Nuts and Seeds Market Size (2024 – 2030)

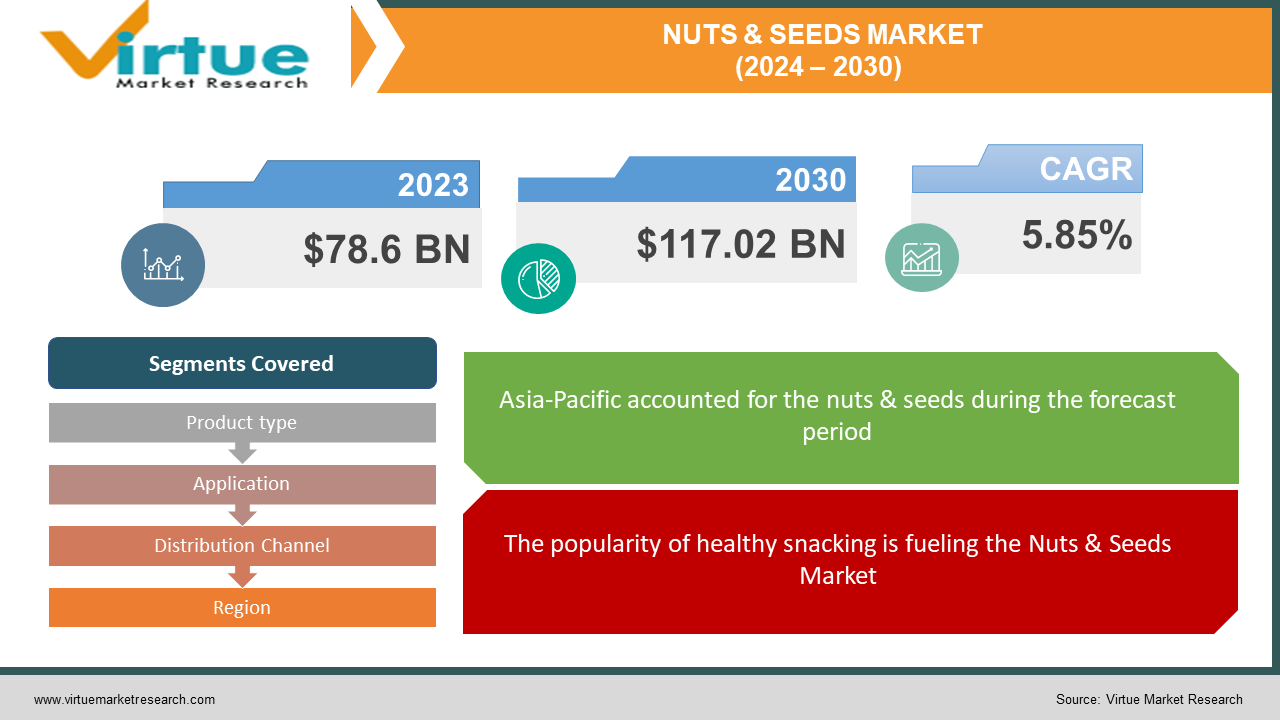

The Global Nuts & Seeds Market was valued at USD 78.6 billion in 2023 and is projected to reach a market size of USD 117.02 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.85%.

Demand for the global nut and seed industry is increasing due to the expansion of the food and beverage industry. The use of nuts and seeds is not limited to food products, as many products are made by mixing seeds, nuts, and fruits. Therefore, there is no dispute that the world nuts and seeds market will expand at an alarming rate. Nuts are widely used in food products to add taste and flavor to the products, which is important to make the business more demanding. In addition, seed diversity for seedling germination has created a huge market demand. Producing special oil with the help of good seeds also makes the market attractive. The global nut and seed trade will likely find new and untapped growth opportunities. Nuts and seeds are common in cooking in many cuisines, including Indian, Thai, and Greek. Therefore, the world olive and seed market should grow rapidly in the coming years.

Key Market Insights:

The Asia-Pacific region dominates, accounting for over 35% of the global market, showing strong engagements and growing revenue. Nuts are still available, but seeds are also stealing the show, with chia, flax, and pumpkin seeds growing at a faster rate.

Forget our daily meals; busy lifestyle, fruits, and seeds become winning snacks in terms of mobility and satisfaction. This trend is also associated with a focus on health and wellness, as consumers look for easy ways to absorb nutrients.

Gone are the days of dusty bulk boxes. Online sales are on the rise due to increased convenience and changing consumer preferences towards digital shopping.

Ethics and Sustainability are not just theoretical; they influence the purchasing decision. Consumers are looking for products that care about the environment and the communities they come from.

From exciting combinations and alternative routes to new products like nut butter and seed bars, this constant change keeps the market strong and attracts new customers.

Nuts & Seeds Market Drivers:

The popularity of healthy snacking is fueling the Nuts & Seeds Market.

As millennials become more health-conscious, their eating habits have increased the demand for nutrient-dense foods. Producers have developed products to meet the needs of the market for fruit and seed products, especially those using stems. Increasing consumer preference for nutritional supplements such as whole grains in smoothie bowls is driving demand for nuts and seeds. In recent years, the popularity of "super" ingredients has increased as consumers turn to natural and healthy ingredients.

These products are nutritionally rich and beneficial, and their chemical composition is rich in PUFA (polyunsaturated fatty acids), especially omega-3, protein, dietary fiber, and bioactive compounds. According to the International Hazelnut and Dried Fruit Council, global peanut production is estimated to be 795,300 tonnes in 2021/2022. Famous companies focus on the research and development of new products to meet customer needs. The increasing use of nuts and seeds as a nutritious and healthy food by processed food companies contributes to the market.

As innovation blossoms, the Nuts and Seeds Market sees explosive growth.

The store refused to stand still. Food manufacturers continue to push new techniques, exciting combinations, and new products like nut butter and seed bars to keep the market strong and attract new customers with different tastes.

Plant-powered boom fuels the market growth.

Vegan and plant-based diets are on the rise, with nuts and seeds providing valuable sources of protein for those who consume animal products. This difference has opened the door to a large and yet untapped market for the business world.

Nuts & Seeds Market Restraints and Challenges:

Competition from similar markets restraints the growth of the sector.

While nuts and seeds are gaining ground, they face stiff competition from other snacks like fruit, yogurt, and protein bars. Constant innovation and product differentiation are essential to create a unique niche in retail.

Supply Chain Snags hinder the market growth.

Disruptions in global supply chains can lead to product shortages and higher prices, upset consumers and forcing businesses to find other sources.

The volatility in Nuts & Seeds prices brings a challenge to market growth.

Global Nuts & Seeds prices fluctuate significantly due to factors like currency fluctuations, and speculation. This uncertainty can discourage investment and harm smaller players.

Nuts & Seeds Market Opportunities:

Nuts and seeds can go beyond being snacks and bring new possibilities to the world of cooking. Just think about how nut-based flours can add richness and texture to goods or how incorporating seeds into ingredients can elevate the flavors of treats. With these powerhouses, one can create amazing plant-based alternatives that are both healthy and tasty.

The digital world provides a rich field of knowledge on brand and customer interaction through knowledge through the social media ecosystem, collaboration, collaboration, and understanding. Imagine the excitement of joining a powerful online community, building trust, and opening new audiences with the power of harvest.

NUTS & SEEDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.85% |

|

Segments Covered |

By Product type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Olam International Limited, Blue Diamond Growers, Diamond Foods, LLC, Mariani Nut Company, Select Harvests Limited, The Wonderful Company LLC, Sincerely Nuts Inc., John B. Sanfilippo & Son, Inc., Sun-Maid Growers of California |

Nuts & Seeds Market Segmentation - by Product Type

-

Nuts

-

Almonds

-

Cashew

-

Pistachio

-

Others

-

-

Seeds

-

Chia Seeds

-

Sunflower Seeds

-

Flax Seeds

-

Others

-

In 2023, based on the Product Type, the Nuts segment is projected to grow at a CAGR of 3.86% and is currently leading the charts followed by the Seeds segment. Due to the widespread use of almonds and cashews in desserts and bakeries, the world hazelnut and seed market is expected to expand in the coming years. Some say eating nuts as part of a healthy diet can help you gain and maintain weight. Large companies in the industry are focusing on growing their businesses through investments and acquisitions. For example, Turlock, California-based almond marketer and processor Blue Diamond Growers began expanding its award-winning portfolio in January 2019. The expansion will add additional assets, allowing Fresh almond products to be shipped worldwide. The seed market should be driven by increased consumer awareness of the health benefits of consuming seeds. The global nuts and seeds market should benefit from the growing vegan population and increasing reliance on plant-based foods for protein consumption. The Seed segment is expected to witness a CAGR of 3.2% during the forecasting period.

Nuts & Seeds Market Segmentation - by Application

-

Bakery and Confectionery

-

Beverages

-

Cereals and Cereal Products

-

Processed Dairy Products

-

Others

In 2023, based on Application, the Bakery and Confectionery segment accounted for the largest revenue share with approximately 45% of the market and registered a CAGR of 4.53%.

Owing to the increasing demand for Bakery and confectionery products, it is expected to witness remarkable growth during the forecast period. The increasing offering of baked goods and savory foods containing the ingredients required by marketers is expected to increase its application in this segment.

Nuts & Seeds Market Segmentation - by Distribution Channel

-

Offline

-

Online

In 2023, based on Distribution Channel, the Offline segment accounted for the largest revenue share with approximately 62% of the market and is expected to show a CAGR of 3.55% during the forecasting period.

The Online segment is expected to progress at a higher CAGR of 4.2% during the forecasting period.

Nuts & Seeds Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on Region, the Asia-Pacific accounted for the largest revenue share with approximately 42% of the market and is expected to show a CAGR of 3.55% during the forecasting period. This is due to high population density and more disposable income.

North America is expected to show a relatively higher CAGR of 4.86% and currently stands second in the queue with Asia-Pacific. In terms of market share, this region is followed by the European region and then by the Middle East & Africa and then by South America.

COVID-19 Impact Analysis on the Global Nuts & Seeds Market:

Although the food, beverage, and retail sectors are more vulnerable to shortages of labor and raw materials needed in the production process, retailers and food and beverage suppliers are forced to face difficult challenges from the outset. The challenge for food retailers is to meet the potential of regular customers while measuring the ability to reliably store food and beverages so that consumers can access the products they are considering purchasing. food. The impact of this situation is that more customers will stay away from public events or be isolated if they test positive. Concerns about food safety and the risk of contamination from public contact are having a major impact on consumer attendance at restaurants. In addition to the above factors, from an economic perspective, even if the prices of food, beverages, and agricultural products remain stable, the long-term spread of COVID-19 will lead to economic instability and inflation in food prices.

Latest Trends/ Developments:

Vegan and plant-based foods have taken center stage, riding the wave of nut and seed ingredients. From dairy-free cheeses made with cashews to meat alternatives based on peanuts and sunflower seeds, these versatile ingredients are changing the food landscape.

People pay attention to the function of fruits and seeds as well as their delicious taste. Products containing specific vitamins, minerals, and antioxidants related to health needs, such as anti-inflammatory or omega-3 enriched snacks.

Innovation extends beyond product development. The market is embracing technology with online platforms offering personalized recommendations, subscription boxes delivering curated nut and seed mixes, and even AI-powered recipe suggestions utilizing these versatile ingredients.

One-size-fits-all is out, personalization is in. Consumers are demanding customized mixes, portion-controlled packs, and products tailored to specific dietary restrictions and preferences. This trend reflects the growing desire for convenience and individuality.

Key Players:

-

Archer Daniels Midland Company

-

Olam International Limited

-

Blue Diamond Growers

-

Diamond Foods, LLC

-

Mariani Nut Company

-

Select Harvests Limited

-

The Wonderful Company LLC

-

Sincerely Nuts Inc.

-

John B. Sanfilippo & Son, Inc.

-

Sun-Maid Growers of California

-

In March 2022, PB2 Foods, a well-known player in the nut butter industry, launched PB2 Cashew Powder. The company claims that this powder is made from non-GMO cashews, is kosher, vegan, and gluten-free, and contains no added salt, sugar, or preservatives.

-

In February 2022, Olam Nuts, a subsidiary of Singapore-based Olam International Group, acquired AdAdobe Inc., an American multinational software company. Through its partnership with, it has chosen a digital strategy to sell small manufacturers and businesses such as bakeries, caterers, and restaurants in the United States and Canada.

Chapter 1. Nuts & Seeds Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nuts & Seeds Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nuts & Seeds Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nuts & Seeds Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nuts & Seeds Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nuts & Seeds Market – By Product Type

6.1 Introduction/Key Findings

6.2 Nuts

6.3 Almonds

6.4 Cashew

6.5 Pistachio

6.6 Others

6.7 Seeds

6.8 Chia Seeds

6.9 Sunflower Seeds

6.10 Flax Seeds

6.11 Others

6.12 Y-O-Y Growth trend Analysis By Product Type

6.13 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Nuts & Seeds Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery and Confectionery

7.3 Beverages

7.4 Cereals and Cereal Products

7.5 Processed Dairy Products

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application:

7.8 Absolute $ Opportunity Analysis By Application:, 2024-2030

Chapter 8. Nuts & Seeds Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Offline

8.3 Online

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Nuts & Seeds Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application:

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application:

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application:

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application:

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application:

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Nuts & Seeds Market – Company Profiles – (Overview, By Product Type Portfolio, Financials, Strategies & Developments)

10.1 Archer Daniels Midland Company

10.2 Olam International Limited

10.3 Blue Diamond Growers

10.4 Diamond Foods, LLC

10.5 Mariani Nut Company

10.6 Select Harvests Limited

10.7 The Wonderful Company LLC

10.8 Sincerely Nuts Inc.

10.9 John B. Sanfilippo & Son, Inc.

10.10 Sun-Maid Growers of California

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Nuts & Seeds Market was valued at USD 78.6 billion in 2023 and is projected to reach a market size of USD 117.02 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.85%.

The segments under the Global Nuts & Seeds Market based on Application are Bakery and Confectionary, Beverages, Cereals and Cereal Products, Processed Dairy Products, and Others.

The Asia-Pacific region is the dominant Global Nuts & Seeds Market.

Archer Daniels Midland Company, Olam International Limited, Blue Diamond Growers, Diamond Foods, LLC, Mariani Nut Company, Select Harvests Limited, The Wonderful Company LLC, Sincerely Nuts Inc., John B. Sanfilippo & Son Inc., Sun-Maid Growers of California, etc.

In March 2022, PB2 Foods, a well-known player in the nut butter industry, launched PB2 Cashew Powder. The company claims that this powder is made from non-GMO cashews, is kosher, vegan, and gluten-free, and contains no added salt, sugar, or preservatives.