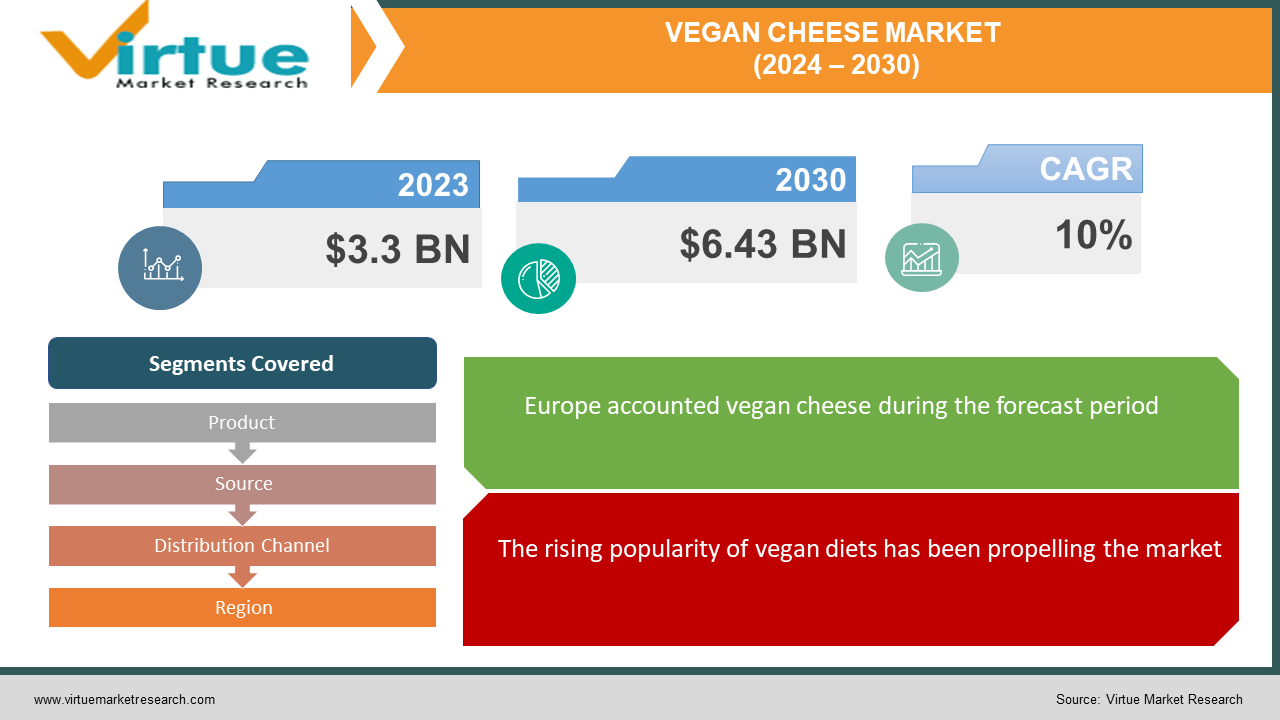

Vegan Cheese Market Size (2024 – 2030)

The global vegan cheese market was valued at USD 3.3 billion in 2023 and will grow at a CAGR of 10% from 2024 to 2030. The market is expected to reach USD 6.43 billion by 2030.

Vegan cheese is made from plants and doesn't include any animal ingredients. It is composed of rice, potatoes, tapioca, almonds, seeds, coconut oil, nutritional yeast, and vegetable proteins. From soft, fresh cheeses to hard, grateable cheeses that have aged and matured, vegan cheeses are available.

Key Market Insights:

According to a report in Mintel in 2022, sales of vegan cheese increased by 17%, outpacing the growth rate of traditional dairy cheese, reflecting shifting consumer preferences towards plant-based alternatives

Global Vegan Cheese Market Drivers:

The rising popularity of vegan diets has been propelling the market:

The tide is turning towards vegan diets, driven by a confluence of health, environmental, and ethical concerns. Consumers are increasingly health-conscious, seeking plant-based alternatives rich in protein and essential nutrients like calcium, which vegan cheese can provide. This dietary shift is fueled by a growing awareness of the potential health benefits associated with plant-based eating. Furthermore, the environmental footprint of animal agriculture is a major motivator. Vegan cheese production generally requires less land, water, and resources compared to traditional dairy cheese, appealing to environmentally responsible consumers. Additionally, animal welfare concerns are pushing people to embrace vegan alternatives. With the ethics of factory farming gaining traction, consumers are opting for cruelty-free cheese options. This surge in demand for plant-based cheese is creating a lucrative market with expanding product varieties, improved taste, and texture, all catering to a growing population seeking healthy, sustainable, and ethical food choices.

Growing awareness of health benefits is accelerating the growth rate.

While traditionally, cheese has been a dairy-derived source of protein and calcium, vegan cheese is emerging as a strong contender in the realm of plant-based nutrition. Formulated from various ingredients like nuts, seeds, legumes, and even vegetables, vegan cheese can be a surprisingly good source of protein, essential for building and maintaining muscle mass. Additionally, some varieties are fortified with calcium, a crucial mineral for strong bones and teeth, addressing a potential concern for vegans who might struggle to meet their daily calcium intake. But the benefits go beyond these two key nutrients. Manufacturers are constantly innovating, incorporating vitamins and minerals like vitamin B12, essential for energy production and nervous system function, as well as zinc and iron, which play vital roles in immunity and oxygen transport. This fortification elevates vegan cheese from a delicious dairy alternative to a potentially powerful nutritional ally, offering a convenient way for health-conscious consumers to incorporate essential nutrients into their diet.

Increasing lactose intolerance is elevating the demand.

Lactose intolerance, a digestive hurdle affecting a large portion of the world's population, throws a wrench into enjoying cheese. This condition arises when the body struggles to break down lactose, a sugar naturally found in milk. The resulting symptoms, like bloating, gas, and cramps, can dampen any cheese lover's enthusiasm. Vegan cheese swoops in as a delicious and safe alternative. Made entirely from plant-based ingredients like nuts, seeds, or even starches, vegan cheese offers the creamy, savory taste and satisfying textures of dairy cheese, minus the lactose. This opens up a world of culinary possibilities for those with lactose intolerance. They can indulge in pizzas topped with melty vegan cheese, savor creamy pasta dishes, or even enjoy a decadent vegan cheese board without the digestive woes. For lactose-intolerant individuals, vegan cheese isn't just a dietary substitute; it's a key that unlocks a world of flavor and culinary enjoyment they might have thought was out of reach.

Global Vegan Cheese Market Challenges and Restraints:

Price volatility is a major hurdle.

While the demand for vegan cheese surges, a significant hurdle remains: affordability. Unlike dairy cheese, which has an established and often subsidized supply chain, vegan cheese production relies on innovative but sometimes pricier ingredients. Nuts, seeds, legumes, and even specific vegetables form the base for many vegan cheeses, and these can be more expensive than readily available cow's milk. Additionally, the manufacturing processes for vegan cheese are often more complex compared to traditional cheesemaking. These factors translate to a higher price tag for the final product, potentially limiting accessibility for some consumers who might be priced out or looking for budget-friendly options. This can be a major roadblock to the wider adoption of vegan cheese, especially in regions or demographics where cost is a key consideration when making grocery choices.

Taste and texture are other hindrances.

Despite major strides in replicating the beloved taste and texture of dairy cheese, vegan cheese can still face a critical challenge: meeting the expectations of cheese purists. Achieving that gooey melt, the sharp tang of cheddar, or the creamy richness of brie has proven difficult for some vegan cheese alternatives. While manufacturers have developed clever workarounds using plant-based fats and starches, they may not perfectly capture the nuanced flavors and textures that define specific cheese styles. This can be a significant hurdle for long-time cheese lovers who are accustomed to the sensory experience of dairy cheese. For consumers, the gap between the familiar and the novel can be a barrier to fully embracing vegan cheese. However, continued innovation and a focus on replicating the sensory experience of dairy cheese hold the promise of attracting a wider audience to the world of plant-based cheese.

Allergen concerns can create losses.

Unfortunately, a large number of consumers may find it difficult to overcome the very elements that give vegan cheese its delicious creaminess and rich basis. Many popular vegan cheese varieties rely on common allergens like nuts, soy, or even coconut to achieve their desired texture and mouthfeel. This creates a frustrating exclusion zone for people with nut or soy allergies, who may be unable to safely enjoy these plant-based alternatives. This limitation can be particularly disheartening for individuals who are already embracing a restricted diet. The good news is that the vegan cheese industry is recognizing this challenge. Manufacturers are actively exploring alternative bases derived from ingredients like sunflower seeds, peas, or even tapioca, which can provide a safe and delicious option for those with nut and soy allergies. This opens the door for a more inclusive vegan cheese experience, allowing everyone to explore the world of plant-based cheesy goodness.

Global Vegan Cheese Market Opportunities:

The booming vegan cheese market offers a bounty of opportunities for innovative companies. From exploring alternative allergen-free bases like sunflower seeds or peas to perfecting melty textures for classic dishes, there's room to expand flavor profiles and functionality. Specialty vegan cheeses catering to brie, feta, or parmesan lovers can broaden the cheese experience, while a focus on sustainable practices using upcycled ingredients attracts eco-conscious consumers. Reaching new markets globally requires cultural sensitivity in flavors and dietary restrictions, and collaboration between established food giants and vegan startups can accelerate product development and distribution, ultimately bringing delicious and ethical vegan cheese options to a worldwide audience.

VEGAN CHEESE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Product, Source, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Violife Foods, Daiya Foods Inc., Follow Your Heart, Miyoko's Creamery, Kite Hill , FYH (Follow Your Heart),So Delicious Dairy-Free, Bute Island Foods Ltd, Nuttle Cheese, Treeline Cheese |

Vegan Cheese Market Segmentation: By Product

-

Mozzarella

-

Cheddar

-

Parmesan

-

Ricotta

-

Cream Cheese

-

Others

Vegan mozzarella is the largest growing product. Almond, soy, or cashew milk, together with a coagulant such as agar or carrageenan, are the usual ingredients of vegan mozzarella. To enhance the flavor and texture, certain brands could additionally include proteins or starches. High-quality lipids, including omega-3 and omega-6 fatty acids, which can help prevent cardiovascular disease, are abundant in vegan mozzarella cheese. It is also devoid of lactose, casein, and cholesterol and has natural, high-quality lipids and proteins. Additionally, vegan mozzarella cheese may lower blood sugar and cholesterol and offer gut-flora-supporting microbes. Ricotta is the fastest-growing category. Made from a range of plant-based components, vegan ricotta resembles the creamy texture and slightly sour flavor of conventional ricotta cheese. These ingredients include nuts (like cashews or almonds), tofu, and even vegetables like cauliflower. This is adaptable and works well in a range of recipes. It may be added to salads and pasta dishes for a creamy touch, used as a filling for vegan lasagna or filled shells, or as a topping for pizzas or bruschetta. In vegan ricotta recipes, nuts, seeds, and certain oils are utilized to supply monounsaturated and polyunsaturated fats, which are good. These fats are good for food absorption, heart health, and brain function.

Vegan Cheese Market Segmentation: By Source

-

Soy

-

Almond

-

Cashew

-

Coconut

-

Others

Cashew is the largest growing source. Vegan cheese made from cashews is low in fat and rich in vitamins B2 and B12. This makes it popular with customers worldwide who are concerned about their health. In addition, cashew goods devoid of cholesterol and gluten are becoming increasingly popular because of their health advantages. The soy category is expected to grow at the fastest rate. Soy milk, a cheap alternative to dairy products, has all the necessary amino acids and fatty acids in the right amounts. As such, it's an affordable option for large-scale makers of vegan cheese. Furthermore, because soy-based cheese melts easily, it is becoming more and more popular among customers.

Vegan Cheese Market Segmentation: By Distribution Channels

-

Online Retail

-

Supermarkets & Hypermarkets

-

Specialty Stores

Supermarkets & hypermarkets are the largest growing channels. They are the go-to for most, offering the widest selection of brands and product types, from familiar slices and shreds to specialty cheeses. Furthermore, people can visually inspect the product's quality. Online retail is the fastest-growing segment. This mode of shopping allows consumers to browse and purchase vegan cheese from the comfort of their homes, with many retailers offering convenient delivery options. The growing trend of digitalization is fueling the expansion of this category.

Vegan Cheese Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe reigns supreme, boasting the largest market share due to its long history of plant-based diets, while North America experiences rapid growth fueled by a burgeoning vegan population. In contrast, the rest of the world is still in its early stages, with Latin America and the Middle East offering exciting possibilities. Asia-Pacific stands out as the fastest-growing region, driven by a rising middle class, health consciousness, and an openness to exploring new flavors and textures at an attractive price point. By understanding these regional trends, vegan cheese manufacturers can tailor their offerings to resonate with cheese lovers across the globe.

COVID-19 Impact Analysis on the Global Vegan Cheese Market

The COVID-19 pandemic's impact on the vegan cheese market was mixed. Initial lockdowns and disruptions to supply chains caused a temporary dip in sales during the first half of the pandemic. However, the trend quickly reversed as home cooking surged. Consumers, with more time on their hands, experimented with plant-based recipes, leading to increased demand for vegan cheese. Additionally, growing health concerns during the pandemic heightened interest in healthy and potentially immune-boosting foods, placing a spotlight on plant-based alternatives like vegan cheese. This, coupled with a rise in online grocery shopping options offering convenient access to vegan products, fueled market growth. While the long-term effects of COVID-19 are still unfolding, it appears to have accelerated the existing trend towards plant-based eating, giving the vegan cheese market an unexpected boost.

Latest Trends/Developments

The global vegan cheese market is experiencing a wave of exciting developments. Innovation is a key driver, with manufacturers constantly pushing the boundaries of taste, texture, and functionality. New plant-based ingredients like sunflower seeds, peas, and even chickpeas are emerging as alternatives to common allergens like nuts and soy, making vegan cheese more inclusive. Fermentation techniques are being explored to create richer, more complex flavors reminiscent of aged cheeses. Additionally, sustainability is a growing focus, with manufacturers developing vegan cheese using upcycled ingredients or minimizing water usage in production processes. The market is also witnessing a rise in specialty vegan cheeses, offering options like brie, feta, and parmesan, catering to specific cheese preferences. Furthermore, major food companies are entering the vegan cheese arena alongside established vegan brands, bringing wider distribution and brand recognition. This confluence of factors—innovation, inclusivity, sustainability, and wider market penetration—is poised to propel the global vegan cheese market to new heights, offering a delicious and ethical alternative for cheese lovers everywhere.

Key Players:

-

Violife Foods

-

Daiya Foods Inc.

-

Follow Your Heart

-

Miyoko's Creamery

-

Kite Hill

-

FYH (Follow Your Heart)

-

So Delicious Dairy-Free

-

Bute Island Foods Ltd

-

Nuttle Cheese

-

Treeline Cheese

Chapter 1. VEGAN CHEESE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. VEGAN CHEESE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. VEGAN CHEESE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. VEGAN CHEESE MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. VEGAN CHEESE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. VEGAN CHEESE MARKET – By Product

6.1 Introduction/Key Findings

6.2 Mozzarella

6.3 Cheddar

6.4 Parmesan

6.5 Ricotta

6.6 Cream Cheese

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. VEGAN CHEESE MARKET – By Source

7.1 Introduction/Key Findings

7.2 Soy

7.3 Almond

7.4 Cashew

7.5 Coconut

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Source

7.8 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 8. VEGAN CHEESE MARKET – By Distribution Channels

8.1 Introduction/Key Findings

8.2 Online Retail

8.3 Supermarkets & Hypermarkets

8.4 Specialty Stores

8.5 Y-O-Y Growth trend Analysis By Distribution Channels

8.6 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 9. VEGAN CHEESE MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Source

9.1.4 By Distribution Channels

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Source

9.2.4 By Distribution Channels

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Source

9.3.4 By Distribution Channels

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Source

9.4.4 By Distribution Channels

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Source

9.5.4 By Distribution Channels

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. VEGAN CHEESE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Violife Foods

10.2 Daiya Foods Inc.

10.3 Follow Your Heart

10.4 Miyoko's Creamery

10.5 Kite Hill

10.6 FYH (Follow Your Heart)

10.7 So Delicious Dairy-Free

10.8 Bute Island Foods Ltd

10.9 Nuttle Cheese

10.10 Treeline Cheese

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global vegan cheese market was valued at USD 3.3 billion in 2023 and will grow at a CAGR of 10% from 2024 to 2030. The market is expected to reach USD 6.43 billion by 2030.

The rising popularity of vegan diets, growing awareness of their health benefits, and increasing lactose intolerance are the reasons that are driving the market.

Based on the source, the market is divided into three segments: soy, almond, cashew, coconut, and others.

Europe is the most dominant region for the global vegan cheese market.

Violife Foods, Daiya Foods Inc., Follow Your Heart, Miyoko's Creamery and Kite Hill are the leading players.