Motion Control Market Size (2025-2030)

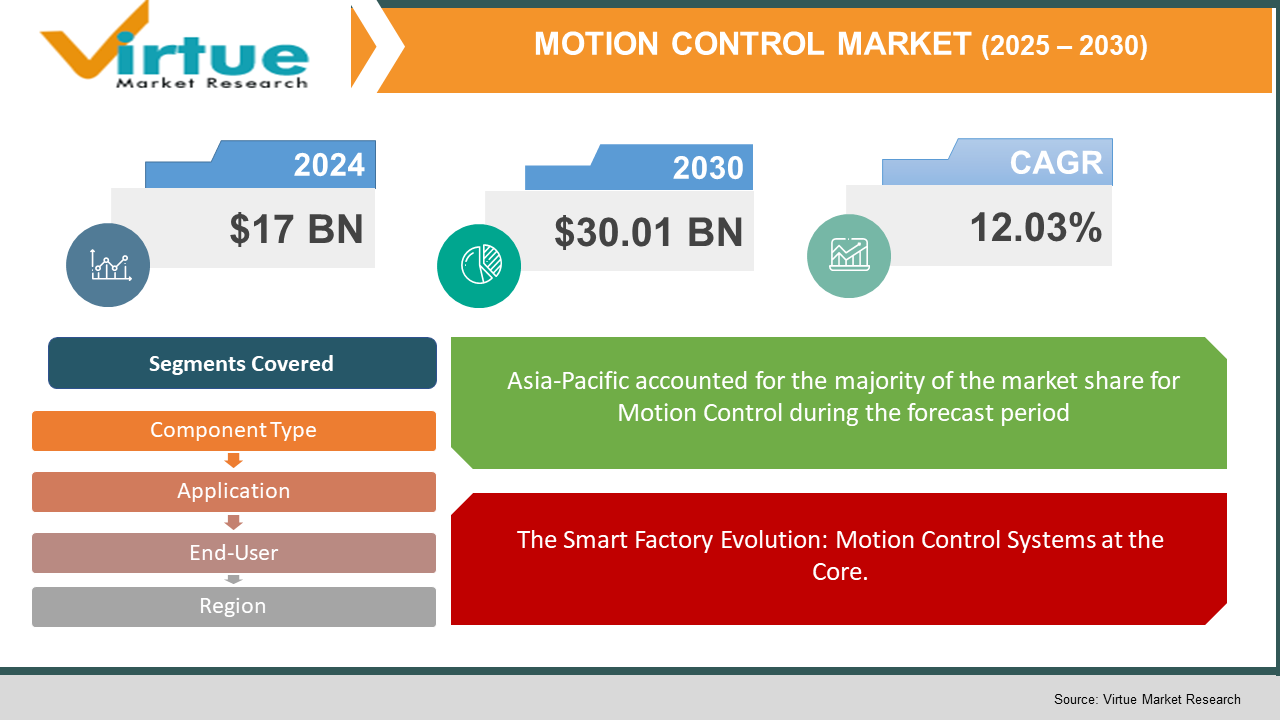

The Motion Control Market was valued at USD 17 billion and is projected to reach a market size of USD 30.01 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.03%.

Motion control technology represents a critical component of modern industrial automation, combining precision engineering with advanced control systems to enable accurate movement in manufacturing processes. The industry has experienced significant technological advancements in the 21st century, including the integration of artificial intelligence, machine learning, and IoT connectivity. With Industry 4.0 transforming manufacturing landscapes worldwide, motion control systems have become indispensable for achieving higher productivity, improved quality, and enhanced operational efficiency.

Key Market Insights:

- According to the International Federation of Robotics (IFR) report for 2022, approximately 422,000 industrial robots were installed globally, representing a 14% increase year-over-year, with each installation requiring sophisticated motion control systems that account for an average investment of $12,500 per unit.

- The manufacturing sector currently utilizes motion control technology in 73% of automated production lines, with implementation resulting in average productivity improvements of 27% and defect reduction rates of 32% according to the Motion Control Association's industry survey conducted across 1,500 manufacturing facilities.

- Energy efficiency improvements in modern motion control systems have demonstrated electricity consumption reductions of up to 45% compared to conventional systems, with ROI typically achieved within 15-18 months of implementation as reported by the Industrial Energy Efficiency Coalition in their 2022 industry benchmark study.

- Smart motion control systems incorporating predictive maintenance capabilities have reduced unplanned downtime by an average of 38% and extended equipment lifespan by 23% according to data collected from 2,800 manufacturing plants worldwide, translating to annual savings of approximately $265,000 for medium-sized manufacturing operations.

Motion Control Market Drivers:

The Smart Factory Evolution: Motion Control Systems at the Core.

Manufacturing facilities worldwide are investing heavily in automation infrastructure, with global spending on industrial automation solutions reaching $197 billion in 2022 and projected to surpass $265 billion by 2025. Motion control systems represent a critical component of this transformation, with implementation rates growing at approximately 8.7% annually across diverse industrial sectors. The integration of artificial intelligence and machine learning capabilities into motion control architecture has revolutionized operational possibilities, enabling predictive analytics that optimize performance parameters in real-time while reducing human intervention requirements by up to 67% in certain applications. Modern manufacturing facilities implementing comprehensive motion control solutions have documented throughput improvements averaging 34% alongside quality consistency gains of 29%, creating compelling economic justification for continued investment. The manufacturing labor shortage—with an estimated 2.1 million unfilled manufacturing positions projected by 2030—further accelerates automation adoption, as motion control systems effectively bridge workforce gaps while maintaining or improving production standards. Additionally, customer demands for product customization have necessitated highly flexible manufacturing systems, with motion control enabling rapid production line reconfiguration that reduces changeover times by an average of 71% compared to conventional mechanical systems. Multinational manufacturers have reported average cost reductions of 18% and efficiency improvements of 26% following comprehensive motion control implementation, establishing a clear business case that continues to drive market expansion.

Environmental sustainability initiatives and increasingly stringent energy efficiency regulations are creating strong market demand for next-generation motion control systems.

Energy consumption in industrial operations accounts for approximately 37% of global energy usage, creating urgent imperatives for efficiency improvements that modern motion control systems directly address. Advanced servo drives and motors with intelligent energy management capabilities have demonstrated electricity consumption reductions averaging 41% compared to conventional systems, with certain applications achieving reductions up to 60% during partial load operations. These efficiency gains translate to direct operational cost reductions while simultaneously supporting corporate sustainability objectives and regulatory compliance requirements. Carbon emission reduction targets established across major industrial economies have accelerated replacement cycles for legacy motion control equipment, with approximately 38% of manufacturers citing sustainability compliance as a primary motivation for system upgrades according to a 2022 industry survey.

Motion Control Market Restraints and Challenges:

There are major problems and initial cost increases are the major challenges facing the Motion Control Market.

Despite compelling benefits, motion control implementation faces significant barriers including high initial capital requirements, with comprehensive system installations for medium-sized manufacturing operations averaging $380,000-$750,000 depending on complexity and precision requirements. This substantial investment creates particular challenges for small and medium enterprises (SMEs), which represent 63% of global manufacturing organizations but often operate with limited capital access and thin operating margins. Technical complexity presents additional obstacles, with integration surveys revealing that 47% of implementation projects exceed scheduled timelines and 39% experience budget overruns due to unforeseen compatibility challenges with existing infrastructure. The chronic shortage of qualified automation engineers—with worldwide demand exceeding supply by approximately 1.8 million professionals—further complicates both implementation and ongoing maintenance.

Motion Control Market Opportunities:

The convergence of motion control with edge computing capabilities presents transformative market opportunities, with edge-enabled systems demonstrating latency reductions of 97% compared to cloud-dependent architectures—a critical advantage for high-speed manufacturing applications requiring microsecond response times. The rapidly expanding robotics sector, projected to reach $43.5 billion by 2026, creates substantial demand for sophisticated motion control technologies that enable increasingly complex movement patterns and human-robot collaboration capabilities. Emerging economies present significant growth potential, with industrial automation adoption rates in regions like Southeast Asia, India, and Eastern Europe growing at 14.2% annually—nearly double the global average. The retrofitting market for legacy manufacturing equipment offers particularly accessible opportunities, with motion control upgrades delivering approximately 65% of the benefits of complete system replacement at roughly 40% of the cost.

MOTION CONTROL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12.03% |

|

Segments Covered |

By component Type, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, ABB Ltd., Schneider Electric, Rockwell Automation, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Bosch Rexroth, Parker Hannifin Corporation, Delta Electronics, Omron Corporation |

Motion Control Market Segmentation:

Motion Control Market Segmentation: By Component Type:

- Motors

- Drives

- Controllers

- Sensors

- Others

In 2023, the motors segment dominated the market with approximately 36.5% revenue share due to their fundamental role as the primary actuators in motion control systems. Servo motors particularly witnessed substantial growth with sales increasing 16.8% year-over-year, driven by their superior precision capabilities with positioning accuracies reaching 0.001 degrees in high-end applications. The increasing adoption of direct drive motor technology has eliminated mechanical transmission components in precision applications, reducing system complexity while improving reliability with mean time between failures (MTBF) ratings exceeding 100,000 hours in controlled environments.

The controllers segment is projected to grow at the highest CAGR of 8.3% during the forecast period, fueled by rapid technological advancements in processing capabilities and connectivity features. Modern multi-axis controllers can simultaneously coordinate movements across 32 or more axes with synchronization accuracies within microseconds, enabling complex manufacturing processes previously impossible with mechanical systems. The integration of advanced algorithms including artificial intelligence and machine learning has transformed controllers from simple movement executors to intelligent process optimizers, with self-tuning capabilities reducing commissioning times by an average of 67% while improving dynamic performance by 41% compared to conventionally tuned systems.

Motion Control Market Segmentation: By Application

- Packaging

- Assembly

- Robotics

- Material Handling

- Others

The robotics application segment held the largest market share at 28.7%, reflecting the exponential growth in industrial robot deployments worldwide. Six-axis articulated robots represent the fastest-growing robot type, requiring sophisticated motion control systems capable of performing complex spatial movements with repeatability ratings as precise as ±0.02mm. Collaborative robots (cobots) have emerged as a particularly dynamic sub-segment, with annual installations increasing 37% year-over-year and creating unique motion control requirements that emphasize safety features including advanced force sensing and responsive collision detection capabilities.

The packaging application segment is anticipated to witness substantial growth with a CAGR of 7.9% during the forecast period, driven by increasing automation in the consumer packaged goods industry. Modern packaging operations require exceptional motion precision at extremely high speeds, with advanced systems capable of maintaining positioning accuracies within 0.1mm while operating at 1,800 cycles per minute in certain applications. The rising demand for sustainable packaging solutions has created additional requirements for motion control systems capable of handling eco-friendly materials with variable physical properties, necessitating adaptive control capabilities that automatically optimize motion parameters based on material characteristics detected through integrated sensing systems.

Motion Control Market Segmentation: By End-User

- Automotive

- Electronics

- Healthcare

- Aerospace

- Others

The electronics manufacturing segment captured the largest market share at 31.4% in 2022, driven by the precision requirements of semiconductor and microelectronics production. Motion control systems in semiconductor fabrication must maintain positioning accuracies within nanometers while operating in cleanroom environments, with specialized designs incorporating vacuum-compatible components and non-particle generating materials. The accelerating development of advanced packaging technologies including chip stacking and heterogeneous integration has further increased precision requirements, with leading-edge applications demanding motion systems capable of sub-micron accuracies even during high-throughput operations.

The healthcare segment is projected to experience the most rapid growth at a CAGR of 9.7% through 2030, fueled by increasing automation in medical device manufacturing, pharmaceutical production, and surgical robotics. Motion control systems for medical applications must meet exceptionally stringent regulatory requirements including FDA 21 CFR Part 11 compliance and ISO 13485 certification, creating higher barriers to entry but also enabling premium pricing approximately 35% above industrial equivalents. Surgical robotics represents a particularly high-value application, with systems requiring motion precision measured in micrometres alongside force-feedback capabilities that can detect tissue resistance with sensitivities below 0.1 newton—technological achievements commanding significant price premiums while enabling revolutionary medical procedures.

Motion Control Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The Asia-Pacific region dominated the global motion control market with a revenue share of 39.7%, driven primarily by China's position as the world's manufacturing center and aggressive industrial automation initiatives across developing economies. China alone installed approximately 168,000 industrial robots in 2022—representing 40% of global installations—each requiring sophisticated motion control systems. Japan maintains leadership in motion control technology development, with Japanese manufacturers holding approximately 37% of global high-precision servo motor patents and maintaining dominant positions in semiconductor manufacturing equipment requiring nanometre-level positioning capabilities.

North America holds the second-largest market share at 28.3%, characterized by widespread adoption of advanced motion control technologies particularly in aerospace, medical device manufacturing, and automotive industries. The region leads in motion control software development with approximately 62% of machine learning and AI-enhanced motion control technologies originating from North American companies.

COVID-19 Impact Analysis on the Global Motion Control Market:

The COVID-19 pandemic created unprecedented disruptions in motion control manufacturing and supply chains, with component shortages particularly acute for semiconductor-based products including drives and controllers. Lead times for critical components extended from typical 6-8 week periods to 9-14 months in extreme cases, forcing machine builders to redesign systems around available components and creating significant market share shifts among suppliers able to maintain more reliable deliveries. Installation and commissioning activities faced similar challenges with international travel restrictions preventing specialist engineers from accessing customer sites, accelerating the development of remote commissioning technologies including augmented reality guidance systems that reduced on-site specialist requirements by approximately 65%.

Latest Trends/ Developments:

Wireless motion control technology has gained significant market traction, with approximately 28% of new installations now incorporating wireless connectivity for at least monitoring functions, reducing installation complexity while enabling more flexible machine configurations and simplified retrofitting of existing equipment without extensive rewiring requirements.

The integration of digital twin technology with motion control systems has accelerated commissioning efficiency, with virtual commissioning reducing physical setup time by an average of 63% while allowing operators to test multiple configuration scenarios in simulated environments before implementing physical changes.

Mitsubishi Electric's recent acquisition of motion control software developer Realtime Robotics for $178 million highlights the increasing importance of software intelligence in motion systems, combining Mitsubishi's hardware expertise with Realtime's collision avoidance algorithms that enable dynamic path planning capabilities essential for next-generation collaborative robotics applications.

Key Players:

- Siemens AG

- ABB Ltd.

- Schneider Electric

- Rockwell Automation

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- Bosch Rexroth

- Parker Hannifin Corporation

- Delta Electronics

- Omron Corporation

Chapter 1. Motion Control Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Motion Control Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Motion Control Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Component typeScenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Motion Control Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Motion Control Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Motion Control Market – By Component type

6.1 Introduction/Key Findings

6.2 Motors

6.3 Drives

6.4 Controllers

6.5 Sensors

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Component type:

6.8 Absolute $ Opportunity Analysis By Component type:, 2025-2030

Chapter 7. Motion Control Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Assembly

7.4 Robotics

7.5 Material Handling

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. Motion Control Market – By End-User

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Electronics

8.4 Healthcare

8.5 Aerospace

8.6 Others

8.7 Y-O-Y Growth trend Analysis End-User

8.8 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9. Motion Control Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Application

9.1.3. By End-User

9.1.4. By Component type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Application

9.2.3. By End-User

9.2.4. By Component type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Application

9.3.3. By End-User

9.3.4. By Component type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By End-User

9.4.3. By Application

9.4.4. By Component type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By End-User

9.5.3. By Application

9.5.4. By Component type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Motion Control Market – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

10.1 Siemens AG

10.2 ABB Ltd.

10.3 Schneider Electric

10.4 Rockwell Automation

10.5 Mitsubishi Electric Corporation

10.6 Yaskawa Electric Corporation

10.7 Bosch Rexroth

10.8 Parker Hannifin Corporation

10.9 Delta Electronics

10.10 Omron Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The motion control market involves technologies and systems that control the movement of machines, often used in automation, robotics, manufacturing, and aerospace

Key components include controllers, motors, drives, sensors, and feedback devices that together manage speed, position, and torque

Industries include automotive, electronics, packaging, semiconductor, healthcare, and industrial automation.

Trends include increased demand for automation, integration with AI and IoT, miniaturization of components, and energy-efficient solutions

Challenges include high implementation costs, system complexity, and the need for skilled operators and real-time precision