Europe Candy Market Size (2024-2030)

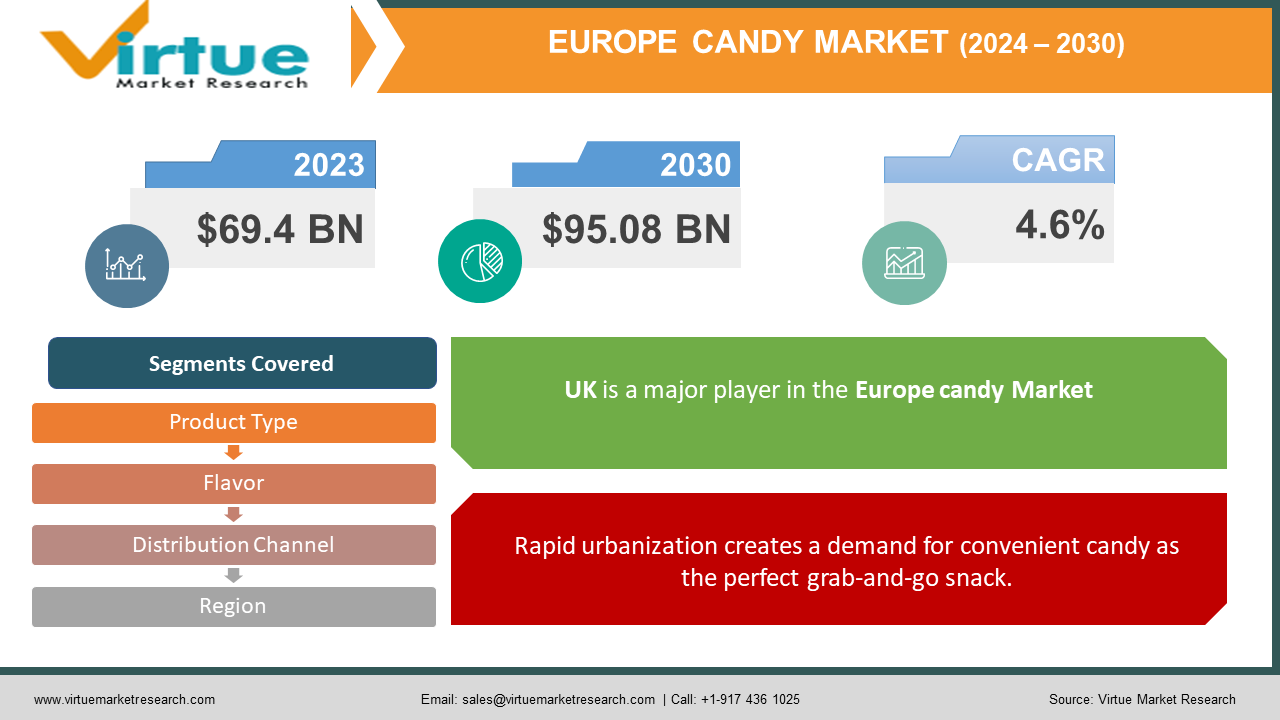

The Europe Candy Market was valued at USD 69.4 billion in 2023 and is projected to reach a market size of USD 95.08 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 4.6%.

The European candy market is a sweet spot for indulgence, with countries like Germany, France, and the UK leading the pack in consumption. This booming market is fueled by several factors. Consumers have more disposable income, allowing for treat purchases. Growing cities create a demand for convenient snacks, and candy perfectly fits the bill. Interestingly, there's a rising awareness of healthier candy options, with sugar-free varieties gaining traction.

Key Market Insights:

The European candy market is a land of opportunity, with some intriguing consumer trends shaping its future. Consumers are showing a growing desire for indulgence, with rising disposable income fueling demand for premium and indulgent candies. This trend is particularly strong in urban areas, where convenience reigns supreme and candy becomes a perfect grab-and-go option; 72% of German snackers consume candy bars weekly. Interestingly, health consciousness isn't stopping the candy love. The market is witnessing a rise in sugar-free and potentially healthier candy options, catering to consumers who want their treat and potentially healthier choices too.

The Europe Candy Market Drivers:

Rapid urbanization creates a demand for convenient candy as the perfect grab-and-go snack.

The rapid pace of urbanization across Europe creates a demand for convenient and portable snacks that can fit seamlessly into busy lifestyles. Candy perfectly fills this niche as a popular grab-and-go option. Its compact size, long shelf life, and variety of flavors make it ideal for satisfying hunger pangs or sugar cravings on the move. Additionally, the ease of consumption without needing utensils or preparation further fuels its popularity in fast-paced urban environments. (For example, a whopping 72% of German snackers consume candy bars every week, highlighting the prevalence of candy as a go-to snack.

The evolving candy landscape offers sugar-free and potentially healthier options to meet diverse needs.

The European candy market is no longer a one-size-fits-all industry. It's constantly adapting to cater to a wider range of consumer preferences with a more diverse candy landscape. This includes offering sugar-free and potentially healthier options alongside traditional favorites. This caters to the growing health consciousness among consumers who might be looking for ways to manage sugar intake but still enjoy a sweet treat. Additionally, the market is exploring new flavor profiles, textures, and formats to keep offerings exciting and cater to evolving tastes.

Functional confectionery emerges, blurring the lines between treatment and wellness with added benefits.

A new and intriguing trend is emerging in the European candy market – functional confectionery. These candies aim to offer not just indulgence but also additional benefits like vitamins, minerals, or even protein. This caters to health-conscious consumers who are looking for ways to integrate some indulgence into their wellness routines. While the growth potential is significant, it's still a developing segment within the market. However, it highlights the candy industry's willingness to adapt and innovate to meet the evolving needs of its consumers.

The Europe Candy Market Restraints and Challenges:

The European candy market, despite its sweetness, faces some bitter challenges. A significant hurdle is the growing focus on health. Consumers are increasingly concerned about sugar intake, potentially leading to a decline in traditional candy sales. Stringent regulations on sugar content might also force reformulations, impacting the taste and charm of classic candies. This "sugar war" presents a complex obstacle for the industry.

Furthermore, competition in the snack arena is heating up. Candy is no longer the only king in town. It faces fierce competition from other snack categories like healthy bars, granola mixes, and yogurt parfaits. These alternatives often position themselves as the more health-conscious choice, potentially swaying consumers away from candy.

Finally, the candy market needs to constantly innovate to stay relevant. Consumer preferences are like a kaleidoscope, constantly shifting. The challenge lies in keeping pace with these changes. This means developing new flavor profiles, textures, and potentially healthier candy options. But innovation goes beyond just variety. It's about maintaining the indulgent appeal that defines candy, ensuring it remains a delightful treat even in an evolving snack landscape.

The Europe Candy Market Opportunities:

The European candy market isn't just about navigating challenges, it's also a land of opportunity. Premiumization offers a golden path, with consumers drawn to unique experiences. Imagine high-quality candies boasting exotic flavors, or even the ability to personalize your candy bar! This caters to a growing desire for indulgence with a touch of exclusivity. Health-conscious consumers with sweet teeth are also a wide-open door. The market can develop candies fortified with vitamins, minerals, or even protein. Who knew candy could be functional?

Consumers are increasingly eco-conscious, and the candy market can win them over with sustainable packaging solutions and ethically sourced ingredients. Imagine candy that's not just delicious, but kind to the planet! Finally, the digital world beckons. Targeted online marketing campaigns and expansion into e-commerce platforms can connect directly with consumers and create engaging brand experiences.

EUROPE CANDY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Product Type, flavor, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Ferrero, Nestle, Lindt & Sprungli, Pladis, Haribo, Perfetti Van Melle, August Storck, Mars, Mondelez, Cémoi, Hershey, Roshen |

The Europe Candy Market Segmentation:

Europe Candy Market Segmentation: By Product Type:

- Hard-boiled candies

- Gums, pastilles, jellies & chews

- Toffees, caramels, and licorice

- Chocolate

- Sugar-free and functional candies

The European candy market is a diverse landscape segmented by product type. Chocolate reigns supreme, encompassing a wide variety of candies like bars, truffles, and pralines. This category accounts for the largest market share. However, sugar-free and functional candies are experiencing the fastest growth, catering to health-conscious consumers who crave sweet treats but also seek added benefits or sugar reduction.

Europe Candy Market Segmentation: By Flavor:

- Chocolate

- Fruit

- Mint

- Caramel

- Sour

The chocolate segment reigns supreme in the European candy market by flavor, accounting for a dominant share. On the other hand, sugar-free and functional flavors are experiencing the fastest growth, driven by the increasing health consciousness among consumers. This segment caters to those who seek indulgence but also want to be mindful of their sugar intake or incorporate added benefits like vitamins or protein into their treats.

Europe Candy Market Segmentation: By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retailers

The European candy market is segmented by distribution channel, with supermarkets and hypermarkets reigning supreme. These one-stop shops offer a vast candy selection, making them the most dominant segment. However, the fastest growth is projected for online retailers. The rise of e-commerce and convenience drives this segment, with consumers increasingly turning to online platforms for their candy fixes. This trend highlights the growing importance of digital presence for candy companies in the European market.

Europe Candy Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

The United Kingdom is a major player in the European candy scene, boasting a strong consumer base with a particular fondness for chocolate. Popular candies include traditional favorites like Cadbury Dairy Milk and Mars Bars, alongside innovative new offerings. The UK market also shows a growing interest in sugar-free and healthier candy options.

Germany reigns supreme as the top candy consumer in Europe. This sweet-toothed nation loves a variety of candies, with chocolate, gummies, and pastilles leading the pack. German consumers are open to trying new flavors and textures, making the market receptive to innovation. Additionally, there's a strong emphasis on convenience, with grab-and-go candy options performing well.

France is known for its refined palate, and this extends to the candy market. French consumers appreciate high-quality ingredients and unique flavor profiles. Chocolate reigns supreme, but candies with fruit flavors, nuts, and even liquor fillings are also popular. Sugar-free and healthier options are gaining traction, but French consumers still value indulgence in their candy choices.

The Italian candy market is a delightful blend of tradition and innovation. Classic treats like hard candies and nougat share shelf space with modern creations. Chocolate is popular, but Italy also boasts unique regional specialties like hazelnut-based gianduja and chewy licorice. While health concerns are present, Italian consumers still appreciate the pleasure of a well-crafted candy.

The Spanish candy market is vibrant and colorful, reflecting the country's culture. Gummies, hard candies, and chewy candies are all popular choices. There's a strong emphasis on fruit flavors, with citrus and tropical varieties being particularly well-liked. Sugar-free options are gaining traction, but Spanish consumers still enjoy the sweet indulgence of traditional candies.

Eastern Europe and other regions within Europe represent a diverse and growing market for candy. Local preferences vary, but chocolate and traditional candies remain popular. As disposable income rises, there's a potential for increased demand for premium and innovative candy options in these regions.

COVID-19 Impact Analysis on the Europe Candy Market:

The COVID-19 pandemic cast a shadow over the previously carefree world of European candy. Lockdowns and social distancing measures threw a wrench into well-oiled supply chains, causing temporary shortages of raw materials like sugar and chocolate. This initial disruption led to production slowdowns and even potential product gaps on store shelves. Consumer behavior also shifted dramatically.

However, the European candy market proved to be surprisingly resilient. As the pandemic progressed and the initial shock subsided, a gradual recovery emerged in the latter half of 2020. Supply chains stabilized, and consumers adjusted their spending habits, with some discretionary income returning. The rise of online grocery shopping during this period also played a big role in the recovery. This convenient way to purchase candy from the safety of one's home helped bridge the gap for consumers who still craved their favorite treats.

Latest Trends/ Developments:

The European candy market isn't just about keeping things sweet, it's about innovation. Functional candy is on the rise, offering treats with added benefits like vitamins or protein. This caters to health-conscious consumers who crave indulgence without compromising on wellness. Sustainability is another hot trend. Candy companies are switching to eco-friendly packaging and ethically sourced ingredients, appealing to environmentally conscious consumers.

The focus on personalization extends beyond taste. Subscription boxes delivering unique candy selections and online platforms for creating custom candy bars are gaining traction. Brick-and-mortar stores are also getting a makeover. Imagine interactive candy creation workshops or AR games that unlock special flavors – these are just some ways stores are creating engaging experiences for customers. Finally, the rise of vegan and plant-based diets is influencing the candy market. Manufacturers are developing innovative candy options using plant-based ingredients, catering to the growing vegan population and those with dietary restrictions. The European candy market is constantly evolving, and these trends highlight its commitment to delicious innovation and staying relevant in a changing consumer landscape.

Key Players:

- Ferrero

- Nestle

- Lindt & Sprungli

- Pladis

- Haribo

- Perfetti Van Melle

- August Storck

- Mars

- Mondelez

- Cémoi

- Hershey

- Roshen

Chapter 1. Europe Candy Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Candy Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Candy Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Candy Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Candy Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Candy Market– By Product Type

6.1. Introduction/Key Findings

6.2. Hard-boiled candies

6.3. Gums, pastilles, jellies & chews

6.4. Toffees, caramels, and licorice

6.5. Chocolate

6.6. Sugar-free and functional candies

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Europe Candy Market– By Flavor

7.1. Introduction/Key Findings

7.2 Chocolate

7.3. Fruit

7.4. Mint

7.5. Caramel

7.6. Sour

7.7. Y-O-Y Growth trend Analysis By Flavor

7.8. Absolute $ Opportunity Analysis By Flavor , 2024-2030

Chapter 8. Europe Candy Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience Stores

8.4. Specialty Stores

8.5. Online Retailers

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Candy Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Product Type

9.1.3. By Flavor

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Candy Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Ferrero

10.2. Nestle

10.3. Lindt & Sprungli

10.4. Pladis

10.5. Haribo

10.6. Perfetti Van Melle

10.7. August Storck

10.8. Mars

10.9. Mondelez

10.10. Cémoi

10.11. Hershey

10.12. Roshen

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Europe Candy Market was valued at USD 69.4 billion in 2023 and is projected to reach a market size of USD 95.08 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 4.6%.

Indulgence on the Rise, Urban Snacking on the Go, Evolving Candy Landscape to Meet Diverse Needs, Functional Confectionery.

Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retailers.

Germany reigns supreme as the top consumer market for candy in Europe, followed closely by the United Kingdom and France. This powerhouse trio drives the overall European candy market growth.

Ferrero, Nestle, Lindt & Sprungli, Pladis, Haribo, Perfetti Van Melle, August Storck, Mars, Mondelez, Cémoi, Hershey, Roshen