring 80% less water compared to almond milk and producing lower greenhouse gas emissions.

Asia-Pacific is emerging as a lucrative market for oat milk, projected to grow at a CAGR of 13% from 2025 to 2030 due to increasing health awareness and dietary shifts.

Global Oat Milk Market Drivers

Rising Health Consciousness and Dietary Preferences is driving market growth:

Increasing awareness about health and wellness is a key driver for the oat milk market. Consumers are prioritizing nutrient-rich alternatives, and oat milk aligns with this demand by offering low-fat, high-fiber, and heart-healthy options. Oat milk contains beta-glucans, known to reduce cholesterol, which appeals to health-conscious individuals. Additionally, its suitability for lactose-intolerant consumers and those with milk allergies broadens its appeal. Oat milk is often fortified with essential nutrients like calcium and vitamin D, making it comparable to dairy milk in nutritional value. This shift in dietary preferences, coupled with oat milk’s perceived health benefits, is propelling market growth globally.

Sustainability and Environmental Benefits is driving market growth:

Sustainability is a significant factor driving the oat milk market. The production process of oat milk is environmentally friendly, requiring considerably less water than almond milk and producing lower greenhouse gas emissions compared to dairy milk. As environmental concerns rise, consumers are gravitating toward eco-conscious products. Oat milk’s sustainable profile resonates strongly with environmentally aware consumers, especially millennials and Gen Z. Furthermore, many oat milk manufacturers adopt sustainable packaging, enhancing their market positioning. The global push for reducing carbon footprints is expected to sustain the growth momentum of oat milk as a preferred plant-based alternative.

Expanding Product Portfolios and Innovations is driving market growth:

Innovation in oat milk products is driving market expansion. Leading companies are introducing diverse oat milk-based items, including yogurts, ice creams, and protein shakes, to cater to varied consumer tastes. Coffee culture also contributes significantly, with oat milk emerging as a preferred dairy alternative due to its creamy texture and ability to foam well. Additionally, brands are offering fortified and flavored oat milk to meet the nutritional needs and taste preferences of different demographics. Such product innovations attract a broader audience and are instrumental in maintaining consumer interest in the market.

Global Oat Milk Market Challenges and Restraints

Competition from Other Plant-Based Milk Alternatives is restricting market growth:

The oat milk market faces intense competition from other plant-based milk alternatives such as almond, soy, and coconut milk. Almond milk, for instance, has a well-established consumer base due to its low-calorie content and neutral taste. Similarly, soy milk is a popular choice for protein-rich options. While oat milk offers unique benefits, it may struggle to differentiate itself in a crowded market. The price of oat milk, often higher than dairy milk and some plant-based counterparts, could also deter price-sensitive consumers. Moreover, marketing and distribution challenges in developing regions can limit its penetration and growth potential.

Supply Chain and Cost Constraints is restricting market growth:

The production of oat milk requires high-quality oats and specialized processing, which can result in supply chain inefficiencies. Fluctuating raw material costs and limited suppliers for organic oats exacerbate these challenges. Moreover, maintaining the quality and shelf life of oat milk is a logistical hurdle, particularly in regions with underdeveloped cold chain infrastructure. Additionally, the high energy and resource costs associated with processing and fortifying oat milk add to its overall price, potentially impacting its competitiveness. Addressing these supply chain constraints is critical to achieving consistent growth in the market.

Market Opportunities

The oat milk market presents significant opportunities for growth, driven by evolving consumer preferences and expanding market penetration. As health-conscious consumers seek plant-based alternatives, oat milk offers a compelling proposition with its rich nutritional profile, including fiber and beta-glucans, known for heart health benefits. Furthermore, the increasing prevalence of lactose intolerance globally underscores the need for dairy-free alternatives. Emerging markets, particularly in Asia-Pacific and South America, present untapped potential, where rising disposable incomes and awareness about plant-based diets can drive demand. Innovation also plays a pivotal role, with brands introducing fortified, organic, and functional oat milk products tailored to diverse consumer needs. The burgeoning coffee culture offers another avenue for growth, as oat milk’s compatibility with coffee positions it as a favorite among baristas and consumers. Moreover, partnerships with food service providers and the growing adoption of e-commerce platforms create opportunities to expand the reach of oat milk brands.

OAT MILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Oatly, Califia Farms, Planet Oat, Elmhurst 1925, Chobani, Pacific Foods, Rise Brewing Co., Minor Figures, Alpro, Danone |

Oat Milk Market Segmentation - By Type

-

Plain Oat Milk

-

Flavored Oat Milk

-

Fortified Oat Milk

-

Organic Oat Milk

Flavored oat milk dominates the market, accounting for over 40% of the revenue share in 2024. The increasing consumer preference for indulgent and taste-enhanced dairy alternatives has propelled the demand for flavored oat milk. Popular variants like vanilla, chocolate, and coffee-flavored oat milk attract a wide demographic, particularly millennials and Gen Z consumers.

Oat Milk Market Segmentation - By Application

-

Beverages

-

Bakery and Confectionery

-

Frozen Desserts

-

Nutritional Products

-

Others

The beverages segment leads the oat milk market, contributing over 50% of the revenue share in 2024. The versatility of oat milk as a standalone drink and its extensive use in coffee, tea, and smoothies drive its dominance. The rising café culture and demand for plant-based milk in beverages support the growth of this segment.

Oat Milk Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the oat milk market, accounting for 40% of the global revenue in 2024. This dominance is attributed to the region's growing health consciousness, increasing adoption of vegan diets, and the prevalence of lactose intolerance. The United States leads the market with a strong preference for plant-based beverages. Additionally, well-established distribution networks and the presence of leading oat milk brands contribute to the region's market leadership.

COVID-19 Impact Analysis on the Oat Milk Market

The COVID-19 pandemic had a profound impact on the oat milk market, with both positive and negative effects. In the early stages, the market faced significant challenges due to disruptions in supply chains and logistical difficulties, which impacted production and distribution. These setbacks created temporary barriers for oat milk manufacturers and suppliers. However, the pandemic also triggered a shift in consumer behavior, with heightened awareness of health and wellness. As a result, there was a growing demand for plant-based, immune-boosting products, and oat milk, known for its sustainability and health benefits, emerged as a popular choice. Consumers increasingly sought out dairy alternatives during the pandemic, driven by concerns over nutrition and environmental impact. Oat milk, with its nutritional profile and eco-friendly production methods, was particularly appealing. In addition, the rise of e-commerce during the pandemic played a pivotal role in the market's growth. With lockdowns in place and a surge in online shopping, consumers increasingly turned to digital platforms to purchase their preferred oat milk brands, boosting retail sales. While the food service sector faced temporary setbacks due to restaurant closures and reduced demand, the retail segment of the oat milk market experienced steady growth. The resilience of the oat milk market during this period highlights its strong value proposition as both a nutritious and environmentally friendly alternative to traditional dairy. As health-conscious and eco-aware consumers continue to drive demand, the future of the oat milk market remains promising, with sustained growth expected as global consumption trends shift toward more plant-based options.

Latest Trends/Developments

The oat milk market is experiencing notable innovations and emerging trends, driven by evolving consumer preferences and increasing demand for plant-based products. One of the key developments is the introduction of premium oat milk variants, such as barista blends tailored for coffee enthusiasts. These specialty products have captured the attention of consumers seeking the perfect dairy alternative for their beverages. Additionally, there is a growing trend of fortifying oat milk with essential nutrients, including vitamin D, calcium, and protein, to cater to the health-conscious market. This aligns with consumer interest in products that offer nutritional benefits beyond simple dairy replacements. Organic and non-GMO oat milk products are also seeing a surge in demand, reflecting a broader shift towards more natural, sustainable food options. Consumers are becoming increasingly conscious of ingredient sourcing and are choosing products that align with their values of health and sustainability. In response, brands are focusing on sustainable packaging solutions, such as recyclable and biodegradable materials, to appeal to environmentally aware buyers. Another emerging trend is the rise of oat milk-based snacks, desserts, and ready-to-drink beverages, expanding the market beyond traditional milk alternatives. These innovative products are catering to consumers looking for convenient and tasty plant-based options. Furthermore, collaborations between oat milk brands and food service providers, along with expanded e-commerce strategies, are helping to drive the market’s growth. These partnerships and digital initiatives are expanding the reach of oat milk products and making them more accessible to a broader audience. As these trends continue to evolve, the oat milk market is poised for sustained growth, offering a wide array of innovative and health-conscious options for consumers.

Key Players

-

Oatly

-

Califia Farms

-

Planet Oat

-

Elmhurst 1925

-

Chobani

-

Pacific Foods

-

Rise Brewing Co.

-

Minor Figures

-

Alpro

-

Danone

Chapter 1. Oat Milk Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Oat Milk Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Oat Milk Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Oat Milk Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Oat Milk Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Oat Milk Market – By Type

6.1 Introduction/Key Findings

6.2 Plain Oat Milk

6.3 Flavored Oat Milk

6.4 Fortified Oat Milk

6.5 Organic Oat Milk

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Oat Milk Market – By Application

7.1 Introduction/Key Findings

7.2 Beverages

7.3 Bakery and Confectionery

7.4 Frozen Desserts

7.5 Nutritional Products

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Oat Milk Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Oat Milk Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Oatly

9.2 Califia Farms

9.3 Planet Oat

9.4 Elmhurst 1925

9.5 Chobani

9.6 Pacific Foods

9.7 Rise Brewing Co.

9.8 Minor Figures

9.9 Alpro

9.10 Danone

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Oat Milk Market was valued at USD 2.5 billion in 2024 and will grow at a CAGR of 10% from 2025 to 2030. The market is expected to reach USD 4.43 billion by 2030.

Key drivers include rising health consciousness, sustainability concerns, and expanding product portfolios with innovative oat milk-based items.

By product: Plain, Flavored, Fortified, Organic.

By application: Beverages, Bakery and Confectionery, Frozen Desserts, Nutritional Products, Others.

North America is the most dominant region, contributing 40% of the market revenue in 2024, driven by health awareness and vegan adoption.

Leading players include Oatly, Califia Farms, Planet Oat, Elmhurst 1925, Chobani, Pacific Foods, and Minor Figures.