North America Pastry Market Size (2024-2030)

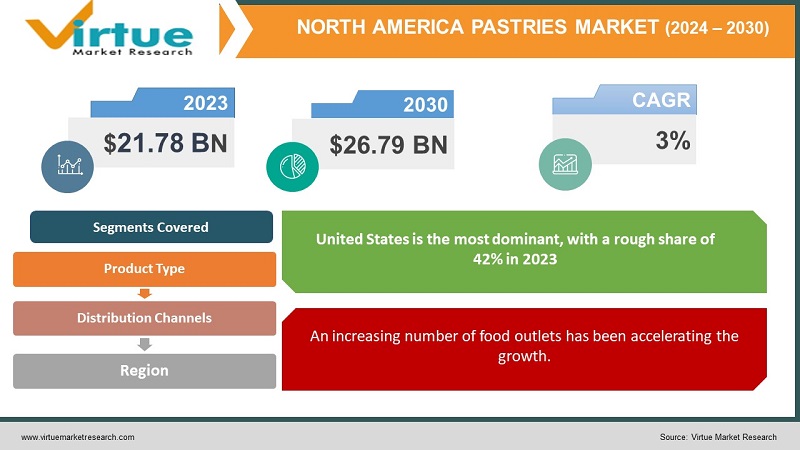

The North American pastry market was valued at USD 21.78 billion and is projected to reach a market size of USD 26.79 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3%.

Download FREE Sample Report Copy

Made of flour, water, and solid fats like butter or lard, pastry is a baked food. They have a buttery, fluffy, and light texture. Pastries can be sweet, savory, or specialized. This market has always had a good presence in North America. In the past, this market has made considerable progress owing to demand. Presently, this market has had a rapid expansion, mainly because of online retail, a growing population, and product diversity. In the future, with culinary innovations and healthier options, this market is anticipated to have a notable enlargement.

Key Market Insights:

- In 2022, 8.6 billion kilograms of cake and pastries were consumed by Americans.

- By 2028, it's anticipated that the pastry market in North America will grow to $9.25 billion.

- Bakers' employment is predicted to grow by 8% until 2031, which is faster than the average for all occupations.

- Breakfast pastries like scones and muffins are the biggest sellers, according to 8.5% of the bakers.

- Based on data from Ingredion's Sugar Reduction Resource Center, 42% of consumers want to reduce their sugar intake. To tackle this, organizations in the industry have been working towards the commercialization of alternatives that have fewer calories and sugar.

Get A Free Sample Copy Of This Report - https://virtuemarketresearch.com/report/north-america-pastries-market/request-sample

North America Pastries Market Drivers:

Changing consumer preferences have been propelling the expansion.

The consumption of a wide range of culinary products has increased significantly. This is a result of the growing middle class, increasing income, and globalization. Additionally, numerous advancements in economic growth have made it possible for more individuals to purchase goods and luxuries. A wider choice of flavors has been introduced, which has assisted in growing the consumer base. Aside from that, its convenience has led to an increase in the number of individuals choosing it. Many of them may not always have time to cook because of their busy schedules. This is a time-saver that helps fulfill hunger. Moreover, a lot of people prefer to have sweet foods and desserts to satisfy their cravings. Pastry is a popular dessert consumed by the population, helping the market to develop.

An increasing number of food outlets has been accelerating the growth.

Over the years, there have been a lot of changes in the standard of living. People prefer to go out more often. To support this, there have been many bakeries, fast food chains, and other cafes that have come into existence. A greater percentage of the population tends to experiment with their food. People are excited to try out different cuisines. The pastry industry has evolved by coming up with many varieties like croissants, macarons, baklava, puff pastry, Danish pastry, cannoli, eclair, tiramisu, and many more. Hence, more profits are generated since so many choices are available. Social media plays a crucial role in promoting these products. Many users engage with food content and, accordingly, search for suitable places to satisfy their cravings. Furthermore, the Internet has become a boon since people can order many kinds from their houses. Almost all of the food outlets prioritize having a virtual presence due to this.

North America Pastries Market Restraints and Challenges:

Health concerns, competition from healthier alternatives, and freshness are the main issues that the market is currently experiencing.

One of the biggest barriers to the market is increasing health consciousness. Pastries have high amounts of sugar, calories, oil, and other fats, which is more than the recommended intake. Due to changing lifestyles, the prevalence of chronic illnesses like diabetes, high blood pressure, and other heart diseases has significantly increased. As such, consumers are becoming more aware of what they consume. Many of them have been trying to cut down on their junk food intake, which involves bakery products. This can cause a lot of losses for the market. Secondly, due to this shift in consumer preference, other sweets like protein bars, energy bars, and other low-calorie snacks have been gaining prominence. Consumers might therefore go for these healthy options instead of pastries. Furthermore, pastries are known to have a very short shelf life. Hence, customers are advised to not store it for a longer duration to retain the texture and flavor. This can be a hindrance during transportation.

North America Pastry Market Opportunities:

Healthier alternative options are providing the market with many possibilities. Manufacturers in the industry have been prioritizing developing suitable choices that have reduced sugar and calorie content. Jaggery is one such choice that is preferred instead of sugar because it is usually perceived as a healthier choice. Veganism has been gaining a lot of prominence. This is the practice of incorporating plant-based diets. There are many dairy-free options available. This includes the use of milk alternatives, which include soy, almond, and other lactose-free selections. Product innovations in the culinary industry help create more flavors, which are often found to be more appealing. Using unique and exotic fruits is one such recent development that is being well-received by the public. Furthermore, sustainable packaging solutions have been beneficial to the market. By using recyclable materials and other biodegradable options, a greater percentage of the population can be inclined toward buying these products.

NORTH AMERICA PASTRY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, Canada, Mexico |

|

Key Companies Profiled |

Grupo Bimbo, Mondelez International, Hostess Brands, McKee Foods Corporation, Flowers Foods, Pepperidge Farm (Campbell Soup Company), Krispy Kreme Doughnuts, Entenmann's (Bimbo Bakeries), Otis Spunkmeyer (ARYZTA), Tastykake (Flowers Foods) |

North America Pastries Market Segmentation:

North America Pastries Market Segmentation: By Product Type

- Sweet Pastries

- Savory Pastries

- Frozen Pastries

- Specialty Pastries

Based on product type, sweet pastries are the largest segment in this market in 2023. A lot of people have sweet cravings. This category fits in perfectly with the taste buds, making it an attractive choice. Additionally, sugar is associated with the release of a hormone called serotonin, which is known to make people happy. Sugar has become more affordable, and therefore, the development of these types of desserts has become easier. Besides, these are the most common types of pastry available in every distribution channel. This accessibility contributes to its success.

Specialty pastries are the fastest-growing category. The market for specialty bakeries has expanded recently as a result of shifting customer tastes and an increased focus on fitness goals. The main goal of specialty bakeries is to create and market exceptional baked products. They frequently focus on producing handcrafted, artisanal goods that appeal to specialized consumers or certain dietary requirements. Specialty bakeries have become more well-known as the go-to place for those looking for delicious pastries that fit their dietary needs or preferences as customers grow more health-conscious and open to trying different diets.

North America Pastries Market Segmentation: By Distribution Channels

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Others

With a share of over 50%, supermarkets and hypermarkets are the distribution channels that are the most dominant in 2023. Their products are readily available and simple to purchase. They are frequently found in every neighborhood, making it simple for the public to obtain the supplies they need. This enables direct communication between the customer and the company owner, allowing them to check the freshness and quality of the pastries. Additionally, few individuals select this channel because they do not have an internet connection or are unaware of technology.

Online retail is the distribution channel in this market that is growing at the fastest rate. The main reason for this is convenience. Customers can order products from the comfort of their homes and have the item delivered to their doorstep. People can also choose from a variety of options. Because online retailers occasionally provide free shipping and discounts, they are also an affordable option for shoppers. This makes it a cost-effective alternative, which benefits a larger audience.

North America Pastries Market Segmentation: Regional Analysis

- United States

- Canada

- Mexico

Based on region, the United States is the most dominant, with a rough share of 42% in 2023. The main reason for this is economic progress. There are a lot of restaurants, hotels, and other food chains that offer a wide range of desserts, including pastries. Customers get to choose from many choices. Besides, most of the popular companies are present in this region. A few of them include Hostess Brands, Mondelez International, McKee Foods Corporation, Krispy Kreme Doughnuts, etc. These players have a global presence through various branches and subsidiaries, which contributes to their greater income. Besides, having a strong online presence benefits these companies.

Canada is the fastest-growing region. This area holds an approximate share of 33% in 2022. This region has witnessed remarkable growth in the bakery industry. Over the past few years, there have been many new openings in food outlets that have gained significant prominence. There is a growing population that is keen on experimenting with a wide range of foods. Furthermore, the culinary industry has been working on many innovations to create authentic and unique flavors, which have been greatly appreciated by the public.

COVID-19 Impact Analysis on the North American Pastries Market:

The outbreak of the virus hurt the market. There was a lot of disruption in the supply chain, transportation, and other logistics due to lockdowns, social isolation, and movement restrictions. Import-export trade activities were severely affected by this. An economic downfall was observed. Besides, the pandemic highlighted the importance of having good physical and mental health. Many customers became aware of their food choices.

In the Food & Health Survey, conducted by IFIC, 72% of Americans reported reducing or giving up sugar during this period. Moreover, most of the companies and manufacturing units were shut down temporarily. Additionally, labor wasn’t sufficient to carry out the end-to-end operations due to uncertainty. Most of the priorities and findings were shifted towards healthcare applications. This caused delays in all launches, collaborations, and investments. Post-pandemic, by introducing healthier choices and with the aid of e-commerce, the market has picked up.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing technologies while maintaining competitive pricing. This has further resulted in increased enlargement.

Customization of pastries is a popular trend. By tailoring the pastries with ingredients and toppings as per the needs of the customer, a broader consumer base can be achieved. This move gives businesses an advantage in a market where customer preferences are emphasized.

Key Players:

- Grupo Bimbo

- Mondelez International

- Hostess Brands

- McKee Foods Corporation

- Flowers Foods

- Pepperidge Farm (Campbell Soup Company)

- Krispy Kreme Doughnuts

- Entenmann's (Bimbo Bakeries)

- Otis Spunkmeyer (ARYZTA)

- Tastykake (Flowers Foods)

- In October 2023, with its formal opening in Calgary, TOUS les JOURS, a French-Asian bakery café chain, established its foothold in Canada. The business offers over 300 handmade pastries, gourmet cakes, and desserts that are prepared in-store every day. Canada is TOUS les JOURS' eighth nation worldwide and will act as a launchpad for further growth throughout North America and beyond, following a year of remarkable progress throughout the U.S.

- In March 2023, Paris Baguette's first bakery café was opened in Canada. With at least seven planned to open throughout Canada and over 64 in the US by 2023 due to a smart mix of corporate-owned and franchise sites, the new shop signifies the development of the quickly expanding brand's North American reach.

- In May 2022, Premier Foods, based in the United Kingdom, introduced the Mr. Kipling brand of baked goods to the American market. Mr. Kipling is the ideal product for the US market because he bridges the gap between customers' needs for quick and simple snacking forms and their demand for premium sweet delicacies.

Chapter 1. North America Pastries Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Pastries Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Pastries Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Pastries Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Pastries Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Pastries Market– By Product Type

6.1. Introduction/Key Findings

6.2. Sweet Pastries

6.3. Savory Pastries

6.4. Frozen Pastries

6.5. Specialty Pastries

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Pastries Market– By Distribution Channels

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Specialty Stores

7.4. Online Retail

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channels

7.7. Absolute $ Opportunity Analysis By Distribution Channels , 2024-2030

Chapter 8. North America Pastries Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channels

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Pastries Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Grupo Bimbo

9.2. Mondelez International

9.3. Hostess Brands

9.4. McKee Foods Corporation

9.5. Flowers Foods

9.6. Pepperidge Farm (Campbell Soup Company)

9.7. Krispy Kreme Doughnuts

9.8. Entenmann's (Bimbo Bakeries)

9.9. Otis Spunkmeyer (ARYZTA)

9.10. Tastykake (Flowers Foods)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North American pastry market was valued at USD 21.78 billion and is projected to reach a market size of USD 26.79 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3%.

Changing consumer preferences and an increasing number of food outlets are the main factors propelling the North American Pastries Market.

Based on Product Type, the North American pastries Market is segmented into Sweet Pastries, Savory Pastries, Frozen Pastries, and Specialty Pastries.

The United States is the most dominant region for the North American Pastries Market.

Grupo Bimbo, Mondelez International, and Hostess Brands are the key players operating in the North American Pastries Market.