North America Nuts and Seeds Market Size (2024-2030)

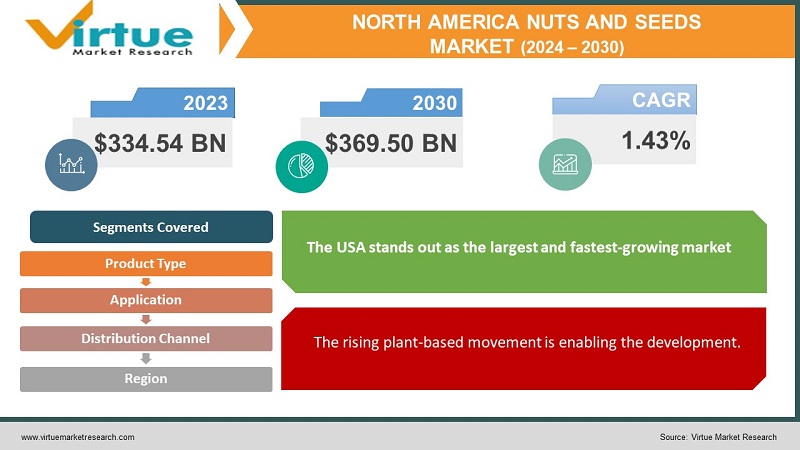

The North American nuts and seeds market reached a valuation of USD 334.54 billion in 2023 and is projected to witness substantial growth, reaching USD 369.50 billion by the end of 2030. Over the forecast period spanning from 2024 to 2030, the market anticipates a robust compound annual growth rate (CAGR) of 1.43%.

Nuts and seeds are highly valued for their nutritional value, culinary diversity, and flavor profiles. They are made up of a wide variety of edible kernels derived from different plant sources. Numerous health advantages, including heart-healthy fats, protein, fiber, vitamins, minerals, and antioxidants, are provided by these nutrient-dense powerhouses.

Key Market Insights:

The United States is the undisputed leader in the North American nuts and seeds market. This dominance is attributed to its large and diverse population with varied dietary needs, a strong snacking culture that prioritizes convenience and health, and a growing emphasis on incorporating these nutritious options into daily diets. Additionally, the US boasts a well-established distribution network that ensures widespread availability of nuts and seeds across the country.

Looking ahead, the North American Nuts and Seeds Market presents fertile ground for growth. By adapting to consumer preferences, addressing affordability concerns, and emphasizing the health benefits of their products, the industry can ensure nuts and seeds remain a staple in North American snacking habits.

North America Nuts and Seeds Market Drivers:

Health and wellness trends are driving market growth.

Consumers increasingly prioritize health and well-being in their dietary choices. Nuts and seeds are powerhouses of nutrients, offering essential vitamins, minerals, healthy fats, and fiber. This alignment with health trends is driving demand for these natural, nutrient-dense options.

Associated convenience is accelerating the market.

Our fast-paced lifestyles demand convenient food options. Nuts and seeds perfectly fit the bill. They are portable, require no preparation, and offer a satisfying crunch with a burst of flavor. This convenience factor makes them ideal for on-the-go snacking or adding a nutritious meal boost.

Product innovation and variety are boosting the market.

The market is witnessing a surge in product innovation, catering to diverse consumer preferences. Flavored nuts, trail mixes with exotic ingredients, nut butter blended with fruits, and sprouted seed options are just a few examples. This constant innovation keeps the market exciting and caters to a wider range of taste buds.

The rising plant-based movement is enabling the development.

The growing popularity of plant-based diets is creating a significant demand for alternative protein sources. Nuts and seeds offer a complete protein option for vegetarians and vegans. Additionally, their healthy fats contribute to satiety, making them a valuable addition to plant-based meal plans.

An emphasis on sustainability is facilitating the expansion.

Consumers are increasingly looking for brands that align with their environmental values. Sustainability practices adopted by nut and seed companies, such as ethical sourcing and eco-friendly packaging, are attracting conscious consumers. This focus on sustainability can become a key differentiator in a competitive market.

Nuts and Seeds Market Restraints and Challenges:

Price volatility and supply chain disruptions are challenging to tackle.

The market is susceptible to fluctuations in nut and seed prices due to factors like weather patterns, global demand, and transportation costs. Disruptions in the supply chain further exacerbate this challenge, making it difficult for companies to maintain consistent pricing and product availability.

Allergy concerns and food safety cause barriers.

Nut and seed allergies are a significant concern for a growing segment of the population. This necessitates stringent food safety measures throughout the supply chain, from production to packaging and distribution. Addressing these concerns and ensuring clear labeling is crucial for maintaining consumer trust.

Competition and market saturation can hinder market growth.

The market is witnessing an influx of new players, leading to increased competition. Additionally, with the growing popularity of nuts and seeds, the market might face saturation in certain segments. Companies need to differentiate themselves through innovative product offerings, strategic marketing, and a focus on customer loyalty.

Sustainability concerns and environmental impacts create hurdles.

While some companies prioritize sustainable practices, the overall environmental impact of the nut and seed industry can be a concern. Issues like deforestation for nut production and water usage require solutions. Sustainable sourcing practices and eco-friendly packaging are essential to ensuring long-term growth without compromising environmental well-being.

Nuts and Seeds Market Opportunities:

The personalization of products is beneficial.

Consumers today crave personalized experiences. Offering customized nut and seed mixes based on dietary needs (e.g., low-carb, keto-friendly) or taste preferences (e.g., spicy, sweet) can be a game-changer. Subscription boxes tailored to individual preferences are another avenue for exploration.

Functional foods and nutraceuticals are providing the market with many possibilities.

The market for functional foods and nutraceuticals (foods with added health benefits) presents a significant opportunity. Developing nut and seed blends fortified with vitamins, minerals, or probiotics can cater to consumers seeking targeted health benefits like improved gut health or immunity.

Emerging markets and distribution channels have been raising revenue.

Venture beyond traditional grocery stores. Explore opportunities in online retail channels, convenience stores, and healthy vending machines to reach a wider audience. Additionally, consider expanding into untapped markets within North America, such as targeting specific ethnic communities with culturally relevant nut and seed blends.

Evolving snacking habits are contributing to the success.

Snacks are no longer mere indulgences; they are a vital part of daily routines. Capitalize on this trend by developing innovative snacking options like nut and seed bars with unique flavor combinations, protein-rich trail mix variations, or single-serve nut and seed pouches for portion control.

Focus on sustainability is helping the market.

Consumers are increasingly associating themselves with brands that prioritize sustainability. Emphasize sustainable sourcing practices, eco-friendly packaging solutions, and partnerships with organizations promoting environmental well-being. Highlighting these efforts can attract environmentally conscious consumers and differentiate the brand in the market.

NORTH AMERICA NUTS AND SEEDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

1.43% |

|

Segments Covered |

By Product Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, Canada, Rest of North America |

|

Key Companies Profiled |

Cargill Incorporated , ADM , Dupont , Evonik , BASF SE, DSM , Ajinomoto Co., Inc. , Novozymes , Chr. Hansen Holding A/S , TEGASA |

North America Nuts and Seeds Market Segmentation:

North America Nuts and Seeds Market Segmentation: By Product Type:

- Nuts

- Seeds

In the North American nuts and seeds market, the largest and fastest-growing segment is nuts, holding the largest share. Firstly, nuts are often perceived as having a higher nutritional value compared to seeds, being richer sources of protein and healthy fats. This perception appeals to health-conscious consumers and fitness enthusiasts. Secondly, nuts offer versatility in consumption. They can be enjoyed as snacks, incorporated into various recipes for added flavor and texture, or used as toppings for salads and yogurt. This adaptability makes them a preferred ingredient over some seeds.

Additionally, the nut industry benefits from brand recognition and effective marketing campaigns. Established brands and targeted marketing contribute to positive consumer perception and a higher market share for nuts compared to seeds. While seeds offer a growing range of health benefits and culinary applications, nuts maintain their leading position in the North American Nuts and Seeds Market due to their perceived nutritional value, versatility, and established brand presence.

North America Nuts and Seeds Market Segmentation: By Application

- Snacks and Bars

- Bakery and Confectionery

- Breakfast Cereals

- Dairy Products

- Others

Bakery & confectionery are the largest growing application. Nuts and seeds are frequently added to baked goods as toppings, fillings, or inclusions to give them a crunchy texture or nutty flavor. In the confectionery industry, nuts and seeds are often used to provide richness and diversity to chocolates, sweets, and bars. Nuts like hazelnuts, peanuts, and almonds are common additions to chocolate bars, while sesame and sunflower seeds are utilized in nougat and brittle. Snacks and bars are the fastest-growing applications. This dominance stems from several key factors: Firstly, there has been a surge in snacking culture across North America, and nuts and seeds are well-suited to capitalize on this trend. Their portability, convenience, and perceived health benefits make them ideal options for consumers seeking quick and nutritious snacks on the go. Additionally, the nut and seed bar segment has seen significant innovation in product development. Manufacturers are creating bars that cater to specific dietary needs, incorporate unique flavor combinations, and offer added functional benefits such as protein or energy boosts. This wide variety caters to diverse consumer preferences within the snacking category. Furthermore, marketing campaigns for nut and seed snack products often focus on their convenience, portability, and health benefits. This messaging resonates with consumers who prioritize healthy snacking options that align with their busy lifestyles.

North America Nuts and Seeds Market Segmentation: By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

Supermarkets and hypermarkets have emerged as the largest growing distribution channels. This dominance is underpinned by several factors: Foremost is the one-stop shopping convenience offered by supermarkets, allowing consumers to find a wide variety of nut and seed options in a single location. This convenience is particularly attractive to busy consumers who value efficiency during their regular grocery shopping trips. Moreover, supermarkets and hypermarkets boast a widespread presence across North America, ensuring easy access to nuts and seeds for a large portion of the population. This extensive network of stores solidifies their position as the preferred destination for many consumers seeking these products. Furthermore, supermarkets cater to diverse buying preferences by offering nuts and seeds in bulk quantities for cost-conscious consumers and pre-packaged, portion-controlled options ideal for snacking on the go. This variety ensures they can appeal to a broader customer base with different needs and preferences. Online retail is the fastest-growing channel. This is because of the convenience. Products are delivered to the doorsteps of customers. Besides, they have a variety of products that are available on the website. This attracts a lot of customers, propelling growth.

North America Nuts and Seeds Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

The USA stands out as the largest and fastest-growing market. This leadership is driven by several key factors. The USA boasts a large and culturally diverse population, resulting in a wide range of dietary preferences and culinary traditions that incorporate nuts and seeds. This diversity fuels demand for a vast array of nut and seed varieties, contributing to the country's significant market share. Additionally, American culture places a strong emphasis on snacking, with nuts and seeds being perceived as convenient, healthy, and portable snack options. This entrenched snacking habit translates to a high per capita consumption of nuts and seeds compared to neighboring Canada or Mexico. Furthermore, there is a growing focus on health and wellness in the US, with nuts and seeds increasingly recognized as sources of essential nutrients, protein, and healthy fats. This perception drives demand across various demographics, from health-conscious consumers to fitness enthusiasts.

COVID-19 Impact Analysis on the North American Nuts and Seeds Market:

The COVID-19 pandemic churned up a wave of complex influences on the North American Nuts and Seeds Market. Initially, panic buying triggered temporary shortages of certain nuts and seeds, particularly shelf-stable options like almonds and peanuts. Disruptions in supply chains also played a role. However, the pandemic also presented unexpected opportunities. As consumers focused on health and immunity during lockdowns, nuts, and seeds were viewed as a source of essential nutrients and healthy fats. This perception fueled a surge in demand for products perceived to have immunity-boosting properties, like walnuts and sunflower seeds. Additionally, the rise of home baking and snacking increased the consumption of nuts and seeds across the board. The long-term impact of COVID-19 remains to be seen. While demand has stabilized somewhat, concerns about inflation and affordability may influence purchasing decisions. The industry's ability to address price sensitivity, explore innovative packaging solutions to reduce waste, and potentially highlight the functional benefits of certain nuts and seeds can influence its post-pandemic trajectory.

Latest Trends/ Developments:

In March 2022, PB2 Foods, a renowned player in the powdered nut butter market, introduced PB2 Cashew Powder. The cashew powders were claimed to be manufactured entirely of non-GMO cashews, kosher, vegan, and gluten-free, and included no additional salt, sugar, or preservatives as per the company.

In February 2022, by collaborating with United States multinational software company Adobe Inc., Olam Nuts, a division of Singapore-based Olam International Group, chose a digital strategy to provide smaller volumes of its product to small manufacturers and businesses like bakeries, caterers, and restaurants in the United States and Canada.

Key Players:

- Cargill Incorporated

- ADM

- Dupont

- Evonik

- BASF SE

- DSM

- Ajinomoto Co., Inc.

- Novozymes

- Chr. Hansen Holding A/S

- TEGASA

Chapter 1. North America Nuts and Seeds Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Nuts and Seeds Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Nuts and Seeds Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Nuts and Seeds Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Nuts and Seeds Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Nuts and Seeds Market– By Application

6.1. Introduction/Key Findings

6.2. Snacks and Bars

6.3. Bakery and Confectionery

6.4. Breakfast Cereals

6.5. Dairy Products

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Application

6.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. North America Nuts and Seeds Market– By Product Type

7.1. Introduction/Key Findings

7.2. Nuts

7.3. Seeds

7.4. Y-O-Y Growth trend Analysis By Product Type

7.5. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 8. North America Nuts and Seeds Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and Hypermarkets

8.3. Convenience Stores

8.4. Online Retail

8.5. Specialty Stores

8.6. Y-O-Y Growth trend Analysis By Distribution Channel

8.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 9. North America Nuts and Seeds Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By Application

9.1.3. By Product type

9.1.4. Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Nuts and Seeds Market– Company Profiles – (Overview, Application Portfolio, Financials, Strategies & Developments)

10.1. Cargill Incorporated

10.2. ADM

10.4. Dupont

10.5. Evonik

10.6. BASF SE

10.7. DSM

10.8. Ajinomoto Co., Inc.

10.9. Novozymes

10.10. Chr. Hansen Holding A/S

10.11. TEGASA

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North American nuts and seeds market reached a valuation of USD 334.54 billion in 2023 and is projected to witness substantial growth, reaching USD 369.50 billion by the end of 2030. Over the forecast period spanning from 2024 to 2030, the market anticipates a robust compound annual growth rate (CAGR) of 1.43%.

Health and wellness trends, convenience, product innovation and variety, and a rising plant-based movement are propelling the North American nuts and seeds market.

Based on product type, the North American nuts and seeds market is segmented into nuts and seeds.

The USA is the most dominant region for the North American nuts and seeds market.

Cargill Incorporated, ADM, Dupont, Evonik, BASF SE, DSM, Ajinomoto Co., Inc., Novozymes, Chr. Hansen Holding A/S and TEGASA are the key players operating in the North American nuts and seeds market.