Latin America Nuts and Seeds Market Size (2024-2030)

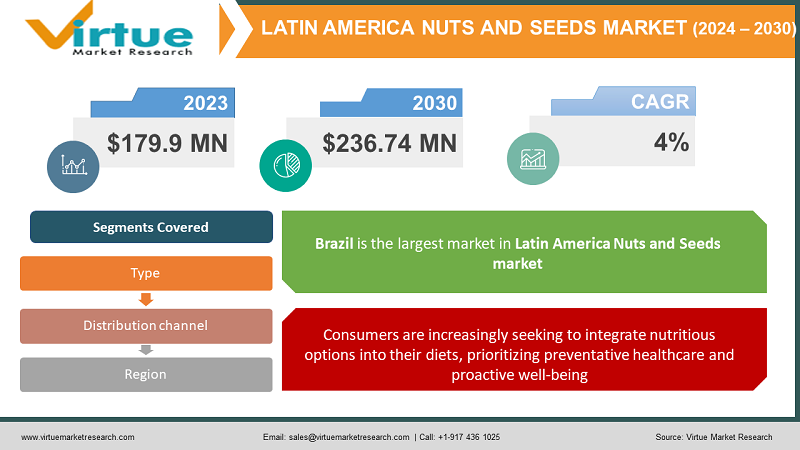

The Latin America Nuts and Seeds Market was valued at USD 179.9 Million in 2024 and is projected to reach a market size of USD 236.74 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4%.

Nuts and seeds are the culinary equivalent of chameleons; they have a variety of tastes and textures that may be added to or taken out of a meal. Because nuts and seeds may be used in a wide variety of recipes, including trail mixes, granola bars, salads, yogurt parfaits, and baked products, consumers can experiment and create a customized diet. The burgeoning popularity of plant-based diets in Latin America is creating new opportunities for nuts and seeds. As consumers seek alternative protein sources, nuts and seeds, with their high plant-based protein content, are emerging as a popular choice for vegetarians and vegans alike. Fast-paced lifestyles and busy schedules are driving the popularity of convenient snacking options. Nuts and seeds, with their natural portability and long shelf life, fit perfectly into this trend. Consumers can enjoy a satisfying and nutritious snack on the go, without sacrificing taste or health benefits.

Key Market Insights:

In 2024, the nuts and seeds market for the domestic consumption industry is projected to reach $11.84 billion. The nuts and seeds market for the traditional cuisine industry is expected to be valued at $2.96 billion in 2024.

In 2024, the nuts and seeds market for the vegan and vegetarian food industry is projected to reach $1.48 billion. The nuts and seeds market for the organic food industry is expected to be valued at $1.11 billion in 2024.

The nuts and seeds market for the health food industry is anticipated to grow at a CAGR of 5.8%. The nuts and seeds market for the food service providers industry is expected to be valued at $592 million in 2024.

Latin America Nuts and Seeds Market Drivers:

Across Latin America, a powerful melody of health and wellness is rising. Consumers are increasingly seeking to integrate nutritious options into their diets, prioritizing preventative healthcare and proactive well-being.

Nuts and seeds are nutritional powerhouses, supplying an abundance of essential vitamins, minerals, and healthy fats. For instance, chia seeds and almonds are valued for their fiber and omega-3 fatty acids and almonds are well-known for their high protein content. Thanks to this nutritional diversity, customers can focus on certain needs, such as getting protein for muscular growth or fiber for digestive health. There are more prospects for nuts and seeds as a result of the rise of dietary restrictions like vegetarianism and veganism. Nuts and seeds, with their high plant-based protein content, become an obvious choice for consumers looking for plant-based protein sources to replace meat. Younger generations are especially influenced by this trend, which is increasing demand for creative plant-based snacks that have nuts and seeds as main ingredients.

The Latin American landscape is characterized by increasingly fast-paced lifestyles. Busy work schedules and long commutes leave little time for elaborate meal prep.

Nuts and seeds are nature's pre-packaged snacks. They require no preparation, are mess-free, and offer a burst of energy and flavor. This convenience aligns perfectly with the on-the-go lifestyle of many Latin American consumers. Whether students rush between classes or professionals juggling work and errands, nuts and seeds offer a quick and healthy way to curb hunger pangs. The beauty of the convenience trend in the nuts and seeds market lies in its ability to marry convenience with health. Consumers no longer need to sacrifice nutrition for ease. Instead, they can opt for healthy, on-the-go snacks that are readily available and don't require additional preparation. This trend is likely to continue fueling growth in the Latin American nuts and seeds market. Novel nut and seed-based snacks are flooding the market, meeting consumer demand for tasty and convenient solutions. These consist of trail mixes with dark chocolate and dried fruits, flavored nut mixes, single-serving packets, and even nut and seed butter. With the help of this innovation, customers will have an extensive selection to accommodate their dietary requirements and taste preferences.

Latin America Nuts and Seeds Market Restraints and Challenges:

When compared to some processed foods like chips or cookies, nuts and seeds are frequently thought of as a more expensive snack alternative. Budget-conscious shoppers may find this notion to be a major obstacle, especially in areas with economic inequality. The trick is to explain the benefits of nuts and seeds understandably. It is necessary to highlight their adaptability, long shelf life, and nutritional advantages to defend their price point. Developing cost-effective processing methods and offering a wider range of pack sizes can address price concerns. Smaller, single-serving packs cater to consumers seeking portion control and affordability. Additionally, focusing on value-added products with unique flavor profiles or functional ingredients can command a premium price. Developing alternative distribution channels like mobile markets or partnerships with local retailers can ensure wider accessibility of nuts and seeds in rural areas. Leveraging e-commerce platforms with robust delivery networks can also be a solution, although internet access in rural regions might be a limiting factor. Lack of awareness about the various types of nuts and seeds and their potential health benefits can hinder consumption in certain segments. Educational campaigns and recipe development initiatives can help bridge this knowledge gap and encourage exploration beyond familiar nut and seed varieties.

Latin America Nuts and Seeds Market Opportunities:

The market is ripe for innovative nut and seed-based snack formats that cater to diverse consumer preferences. Flavorful nut and seed mix with exotic spices or regionally inspired ingredients can tantalize taste buds. Experimentation with textures, like combining crunchy nuts with chewy dried fruits, can create unique sensory experiences. The growing interest in functional foods presents a vast opportunity. Nuts and seeds can be combined with other functional ingredients like probiotics, prebiotics, or ancient grains to create snacks that offer targeted health benefits. Products formulated for specific needs, such as energy-boosting mixes for athletes or sleep-promoting blends with calming herbs, can tap into a niche market. With the rise of plant-based diets, nuts and seeds can be positioned as powerful protein sources. Products like nut and seed butter, high-protein granola bars with nut and seed inclusions, or even plant-based burgers incorporating nuts and seeds can cater to this growing segment. The e-commerce boom in Latin America presents a golden opportunity to reach a wider audience. Online platforms allow consumers, particularly in remote areas, to access a broader variety of nuts and seeds, including specialty or imported options, that might not be readily available in traditional stores. Subscription box services that deliver curated selections of nuts and seeds can cater to specific dietary needs or taste preferences.

LATIN AMERICA NUTS AND SEEDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023- 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Type, , Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

Archer Daniels Midland (ADM), Ingredion, Cargill, Blue Diamond Growers, Olam International Ltd, Iansa, Sao Gabriel Alimentos, Nu3 |

Latin America Nuts and Seeds Market Segmentation:

Latin America Nuts and Seeds Market Segmentation: By Type:

- Nuts

- Seeds

Cashews are the undisputed king of Latin American nuts; cashews hold a significant market share (estimated at 25-30%). Their creamy texture, rich taste, and versatility across sweet and savory applications make them a favorite. Cashew consumption might be particularly high in regions with established cashew production, like Brazil. Nuts offer a powerhouse of nutrients, including protein, healthy fats, fiber, vitamins, and minerals. Their versatility allows them to be enjoyed on their own, or incorporated into trail mixes, baked goods, or savory dishes. Additionally, cashews and peanuts, being regionally produced, benefit from a potentially lower price point compared to imported nuts.

With an estimated 10-15% market share, chia seeds are leading the seed revolution and are highly regarded for their high fiber content, omega-3 fatty acids, and possible advantages to digestive health. They are a common component in puddings, smoothies, and baked goods because of their capacity to absorb liquids and develop a gel-like structure. There is a growing trend among consumers to look for meals that they believe provide extra health benefits. Seeds meet this trend with their distinct nutritional compositions. Like nuts, seeds are versatile in the kitchen. They can be eaten on their own, mixed into other foods, or added to salads and yogurt as a topping.

Latin America Nuts and Seeds Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retailers

In Latin America, supermarkets and hypermarkets (estimated market share: 45–50%) control the majority of the distribution of nuts and seeds. They serve a wide range of clients by providing a vast assortment of both domestic and foreign brands. Customers can obtain anything from high-end, organic alternatives to more affordable, roasted nuts. Supermarkets and hypermarkets offer great product visibility and accessibility due to the enormous volume of foot traffic they receive. However, shelf space is often scarce, which makes it difficult for specialized or niche brands to establish themselves.

Latin America is seeing a rise in e-commerce platforms, which offer nuts and seeds a dynamic and quickly expanding distribution channel. There is an extensive assortment of nuts and seeds available to consumers, including specialty items, imported options, and niche brands that are not often found in typical stores. E-commerce platforms allow for targeted marketing strategies, reaching specific consumer segments with personalized recommendations.

Latin America Nuts and Seeds Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

With an astounding 28% market share, Brazil is without a doubt the market leader for nuts and seeds in Latin America. Brazil's enormous size and variety of climate zones make it the ideal place for a variety of nuts and seeds to flourish, such as cashews, Brazil nuts, peanuts, and sunflower seeds. The industry has grown as a result of this abundance in nature. Brazil boasts a sophisticated supply chain infrastructure and cutting-edge processing facilities for its agribusiness industry. This has made it easier to produce, process, and distribute nuts and seeds both domestically and internationally in an effective manner.

While Brazil dominates the overall market, Colombia is emerging as the fastest-growing nuts and seeds market in Latin America. With a market share of 16%, Colombia's nuts and seeds industry is experiencing rapid growth. Colombia has been actively promoting the diversification of its agricultural sector, encouraging the cultivation of high-value crops like nuts and seeds. This initiative has led to an increase in production, contributing to the market's growth. Colombian consumers are increasingly health-conscious and seeking nutritious food options. Nuts and seeds, rich in essential nutrients, antioxidants, and healthy fats, have gained popularity among these health-conscious consumers, driving market expansion.

COVID-19 Impact Analysis on the Latin America Nuts and Seeds Market:

Import and export of nuts and seeds were impacted by supply chain disruptions caused by lockdowns and border restrictions. This resulted in possible price variations as well as brief shortages of specific products. Higher-end types of nuts and seeds that are imported into Latin American countries may have caused more severe interruptions in the supply chain. Early in the epidemic, panic buying and stockpiling caused a spike in demand for shelf-stable, long-lasting snacks, like as nuts and seeds. But as the epidemic spread, consumer concerns over discretionary expenditure combined with an emphasis on immunity and health may have caused a brief decline in demand for several nut and seed products. With people spending more time at home, snacking habits witnessed a shift. Consumers sought convenient, healthy snack options, and nuts and seeds fit the bill perfectly. Snack mixes incorporating nuts and seeds with dried fruits or yogurt-covered nuts gained popularity.

Latest Trends/ Developments:

Even though almonds, cashews, and sunflower seeds are common ingredients in peanut butter, customers are increasingly looking for alternatives. These choices accommodate people who are allergic to peanuts or who want a greater range of flavors and textures. Nut and seed flours have become more popular as gluten-free and grain-free diets have gained popularity. Almond flour, for example, provides a low-carb and nutrient-rich substitute for wheat flour and is used in baked products such as breads, cakes, and cookies. The burgeoning plant-based meat market is incorporating nuts and seeds into product formulations. Walnuts, for example, can add texture and a meaty bite to veggie burgers, while sunflower seeds might be used as a binder. The traditional plastic packaging used for nuts and seeds is under scrutiny. Companies are exploring sustainable packaging options made from recycled materials or compostable bioplastics to minimize environmental impact. Busy lifestyles and the rise of on-the-go snacking are fueling the demand for single-serve and portion-controlled nut and seed packs. These convenient options cater to consumers seeking healthy snacking solutions without the risk of overindulging.

Key Players:

- Archer Daniels Midland (ADM)

- Ingredion

- Cargill

- Blue Diamond Growers

- Olam International Ltd

- Iansa

- Sao Gabriel Alimentos

- Nu3

Chapter 1. Latin America Nuts and Seeds Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Nuts and Seeds Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Nuts and Seeds Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Nuts and Seeds Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Nuts and Seeds Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Nuts and Seeds Market– By Type

6.1. Introduction/Key Findings

6.2. Nuts

6.3. Seeds

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Nuts and Seeds Market– By Distribution channel

7.1. Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Specialty Stores

7.5. Online Retailers

7.6. Y-O-Y Growth trend Analysis By Distribution channel

7.7. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 8. Latin America Nuts and Seeds Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Type

8.1.3. By Distribution channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Nuts and Seeds Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Archer Daniels Midland (ADM)

9.2. Ingredion

9.3. Cargill

9.4. Blue Diamond Growers

9.5. Olam International Ltd

9.6. Iansa

9.7. Sao Gabriel Alimentos

9.8. Nu3

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Consumers are increasingly prioritizing their health and well-being, leading to a greater demand for foods perceived to offer additional health benefits. Nuts and seeds, with their rich nutrient profiles packed with protein, healthy fats, fiber, vitamins, and minerals, perfectly align with this trend.

. Latin America is a region with significant income disparity. While the health-conscious, middle-class population might be willing to pay a premium for certain nuts and seeds perceived to offer health benefits, the price remains a major concern for budget-conscious consumers.

Archer Daniels Midland (ADM), Ingredion, Cargill, Blue Diamond

Growers, Olam International Ltd., Iansa, Sao Gabriel Alimentos, Nu3

With an astounding 28% market share, Brazil is without a doubt the market leader for nuts and seeds in Latin America.

Colombia is emerging as the fastest-growing nuts and seeds market in Latin

America. With a market share of 16%, Colombia's nuts and seeds industry is

experiencing rapid growth.