North America Cookies Market Size (2024-2030)

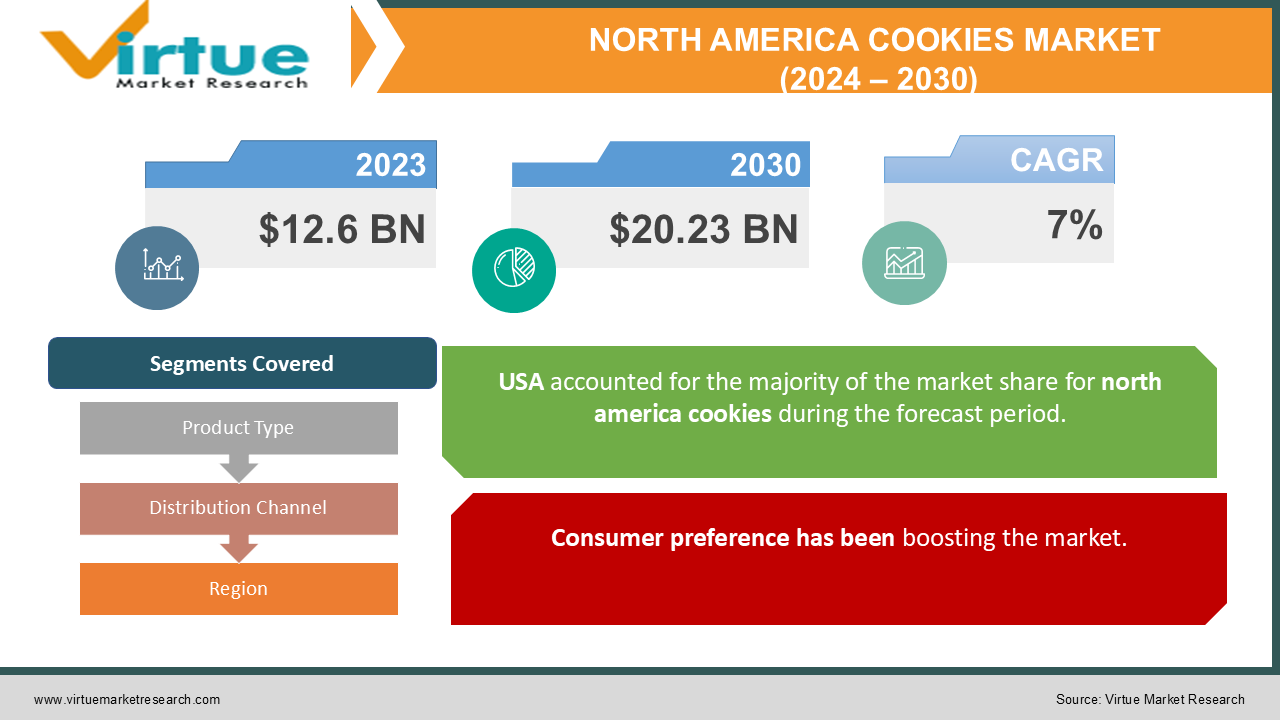

The North American cookies market was valued at USD 12.6 billion and is projected to reach a market size of USD 20.23 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7%.

Cookies are little sweet baked treats or snacks that are typically flat and made with flour, sugar, egg, fat, oil, or butter of some kind. Other ingredients like nuts, chocolate chips, raisins, or oats might also be included. This market has had a notable presence in the past. This is because of the demand and presence of distribution channels. Presently, the market has undergone considerable expansion owing to innovative varieties and e-commerce growth. In the future, with a focus on personalization and health & wellness trends, this market will see good growth.

Key Market Insights:

- Over 2 billion cookies are consumed annually by Americans, or roughly 300 cookies per person.

- By 2024, there will be 251.38 million Americans who will consume ready-to-eat cookies, according to Statista.

- Cookies are eaten as dessert in the US in third place, after ice cream (55%), then chocolate (32%).

- Over 53% of American adults choose chocolate chip cookies over peanut butter cookies, making them the nation's favorite cookie, according to The Cravory.

- As per the 2022 National Diabetes Statistics Report by the CDC, 11.3% of the US population, or 37.3 million people, are affected by diabetes. This comprises 8.6 million individuals with undiagnosed diabetes and 28.7 million individuals with diabetes who have a diagnosis. Cookies have a high sugar content, and processed oils increase the risk of diabetes. As such, to tackle this issue, manufacturers are working towards creating less sweet and calorie options to attract the health-conscious consumer base.

North America Cookies Market Drivers:

Consumer preference has been boosting the market.

Cookies have had a significant presence in North America for many decades. These products are available through most of the distribution channels, like convenience stores and online websites. They are portable, shelf-stable, fulfilling, and a convenient option. Food cravings are satisfied by consuming them. They are an affordable option. Moreover, with dual income becoming the new norm, people are looking for ready-to-eat options. These cookies are the perfect snack because they are high in calories and provide an energy boost.

Product diversification has been contributing to the success.

Over the years, culinary chefs have worked on bringing many innovative flavors to the market. A lot of sweet, spicy, and sour options are being commercialized. Ingredients like chocolate, cashews, almonds, fruits, etc. are a popular choice. Besides this, there is a growing popularity of veganism. This includes the practice of incorporating plant-based foods. As such, companies are using alternative dairy options like soy, almond, and oat milk to bake the cookies. Gluten-free cookies are another choice for health-conscious customers.

Furthermore, organic options have gained prominence. These cookies have no chemicals or preservatives. Apart from this, functional cookies are being emphasized. They have important nutrients, proteins, and vitamins. This nutritional profile helps broaden the consumer base.

North America Cookies Market Restraints and Challenges:

Health concerns and intense competition are the main issues that the market is currently facing.

Cookies often contain a high calorie and sugar content. The sour ones also include an excessive amount of salt. It is not advised to consume them excessively or daily. Obesity, overweight, and diabetes may arise from them. In addition, some of them are chewy. This leads to cavities and other tooth problems. Occasionally, because they are hard to chew on, they might cause dental damage. Additionally, chewing them makes swallowing more difficult, which can lead to stomach issues like bloating.

Furthermore, the market is subject to intense competition. Healthier alternatives are being introduced. This includes less sugar & calories, organic, and other gluten-free choices. The conventional ones can see a tremendous decline as a result. As such, manufacturers need to implement suitable strategies, like introducing innovative formulations, to address such problems.

North America Cookies Market Opportunities:

Cookies with unusual flavors like salted caramel, matcha green tea, and fiery chili-chocolate are becoming more and more popular with consumers. Manufacturers are experimenting with novel flavor combinations and limited-edition releases to draw in customers and set their products apart from competitors' offerings.

Secondly, the customization of candies is beneficial. Cookies are tailored to meet each person's needs, taking into account things like ingredients, flavor preferences, and dietary constraints. Online purchasing is beneficial aside from this. A virtual presence allows for a wider worldwide client base to be reached. Additionally, local and international options are accessible through this mode.

NORTH AMERICA COOKIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United States, Canada, Rest of North America |

|

Key Companies Profiled |

Mondelez International, Kellogg Company, Nestlé S.A., The Hershey Company, Pepperidge Farm (Campbell Soup Company), Grupo Bimbo, Conagra Brands, McKee Foods Corporation, Voortman Cookies Limited, Ferrero Group |

North America Cookies Market Segmentation Analysis

North America Cookies Market Segmentation: By Product Type:

- Bar Cookies

- Molded Cookies

- Pressed Cookies

- Sandwich Cookies

- Others

Bar cookies are the largest-growing product type. They are the most popular kind of cookie and are consumed by the greatest number of people. Popular variations of bar cookies include oatmeal raisin and chocolate chip. Bar cookies have a long shelf life, are portable, and are simple to pack and store. Additionally, they are available in an extensive range of flavors and ingredients, catering to a wide range of consumer preferences. The most adaptable recipes for bar cookies involve combining all the ingredients in a bowl, frying the dough in a pan, allowing it to cool, and then serving it straight from the pan.

Sandwich cookies are the fastest-growing category. Sandwich cookies are a kind of cookie where two cookies are sandwiched together to create a single sandwich-like structure with a delicious filling inside. These cookies can be made in numerous forms, sizes, and tastes, but they usually consist of two round or rectangular cookies with a creamy filling. The filling might be anything from flavored creams, jams, or spreads to cream, frosting, or icing. To accommodate a wide range of tastes and preferences, sandwich cookies are available in a wide variety of flavors and fillings. Because of its adaptability, customers can select from a variety of products to satisfy their dietary requirements and inclinations.

North America Cookies Market Segmentation: By Distribution Channels:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

Supermarkets and hypermarkets are the largest growing distribution routes. These establishments facilitate consumers' purchases by offering a vast array of options. Consumers can visually evaluate the goods to determine their quality. The merchant could provide them with the answers to their questions. Through this approach, customers can also haggle. This channel is frequently chosen by those who are not comfortable using the Internet.

The channel with the fastest growth rate is online retail. E-commerce is growing in popularity due to its broad product range, simplicity of use, and versatility. Consumers can order goods online and have them delivered right to their front door. In addition, the COVID-19 pandemic has expedited the growth of this channel. This is a tempting choice because customers receive multiple offers and discounts for their purchases.

North America Cookies Market Segmentation: Regional Analysis:

- U.S.A

- Canada

- Mexico

The USA is the largest and fastest-growing market. The availability of cookies is the primary cause of this. The region's strong retail presence, wide market penetration, and efficient distribution networks are enabling the development. In addition, there are numerous large corporations with a global reach operating in this field. Mondelez International, Kellogg Company, The Hershey Company, and Pepperidge Farm are a few of them. Their established status contributes to their increased ability to generate revenue. Furthermore, the US cookie market is expanding due to trends like premiumization, e-commerce expansion, and health and well-being.

COVID-19 Impact Analysis on the North American Cookie Market:

The virus outbreak had a detrimental effect on the market. Lockdowns, movement restrictions, and social isolation were some of the new standards. Transportation, logistics, and supply chain management are all impacted by this. As a result, import-export operations suffered.

According to IRI data for the 52 weeks ending September 4, 2022, the cookie category's recent performance reflected unit sales declining 3.8% to 2.8 billion and dollar sales climbing 7.7% to $8.6 billion. Healthy and homemade food became more popular. After the pandemic, the market has begun to recover. The creation of enterprises has contributed to the increase in revenue. Normal functioning is now made easier by the easing of laws and restrictions. Online retail has contributed to a rise in market revenue.

Latest Trends/ Developments:

- Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

- There is growing consumer awareness about environmental sustainability, which is driving the market for chewy candies packaged with recyclable, compostable, or biodegradable materials. Manufacturers are considering sustainable packaging choices as a way to reduce their environmental impact and meet consumer requests for packaging that complies with ethical standards.

Key Players:

- Mondelez International

- Kellogg Company

- Nestlé S.A.

- The Hershey Company

- Pepperidge Farm (Campbell Soup Company)

- Grupo Bimbo

- Conagra Brands

- McKee Foods Corporation

- Voortman Cookies Limited

- Ferrero Group

- In September 2023, the Innovation Center and North America R&D Labs of Ferrero North America, a part of the international sweet-packaged food giant Ferrero Group, which is well-known for its beloved brands Keebler, Butterfinger, Nutella, Kinder, and Tic Tac, opened in Chicago. Bringing together Ferrero's R&D teams from across the country, the new 45,000 square-foot facility housed in the historic Marshall Field and Company Building employs over 150 people and is home to teams working on Keebler, Famous Amos, Mother's, Fannie May, and other brands in the Ferrero portfolio.

- In June 2023, Keebler introduced the Keebler® Chips Deluxe Fudgy. This latest creation enhances the delicious Fudge chunks in the traditional Chips Deluxe for even more elfin delight.

- In May 2022, Great American Cookies introduced a limited-edition Caramel Popcorn Cookie. The flavors of the cookie are peppery and sweet. Gourmet cookies, particularly cookie cakes, are the specialty of the independently run franchised brand Great American Cookies. Their products are baked at a facility that also processes products containing peanuts and tree nuts and also contains eggs, milk, soy, and wheat.

- In February 2022, Carl Brandt, Inc. announced that Matterhorn Swiss Biscuits, Chocolate Bretzeli Swiss Biscuits, Bretzeli Tin Gold, and the Primavera Gift Box will be the four new products that Kambly Swiss Biscuits will be launching in the United States. Luxurious Swiss biscuits from Kambly are created with the greatest natural ingredients, clean labels, and sustainable practices.

Chapter 1. North America Cookie Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Cookie Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Cookie Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Cookie Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Cookie Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Cookie Market– By Product Type

6.1. Introduction/Key Findings

6.2. Bar Cookies

6.3. Molded Cookies

6.4. Pressed Cookies

6.5. Sandwich Cookies

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. North America Cookie Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets/Hypermarkets

7.3. Specialty Stores

7.4. Online Retail

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. North America Cookie Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Product Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Cookie Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Mondelez International

9.2. Kellogg Company

9.3. Nestlé S.A.

9.4. The Hershey Company

9.5. Pepperidge Farm (Campbell Soup Company)

9.6. Grupo Bimbo

9.7. Conagra Brands

9.8. McKee Foods Corporation

9.9. Voortman Cookies Limited

9.10. Ferrero Group

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North American cookies market was valued at USD 12.6 billion and is projected to reach a market size of USD 20.23 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7%.

Consumer preference and product diversification are the main factors propelling the North American cookie market

Based on product type, the North American cookie market is segmented into bar cookies, molded cookies, pressed cookies, sandwich cookies, and others

The USA is the most dominant region in the North American cookie market.

Mondelez International, Kellogg Company, and Nestlé S.A. are the key players operating in the North American cookie market.