Nuts and Nutmeals Market Size (2024 – 2030)

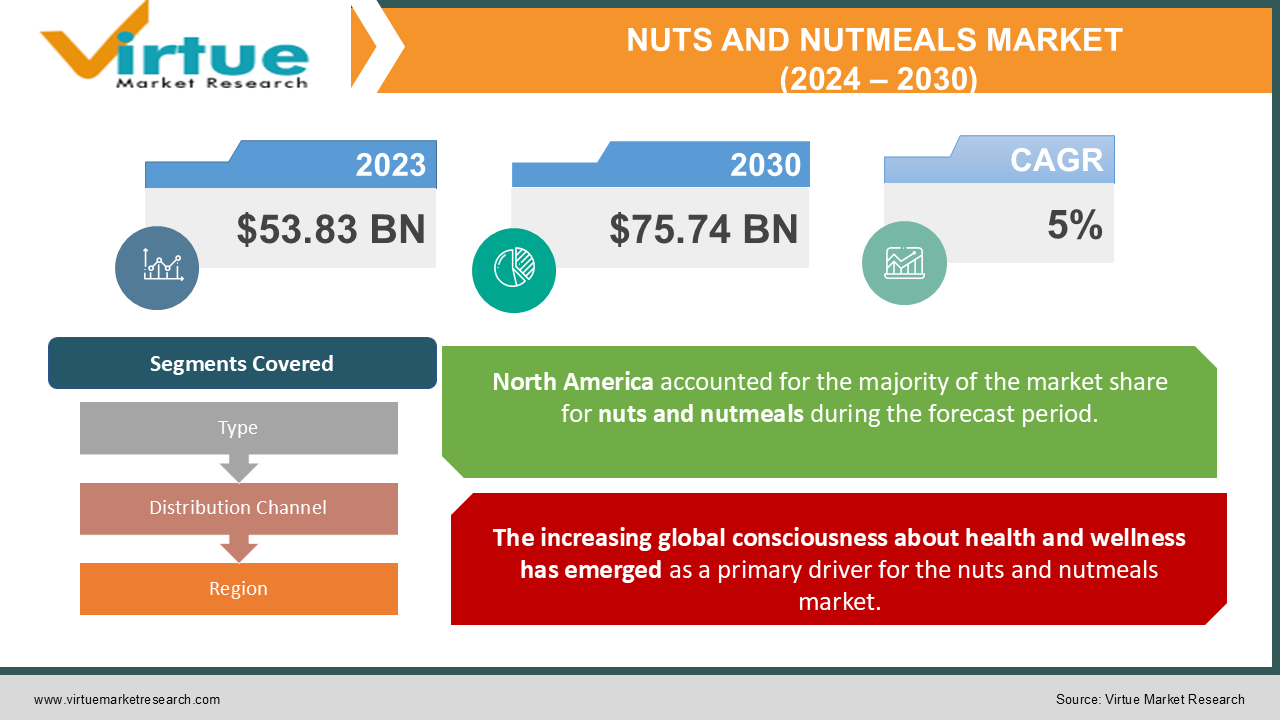

The Nuts and Nutmeals Market was valued at USD 53.83 Billion in 2024 and is projected to reach a market size of USD 75.74 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

The global nuts and nutmeals market has witnessed a remarkable transformation in 2023, driven by evolving consumer preferences toward healthier snacking options and growing awareness of plant-based protein sources. The market has experienced significant growth due to the increasing adoption of nuts and nutmeals in various applications, from direct consumption to food processing industries. Consumer behaviors have shifted dramatically toward incorporating nutrient-dense foods into their daily diets, with nuts and nutmeals becoming a preferred choice due to their rich protein content, healthy fats, and essential minerals.

Key Market Insights:

Global nuts and nutmeals consumption reached 14.2 million metric tons.

Average per capita consumption of nuts increased to 1.8 kg annually.

Online sales of nuts and nutmeals grew by 28% year-over-year.

Plant-based protein demand drove 15% growth in nutmeal consumption.

Almond production reached 1.9 million metric tons globally in 2023. Walnut consumption increased by 22% in urban areas. Specialty nut products saw 35% growth in premium retail channels.

Commercial food service demand increased by 30%.

Specialty nut butter market grew by 48%.

Health food stores reported a 38% increase in net sales.

Convenience packaging solutions grew by 40%.

Traditional retail channels maintained a 45% market share.

Nuts and Nutmeals Market Drivers:

The increasing global consciousness about health and wellness has emerged as a primary driver for the nuts and nutmeals market.

Consumers have become more informed about the nutritional benefits of nuts, including their high protein content, healthy fats, fiber, and essential minerals. Scientific research supporting the health benefits of regular nut consumption has significantly influenced consumer behavior. The rise in lifestyle-related health issues has led to a greater emphasis on preventive healthcare, where nuts play a crucial role. Their heart-healthy properties, ability to aid in weight management, and potential to reduce the risk of chronic diseases have made them a preferred choice among health-conscious consumers. The growing popularity of plant-based diets has further accelerated market growth, as nuts serve as an excellent protein source for vegetarians and vegans. The versatility of nuts in various dietary patterns, from keto to Mediterranean diets, has expanded their consumer base significantly. Medical professionals and nutritionists increasingly recommend nuts as part of a balanced diet, contributing to their mainstream adoption. The inclusion of nuts in dietary guidelines and health recommendations by various organizations has legitimized their role in maintaining good health.

Revolutionary developments in processing technologies have significantly transformed the nuts and nutmeals market.

Advanced processing methods have improved product quality, extended shelf life, and enhanced the nutritional value retention of nuts and nutmeals. Modern packaging solutions have addressed previous challenges related to freshness and convenience. Innovation in modified atmosphere packaging has significantly extended product shelf life, while portion-controlled packaging has catered to the growing demand for convenient, on-the-go consumption. Automation in processing has led to increased efficiency and reduced production costs, making nuts and nutmeals more accessible to a broader consumer base. The implementation of advanced sorting and grading technologies has improved product quality and consistency, meeting stringent consumer expectations. Digital technologies in supply chain management have enhanced traceability and quality control, building consumer trust. The integration of IoT devices in storage and transportation has improved product preservation and reduced waste throughout the supply chain.

Nuts and Nutmeals Market Restraints and Challenges:

The nuts and nutmeals market faces several significant challenges that impact its growth potential. Price volatility remains a major concern, influenced by factors such as weather conditions, crop yields, and global supply chain disruptions. The long cultivation period for nut trees and the significant initial investment required for plantation development create barriers to market entry and expansion. Agricultural challenges, including pest infestations and diseases, pose constant threats to production stability. Climate change has introduced additional uncertainties, affecting crop yields and quality across different growing regions. Storage and preservation present ongoing challenges, particularly in regions with inadequate infrastructure. The susceptibility of nuts to rancidity and contamination requires sophisticated storage facilities and careful handling, adding to operational costs. Allergen concerns remain a significant market restraint, limiting product adoption and requiring strict labeling and processing protocols. Cross-contamination risks in processing facilities necessitate expensive dedicated production lines and rigorous quality control measures. Competition from alternative protein sources and snacking options creates pressure on market growth. The relatively higher price point of nuts compared to other snack options can limit market penetration in price-sensitive regions.

Nuts and Nutmeals Market Opportunities:

The nuts and nutmeals market presents numerous growth opportunities across various segments. The rising demand for plant-based protein alternatives opens new avenues for product development and market expansion. The growing popularity of clean-label and natural products aligns perfectly with the inherent characteristics of nuts and nutmeals. Innovation in product formulations and applications presents significant opportunities. The development of new flavor profiles, convenient formats, and value-added products can capture additional market share and consumer interest. Emerging markets offer substantial growth potential, particularly in regions with rising disposable incomes and increasing health awareness. The expansion of e-commerce platforms provides opportunities to reach previously underserved markets and consumer segments. The growing interest in sustainable and ethically sourced products creates opportunities for differentiation and premium positioning. Companies investing in transparent supply chains and sustainable practices can capture the growing environmentally conscious consumer segment. Technology integration in production and distribution presents opportunities for efficiency improvements and cost reduction. Advanced processing techniques can lead to new product developments and applications in various industries.

NUTS AND NUTMEALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Blue Diamond Growers, Diamond Foods LLC, John B. Sanfilippo & Son Inc., Kraft Heinz Company, Wonderful Pistachios & Almonds LLC, Olam International, Select Harvests Limited, Mariani Nut Company, Kanegrade Limited |

Nuts and Nutmeals Market Segmentation: By Type

-

Tree Nuts (Almonds, Walnuts, Pistachios, Cashews)

-

Ground Nuts (Peanuts)

-

Nutmeals

-

Processed Nut Products

-

Mixed Nuts

Tree nuts dominate the market, particularly almonds, accounting for 42% of the total market share. This dominance is attributed to their versatile applications in snacking, baking, and plant-based alternatives. Almonds specifically lead due to their perceived health benefits and widespread use in multiple food applications.

Nutmeals have emerged as the fastest-growing segment, experiencing a growth surge due to increasing adoption in gluten-free baking and health food applications. The rise of home baking and health-conscious cooking has particularly driven the demand for almond meal and hazelnut meal.

Nuts and Nutmeals Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Online Retail

-

Direct Sales

-

Convenience Stores

Supermarkets/Hypermarkets lead the distribution channels, commanding 45% of sales. Their dominance stems from wide product variety, competitive pricing, and convenience for consumers.

Online retail has emerged as the fastest-growing distribution channel, driven by convenience, wider product selection, and the shift in consumer shopping habits. E-commerce platforms have enabled direct-to-consumer sales and subscription-based models.

Nuts and Nutmeals Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America has maintained its position as the market leader, driven by high consumer awareness, strong distribution networks, and robust demand for healthy snacking options. The region's advanced processing capabilities and innovative product developments have contributed to its market dominance. The strong presence of major market players and early adoption of new product variants has further strengthened its position.

Asia Pacific has emerged as the fastest-growing region, experiencing rapid market expansion due to increasing disposable incomes, changing dietary preferences, and growing health consciousness. The region's large population base, coupled with rising urbanization and westernization of diets, has created substantial growth opportunities. Investment in processing facilities and improvement in distribution infrastructure have supported this growth trajectory.

COVID-19 Impact Analysis on the Nuts and Nutmeals Market:

The COVID-19 pandemic has significantly influenced the nuts and nutmeals market, creating both challenges and opportunities. Initial supply chain disruptions led to temporary shortages and price fluctuations, particularly during the early stages of the pandemic. Consumer behavior shifted notably during lockdowns, with an increased focus on health and immunity-boosting foods benefiting the nuts market. Home cooking and snacking trends drove higher retail sales, while food service sector demand temporarily declined. E-commerce channels gained prominence as consumers shifted to online shopping, accelerating digital transformation in the industry. Companies adapted by strengthening their online presence and developing direct-to-consumer models. The pandemic highlighted the importance of supply chain resilience, leading to investments in local processing capabilities and storage infrastructure. Food safety concerns increased attention to hygiene protocols in processing and packaging. The crisis accelerated several pre-existing trends, including the shift toward healthy snacking and plant-based proteins. Recovery patterns varied across regions, influenced by local pandemic responses and economic conditions.

Latest Trends and Developments:

Innovation in product formulations has led to the emergence of new flavored variants and functional nut products. Manufacturers are focusing on clean-label products with minimal processing and natural ingredients. Sustainable packaging solutions have gained prominence, with biodegradable and recyclable materials becoming increasingly common. Digital technology integration has improved supply chain transparency and traceability. Personalization trends have led to the development of customized nut mixes and subscription services. Health-focused product positioning has expanded to include specific functional benefits and targeted nutritional profiles. Advanced processing technologies have enabled the development of new texture profiles and applications. Cross-category innovation has resulted in unique nut-based products in various food segments. The rise of premium and organic variants has created new market segments catering to specific consumer preferences. Integration of nuts in ready-to-eat meals and convenience foods has opened new market opportunities.

Key Players:

-

Archer Daniels Midland Company

-

Blue Diamond Growers

-

Diamond Foods LLC

-

John B. Sanfilippo & Son Inc.

-

Kraft Heinz Company

-

Wonderful Pistachios & Almonds LLC

-

Olam International

-

Select Harvests Limited

-

Mariani Nut Company

-

Kanegrade Limited

Chapter 1. Nuts and Nutmeals Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nuts and Nutmeals Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nuts and Nutmeals Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nuts and Nutmeals Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nuts and Nutmeals Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nuts and Nutmeals Market – By Type

6.1 Introduction/Key Findings

6.2 Tree Nuts (Almonds, Walnuts, Pistachios, Cashews)

6.3 Ground Nuts (Peanuts)

6.4 Nutmeals

6.5 Processed Nut Products

6.6 Mixed Nuts

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Nuts and Nutmeals Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Specialty Stores

7.4 Online Retail

7.5 Direct Sales

7.6 Convenience Stores

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Nuts and Nutmeals Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Nuts and Nutmeals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company

9.2 Blue Diamond Growers

9.3 Diamond Foods LLC

9.4 John B. Sanfilippo & Son Inc.

9.5 Kraft Heinz Company

9.6 Wonderful Pistachios & Almonds LLC

9.7 Olam International

9.8 Select Harvests Limited

9.9 Mariani Nut Company

9.10 Kanegrade Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumers are increasingly seeking nutrient-dense foods, and nuts are rich in protein, fiber, healthy fats, and essential minerals.

Nuts are among the most common allergens, with severe reactions possible. This limits the market reach and necessitates strict labeling and separate processing facilities, which can increase production costs.

Archer Daniels Midland Company, Blue Diamond Growers, Diamond Foods LLC, John B. Sanfilippo & Son Inc., Kraft Heinz Company, Wonderful Pistachios & Almonds LLC, Olam International, Select Harvests Limited.

North America currently holds the largest market share, estimated at around 35%.

Asia-Pacific has shown significant room for growth in specific segments.