Cheese Market Size (2023 – 2030)

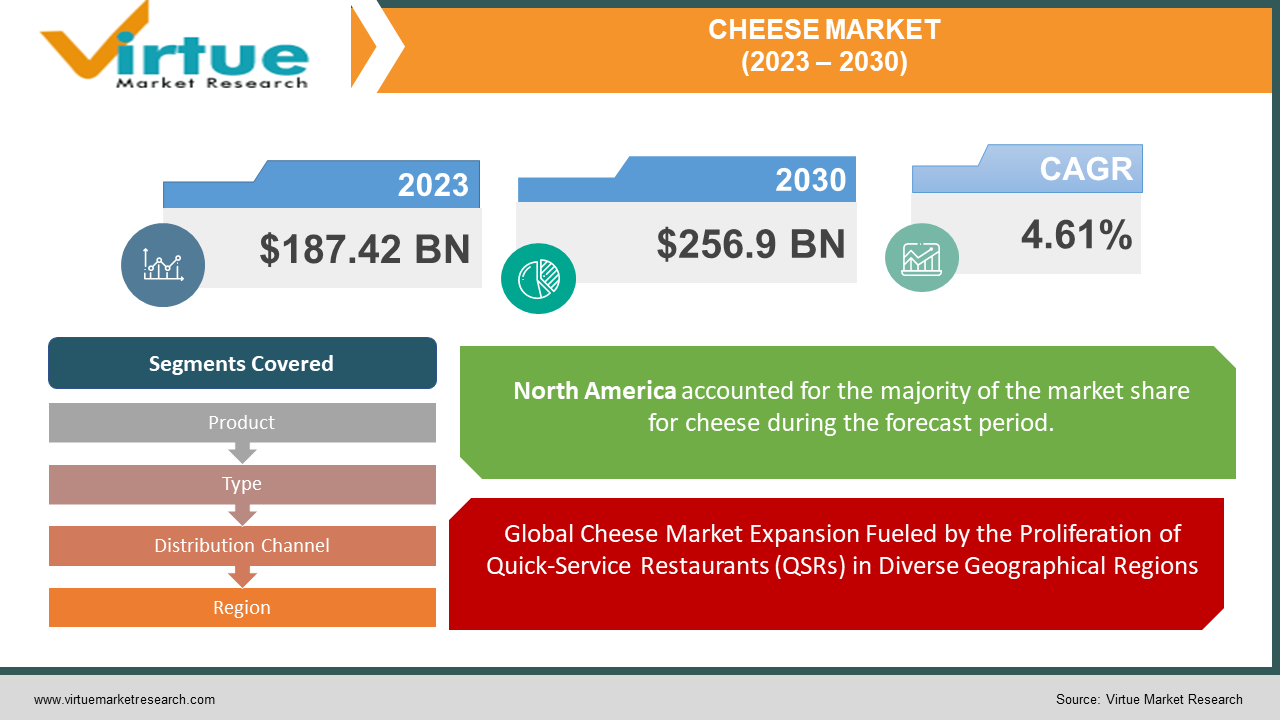

The Cheese Market was valued at USD 187.42 billion in 2023 and is projected to reach a market size of USD 256.9 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.61%.

The cheese market has undergone significant evolution in the past, marked by consistent growth driven by changing consumer preferences and an expanding global demand for diverse cheese varieties. Traditional cheeses held sway, but the market saw a shift toward artisanal and specialty options. In the present, the industry thrives on sustainability, health-conscious choices, and the rising popularity of plant-based alternatives, adapting to shifting dietary trends. Looking forward, the future of the cheese market appears promising, with anticipated growth fueled by technological advancements, expanding markets, increased awareness of nutritional benefits, and a continued emphasis on quality and authenticity, making it a dynamic and evolving landscape.

Key Market Insights:

Global cheese consumption has notably risen in recent years, particularly since 2015, with the European Union contributing to almost half of the world's cheese production.

European protected designation of origin (PDO) regulations play a role in promoting traditional cheese varieties, stimulating growth in artisanal segments. Additionally, the influence of tariffs and trade policies on international cheese trade can impact market dynamics.

As of 2020, North America and Europe jointly held a substantial 77% share of the cheese market. Currently, the growth of the global cheese market is attributed to the increasing number of quick-service restaurants (QSRs) in developing regions and the presence of well-established QSR outlets in developed regions.

Cheese Market Drivers:

Global Cheese Market Expansion Fueled by the Proliferation of Quick-Service Restaurants (QSRs) in Diverse Geographical Regions:

The remarkable growth in the global cheese market is propelled by the widespread emergence and increasing prevalence of Quick-Service Restaurants (QSRs), both in developing and developed regions, consequently driving a significant surge in cheese consumption. Quick-Service Restaurants (QSRs) are popping up everywhere. Their growth has a big part in making the cheese market expand across the globe. This surge is witnessed not only in developed regions but also in diverse geographical areas that include developing nations. The prevalence of QSRs has, in turn, led to a substantial uptick in cheese consumption, highlighting the integral connection between the quick-service dining sector and the expansion of the global cheese market.

Health-Conscious Consumer Shift: Fueling Demand for Specialized and Nutrient-Rich Cheese Varieties:

The evolving landscape of consumer preferences towards healthier dietary choices is a key driver in the global cheese market. Specialized and nutrient-rich cheese kinds, such as organic or low-fat variants, are becoming more and more popular, indicating a rising awareness of and prioritization of health-conscious living. This shift in consumer preferences towards healthier dietary choices stands out as a critical driver in the global cheese market. The demand for specialized and nutrient-rich cheese varieties, including options like low-fat or organic cheeses, is experiencing a notable uptick. This trend underscores a broader awareness and prioritization of health-conscious lifestyles among consumers. As individuals increasingly seek out cheese options that align with their dietary preferences and wellness goals, the market continues to respond with an evolving range of choices to cater to this health-centric shift in consumer demand.

Nurturing Artisanal Cheese Growth Through the Implementation of European Countries' Protected Designation of Origin (PDO) Regulations:

A critical driver for growth in the global cheese market lies in the implementation of Protected Designation of Origin (PDO) regulations by European countries, which not only safeguards traditional cheese varieties but also serves as a catalyst for the flourishing artisanal cheese market segment. The implementation of Protected Designation of Origin (PDO) regulations by European countries emerges as a critical driver fostering growth in the global cheese market. Beyond safeguarding traditional cheese varieties, these regulations act as a catalyst, particularly fueling the flourishing artisanal cheese market segment. PDO regulations support both the preservation of culinary legacy and rising consumer interest in artisanal, locally made cheeses by maintaining the authenticity and distinctive qualities of region-specific cheeses. This regulatory framework plays a pivotal role in shaping the cheese market landscape, promoting diversity, and elevating the status of artisanal cheese offerings worldwide.

Navigating Market Dynamics: The Impact of Tariffs and Trade Policies on Global Cheese Industry Evolution:

The ebb and flow of market dynamics within the global cheese industry are intricately woven with the impact of tariffs and trade policies, shaping the course of international cheese trade and contributing to significant shifts in market trends and discerning consumer preferences. The intricate dance of market dynamics within the global cheese industry is significantly influenced by the ebb and flow of tariffs and trade policies. These external factors intricately shape the course of the international cheese trade, leading to substantial shifts in market trends and influencing discerning consumer preferences. The impact of tariffs and trade policies extends beyond economic considerations, permeating the very fabric of the cheese market evolution. This dynamic interplay underscores the importance of geopolitical decisions in steering the trajectory of the global cheese industry, creating a landscape where adaptability and strategic foresight become paramount for industry participants.

Cheese Market Restraints and Challenges:

Navigating Regulatory Hurdles and Sustainability Imperatives: The Challenge of Adhering to Stringent Environmental Standards and Regulatory Frameworks in the Global Cheese Market:

As the global cheese market continues to expand, a formidable challenge emerges in the form of navigating stringent environmental standards and regulatory frameworks. The cheese industry faces increasing pressure to align with sustainability imperatives, encompassing considerations such as reduced carbon footprints, responsible waste management, and ethical sourcing practices. Striking a delicate balance between meeting these regulatory demands and maintaining operational efficiency poses a significant hurdle. Additionally, the diverse and evolving nature of global regulations adds a layer of complexity, necessitating a proactive approach and strategic investments to ensure long-term market viability while embracing environmentally conscious practices. As the global cheese market undergoes expansion, a formidable challenge arises in navigating the intricate landscape of stringent environmental standards and regulatory frameworks. The cheese industry encounters escalating pressure to align with sustainability imperatives, encompassing critical considerations such as minimizing carbon footprints, implementing responsible waste management, and adopting ethical sourcing practices. Striking a delicate balance between meeting these rigorous regulatory demands and maintaining operational efficiency becomes a significant hurdle for industry players. Moreover, the diverse and ever-evolving nature of global regulations adds a layer of complexity, necessitating a proactive approach and strategic investments to ensure long-term market viability while embracing environmentally conscious practices. This challenge underscores the industry's commitment to responsible and sustainable growth in the face of regulatory complexity.

Cheese Market Opportunities:

The cheese market presents lucrative opportunities driven by a growing consumer appetite for diverse and premium cheese offerings. Opportunities for market development are created by the growing popularity of plant-based substitutes and the growing demand for artisanal and specialty cheeses. The globalization of culinary preferences and the advent of online platforms further open doors for global market penetration. Leveraging these trends and exploring innovative production methods can position businesses to capitalize on the flourishing opportunities within the dynamic cheese market.

CHEESE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.61% |

|

Segments Covered |

By Product, Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arla Foods amba, Fonterra Co-operative Group Limited, Almarai Company,Land O'Lakes Inc., GCMMF (Amul), Bel Group, Kraft Heinz, Lactalis Group, SAVENCIA SA, Britannia Industries Limited |

Cheese Market Segmentation: By Product

-

Mozzarella Cheese

-

Cheddar Cheese

-

Parmesan Cheese

-

Other Cheese

The largest in this segment is Mozzarella Cheese and the fastest growing during the forecast period is Mozzarella Cheese. This trend aligns with the dynamic culinary landscape where Mozzarella finds versatile applications, from traditional Italian dishes to modern fusion cuisines. As consumer tastes evolve and global food trends influence preferences, Mozzarella Cheese continues to lead the market, reflecting its widespread culinary appeal and adaptability.

Cheese Market Segmentation: By Type

-

Natural Cheese

-

Processed Cheese

The largest in this segment is Processed Cheese and the fastest growing during the forecast period is Natural Cheese. This change highlights an increasing consumer preference for products that contain fewer additives and maintain a stronger link to natural, wholesome ingredients. The contrast between the well-established dominance of Processed Cheese and the rising demand for Natural Cheese exemplifies the changing dynamics in consumer preferences within the cheese market.

Cheese Market Segmentation: By Distribution Channel

-

Hypermarket/Supermarket

-

Specialty Stores

-

Business to business

-

Others

The largest in this segment is Business to business and the fastest growing during the forecast period is other distribution channels. In addition to the dominant business-to-business (B2B) segment, other distribution channels play distinct roles in the market. Hypermarkets and supermarkets serve as key retail hubs, providing a wide array of cheese options for consumers seeking convenience and variety. Specialty stores cater to niche markets, offering curated selections and artisanal cheeses for those with specific taste preferences. The "Others" category encompasses diverse distribution channels, such as online platforms and local markets, contributing to the market's flexibility and adaptability to evolving consumer shopping patterns.

Cheese Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest in this segment is North America and the fastest growing during the forecast period is Asia-Pacific. Additionally, the North American cheese market is booming due to the rising government support and the emergence of various foods and cuisines that use cheese, such as pizzas, burgers, pasta, and others. Latin America is home to prominent market players who produce and offer a variety of cheese in the region. The proliferation of food chains across the region and the extensive utilization of various varieties, such as mozzarella, parmesan, feta, Roquefort, and cheddar, for the preparation of pizzas, sandwiches, and wraps are among the primary factors driving the European cheese market.

COVID-19 Impact Analysis on the Cheese Market:

Amid the pandemic, France, renowned for its high-quality cheese production by dairy farmers, grappled with a nearly 60% drop in cheese sales in 2021. This decline resulted from reduced international trade and decreased consumer spending on premium products. Specialty cheesemakers, especially those producing high-end varieties, faced challenges in sustaining their market presence. The closure of HoReCa sectors further contributed to a decline in specialty cheese production and sales, as consumers were less inclined to pay premium prices for these products during the pandemic, collectively impacting the overall cheese industry in France.

Latest Trends/ Developments:

The rising preference for fresh, homemade, and specialty cheese varieties, deemed safer due to natural processing methods, is gaining traction among consumers. Increased willingness to explore new flavors, a growing trend of dining out, and a rise in the consumption of foods featuring processed cheese drive demand. According to a 2020 survey by the American Cheese Society, 980 artisan cheesemakers in the U.S. crafted popular handmade, naturally flavored, or farm-fresh products. Consumers, motivated by factors ranging from nutrition to taste and convenience, are developing new interests and expectations for diverse options in the market.

Key Players:

-

Arla Foods amba

-

Fonterra Co-operative Group Limited

-

Almarai Company

-

Land O'Lakes, Inc.

-

GCMMF (Amul)

-

Bel Group

-

Kraft Heinz

-

Lactalis Group

-

SAVENCIA SA

-

Britannia Industries Limited

- June 2022: Land O Lakes Cheese, based in Wisconsin, United States, has unveiled Land O Lakes® Shredded Cheese, a new line featuring seven cheese products available in the dairy section of grocery stores. The cheese supply chain originates with Wisconsin farmers providing milk, which is then transported to the Land O'Lakes plant in Kiel, Wisconsin, where the cheese is produced.

- May 2021: Arla Foods, a Danish dairy cooperative, invested DKK 50 million (approximately USD 8.2 million) in the construction of a new cheese production facility in Japan. In addition to this international venture, Arla revealed plans for two additional ripening warehouses, the installation of new cheese machinery, and the creation of a new drainage room at its home market, Troldhede Dairy in West Jutland.

Chapter 1. Cheese Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cheese Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cheese Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cheese Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cheese Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cheese Market – By Product

6.1 Introduction/Key Findings

6.2 Mozzarella Cheese

6.3 Cheddar Cheese

6.4 Parmesan Cheese

6.5 Other Cheese

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Cheese Market – By Type

7.1 Introduction/Key Findings

7.2 Natural Cheese

7.3 Processed Cheese

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Cheese Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Hypermarket/Supermarket

8.3 Specialty Stores

8.4 Business to business

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Cheese Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Type

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Type

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Type

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Type

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Type

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cheese Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Arla Foods amba

10.2 Fonterra Co-operative Group Limited

10.3 Almarai Company

10.4 Land O'Lakes, Inc.

10.5 GCMMF (Amul)

10.6 Bel Group

10.7 Kraft Heinz

10.8 Lactalis Group

10.9 SAVENCIA SA

10.10 Britannia Industries Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Cheese Market was valued at USD 187.42 billion in 2023 and is anticipated to reach USD 256.9 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.61%.

Key drivers include the proliferation of Quick-Service Restaurants (QSRs) globally, a shift in consumer preferences toward health-conscious choices and specialized cheese varieties, and the implementation of European countries' Protected Designation of Origin (PDO) regulations fostering artisanal cheese growth.

The Cheese Market is segmented by product into Mozzarella Cheese, Cheddar Cheese, Parmesan Cheese, and Other Cheese. Regarding type, it is categorized into Natural Cheese and Processed Cheese.

Major distribution channels include Hypermarkets/supermarkets, Specialty Stores, Business to Business, and Others. Business-to-business stands as the largest segment, while other distribution channels exhibit the fastest growth during the forecast period.

As of 2020, North America and Europe collectively held a substantial 77% share of the Cheese Market. Currently, North America is the largest segment, while Asia-Pacific is the fastest-growing region during the forecast period.