North America Cheese Market Size (2024-2030)

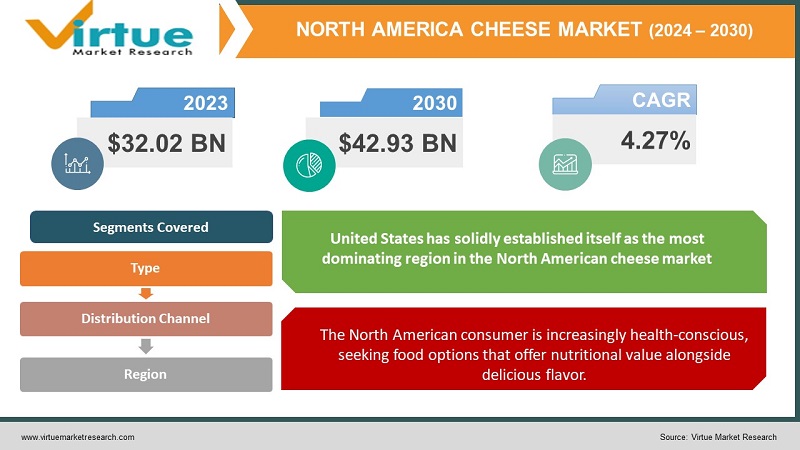

The North America Cheese Market was valued at USD 32.02 Billion in 2023 and is projected to reach a market size of USD 42.93 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.27%.

Cheese, a delightful dairy product enjoyed in countless ways, is a staple on North American tables. The North American cheese market itself is a vibrant tapestry, woven with diverse tastes, consumer preferences, and a thriving industry. The fast-paced lives of urban dwellers lead to a demand for convenient food options. Pre-shredded cheese, single-serve cheese portions, and cheese-incorporated snack foods cater to this need. The growing popularity of ethnic cuisines from around the world, particularly those featuring cheese prominently is driving cheese consumption. Calcium, protein, and other important minerals can be found in cheese. Customers looking to make healthier food choices are gravitating towards cheese types said to provide certain health advantages, such as those high in probiotics or low in fat.

Key Market Insights:

The need for easy-to-consume and portable cheese options is expected to drive the $4.9 billion cheese snack and convenience product market in 2024.

By 2024, the market for cheese products catered to certain dietary requirements (lactose-free, low-fat, low-sodium) is projected to be valued $3.6 billion in North America.

Probiotic and omega-3 fortified cheese products are anticipated to see rapid growth, with a compound annual growth rate (CAGR) of 6.8% and a market value of $1.2 billion by the end of 2024.

It is estimated that in 2024, the market for cheese products with cutting-edge packaging (resealable, portion-controlled, and environmentally friendly) will be worth $2.8 billion.

The North American market for cheese products intended for particular culinary uses (baking, grilling, melting) is projected to be valued $2.4 billion.

Given the increasing concern about the effects on the environment, the market for cheese products with improved sustainability and eco-friendly methods is expected to reach $1.8 billion in 2024.

It is projected that in 2024, the market for cheese products manufactured using sophisticated techniques (such as ageing, curing, and smoking) will be worth $4.6 billion.

At a growth rate of 7.2%, the market for cheese products with increased nutritional analysis and personalisation is projected to reach $1.1 billion by the end of 2024.

North America Cheese Market Drivers:

In today's fast-paced world, convenience reigns supreme. North American consumers, juggling busy careers and active lifestyles, increasingly seek convenient food options that simplify meal preparation and cater to on-the-go consumption.

Pre-shredded and pre-sliced cheese varieties offer unparalleled convenience, saving valuable time in the kitchen. This makes them ideal for busy families whipping up quick weeknight dinners or individuals seeking a hassle-free way to incorporate cheese into their meals. The ease of use translates to a wider consumer base, including those who might shy away from the perceived complexity of grating or slicing cheese themselves. The rise of single-serve packaging caters to the growing trend of single-person households and portion control. Cheese cubes, cheese sticks, and individually wrapped cheese slices offer convenient snacking options or a quick way to add a cheesy punch to salads or lunchboxes. This caters to the desire for personalized portions and avoids the need for consumers to commit to a larger block of cheese that might go to waste.

The North American consumer is increasingly health-conscious, seeking food options that offer nutritional value alongside delicious flavor.

An essential food for gaining and preserving muscular mass, cheese is a natural source of protein. This appeals to customers who are concerned about their health, especially those who are athletes looking for fuel after an exercise or who follow high-protein diets. To draw in this market, producers are emphasizing the protein content of their cheese selections. Some types of cheese are a rich source of probiotics, especially aged cheeses and those with live and active microorganisms. Beneficial microorganisms called probiotics improve digestion and intestinal health. As a result, there is an increasing demand for probiotic-rich cheeses, especially from customers looking to strengthen their immune systems or improve their digestive health.

North America Cheese Market Restraints and Challenges:

Cheese can be a significant source of sodium, a potential concern for individuals with high blood pressure or those seeking to limit their sodium intake. While some manufacturers are exploring ways to reduce sodium content without compromising on taste, this remains an ongoing challenge. Milk allergies and lactose intolerance can limit cheese consumption for certain individuals. While lactose-free cheese options are emerging, ensuring widespread availability and affordability for those with these dietary restrictions remains an issue. Consumers worried about the health implications of cheese might limit their overall consumption, opting for cheese only on special occasions or in smaller portions. Consumers are increasingly demanding transparency regarding cheese production processes and the use of ingredients. This includes concerns about the use of artificial additives, preservatives, or hormones in cheese production.

North America Cheese Market Opportunities:

Expanding the cheese selection beyond traditional cheddar and mozzarella to include international favorites like creamy brie from France, crumbly feta from Greece, or nutty Manchego from Spain. This caters to adventurous palates and allows consumers to explore the diverse world of cheese. Cheesemakers can experiment with incorporating regionally sourced ingredients and spices into cheese varieties. This creates unique flavor profiles that appeal to consumers seeking a distinctive cheese experience. Imagine a maple syrup-infused cheddar from Vermont or a chipotle pepper jack cheese inspired by Mexican cuisine. Collaborations with international cheesemakers can leverage expertise and introduce new production methods or cheese varieties to the North American market. This fosters cultural exchange and offers consumers a taste of authentic cheesemaking tradition. Artisanal cheesemakers often use traditional methods and high-quality ingredients, resulting in unique and complex flavours. This caters to cheese enthusiasts seeking a more differentiated cheese experience compared to mass-produced varieties. Combining cheese with other popular snack ingredients like nuts, fruits, or whole grains can create a more complete and satisfying snacking experience. This caters to consumers seeking a balanced and flavorful snack.

NORTH AMERICA CHEESE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.27% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, Canada, Rest of North America |

|

Key Companies Profiled |

The Kraft Heinz Company, Saputo Inc., Mondelez International, Bel Group, Schreiber Foods Inc., Agropur Cooperative, Cowgirl Creamery, Jasper Hill Farm |

North America Cheese Market Segmentation:

North America Cheese Market Segmentation: By Type

- Natural Cheese

- Processed Cheese

Natural Cheese segment reigns supreme, capturing roughly 75% of the North American cheese market. Natural cheese undergoes a natural fermentation and aging process, resulting in a wider spectrum of flavours and textures compared to processed cheese. Cheddar, mozzarella, parmesan, and brie are all examples of popular natural cheese varieties. The textures of natural cheese range from the crumbly texture of feta to the smooth creaminess of camembert. This variety offers options for different culinary applications and taste preferences. Natural cheese is generally perceived as a more natural and potentially healthier option compared to processed cheese due to the absence of added ingredients.

Processed cheese is experiencing steady growth. Processed cheese offers unbeatable convenience, particularly in pre-shredded or sliced formats. This caters to busy lifestyles and simplifies meal preparation. Manufacturers are constantly innovating to improve the taste and quality of processed cheese, making it a more attractive option for consumers who might have previously perceived it as inferior. Processed cheese lends itself well to single-serve packaging formats, catering to the growing snacking culture and portion-control trends.

North America Cheese Market Segmentation: By Distribution Channel

- Specialty Cheese Stores

- Supermarkets and Hypermarkets

- Online Retailers

- Convenience Stores

Supermarkets and Hypermarkets (60%) segment reigns supreme, offering a one-stop shop for groceries, including a vast selection of cheese varieties. Supermarkets and hypermarkets cater to a broad range of consumers with diverse budgets and preferences. Consumers appreciate the one-stop shopping experience, simplifying grocery purchases and allowing them to find cheese alongside other ingredients for their meals. Supermarkets offer a wide variety of cheese options, from budget-friendly staples to premium specialty cheeses. This caters to diverse consumer preferences and budgets. Specialty cheese stores and online retailers pose a threat by offering a more curated selection and potentially higher-quality cheese varieties.

Online cheese retailers are experiencing explosive growth. Online platforms can provide detailed product descriptions, cheese pairing suggestions, and educational resources, empowering consumers and fostering a deeper appreciation for cheese. The rise of cheese subscription boxes offers a curated selection delivered at regular intervals, catering to adventurous palates and those seeking a cheese exploration experience. Because they are not as limited by physical area as brick-and-mortar businesses are, online sellers are able to provide a greater selection of cheese selections. Cheese lovers looking for particular types or foreign options can be satisfied by this.

North America Cheese Market Segmentation: Regional Analysis:

- United States

- Canada

- Mexico

With an astounding 70% market share, the United States has solidly established itself as the most dominating region in the North American cheese market. Numerous elements contribute to its supremacy, including as the nation's sizable population, varied culinary customs, and a firmly developed cheese-making sector. Cheese production in the United States has a long history that dates back to the early era of European colonisation. Because of the impacts of diverse cultural backgrounds and local ingredients, several regions of the country have created their own distinctive cheese styles and types over the course of centuries. The variety of American cheese, which ranges from the tart blue cheeses of California to the creamy cheddars of Wisconsin, is evidence of the melting pot of cultures and customs that makes up our country.

Mexico has become the fastest-growing region due to increased disposable incomes, shifting dietary choices, and the expanding impact of international food trends. Fresh and semi-soft cheeses, such queso fresco and Oaxaca cheese, which are essential to traditional Mexican cuisine, have historically dominated the Mexican cheese industry. But there has been a discernible change in consumer tastes in recent years, with a rise in the desire for a greater range of cheese varieties and flavours. The impact of other cuisines and increased exposure to global culinary trends are two major factors contributing to this rise. There has been an increase in demand for speciality cheeses like blue, gouda and brie as Mexican customers get more daring with their culinary choices.

COVID-19 Impact Analysis on the North America Cheese Market:

Lockdowns and social distancing measures caused labour shortages at cheese production facilities and farms, impacting milk production and cheese processing. This led to temporary slowdowns and potential price fluctuations. Restrictions on cross-border movement hampered the flow of raw materials like milk and rennet, impacting cheesemakers who relied on imports. This highlighted the importance of regional self-sufficiency in the cheese supply chain. Lockdowns and disruptions in transportation networks caused delays in cheese shipments, impacting both domestic distribution and exports. This led to logistical challenges and potentially increased spoilage rates. The pandemic accelerated the shift towards online grocery shopping. This benefited online cheese retailers who offered a wider selection and convenient home delivery, potentially taking market share away from brick-and-mortar stores.

Latest Trends/ Developments:

Plant-based cheese is a tasty solution for people who are lactose intolerant to enjoy the flavour and texture of cheese without experiencing any gastrointestinal distress. Plant-based cheese substitutes in the past faced a lot of backlash for being unauthentic. But more realistic cheese substitutes that melt, stretch, and taste nearly like their dairy counterparts are emerging thanks to advances in plant-based technology. Expanding cheese selections beyond traditional cheddar and mozzarella to include specialty cheeses from around the world, such as creamy brie from France, tangy feta from Greece, or nutty manchego from Spain. Cheesemakers are experimenting with incorporating regionally sourced ingredients and spices into cheese varieties. This creates unique flavor profiles that appeal to consumers seeking a distinctive cheese experience. Collaborations with international cheesemakers can leverage expertise and introduce new production methods or cheese varieties to the North American market. This fosters cultural exchange and offers consumers a taste of authentic cheesemaking traditions. Developing innovative cheese snack formats that are convenient, portable, and cater to individual portion sizes. This could include bite-sized cheese cubes with flavor-infused coatings, cheese crisps made with different cheese varieties, or cheese-filled snack bars.

Key Players:

- The Kraft Heinz Company

- Saputo Inc.

- Mondelez International

- Bel Group

- Schreiber Foods Inc.

- Agropur Cooperative

- Cowgirl Creamery

- Jasper Hill Farm

Chapter 1. North America Cheese Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Cheese Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Cheese Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Cheese Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Cheese Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Cheese Market– By Type

6.1. Introduction/Key Findings

6.2. Natural Cheese

6.3. Processed Cheese

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. North America Cheese Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets/Hypermarkets

7.3. Specialty Cheese Stores

7.4. Online Retail

7.5. Convenience Stores

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. North America Cheese Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Cheese Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. The Kraft Heinz Company

9.2. Saputo Inc.

9.3. Mondelez International

9.4. Bel Group

9.5. Schreiber Foods Inc.

9.6. Agropur Cooperative

9.7. Cowgirl Creamery

9.8. Jasper Hill Farm

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Cheese offers a rich source of protein, appealing to health-conscious consumers seeking to increase their protein intake. This is particularly relevant for fitness enthusiasts and those following high-protein diets

Cheese is known for its rich flavour, which often comes with a high content of saturated fat and cholesterol. This can be a concern for consumers with heart health considerations or those following low-fat diets

The Kraft Heinz Company, Saputo Inc., Mondelez International, Bel Group,

Schreiber Foods Inc., Agropur Cooperative, Cowgirl Creamery, Jasper Hill Farm.

The United States has firmly established itself as the most dominant region in the North American cheese market, commanding an impressive 70% market share.

Mexico has emerged as the fastest-growing region, driven by changing dietary

preferences, rising disposable incomes