European Pastries Market Size (2024-20230)

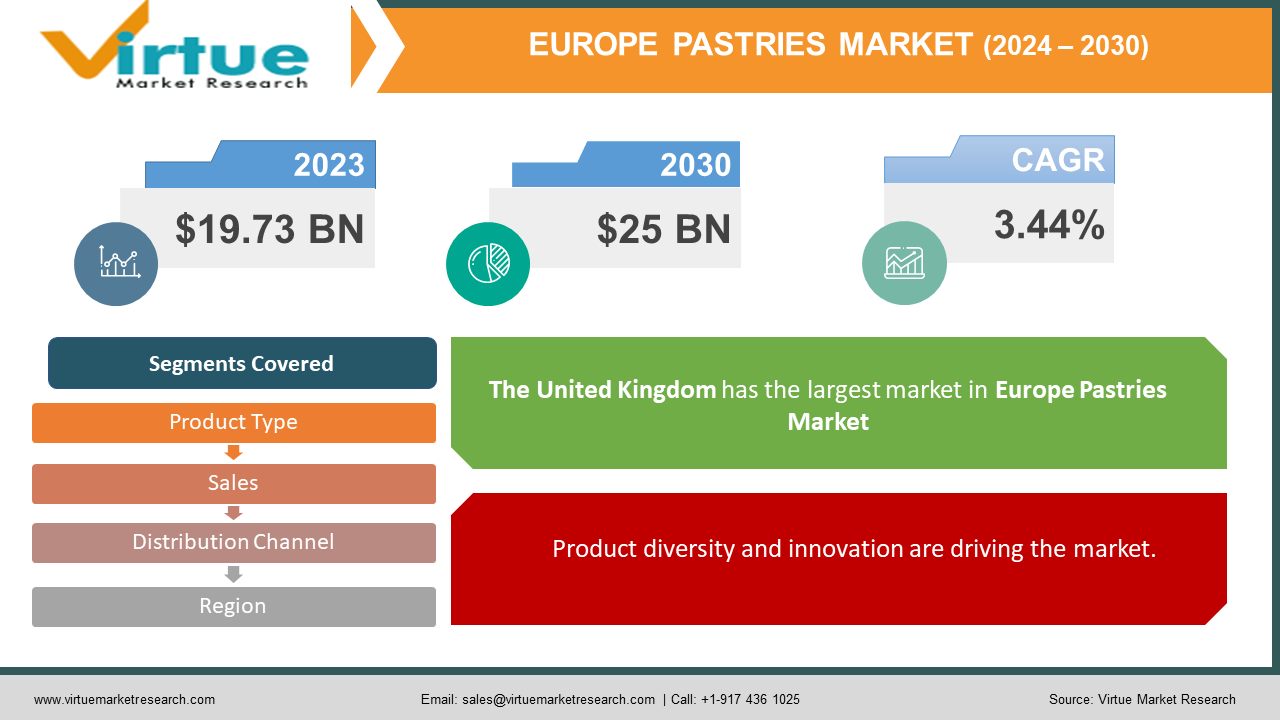

The European Pastries Market was valued at USD 19.73 billion and is projected to reach a market size of USD 25 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.44%.

The term pastries refers to a broad range of baked goods composed of materials such as eggs, flour, sugar, milk, butter, shortening, and baking powder. Pastries are a synecdoche for little tarts and other sweet baked goods. Pies, tarts, quiches, croissants, and pasties are examples of common pastry dishes. This market had a significant presence in the past in many European countries. They helped with the generation of revenue and with the economy. Presently, with online retail, innovations, and globalization, this market has expanded tremendously. In the future, with culinary experimentation and a growing population, this market is set to see a good expansion. During the forecast period, a considerable growth rate is anticipated.

Key Market Insights:

- Since 2012, pastry sales have grown annually in Europe, and this trend is predicted to continue until 2021 when they are projected to reach a value of about 16.2 billion US dollars.

- More than 57% of the French population said they purchased pastries at least once a month in 2023.

- In the UK, the production of fresh pastries, cakes, and bread brings in close to 6.1 billion British pounds in revenue.

- Between 2020 and 2030, bakery employment is expected to expand by 10%, or roughly as fast as the average for all occupations.

- The number of diabetic patients in Europe in 2021 was estimated to be 61 million. This number is expected to reach 69 million by 2045. Therefore, the food and beverage industry is focusing on sugar reduction and healthier alternatives.

Europe Pastries Market Drivers:

Product diversity and innovation are driving the market.

The food industry is keen to experiment with product categories. Significant progress has been achieved in flavor, texture, and quality over time. The food and beverage industry promotes a variety of fitness goals. They are creating healthier substitutes to market them. As per a report by Tata and Lyle, nearly three-quarters of the 400 senior bread industry executives we surveyed in Germany, France, Spain, and the UK said that lower sugar and calorie goods are the main factor driving business growth as customers seek out healthier choices Furthermore, several pastries are being customized to satisfy the needs of certain individuals. A larger consumer base has been formed as a result.

Online retail has been a boon for the market.

The pandemic caused a shift towards digitalization. This caused huge benefits for almost every industry. People can access a wide range of products and compare prices. This helps in strengthening the economy of the nation as well. Besides, discounts and deals are offered during the festive season. Additionally, online shopping is very convenient. Furthermore, the corporate sector, through various collaborations, is promoting the channel with various gift cards and offers.

Changing lifestyles and consumer preferences are accelerating the growth rate.

Over the years, urbanization, the rising middle class, and an increasing disposable income have caused significant changes in the way of life. People are eager to experiment with various food varieties. Social media has played a crucial role in the marketing of pastries. Content creators endorse specific dineries and other fast-food chains, helping the vendors generate more profits. Besides, with dual incomes, people find limited time due to hectic schedules. Therefore, go-to-food options have gained immense popularity. These food products are tasty and fulfilling. This increased consumption is creating an upsurge. Furthermore, the travel and tourism industry has undergone enormous growth. Due to this, foreigners consume the delicacies of the nation, which include pastry options like croissants, churros, bombolone, cannoli, schneeball, and many more. This helps in the generation of more profits.

Europe Pastries Market Restraints and Challenges:

Increasing health consciousness, dietary restrictions, and limited shelf life are the main issues that the market is currently experiencing.

One of the biggest barriers to the market is the unhealthy content in the pastries. Because baked goods include a lot of sugar and fat, they are often rich in calories. Overindulging in calories can result in weight gain and raise the chance of obesity, which raises the risk of developing other chronic illnesses, including diabetes and heart disease. There have been numerous surveys and statistics conducted that have indicated the extent of diabetes. This fear can cause losses for the market. Secondly, there have been changes in dietary preferences. This includes the consumption of gluten-free products, vegan-based food, and other low-calorie options. This can incur losses for the market. Thirdly, these pastries cannot be stored for a longer amount of time because they have a limited shelf life. Therefore, preservation becomes a challenge. Additionally, care should be taken to ensure quality while importing and exporting this product.

Europe Pastries Market Opportunities:

The development of healthier alternatives has been providing the market with an ample number of possibilities. This includes low-calorie, gluten-free, and other sweet options. Additionally, allergen-free choices are being emphasized. Secondly, innovations in the culinary market are creating an enlargement. Flavors are being experimented with. Fusions of different cultures are being promoted. Furthermore, creativity concerning bases is being prioritized.

EUROPE PASTRIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.44% |

|

Segments Covered |

By Product Type, Sales, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Lantmännen Unibake, Barilla Group, Grupo Bimbo, Lieken AG, Cérélia, Finsbury Food Group, Aryzta, Dr. Oetker, Vandemoortele, Bridor |

Europe Pastries Market Segmentation Analysis

Europe Pastries Market Segmentation: By Product Type

- Sweet Pastries

- Savory Pastries

- Frozen Pastries

- Specialty Pastries

Based on product type, sweet pastries are the largest segment in the European pastry market. This is because of the sweetness these pastries carry. People who have sugar cravings tend to go for bakery products, which include sweet pastries as a popular category. Additionally, they are available in a wide range of flavors. Explorations are being carried out to blend different tastes and create a unique dining experience. Furthermore, the emergence of popular bakeries and cafes is helping with the expansion. During the forecast period, this segment is predicted to further enlarge. Specialty pastries are the fastest-growing category. This is owing to the unique offerings, flavors, options, demand, and healthier alternatives. Besides, they offer personalization catering to specific needs.

Europe Pastries Market Segmentation: By Sales

- Artisanal and In-store Pastries

- Packages Pastries

Artisanal and in-store pastries are considered to be the largest segment in this market. This is because of the quality, freshness, aroma, taste, and appeal. Additionally, these products are often associated with authenticity, cleanliness, and customization. However, packaged pastries are the fastest-growing. These products can be consumed by customers at their convenience. Moreover, the hustle culture is raising the demand for this category.

Europe Pastries Market Segmentation: By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

Supermarkets and hypermarkets are the market's largest distribution channels. Their overall market share is higher than 55%. This is due to factors like availability, presence, accessibility, originality, authenticity, face-to-face interaction, and visual inspection. Online retail is growing at the fastest rate due to the continuous digital transformation. They own around 35 percent of the revenue. A growing number of consumers are choosing online meal delivery services as a result of growing consumer knowledge and the desire to try new choices. They may place orders conveniently from the comfort of their own homes. This facilitates the purchase of food items, especially for people who live in remote areas. Online retailers have also started to provide better customer service and guarantee the freshness of their products, further boosting their success.

Europe Pastries Market Segmentation: Regional Analysis:

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

The United Kingdom is the largest market based on region, holding a nearly 32% market share. This is due to several factors, including population, the presence of large corporations, bulk manufacturing, demand, uniqueness, innovations, cultural importance, attractiveness, and flavor advances. Germany is the country that is expanding at the fastest rate due to several reasons, such as the rise in fast-food franchises and restaurants, population growth, the creation of new companies, global operations, increasing appeal, investments, and experimentation needs. About 25% of the total is made up of this region. France is also experiencing good growth. This is because of an increase in the number of travelers, local delicacies, prestigious restaurants, the growth of online retail, and innovations in flavors. Pastries like macarons, éclairs, and mille-feuille are the most popular choices.

COVID-19 Impact Analysis on the Europe Pastries Market:

The outbreak of the virus hurt the market. Lockdowns, movement restrictions, and social isolation were the new norm. This caused disruptions in the supply chain, transportation, and logistics. Import and export trade activities were hindered. Moreover, due to financial restraints, people lost their jobs, and businesses had to be shut down. This caused an economic downfall. As per a report by Girafood, the COVID-19 pandemic has had a significant influence on European bread consumption, which fell by over 2% annually between 2019 and 2021 despite the market being quite stable during the previous ten years. Furthermore, the food and beverage industry had to be shut down owing to guidelines and protocols. This led to an enormous number of losses. People started realizing the importance of having good health. They started leaning toward home-cooked meals. Besides, social media threw light on the cruelty faced by the animal industry. This caused an increase in the number of vegans during the pandemic. However, post-pandemic, the market is still recovering. Upliftment of lockdowns and relaxation of rules have been fueling the growth. E-commerce has been generating more income.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing creations while maintaining competitive pricing. This has further resulted in increased enlargement.

The adoption of sustainable practices is on the rise. This includes the implementation of recycled plastic, the usage of locally sourced ingredients, the reduction of food waste, and the employment of eco-friendly products for packaging purposes. Even though this strategy is in its initial stages, during the forecast period, a notable augmentation is predicted.

Key Players:

- Lantmännen Unibake

- Barilla Group

- Grupo Bimbo

- Lieken AG

- Cérélia

- Finsbury Food Group

- Aryzta

- Dr. Oetker

- Vandemoortele

- Bridor

- In July 2023, the European bakery firm Panelto Foods, an Irish bakery firm that specializes in bake-off artisan breads, announced that it would open a platform for the UK and Ireland. Client bases across Europe and complementary product selections will benefit the expanded baking group.

- In July 2021, Baking the Future, the first startup accelerator in the bakery industry, was introduced by Cereal, Europastry's new R&D center for pastries and bakery products. Its objectives are to find creative ideas created by startups worldwide and to develop an open innovation model for the business.

- In April 2021, following the split of CSM Bakery Solutions, the specialized European bakery goods company Baker & Baker, with its headquarters located in Wirral, was formally launched. With a revenue of €400 million, the company leads the European bakery convenience industry, employing over 2,500 people and running 12 locations across seven countries. In addition to preserving and expanding its market position in the UK, the company will concentrate on maximizing growth prospects that remain unexplored across continental Europe.

Chapter 1. Europe Pastries Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Pastries Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Pastries Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Pastries Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Pastries Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Pastries Market – By Product Type

6.1. Introduction/Key Findings

6.2. Sweet Pastries

6.3 Savory Pastries

6.4. Frozen Pastries

6.5. Specialty Pastries

6.8. Y-O-Y Growth trend Analysis By Product Type

6.9. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Pastries Market – By Sales

7.1. Introduction/Key Findings

7.2 Artisanal and In-store Pastries

7.3. Packages Pastries

7.4. Y-O-Y Growth trend Analysis By Sales

7.5. Absolute $ Opportunity Analysis By Sales , 2024-2030

Chapter 8. Europe Pastries Market – By Distribution Channel

8.1. Introduction/Key Findings

8.2 Supermarkets/Hypermarkets

8.3. Specialty Stores

8.4. Online Retail

8.5. Others

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Pastries Market , By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.1.2. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Product Type

9.1.3. By Sales

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Pastries Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Lantmännen Unibake

10.2. Barilla Group

10.3. Grupo Bimbo

10.4. Lieken AG

10.5. Cérélia

10.6. Finsbury Food Group

10.7. Aryzta

10.8. Dr. Oetker

10.9. Vandemoortele

10.10. Bridor

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The European Pastries Market was valued at USD 19.73 billion and is projected to reach a market size of USD 25 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.44%.

Product diversity and innovation, online retail, and changing lifestyles and consumer preferences are the main factors propelling the Europe Pastries Market.

Based on Product Type, the European pastries Market is segmented into Sweet Pastries, Savory Pastries, Frozen Pastries, and Specialty Pastries

The United Kingdom is the most dominant region for the Europe Pastries Market

Lantmännen Unibake, Barilla Group, and Grupo Bimbo are the key players operating in the Europe Pastries Market.