Cookies Market Size (2025 – 2030)

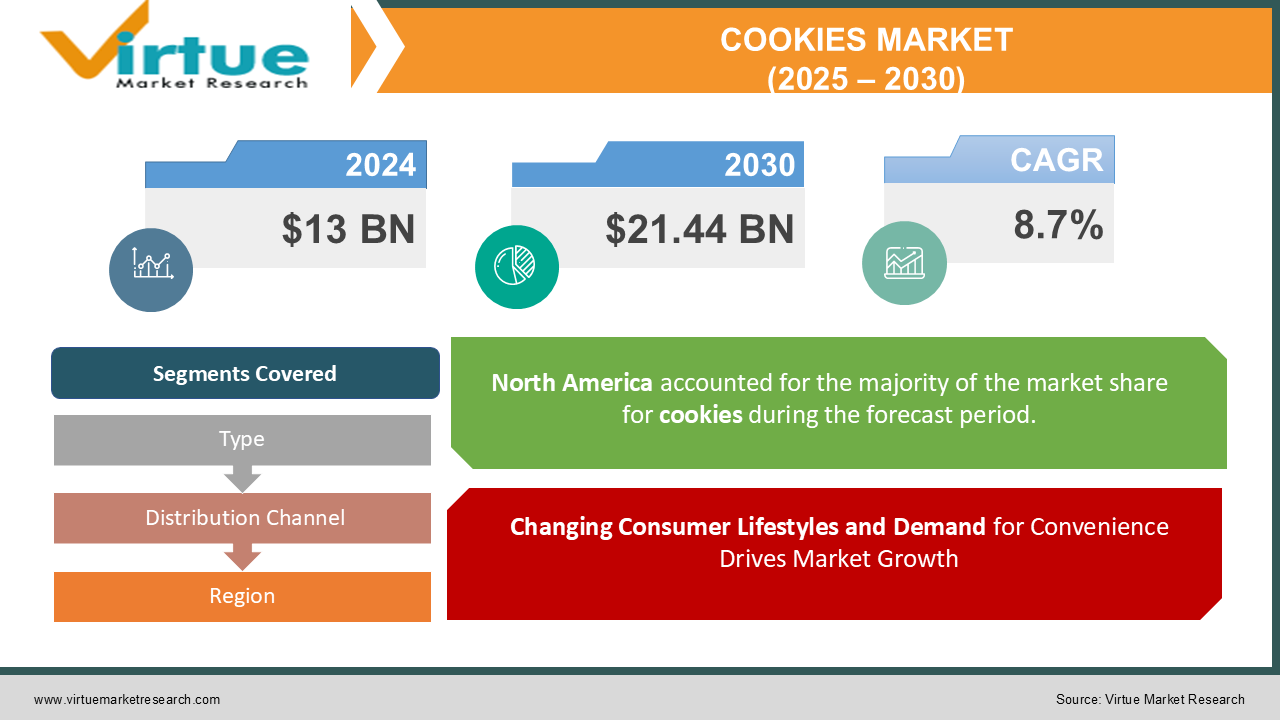

The Cookies Market was valued at USD 13 Billion in 2024 and is projected to reach a market size of USD 21.44 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.7%.

The cookies market is a dynamic and ever-expanding segment of the global food industry, reflecting the evolving preferences of consumers, advancements in production techniques, and the influence of cultural trends. Cookies, known for their versatility and universal appeal, occupy a unique position in the snack food sector. From classic butter and chocolate chip varieties to innovative health-conscious and vegan options, cookies cater to an extensive range of tastes and dietary needs. The market's ability to evolve with consumer preferences has solidified its status as one of the most resilient and adaptable categories within the confectionery sector. Over the years, the cookies market has been significantly influenced by changing consumer lifestyles, increasing urbanization, and the growing popularity of convenience foods. Cookies are no longer viewed as mere indulgent treats but as a staple snack for busy individuals seeking quick energy, comfort, or even nutritional benefits. As a result, manufacturers have diversified their offerings, introducing fortified cookies, gluten-free varieties, and organic options to align with modern dietary trends. Furthermore, packaging innovation has played a critical role in boosting the market, with resealable packs, single-serve portions, and eco-friendly materials enhancing consumer convenience and environmental responsibility.

Key Market Insights:

-

Over 40% of consumers preferred cookies as their primary snack choice. The health-conscious segment grew by 24%, driven by demand for low-sugar options. Vegan cookies captured a 12% market share, up from 8% in 2022. Gluten-free cookies accounted for 9% of total sales, reflecting growing dietary awareness.

-

Premium cookies accounted for 15% of the total market share in 2023. Chocolate chip cookies remained the most popular type, holding a 35% share. Seasonal cookie sales increased by 25% during holiday periods. Artisanal cookie brands grew by 15%, reflecting a trend toward premium products. Cookies with added protein experienced a 19% increase in sales.

-

Organic cookie sales reached $3 billion, up by 10% from the previous year. Specialty cookie stores saw an 11% increase in foot traffic in 2023.

Market Drivers

Changing Consumer Lifestyles and Demand for Convenience Drives Market Growth

Modern lifestyles have significantly influenced the demand for convenience foods, with cookies being a prime beneficiary of this trend. Urbanization and increasingly busy schedules have prompted consumers to seek quick, accessible snacks, making cookies an ideal choice. Their portability, long shelf life, and ability to satisfy both hunger and cravings have elevated them to staple status in households worldwide. Unlike traditional meals, cookies require no preparation, aligning perfectly with the fast-paced lifestyles of today’s consumers. As more individuals, especially working professionals, seek out convenient snacking options, manufacturers have responded by introducing a variety of cookie formats. Single-serve packs, resealable family packs, and even snack bars based on cookie recipes have entered the market, catering to diverse consumption patterns. This packaging innovation not only enhances portability but also minimizes waste, aligning with consumer preferences for eco-conscious products. Moreover, cookies’ versatility in flavors and formats allows them to transcend cultural and geographical boundaries, making them universally appealing. From classic chocolate chip to exotic flavors like matcha and saffron, cookies adapt to regional tastes while maintaining their global appeal. This adaptability ensures their relevance in diverse markets, further driving their growth.

The shift towards health-conscious eating habits has reshaped the cookies market, driving innovation and diversification.

Consumers today are more informed about their dietary choices, seeking snacks that offer nutritional value alongside indulgence. This has led to the rise of cookies fortified with protein, fiber, and essential vitamins. Brands are also introducing low-calorie, sugar-free, and gluten-free options to cater to specific dietary requirements. The growing popularity of plant-based and vegan diets has further fueled innovation in the cookies sector. Traditional recipes are being reimagined with alternative ingredients, such as almond flour, coconut oil, and natural sweeteners like stevia and agave. These healthier formulations not only appeal to vegan consumers but also attract those looking to reduce their intake of animal-based products.

Market Restraints and Challenges:

Despite the impressive growth and innovation in the cookies market, several restraints and challenges hinder its full potential. One significant challenge is the rising consumer awareness about the negative health impacts of excessive sugar and calorie consumption. While cookies remain a beloved indulgence, health-conscious consumers are increasingly scrutinizing their ingredients. Traditional cookie recipes often rely on sugar, butter, and refined flour, which are seen as unhealthy by modern dietary standards. This perception forces manufacturers to reformulate their products, which can lead to higher production costs and potential changes in taste profiles that might alienate long-standing customers. Another pressing issue is the intense competition within the market. The cookies sector is crowded with international giants, regional players, and emerging artisanal brands, all vying for consumer attention. This saturation often leads to aggressive pricing strategies, which can squeeze profit margins, especially for smaller brands. Furthermore, the emergence of private-label cookies offered by large retail chains adds another layer of competition, as these products often mimic premium offerings at lower prices. Supply chain disruptions, exacerbated by the COVID-19 pandemic, have also presented challenges for cookie manufacturers. Fluctuations in the prices of key raw materials such as wheat, sugar, and chocolate have increased production costs. Additionally, the push for sustainable and ethically sourced ingredients adds further strain, as these materials are often more expensive and harder to procure in bulk. Packaging waste and the environmental impact of production are also under scrutiny, with consumers demanding more eco-friendly practices.

Market Opportunities:

The cookies market is ripe with opportunities driven by shifting consumer preferences and advancements in technology. One of the most significant opportunities lies in the health-conscious segment. As consumers increasingly seek healthier snacks, there is a growing demand for cookies enriched with functional ingredients such as oats, quinoa, and chia seeds. Fortified cookies targeting specific health benefits, such as boosting immunity or aiding digestion, represent a lucrative niche. Similarly, the rise of plant-based diets presents opportunities for vegan and dairy-free cookie variants. Customization and personalization are emerging as key trends in the cookies market. Brands are leveraging digital tools to offer consumers the ability to customize their cookies, whether by choosing specific flavors, adding personalized messages, or selecting unique packaging designs. This trend not only enhances the consumer experience but also creates opportunities for premium pricing. Additionally, experiential retail concepts, such as cookie-making workshops and pop-up stores, provide avenues for brands to engage directly with consumers. E-commerce and direct-to-consumer (DTC) models are reshaping the market, offering opportunities for brands to expand their reach beyond traditional retail channels. Online platforms enable manufacturers to cater to niche markets and deliver products directly to consumers' doorsteps, bypassing intermediaries. Subscription-based cookie services, offering curated selections or seasonal specialties, are also gaining traction.

COOKIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.7% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mondelez International, Nestlé SA, Ferrero Group, Campbell Soup Company, General Mills, Inc., The Hershey Company, Britannia Industries, Lotus Bakeries, Bahlsen GmbH & Co. KG, PepsiCo (Quaker Oats) |

Cookies Market Segmentation: by Type

-

Chocolate chip

-

Oatmeal

-

Butter

-

Sandwich

-

Gluten-free, vegan, and protein-enriched varieties

Fastest-Growing Type: Gluten-free cookies are experiencing rapid growth, driven by rising awareness about celiac disease and a general preference for wheat-free diets.

Most Dominant Type: Chocolate chip cookies remain the market leader, holding the largest share due to their universal appeal and versatility across demographics.

Cookies Market Segmentation: by Distribution Channel

-

Supermarkets and hypermarkets

-

Convenience stores

-

Online platforms

-

Specialty stores

Fastest-Growing Channel: Online platforms are witnessing the fastest growth, fueled by increasing internet penetration and the convenience of home delivery.

Most Dominant Channel: Supermarkets and hypermarkets dominate the market, accounting for a significant share due to their wide reach and variety.

Cookies Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America: The region accounts for approximately 30% of the global market share, driven by high consumer spending on snacks and the presence of established brands. It remains the most dominant region due to its strong retail infrastructure and high cookie consumption rates.

Asia-Pacific: Accounting for 28% of the market, this region is the fastest-growing, driven by rising disposable incomes, urbanization, and increasing demand for Western-style snacks.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly impacted the cookies market, presenting both challenges and opportunities. On the one hand, supply chain disruptions, labour shortages, and fluctuating raw material prices created operational difficulties for manufacturers. On the other hand, the pandemic fueled a surge in demand for packaged snacks as consumers stocked up on non-perishable goods during lockdowns. Cookies emerged as a popular comfort food, with sales soaring in the early months of the pandemic. The shift toward e-commerce was one of the most notable impacts of COVID-19 on the cookies market. With physical stores experiencing reduced foot traffic, online platforms became the primary sales channel for many brands. Manufacturers adapted by enhancing their digital presence and offering direct-to-consumer delivery options. Additionally, the pandemic accelerated the trend of health-conscious eating, prompting brands to innovate with immunity-boosting and functional cookie variants.

Latest Trends and Developments:

The cookies market is undergoing a wave of innovation, driven by consumer demands for health, sustainability, and personalization. Plant-based and vegan cookies are gaining prominence, catering to the growing population of environmentally conscious and health-focused consumers. Similarly, gluten-free and keto-friendly options are expanding, reflecting the broader trend toward specialized diets. Sustainability is a key focus for manufacturers, with brands investing in eco-friendly packaging and sustainable sourcing of ingredients. The rise of artisanal and small-batch cookies reflects a shift toward premium, handcrafted products that emphasize quality and uniqueness. Additionally, technological advancements in production, such as automated baking systems, are enabling manufacturers to scale efficiently while maintaining consistency.

Key Players:

-

Mondelez International

-

Nestlé SA

-

Ferrero Group

-

Campbell Soup Company

-

General Mills, Inc.

-

The Hershey Company

-

Britannia Industries

-

Lotus Bakeries

-

Bahlsen GmbH & Co. KG

-

PepsiCo (Quaker Oats)

Chapter 1. Cookies Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cookies Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cookies Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cookies Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cookies Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cookies Market – By Type

6.1 Introduction/Key Findings

6.2 Chocolate chip

6.3 Oatmeal

6.4 Butter

6.5 Sandwich

6.6 Gluten-free, vegan, and protein-enriched varieties

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Cookies Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets and hypermarkets

7.3 Convenience stores

7.4 Online platforms

7.5 Specialty stores

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Cookies Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cookies Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Mondelez International

9.2 Nestlé SA

9.3 Ferrero Group

9.4 Campbell Soup Company

9.5 General Mills, Inc.

9.6 The Hershey Company

9.7 Britannia Industries

9.8 Lotus Bakeries

9.9 Bahlsen GmbH & Co. KG

9.10 PepsiCo (Quaker Oats)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The cookies market growth is driven by rising consumer demand for convenient snacks, innovative flavors, and premium offerings. Health-conscious trends fuel demand for gluten-free, vegan, and low-sugar options. E-commerce expansion increased disposable incomes, and global urbanization also boosted market growth, alongside advancements in sustainable production and eco-friendly packaging solutions.

The main concerns about the cookies market include rising consumer awareness of health issues linked to high sugar and calorie content, intense market competition reducing profit margins, fluctuating raw material prices, and supply chain disruptions. Additionally, meeting demands for sustainable practices and eco-friendly packaging poses challenges for manufacturers.

Mondelez International, Nestlé SA, Ferrero Group, Campbell Soup Company, General Mills, Inc., The Hershey Company.

North America currently holds the largest market share, estimated around 30%.

Asia Pacific has shown significant room for growth in specific segments.