Coconut-flavored Oat Milk Market Size (2024 – 2030)

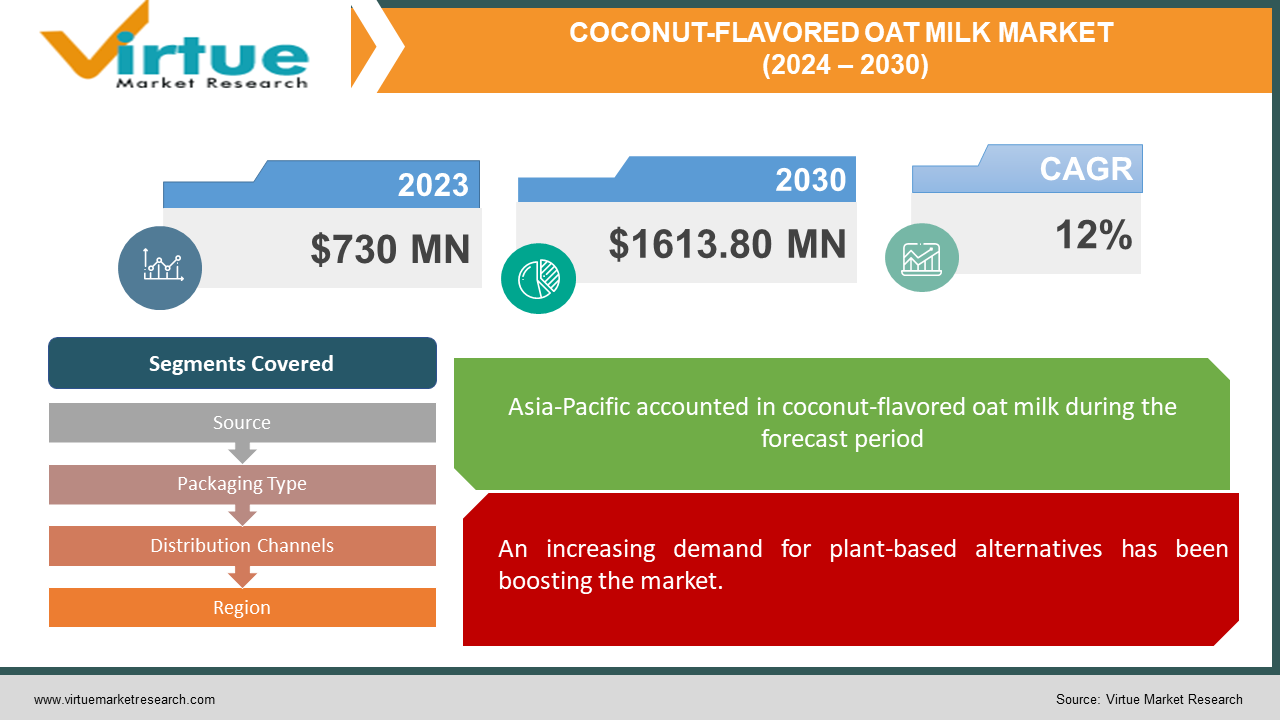

The global coconut-flavored oat milk market was valued at USD 730 million and is projected to reach a market size of USD 1613.80 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12%.

A creamy, dairy-free milk produced with oats, coconut, and cashews is known as coconut-flavored oat milk. The cashews provide a creamy basis, and the coconut levels out the texture and provides a natural sweetness. It goes well with breakfast, coffee, tea, and smoothies. In the past, this market had a limited scope as this was a niche product. Presently, the market has seen an enormous expansion owing to awareness and health consciousness. In the future, with a focus on product diversification and innovation, the market is predicted to see a notable upsurge.

Key Market Insights:

The amount of oat milk consumed per person in 2022 was 1.28 kg. In 2023, the US market for milk substitutes brought in 3.6 billion dollars in sales. India is the world's third-largest coconut-producing nation, with an expected 13.5 million metric tons produced in 2023. Oat milk sales in the US reached $316.2 million in 2022, a 130% increase. The milk substitute market is expected to generate $25.23 billion in revenue by 2024.

Coconut-flavored Oat Milk Market Drivers:

An increasing demand for plant-based alternatives has been boosting the market.

Veganism is the practice of incorporating plant-based diets. This excludes the consumption of traditional dairy products. Veganism gained emphasis because the animal industry was exploited for dairy products like milk and eggs. A lot of animals were injected with harmful injections to double their production. Environmentalists and animal lovers started to spread awareness about this topic, raising the demand for oat milk. To keep up with this trend, manufacturers started commercializing oat milk. Very soon, different flavors became popular. Coconut-based milk was one of the prominent options. Moreover, lactose intolerance is a significant factor propelling market expansion. People who are diagnosed with this condition cannot digest products that have lactose in them. Milk is one such product. Coconut-flavored oat milk has no lactose. Oats, coconut, and water are blended, and the mixture is then strained to create coconut oat milk. All these factors have been contributing to the success of this market.

Health and wellness trends have been enabling market development.

Over the years, a lot of people have started to lead a healthy lifestyle by changing their diet habits. Oat milk aligns well with this trend due to its nutritional profile. Oat milk with a coconut flavor is said to be a healthier option than dairy milk since it contains more fiber, vitamins, and minerals and is frequently lower in calories, fat, and cholesterol. It is loaded with antioxidants. Moreover, this is a healthy option for vegans because it's also a rich source of medium-chain fatty acids. MCFAs are rapidly metabolized and transported, providing a more immediate energy source than other substrates. Furthermore, oats and coconuts are linked to several health advantages, such as strengthening immunity, facilitating digestion, and supporting heart health. These benefits contribute to the growing appeal of coconut-flavored oat milk among health-conscious customers.

Coconut-flavored Oat Milk Market Restraints and Challenges:

Allergen concerns, competition, shelf-life, texture, and price volatility are the main issues that the market is currently facing.

Coconut and oat are common allergens. Consumption of these products can lead to skin irritation, indigestion, rashes, and other such symptoms. As such, companies must follow clean labeling and transparency while selling their products to ensure public safety. Secondly, the market faces intense competition from dairy and non-dairy alternatives. Soy, almond, and rice milk are some of the popular and well-preferred options among the public. Manufacturers need to make their products stand out to gain a broader consumer base. Thirdly, like other plant-based milk products, coconut-flavored oat milk has a shorter shelf life than ultra-high-temperature (UHT) processed dairy milk. It can be difficult for producers and retailers to keep their products fresh and extend their shelf life without adding chemical preservatives, which affects distribution and customer convenience. Moreover, it can be difficult for manufacturers to reliably produce coconut-flavored oat milk with a creamy texture and an appealing flavor profile since consumer expectations about taste and texture might differ greatly. Careful formulation and quality control are needed to balance the different flavors of coconut and oats while maintaining smoothness and palatability. Furthermore, the cost of ingredients and the production process is higher than traditional ones. This leads to higher selling costs. This can be a significant barrier for low-income countries.

Coconut-flavored Oat Milk Market Opportunities:

Product innovation provides the market with an ample number of possibilities. Manufacturers and culinary chefs are continuously working on creating new diversity to attract the population. Vanilla and caramel are two such options that are being introduced in coconut-flavored oat milk. Secondly, the nutritional profile is being enhanced by incorporating functional ingredients. This includes probiotics, prebiotics, essential amino acids, and omega-3 fatty acids. This can support gut health, thereby providing immunity protection. Furthermore, e-commerce channels are being prioritized. By having a virtual presence, greater profits can be achieved since it is possible to reach customers globally. Apart from this, sustainable packaging has gained prominence. Eco-conscious customers are more likely to buy these products if recyclable plastic and other biodegradable methods are used for packaging. This strategy causes less damage to our environment.

COCONUT-FLAVORED OAT MILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Source, Packaging Type, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Oatly, Califia Farms, Silk (Danone), Ripple Foods, Elmhurst 1925, Alpro (Danone), Pacific Foods, Joyya, RISE Brewing Co., Dream (Hain Celestial) |

Coconut-flavored Oat Milk Market Segmentation: By Source

-

Organic

-

Conventional

The conventional segment is the largest and fastest-growing source. The primary reason for this is cost-effectiveness. This attracts a broader consumer base. Secondly, the yield is obtained over a shorter duration. This is because the crops are grown with the aid of fertilizers and other growth hormones. This type of cultivation has been in practice for many decades. A lot of people are familiar with conventional products. Furthermore, an enormous amount is commercialized in the market, making accessibility simpler.

Coconut-flavored Oat Milk Market Segmentation: By Packaging Type

-

Carton

-

Bottle

-

Others

Cartons are the largest growing packaging type. This is because there is a growing need for packaging solutions with excellent quality and long shelf lives. The demand for the segment is also being driven by the growing use of Tetra Pak carton containers, which are predominantly made of paperboard. Due to its sustainability and lightweight, carton packaging is seeing significant investment from several major firms. The widespread use of carton packaging for oat milk can be attributed to a growing global consciousness regarding the environmental impact of paper-based cartons. To boost sales, manufacturers and suppliers are concentrating on producing packaging with eye-catching hues and distinctive patterns. Bottles are the fastest-growing category. Oat milk is packed in bottles because it keeps it fresh and tasty. There is a growing consumer demand for food and drink to be consumed on the move. This has prompted producers to provide bottle-based oat milk packaging options.

Coconut-flavored Oat Milk Market Segmentation: By Distribution Channels

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

The largest growing distribution channels are supermarkets and hypermarkets. These businesses make buying easier for customers by providing a wide range of choices. Customers can assess the products' quality visually. They may get the answers to their inquiries from the merchant. This method also allows customers to barter. People who are uncomfortable utilizing the Internet often choose this medium. Online retail is growing at the fastest rate. Because of its wide selection of products, ease of use, and adaptability, e-commerce is becoming more and more popular. Online shoppers may purchase products and have them delivered straight to their front door. Furthermore, this channel's expansion has been accelerated by the COVID-19 pandemic. This is an alluring option because clients get several discounts on frequent purchases. Besides, exclusive offers are present for memberships, making this an affordable option.

Coconut-flavored Oat Milk Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest growing market. In many Asian cuisines, coconut is a basic ingredient, and oat milk has become more and more popular as a dairy substitute. Asia-Pacific consumers are gravitating toward plant-based milk alternatives like oat milk as they place a greater emphasis on their overall health and well-being. With a sizable and constantly expanding population, the area offers a sizable market for oat milk products. Furthermore, as a result of urbanization, people's dietary preferences are shifting, moving more toward plant-based diets and non-dairy milk options in nations like China and India. North America is the fastest-growing market. Plant-based milk products have found significant success in North America, especially in the United States and Canada, where dietary limitations, environmental concerns, health conscience, and consumer knowledge have all contributed to the trend. The plant-based food and beverage industry in the area is well-established, with several brands providing a large range of options to suit various tastes and preferences. Besides, as a result of growing trends in vegan and vegetarian diets, growing awareness of animal welfare issues, and an increase in lactose intolerance, the market has seen a tremendous expansion. Customers looking for dairy-free options with distinctive flavors and health advantages have been drawn to coconut-flavored oat milk in particular, which has increased in popularity and contributed to the overall expansion of the

COVID-19 Impact Analysis on the Global Coconut-Flavor Oat Milk Market:

The outbreak of the virus had a mixed impact on the market. Lockdowns, movement restrictions, and social isolation became the new normal. This caused disruptions in supply chain, transportation, and logistics. A lot of collaborations and launches were delayed as remote work was prioritized to prevent the spread of the virus. Production and manufacturing activities were stopped or delayed. The majority of the funds were allotted to the healthcare sector. However, on the other hand, people have become more aware of their physical and mental health. Coconut-flavored oat milk was emphasized owing to its health benefits in strengthening the immune system. Veganism gained popularity as social media played a crucial role in highlighting the cruelties faced by the animal industry. Nielsen reported that sales of oat milk increased by 305.5% during the first half of the pandemic. Post-pandemic, the market has continued to grow due to the relaxation of rules and regulations.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this. Organic produce, such as oats and coconuts, is being prioritized. This includes the cultivation of crops without the aid of fertilizers, chemicals, and other pesticides. Research studies have proven that such crops have better nutritional value and are less likely to cause chronic illnesses like diabetes, high blood pressure, and cancer. Additionally, local sourcing is being encouraged to reduce pollution and carbon footprints and support farmers.

Key Players:

-

Oatly

-

Califia Farms

-

Silk (Danone)

-

Ripple Foods

-

Elmhurst 1925

-

Alpro (Danone)

-

Pacific Foods

-

Joyya

-

RISE Brewing Co.

-

Dream (Hain Celestial)

-

In November 2023, a new barista-style milk made with coconut, called The Coconut Collab, was marketed with the promise of tasting, looking, and acting just like dairy alternatives. With its launch, Ocado will be the only retailer of the new product, M!lk, which promises to set a new standard for plant-based milk. The Coconut Collab claims that the product is excellent for hot beverages, smoothies, cereals, and more since it foams nicely, doesn't split when warmed, and doesn't change the flavor of tea.

-

In January 2023, the Vita Coco Company, Inc. unveiled the new Vita Coco Barista MLK, which is only offered by Austin, Los Angeles, and San Francisco-based Alfred Coffee, a contemporary coffee chain. With the addition of the new gluten-free, dairy-free, soy-free, and non-GMO products, the company's non-dairy range has grown. Vita Coco Barista MLK, which is prepared from coconut water and coconut cream, can be used in place of oat, almond, and soy milk alternatives. Customers will be able to add Vita Coco Barista MLK to their orders at all Alfred Coffee outlets as part of the collaboration's menu.

Chapter 1. Coconut-flavored Oat Milk Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Coconut-flavored Oat Milk Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Coconut-flavored Oat Milk Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Coconut-flavored Oat Milk Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Coconut-flavored Oat Milk Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Coconut-flavored Oat Milk Market – By Source

6.1 Introduction/Key Findings

6.2 Organic

6.3 Conventional

6.4 Y-O-Y Growth trend Analysis By Source

6.5 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Coconut-flavored Oat Milk Market – By Packaging Type

7.1 Introduction/Key Findings

7.2 Carton

7.3 Bottle

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Packaging Type

7.6 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 8. Coconut-flavored Oat Milk Market – By Distribution Channels

8.1 Introduction/Key Findings

8.2 Supermarkets/Hypermarkets

8.3 Specialty Stores

8.4 Online Retail

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Distribution Channels

8.7 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 9. Coconut-flavored Oat Milk Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Packaging Type

9.1.4 By Distribution Channels

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Packaging Type

9.2.4 By Distribution Channels

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Packaging Type

9.3.4 By Distribution Channels

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Packaging Type

9.4.4 By Distribution Channels

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Packaging Type

9.5.4 By Distribution Channels

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Coconut-flavored Oat Milk Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Oatly

10.2 Califia Farms

10.3 Silk (Danone)

10.4 Ripple Foods

10.5 Elmhurst 1925

10.6 Alpro (Danone)

10.7 Pacific Foods

10.8 Joyya

10.9 RISE Brewing Co.

10.10 Dream (Hain Celestial)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global coconut-flavored oat milk market was valued at USD 730 million and is projected to reach a market size of USD 1613.80 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12%.

An increasing demand for plant-based alternatives and health & wellness trends are the main factors propelling the global coconut-flavored oat milk market.

Based on packaging type, the global coconut-flavored oat milk market is segmented into cartons, bottles, and others.

Asia-Pacific is the most dominant region for the global coconut-flavored oat milk market.

Oatly, Califia Farms and Silk are the key players operating in the global coconut-flavored oat milk market.