North America Candy Market Size (2024-2030)

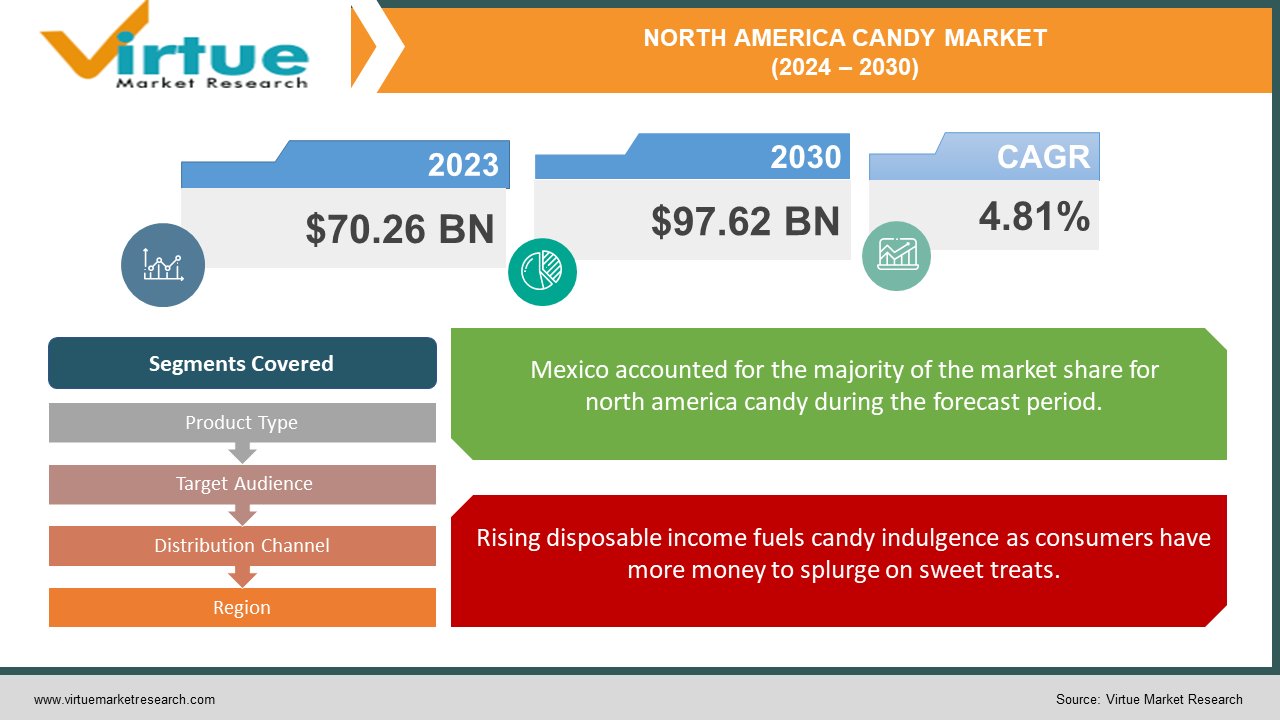

The North America Candy Market was valued at USD 70.26 billion in 2023 and is projected to reach a market size of USD 97.62 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 4.81%.

The North American candy market is a flourishing industry, expected to keep growing thanks to factors like rising disposable income and our love for indulging in sweet treats. Sugar-free, organic, and even functional candies with added benefits are finding their place on store shelves.

Key Market Insights:

The North American candy market is a land of opportunity, projected for continued growth fueled by our love for sweet treats and rising disposable income.

This dynamic market landscape is fuelled by innovation. Candy manufacturers are constantly upping their game to keep pace with these evolving preferences. Expect to see more high-quality ingredients boasting rich flavor profiles. Additionally, exciting flavor combinations and even personalized candy experiences are becoming increasingly popular, ensuring there's a treat to satisfy every sweet tooth.

The North America Candy Market Drivers:

Rising disposable income fuels candy indulgence as consumers have more money to splurge on sweet treats.

As disposable income levels rise across North America, consumers have more discretionary spending power. This translates to increased indulgence in treats like candy, leading to a positive impact on overall market sales. With more money at their disposal, individuals are more likely to splurge on premium candies, experiment with unique flavor profiles, or purchase larger quantities for sharing or celebrations.

Busy urban lifestyles and a growing young demographic drive demand for convenient candy snacks.

The growing trend of urbanization across North America is a significant driver for the candy market. Fast-paced urban lifestyles are characterized by busy schedules and increased snacking habits. Candy serves as a convenient and satisfying on-the-go treat, perfectly suited for these time-pressed consumers. This factor is further amplified by the demographic shift towards younger generations, who are often more open to trying new and innovative candy options.

Consumers crave both indulgence and wellness, leading to a rise in premium chocolates and sugar-free options.

A Symphony of Indulgence and Wellness: The North American candy consumer is no longer satisfied with the sugary classics of the past. Today's market is witnessing a fascinating dance between indulgence and health-consciousness. On one hand, premiumization is a growing trend, with consumers seeking out high-quality ingredients and unique flavor experiences. This translates to a surge in demand for gourmet chocolates boasting rich and complex taste profiles. On the other hand, health considerations are playing an increasingly important role. Sugar-free and organic candies are carving out a significant niche, catering to consumers who desire a treat without compromising their well-being.

The health and wellness movement inspires functional candies with added benefits, expanding the candy market.

The focus on health and wellness is not just influencing candy choices; it's even leading to innovative new product categories. Functional candies with added benefits like vitamins or probiotics are entering the market, appealing to health-conscious consumers who still enjoy a sweet treat. This trend highlights the industry's ability to adapt and cater to evolving consumer preferences, ensuring there's a candy option for everyone, regardless of their dietary needs or desires.

The North America Candy Market Restraints and Challenges:

The North American candy market, despite its sweetness, faces challenges that can dampen its growth. One major concern is the growing focus on health. Consumers are increasingly worried about obesity, diabetes, and other health problems linked to high sugar intake. This has led to a decline in the consumption of traditional sugary candies, forcing manufacturers to innovate with sugar-free and healthier options. Another hurdle is the combination of price sensitivity and inflation. Rising inflation can make consumers more price-conscious, leading them to cut back on discretionary spending like candy. This can be particularly tough for manufacturers who use premium ingredients or innovative production methods, which can make their candy more expensive.

The competitive landscape also presents a challenge. The North American candy market is mature and crowded, with established players and a constant stream of new brands vying for market share. This makes it difficult for manufacturers to stand out and attract customers. Finally, government regulations and evolving labeling requirements can add complexity and cost. Manufacturers need to stay up to date on regulations regarding sugar content, allergens, and other nutritional information, and adapt their products accordingly. These challenges require innovation and adaptation from candy companies to ensure continued success in the North American market.

The North America Candy Market Opportunities:

The North American candy market isn't just about nostalgia and sugar rushes anymore. It's a land of opportunity brimming with exciting avenues for growth. One key trend is the premiumization wave, where high-quality ingredients and unique flavor experiences reign supreme. Imagine gourmet chocolates boasting complex taste profiles or candies that take your taste buds on exotic adventures! But that's not all. The focus on health and wellness creates a sweet spot for sugar-free and organic candies. These cater to health-conscious consumers who crave a treat without compromising their well-being. This segment is ripe for further exploration and product development.

Functional candy is revolutionizing the industry. This caters to a growing group who wants indulgence with an added wellness twist. Manufacturers can leverage this trend to develop innovative and functional candy options. Personalization is another exciting avenue. Companies can explore offering custom candy blends or letting consumers tailor flavors to their preferences. This caters to the desire for a unique and personal candy experience, fostering deeper brand engagement. Finally, the e-commerce boom and subscription boxes offer golden opportunities. Candy manufacturers can reach new customers and expand their market reach through online platforms. Additionally, subscription boxes filled with unique and seasonal candy offerings can tap into the growing popularity of convenience and personalized experiences. By capitalizing on these trends and staying attuned to evolving consumer preferences, candy companies can ensure a sweet and successful future in the North American market.

NORTH AMERICA CANDY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.81% |

|

Segments Covered |

By Product Type, target audience, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, MEXICO, CANADA |

|

Key Companies Profiled |

Mondelez International, Mars Incorporated, Ferrero International, Perfetti Van Melle, The Hershey Company, Blommer, Puratos, Foley's Candies LP, Cargill, Nestle |

The North America Candy Market Segmentation:

North America Candy Market Segmentation: By Product Type

- Chocolate Candy

- Non-Chocolate Candy

- Functional Candy

The dominant segment in the North American candy market by product type is chocolate candy, encompassing everything from classic milk chocolate to gourmet varieties with unique fillings. This category reigns supreme due to its enduring popularity across all age groups. However, the fastest-growing segment is functional candy, which caters to health-conscious consumers by offering candies fortified with vitamins, probiotics, or even protein. This segment is capitalizing on the growing trend of merging indulgence with a wellness twist.

North America Candy Market Segmentation: By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Retailers

- Online Retailers

The dominant distribution channel in the North American candy market is supermarkets and hypermarkets, offering a vast selection and one-stop shopping convenience. However, the fastest-growing segment is e-commerce platforms. Online retailers provide easy access to a wide variety of candies, cater to niche preferences, and offer subscription boxes for a personalized candy experience. This trend is likely to continue as online shopping becomes even more ingrained in consumer habits.

North America Candy Market Segmentation: By Target Audience:

- Children

- Adults

- Health-Conscious Consumers

- Gift-Givers

The dominant target audience in the North American candy market is Children, driven by their preference for fun and colorful candies. This segment is a major driver of sales thanks to its influence on purchasing decisions and brand loyalty. However, the fastest-growing segment is Health-Conscious Consumers. This reflects the increasing focus on health and wellness, with a surge in demand for sugar-free, organic, and even functional candies that cater to a more health-minded approach to sweet treats.

North America Candy Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

The US reigns supreme as the North American candy king. This mature market boasts a strong presence of established candy giants alongside a vibrant scene of niche and artisanal brands. Consumers here have a diverse palate, indulging in classic favorites, premium chocolates, and innovative sugar-free options. The rise of e-commerce platforms and subscription boxes is further propelling growth in this dynamic market.

Canada follows closely behind the US, with a candy market that reflects its neighbor's love for sweet treats. However, there are some unique nuances. Canadian consumers show a higher preference for local brands and a growing interest in organic and fair-trade candies. Additionally, the influence of French-Canadian culture is evident in the popularity of maple-flavored candies and unique chocolate varieties.

Mexico is the fastest-growing star of the North American candy market. This market is characterized by a younger demographic with a taste for bold flavors and spicy candy options. Sugar-coated treats remain popular, but there's also a growing awareness of healthier alternatives. International candy companies are increasingly looking to tap into Mexico's booming market potential, offering a wider variety of candies and catering to evolving consumer preferences.

COVID-19 Impact Analysis on the North America Candy Market:

The COVID-19 pandemic wasn't all sugary treats for the North American candy market. Lockdowns caused disruptions in global supply chains, making it difficult to get ingredients and potentially leading to temporary candy shortages or price hikes. Shifts in consumer behavior also played a role. While some folks at home turned to candy for comfort, others became more health-conscious, impacting traditional candy sales. Additionally, closed movie theaters and fewer impulse buys at convenience stores due to lockdowns likely dampened sales in those channels.

However, there were bright spots too. Increased at-home snacking with more people homebound led to a rise in online candy sales and potentially benefitted grocery stores. The pandemic also fueled the e-commerce boom, offering candy manufacturers a new way to reach customers and potentially offset declines in traditional stores. Overall, while COVID-19 presented challenges, the North American candy market seems to be on the road to recovery, with e-commerce and health-conscious trends likely shaping its future in the post-pandemic world.

Latest Trends/ Developments:

The North American candy market is a land in constant flux, with exciting trends and developments brewing to cater to ever-shifting consumer preferences. Sustainability is a growing concern for candy enthusiasts, prompting companies to explore ethically sourced cocoa and eco-friendly packaging solutions to minimize their environmental footprint. This focus on responsible indulgence extends beyond packaging, with a rise in plant-based candy options. Vegan chocolates, candies crafted with plant-based milk substitutes, and even gummy candies derived from seaweed extracts are gaining traction, appeasing those seeking sweet treats that align with their dietary values.

Locally sourced and artisanal candy makers are also flourishing, offering a refreshing alternative to mass-produced options. These small-batch crafters tantalize taste buds with innovative flavor combinations and handcrafted treats made with premium ingredients. These trends solidify the North American candy market as a dynamic and innovative landscape, where indulgence meets sustainability, artisanal expertise, and the ever-growing desire for a personalized candy experience.

Key Players:

- Mondelez International

- Mars Incorporated

- Ferrero International

- Perfetti Van Melle

- The Hershey Company

- Blommer

- Puratos

- Foley's Candies LP

- Cargill

- Nestle

Chapter 1. North America Candy Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Candy Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Candy Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Candy Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Candy Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Candy Market– By Product Type

6.1. Introduction/Key Findings

6.2. Chocolate Candy

6.3. Non-Chocolate Candy

6.4. Functional Candy

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. North America Candy Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Specialty Retailers

7.5. Online Retailers

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. North America Candy Market– By Target Audience

8.1. Introduction/Key Findings

8.2. Children

8.3. Adults

8.4. Health-Conscious Consumers

8.5. Gift-Givers

8.6. Y-O-Y Growth trend Analysis By Target Audience

8.7. Absolute $ Opportunity Analysis By Target Audience , 2024-2030

Chapter 9. North America Candy Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By Target Audience

9.1.3. By Distribution Channel

9.1.4. product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Candy Market– Company Profiles – (Overview, Application Portfolio, Financials, Strategies & Developments)

10.1. Mondelez International

10.2. Mars Incorporated

10.3. Ferrero International

10.4. Perfetti Van Melle

10.5. The Hershey Company

10.6. Blommer

10.7. Puratos

10.8. Foley's Candies LP

10.9. Cargill

10.10. Nestle

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North America Candy Market was valued at USD 70.26 billion in 2023 and is projected to reach a market size of USD 97.62 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 4.81%.

Surging Disposable Income, Shifting Demographics and Urbanization, Evolving Consumer Preferences, Candy as a Canvas for Health and Wellness.

Supermarkets and Hypermarkets, Convenience Stores, Specialty Retailers, Online Retailers.

The United States reigns supreme as the most dominant region in the North American Candy Market, boasting a mature market with established giants and a strong presence of niche brands.

Mondelez International, Mars Incorporated, Ferrero International, Perfetti Van Melle, The Hershey Company, Blommer, Puratos, Foley's Candies LP, Cargill, Nestle.